Earlier this month, Chocolate announced several negative changes to the Chocolate Visa Card, including reduced earn rates, a cap on miles for bill payments, and a new Miles Multiplier feature which awards bonus miles based on your Chocolate account balance.

The Dark Chocolate event, as I dub it (bitter, but they’ll say it’s better for you!), will take place on 1 July 2025, which gives you a few weeks to digest the news and adjust your strategy accordingly.

So if you’re planning to stick with Chocolate, here are a few important things to know.

Recap: Upcoming nerfs to Chocolate Visa Card

Chocolate Visa Card Chocolate Visa Card |

|||

| Apply here |

First, a brief recap of the changes to the Chocolate Visa Card, effective 1 July 2025.

Reduction in earn rates

| Till 30 June 25 | From 1 Jul 25 | |

| First S$1,000 spend | 2 mpd | 1 mpd |

| Above S$1,000 | 0.4 mpd | 0.4 mpd |

| FCY Fee | None | None |

Chocolate Visa Cardholders will earn 1 mpd for the first S$1,000 spent each calendar month (was: 2 mpd), and 0.4 mpd subsequently (unchanged).

There is no cap on the overall Max Miles that can be earned, and no fee on FCY transactions.

Cap on miles for bill payments

Chocolate Visa Cardholders will be capped at earning a maximum of 100 miles per calendar month from bill payments, defined as transactions with the following MCCs.

| MCC | Category |

| MCC 4900–4999 |

Utilities |

| MCC 6300–6399 |

Insurance |

| MCC 6513, 6531 |

Real Estate and Property Management |

| MCC 7311–7399 |

Business Services |

| MCC 8011–8099 |

Medical Services, Health Practitioners, Hospitals, Dentists |

| MCC 9311–9399 |

Government Services |

| For the avoidance of doubt, the 100 miles cap is shared among all categories | |

Miles Multiplier

The new Miles Multiplier feature awards bonus Max Miles based on the monthly average balance (MAB) in your Chocolate Finance account.

| Monthly Average Balance (MAB)* |

Multiplier % |

| <S$5K | 0% |

| S$5K to <S$10K | 5% |

| S$10K to <S$15K | 10% |

| S$15K to <S$20K | 15% |

| S$20K to <S$25K | 20% |

| S$25K to <S$30K | 25% |

| … | … |

| S$100K and above | 100% |

| *Includes both SGD and USD balances | |

Customers will earn a 5% multiplier for every S$5,000 MAB with Chocolate, capped at S$100,000 or 100%. The Miles Multiplier applies to all spending on the Chocolate Visa Card, not just the first S$1,000.

For example, if John has a S$50,000 MAB and spends S$1,300 on his Chocolate Visa Card during the month, he will receive 1,120 base Max Miles (S$1,000 x 1 mpd + S$300 x 0.4 mpd) and 560 bonus Max Miles (50% x 1,120).

Bonus Max Miles will be automatically credited in the first week of the following month.

How much should you deposit with Chocolate?

It was always inevitable that Chocolate would start tying rewards to AUM, because there’s very little in this partnership for them if people merely use it as a passthrough, i.e. topping up their balance when they spend and not keeping anything inside otherwise.

The Miles Multiplier is supposed to serve as an incentive for deposits, but here’s where I feel Chocolate has missed a trick, because the rewards are simply not lucrative enough to move the needle.

To illustrate, suppose you spent S$1,000 on the Chocolate Visa Card each month to max out the 1 mpd earn rate:

- S$1,000 spend will generate 1,000 base Max Miles

- Depending on your MAB, you’d also earn 50 to 1,000 bonus Max Miles from the Miles Multiplier

- Max Miles can be converted to cash at 2 cents each, so the Miles Multiplier is worth S$1 to S$20

- This is equivalent to incremental interest of 0.24% p.a. (e.g. S$10,000 balance = 10% Miles Multiplier = 100 bonus Max Miles per month = S$24 per year)

If you weren’t particularly inclined to deposit funds with Chocolate in the first place, I can’t imagine an incremental 0.24% p.a. will change your mind (and remember, the Miles Multiplier could be tweaked at any time).

Therefore, the decision to deposit funds with Chocolate really boils down to whether or not you find the base returns attractive.

| Chocolate Finance Returns 🇸🇬 SGD |

||

| Amount | Return | Remarks |

| First S$20K | 3% p.a. | Guaranteed |

| Next S$30K | 2.7% p.a. | Guaranteed |

| Above $50K | 2.7% p.a. | Non-guaranteed |

| Chocolate Finance Returns 🇺🇸 USD |

||

| Amount | Return | Remarks |

| First US$20K | 4.3% p.a. | Guaranteed |

| Next US$30K | 4% p.a. | Guaranteed |

| Above U$50K | 4% p.a. | Non-guaranteed |

I’m simply not well-versed enough with the alternatives to say whether these are competitive rates, but what I do know is that the Miles Multiplier should not be a decisive factor in your decision.

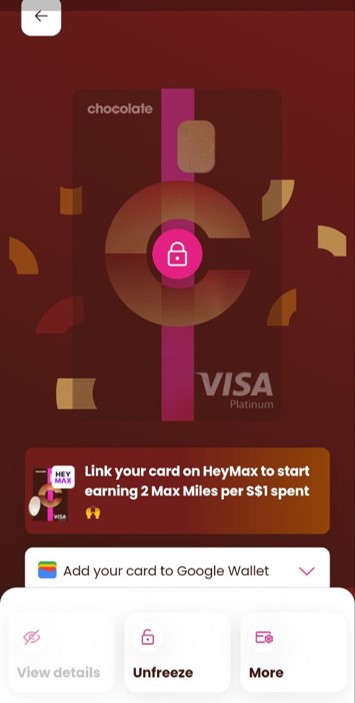

Freeze your card when not in use

If you do intend to keep any sort of balance in Chocolate, it’s best practice to freeze your Chocolate Visa Card whenever it’s not in use. This can be done via the app with a few taps.

Remember, the Chocolate Visa Card is a debit card, not a credit card. This means that any transaction, whether legitimate or fraudulent, is immediately deducted from your funds. While there is a chargeback process, you will be out of pocket until the investigation is completed.

That’s reason enough to be extra paranoid, especially if you plan to keep a larger balance for a bigger Miles Multiplier.

Charity and education survive

While Chocolate will now cap government services, healthcare, insurance and utilities at earning 100 miles per month, charitable donations and education have escaped.

That’s good news, since almost every card on the market now excludes these two categories (Maybank, the last holdout, will remove points for donations on 1 July 2025). 1 mpd on the first S$1,000 and 0.4 mpd subsequently might not sound like impressive earn rates, but it’s better than nothing.

| ❤️ Local donations only |

| Do note that the Chocolate Visa Card can only be used for local charitable giving. Donations to overseas charitable entities will fail |

Cancel your CardUp payments

CardUp transactions code as MCC 6513 and 7399, both of which fall under the new bill payments cap.

This means there’s really no point in using the Chocolate Visa Card with CardUp anymore, even for micropayments because CardUp has a minimum fee of S$3.40 for any payment below S$130.

Some of you may have set up recurring billing arrangements with your Chocolate Visa Card for income taxes. Be sure to change your payment method after the June payment cycle is completed.

Be careful with MCC 7399

One highly annoying thing about Chocolate’s definition of bill payments is that it includes MCC 7399. While this is used by CardUp, it’s also used by a lot of merchants which aren’t remotely connected to bill payments.

For example, Points.com transactions code as MCC 7399, which means that you’re capped at 100 Max Miles when buying miles or points from Aeroplan, Alaska, Flying Blue, GHA, Hilton, IHG, Marriott, Qatar Airways, United and any other airline or hotel which uses the platform.

MCC 7399 can also pop up in unexpected places, like when you’re making cash + points bookings with IHG (which I guess makes sense, since you’re conceptually buying additional points), or even Shopee.

Because of this, if there’s even a shadow of a doubt about the MCC, you should make a point of looking it up before swiping the Chocolate Visa Card.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Conclusion

Dark Chocolate is coming on 1 July 2025, bringing reduced earn rates, caps on bill payments, and a new Miles Multiplier feature that, let’s face it, is unlikely to move the needle for most people.

Since it costs nothing to hold a Chocolate Visa Card, I don’t see the harm in keeping it if only to rack up an extra 1,000 Max Miles each month on stuff that might not otherwise qualify for rewards, like donations and education. Alternatively, if you really hate the idea of paying foreign currency transaction fees, then the Chocolate Visa Card would offer a rewards-earning alternative to YouTrip or Revolut.

But outside of those situations, I’d be hard pressed to choose 1 mpd over 4 mpd alternatives, and the MCC 7399 exclusion means you need to stay on your toes.

How will you be using the Chocolate Visa Card from July?

How will I be using it? Well, I will continue to use until I hit the next 10,000 mile block at which point I will transfer out the miles, delete the App, and destroy the card. Is totally useless in my view.

If you need to exit, you can transfer HeyMax points to Yuu Rewards and then to Krisflyer. No need to wait for the next 10,000 mile block.

Already withdrew all my funds from chocolate

I can’t believe how a company handling people finances can flip and flop policy so often over a year

all these in just first half of the year don’t leave much confidence , which also means the company dosent have much foresight or planning

The CEO will blame it on the users ‘gaming’ the system

It was always just a loss leader style of PR-campaign to grab attention, so that it would be remembered as an option for savings/investment/payment. They never had the funds or the intention to run a long-term benefit system with slim (or negative) margins. And they have no other motives unlike Temasek/DBS/PA with Yuu.

So by having articles written, and complaints voiced, they have achieved their desired outcome for publicity although it was probably a closer call than they might have liked with MAS forced to make comments.

Are payments in FCY to the listed MCCs included in the $100 bill cap? Or is it only SGD txns that are limited to 100 miles per month?

I am afraid the transferring Harvard students will only get 100 miles as SMU fees payment is MCC 9399.

It’s getting darker and darker

Just another passé. Could never use the card meaningfully with the $1k transaction limit anyways

It may be called Chocolate but it’s aging like milk

Important note: bill exceeding $100 from July onwards will earn 0000000 miles. Not even the 0.4miles currently earned so better pay all the insurances and what not now!