|

⚠️ Story update: This promotion has ended on 31 October 2025. [Important Update] BOC Elite Miles World Mastercard – Spend and Earn Promotion 2025’s Reward has been fully redeemed. Eligible spend made on or before 31 Oct 2025 and posted to the card account no later than 10 Nov 2025 will still be awarded miles in accordance with the Promotion’s Terms and Conditions. Please stay tuned for our upcoming promotions! Call us for enquiries. |

Once a year, BOC runs an utterly bonkers promotion that makes everyone temporarily forget what a royal pain it is to deal with.

In 2024, the BOC Elite Miles Card offered an uncapped 7-8 mpd on overseas and online spend, dining, Singapore Airlines, Scoot, KrisShop and Pelago. This promotion, initially scheduled to run for a month, lasted a grand total of two weeks before it was pulled early.

BOC has now launched a similar promotion for 2025, though with some tweaks that should hopefully give it more longevity.

From now till 31 December 2025, BOC Elite Miles Cardholders can earn a bonus 6 mpd on the same categories as last year — which brings the total to 7.4 mpd (SGD) and 8.8 mpd (FCY) after base miles are included. This time, a minimum spend of S$1,000 is required, and there is a cap of 30,000 bonus miles per month (equivalent to S$5,000 of spending).

Even with the additional conditions, it’s still an absolutely insane offer. But since this is BOC, you’re going to want to read the fine print very, very carefully!

Details: BOC Elite Miles bonus 6 mpd promotion

From 20 September to 31 December 2025, BOC Elite Miles Cardholders will earn a bonus 6 mpd on the following transactions.

| Category | Definition |

| Online Spending SGD FCY |

|

| Overseas Spending FCY |

|

| Dining SGD FCY |

|

| Singapore Airlines SGD FCY |

|

The bonus is subject to two conditions:

- A minimum spend of S$1,000 per calendar month

- A cap of S$5,000 per calendar month (equivalent to 30,000 bonus miles)

The BOC Elite Miles Card normally earns 1.4 mpd (SGD) and 2.8 mpd (FCY), so together with the bonus, you’re looking at 7.4 mpd (SGD) and 8.8 mpd (FCY).

| Base | Bonus | Total | |

| SGD | 1.4 mpd (No cap) |

6 mpd (S$5K cap) |

7.4 mpd |

| FCY | 2.8 mpd (No cap) |

6 mpd (S$5K cap) |

8.8 mpd |

I find it a bit strange they felt the need to explicitly mention KrisShop, Pelago, Scoot and Singapore Airlines, since these will invariably be online transactions anyway, but I suppose this would cover those edge cases where you visit the ION Orchard centre to make a transaction in person.

In case you’re wondering what happened to Kris+, do remember that it requires payment via Apple Pay or Google Pay, and BOC does not support either platform at the moment.

Do you need to register?

Yes, but not when you might think.

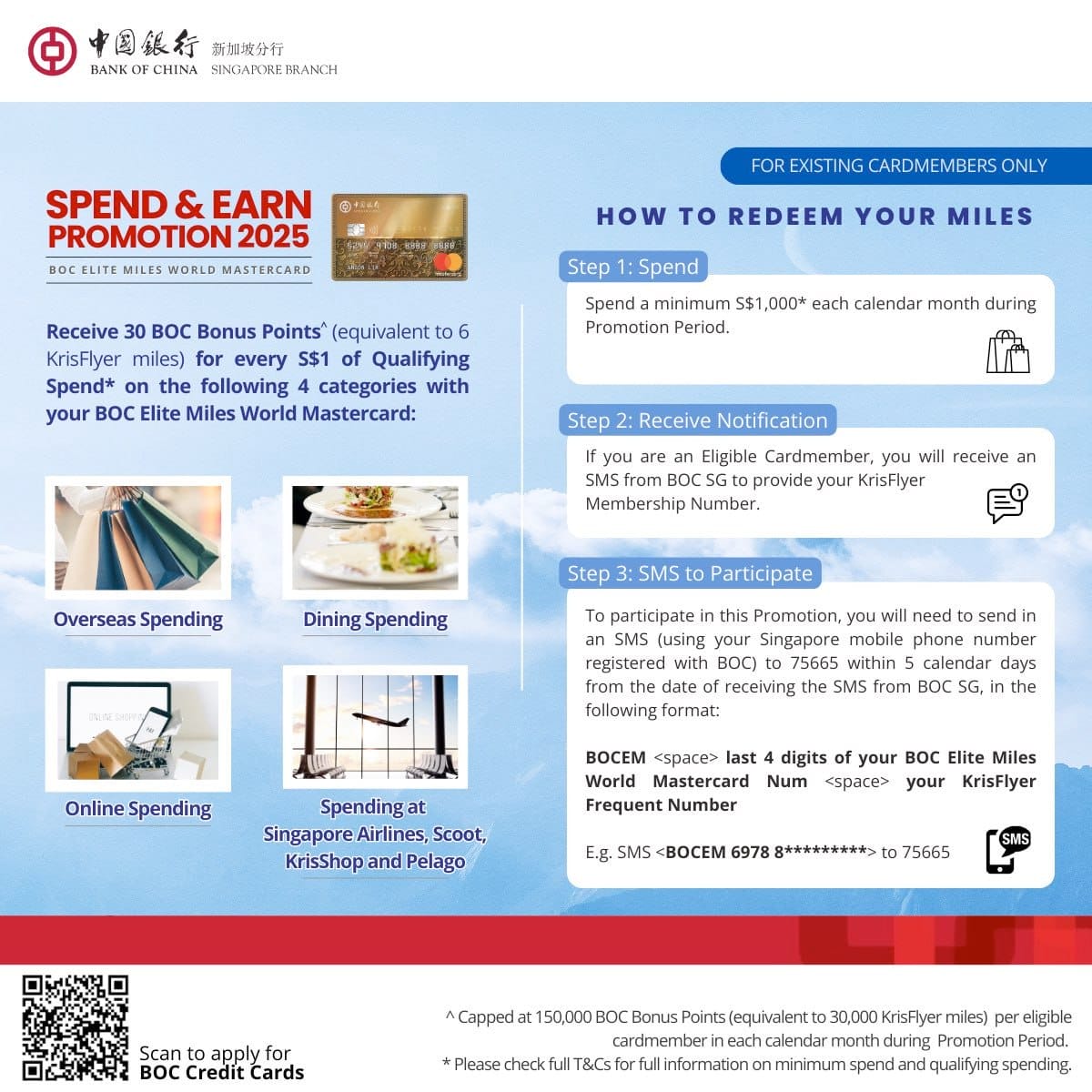

Unlike similar promotions run by other banks, where you need to register before spending, BOC instead requires you to register after they get in touch with you.

Let me explain: 30 days after the end of each calendar month during this promotion period, BOC will send cardholders an SMS requesting your KrisFlyer frequent flyer member number. Once that SMS is sent, you will have five calendar days to send the following SMS to 75665:

| 📱 SMS to 75665 |

| BOCEM<space>Last 4 digits of BOC Elite Miles Card<space>Frequent Flyer Programme Membership Number E.g. SMS <BOCEM 6978 8*********> |

If you miss BOC’s message, or reply later than five calendar days, no bonus miles for you!

What counts towards minimum spend?

BOC Elite Miles Cardholders must spend at least S$1,000 in each calendar month to receive the bonus miles for that particular calendar month.

| Period | Min. Spend |

| 20-30 Sep 2025 | S$1,000 |

| 1-31 Oct 2025 | S$1,000 |

| 1-30 Nov 2025 | S$1,000 |

| 1-31 Dec 2025 | S$1,000 |

The minimum spend excludes any transaction on BOC’s exclusions list, such as:

- CardUp and ipaymy

- Charitable donations

- Government services

- Hospitals

- Insurance premiums

- Prepaid top-ups like GrabPay and YouTrip

- Utilities

The full list of exclusions can be found in the T&Cs at point 2.2.

For the avoidance of doubt, minimum spend need not be qualifying spend. For example, if you spent S$400 at Takashimaya in Singapore (an offline local transaction), this would not be eligible to earn the bonus 6 mpd, but would count towards the S$1,000 necessary to trigger it.

Will Amaze count?

Since online spending is eligible for the bonus, you might be wondering if pairing Amaze with the BOC Elite Miles Card and spending would work.

Two things to note.

First, if you’re planning to spend within Singapore, you should remember that Amaze charges a 1% admin fee (min. S$0.50) for all domestic transactions, which will eat into your returns.

Second, there’s some ambiguity about whether Amaze transactions qualify. The T&Cs state that online spending excludes “any payments made through e-wallets with stored value, such as but not limited to Amaze and YouTrip.” However, the wording seems to refer to Amaze as a stored value facility (i.e topping up the Amaze wallet) rather than using it as a passthrough for credit card spend.

Still, the real question is: are you willing to take that risk?

When will miles be credited?

Cardholders will earn the regular 7 (SGD) or 14 (FCY) BOC Points per S$1 (equivalent to 1.4/2.8 mpd) when the transaction posts.

These BOC Points can be converted into KrisFlyer miles at a time of the cardholder’s choosing, with the payment of a S$30.56 conversion fee.

| Frequent Flyer Programme | Conversion Ratio (BOC Points: Miles) |

| 50,000 : 10,000 |

The bonus 30 BOC Points per S$1 (equivalent to 6 mpd) will be automatically converted into KrisFlyer miles within 60 days of the end of the promotion period (i.e. by 1 March 2026), and credited to the cardholder’s KrisFlyer account. No further conversion fees apply.

Terms & Conditions

The T&Cs of this offer can be found here.

What’s the catch?

One catch I’ve already highlighted is that this isn’t a “fire and forget” campaign, in the sense that you register once and are done. You need to register each month, and there are bound to be cardholders who miss the five-day deadline to reply to BOC’s SMS.

Furthermore, the T&Cs state (point 11) that this reward is available on a “first-come-first-serve basis”. Based on what we saw last year, this probably means that BOC has a fixed pool of miles it will award under this campaign, and once that’s exhausted, it will end the campaign early.

The T&Cs also state (point 17) that if a BOC Elite Miles Cardholder terminates their banking relationship within 12 months of the end of the promotion period, BOC reserves the right to recover the value of the points awarded under this promotion. I’m not sure how they define “banking relationship” though, and whether it’d be OK to terminate your card if you still maintained a bank account with them, or some other card.

BOC has also put a label on its promotional materials saying “for existing cardmembers only”, and what that means is unclear. Does BOC mean that you must have been a cardholder as of 20 September 2025 in order to be eligible? The T&Cs also mention the “existing” criteria (Point 2), but are silent as to what it means exactly.

You might say I’m reading too much into things, but since this is BOC, “reading too much into things” should be the default course of action…

Conclusion

From now till 31 December 2025, BOC Elite Miles Cardholders can earn up to 7.4-8.8 mpd on overseas spend, online spend, dining, Singapore Airlines, Scoot, KrisShop and Pelago. It’s a humdinger of a promotion, and those who kept the faith are going to have some very exciting months ahead.

Now, assuming that this isn’t just for cardholders as of 20 September 2025, the question then becomes: could I apply for a BOC Elite Miles Card and receive it in time to make substantial hay?

I honestly don’t know. Back when I dealt with the bank in 2018 and 2019, card application times were measured in the months, not weeks. That said, it could very well have improved by now, and with the promotion set to run till the end of 2025 (well, unless it gets pulled early again), you should still be able to sneak in some spending.

Any recent experiences with BOC?

Does BOC have any welcome offer for new sign ups for cc?

Hi Aaron, thanks for the informative post. Just a quick question, if I buy a department store gift card online (such as Tangs gift card purchased via tangs.com), will it count as an online transaction and thereby be eligible for the bonus miles? Technically it’s an online transaction but would it also be counted as “topping up money into an account”?

Does the above apply to new sign ups?

I saw it in my email, I don’t have the card, I did quick calc, even if I hit all 4 months, it’s just merely 24K, I will just simply say, this does not worth the hassle.

If we use this card for Atome instalments, would it qualify for the bonus 6mpd?