The AMEX Platinum Charge offers cardholders credits for dining, wine and travel, collectively known as Platinum Statement Credits. This replaced the previous system of S$800 airline and hotel credits, which was discontinued in February 2023.

American Express has just launched 2026’s Platinum Statement Credits, which are significantly changed from last year. In one sense, they’re much simpler to use, because three categories (Local Dining, Entertainment and Fashion) have been eliminated, and the Global Dining credit has been consolidated into a single yearly credit (though you’ll need to wait until March 2026 to use it). In another, that simplification has come at a cost, because this year’s credits are worth S$800, compared to S$1,354 last year.

In this guide, I’ll go through the details of each of the credits, and answer some FAQs regarding their use.

What’s changed from last year?

Here’s a summary of how 2026 Platinum Statement Credits compare with 2025’s.

| 💳 Platinum Statement Credits | ||

| 2025 | 2026 | |

| Local Dining | S$100 per 6 mo. | Discontinued |

| Global Dining | S$100 per 6 mo. | S$200 per yr. |

| Lifestyle | S$200 per 6 mo. (Min. S$300 spend) |

Discontinued |

| Platinum Wine | N/A | S$200 per 6 mo. (Min. S$300 spend) |

| Airline | S$100 per 6 mo. (Min. S$300 spend) |

|

| Entertainment | S$17 per mo. | Discontinued |

| Fashion | S$75 per 6 mo. | Discontinued |

| Total | S$1,354 | S$800 |

There is no change to the Airline credit, which works exactly the same as in 2025. However, the rest of the credits are changing as follows.

Local dining credit replaced by Table for Two

The Local Dining credit, which was awarded as 2x half-yearly S$100 credits in 2025, has been replaced by the new Table for Two benefit.

Table for Two offers AMEX Platinum Charge cardholders one complimentary meal for two people, every two months.

| Redemption Cycle | Entitlement |

| 1 Jan to 28 Feb | 1x free meal |

| 1 Mar to 30 Apr | 1x free meal |

| 1 May to 30 Jun | 1x free meal |

| 1 Jul to 31 Aug | 1x free meal |

| 1 Sep to 31 Oct | 1x free meal |

| 1 Nov to 31 Dec | 1x free meal |

Bookings must be made through the Amex Experiences App, and more details can be found in the guide below.

Global Dining credit now yearly

The Global Dining credit, which was awarded as 2x half-yearly S$100 credits in 2025, has been consolidated into a single S$200 annual credit.

That’s good news, because it allows you to fully utilise it on a single overseas trip, instead of having to take one trip from January to June, and a second trip from July to December like in 2025 (I guess you could have planned a single trip that straddles the June/July changeover, but anyway…).

However, the bad news is that the new Global Dining credit will only be available for registration from 2 March 2026 onwards, so those travelling in January or February are out of luck.

You can find the list of participating restaurants here.

Lifestyle credit becomes Platinum Wine credit

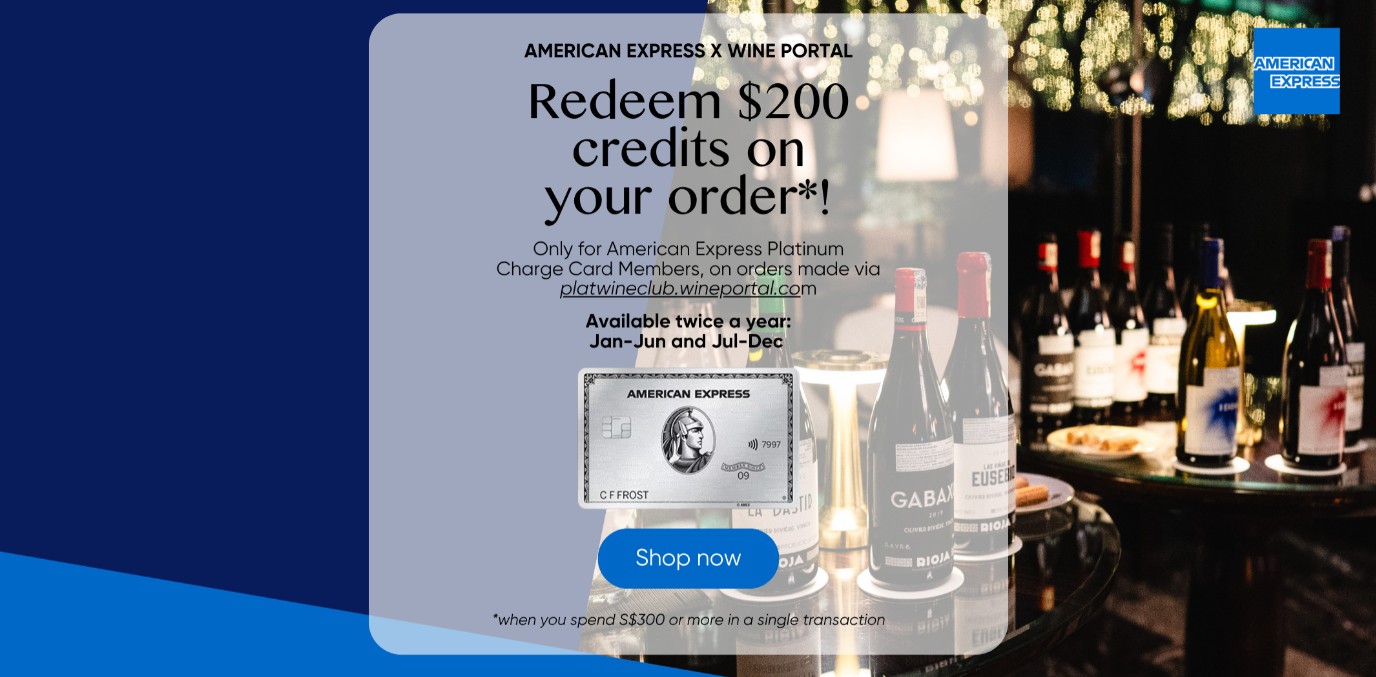

2025’s Lifestyle credit, which could be spent on spa treatments or wines, has been revamped as the Platinum Wine credit for 2026. This credit will be valid for purchases of wine through the Platinum Wine Portal.

The credit will continue to be worth S$400 per year, split into 2x S$200 credits, each with a minimum spend of S$300 in a single transaction.

Entertainment & Fashion credits discontinued

2025’s Entertainment and Fashion credits have been discontinued for 2026.

If you have a recurring billing arrangement with Disney+, Netflix or any of the other eligible entertainment merchants, now would be a good time to swap your card on file!

Overview: 2026 Platinum Statement Credits

|

||

| 💳 Platinum Statement Credits |

||

| Credit | Amt. | No. of Trxns. |

| Global Dining | S$200 per yr. | Multiple |

| Platinum Wine | S$200 per 6 mo. (min. S$300 spend) |

Single |

| Airline | S$100 per 6 mo. (min. S$300 spend) |

Single |

The AMEX Platinum Charge is offering S$800 worth of Platinum Statement Credits for 2026.

The Global Dining credit is awarded on an annual basis (though it will only be available from 2 March 2026), while the Platinum Wine and Airline credits are disbursed on a half-yearly basis.

For half-yearly credits, cardholders will receive:

- 1x credit to be used from 1 January to 30 June

- 1x credit to be used from 1 July to 31 December

All credits require registration, which can be done via the AMEX Offers portal on the desktop website or AMEX SG mobile app. You’ll need to register for each credit separately.

Registration will remain in effect till 31 December 2026, so if you previously registered in 2025, there is no need to register again. However, you will need to register for the Global Dining credit when it launches in March 2026, as that’s considered a new credit altogether.

Once registered, statement credits will be automatically triggered upon meeting the eligibility criteria.

Statement credits officially appear on your billing statement within 30 days from the date of transaction, but in practice often appear much sooner. In my experience, it takes no more than 3-4 days to post.

Only the principal cardholder may enrol for statement credits, and only spending on the principal card will trigger statement credits. Spending on a supplementary card or additional card will not be eligible.

S$200 Global Dining credit

Launching March 2026 Launching March 2026 |

|

| Overseas Dining Credit | |

| Awarded | S$200 annually |

| No. of Transactions | One or more |

| Minimum Spend | None |

From 2 March 2026, AMEX Platinum Charge cardholders will receive a S$200 Global Dining credit that can be used at any participating restaurant worldwide.

No minimum spend is required, and the credit can be used in one or more transactions. In other words, you can use part of it at Restaurant A, and the rest at Restaurant B.

The credit can be used at over 2,000 restaurants in the following countries:

| 🍽️ Global Dining Credit Countries | |

|

|

The credit is only valid for dine-in and excludes purchases of gift cards and vouchers, transactions made towards deposits charged upfront by the participating restaurants, cancellation and no-show charges, take away or dine-at-home services.

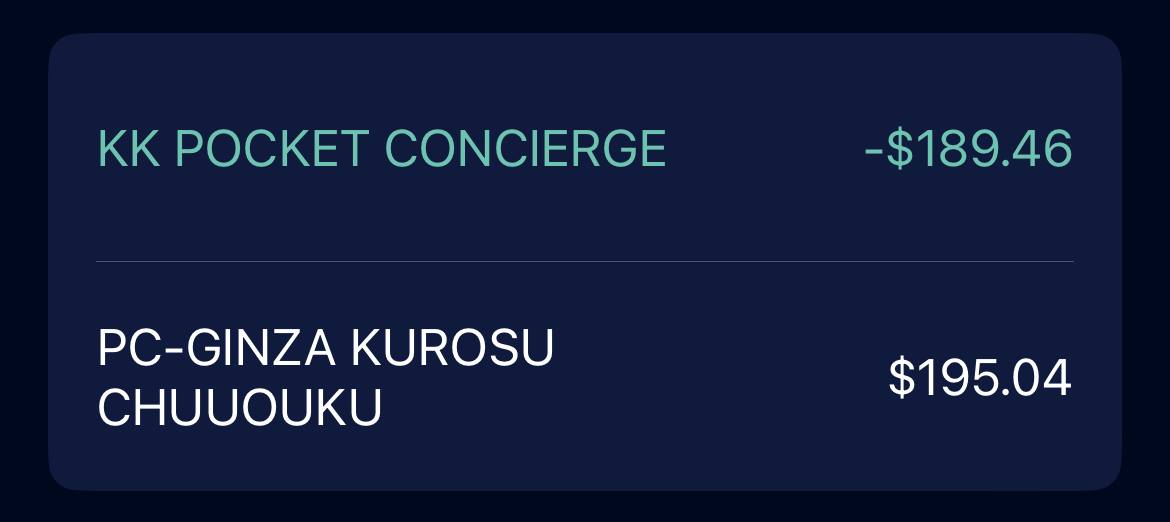

Do note that if you want to book restaurants in Japan, you must use the Pocket Concierge service and make a prepaid reservation. This still triggers the dining credit, despite what the previous paragraph says. I tried this out during a trip to Osaka previously, and the process was very smooth.

While credit posting is usually quite reliable, it’s good practice to retain your receipts and check your statement. I had an issue with Aosta in Arrowtown, New Zealand where the credit did not post. Upon investigation, it was discovered that the merchant was using an older payment terminal still tied to the restaurant’s previous name. The credit was manually awarded after I submitted the receipt for my meal.

S$400 Platinum Wine credit

Note: AMEX hasn’t gotten around to renaming this credit on their app, which still reflects the previous Lifestyle credit name Note: AMEX hasn’t gotten around to renaming this credit on their app, which still reflects the previous Lifestyle credit name |

|

| Platinum Wine Credit | |

| Awarded | Jan-Jun: S$200 credit Jul-Dec: S$200 credit |

| No. of Transactions | Single |

| Minimum Spend | S$300 |

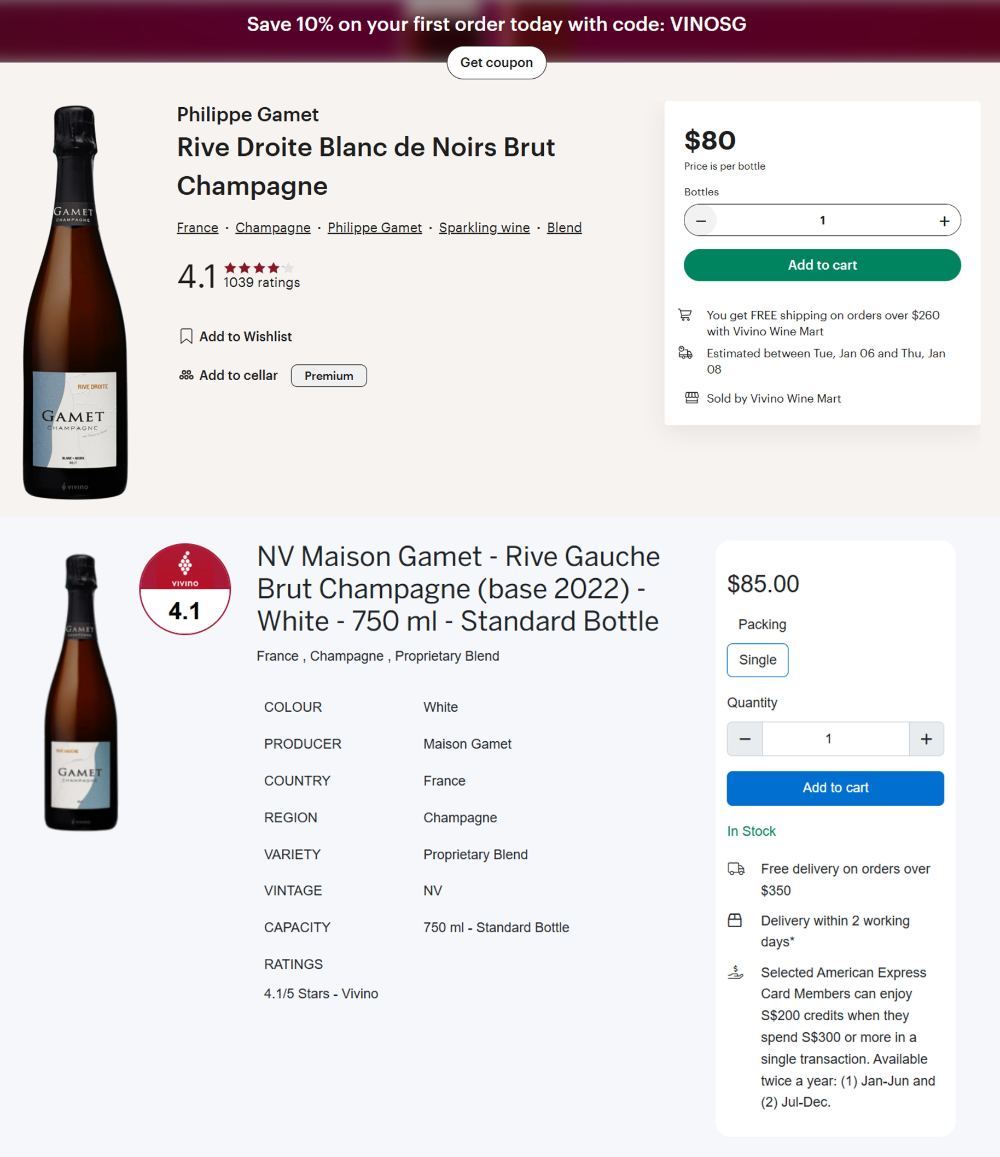

AMEX Platinum Charge cardholders receive 2x S$200 Platinum Wine credits every half-year that can be used for purchases at the Platinum Wine portal.

A minimum spend of S$300 in a single transaction is required.

It’s worth highlighting that the previous Platinum by Grand Cru website could be a bit of a minefield, with cardholders sometimes paying more than Grand Cru’s public website.

I have not done a detailed comparison for the new Platinum Wine Club portal, but there are definitely cases where this happens still. For example, this bottle of champagne costs S$80 on Vivino’s public website (with free delivery from S$260), but S$85 on the Platinum Wine Club (with free delivery from S$350).

Therefore, it’d be a very good idea to comparison shop and make sure you’re not paying over the odds!

Unfortunately for teetotalers, there is no longer a spa alternative. If you don’t drink, your best bet would be to try and resell the wines, or perhaps gift them to your degenerate friends.

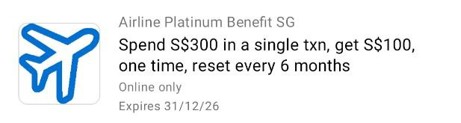

S$200 Airline credit

|

|

| Airline Credit | |

| Awarded | Jan-Jun: S$100 credit Jul-Dec: S$100 credit |

| No. of Transactions | Single |

| Minimum Spend | S$300 |

AMEX Platinum Charge cardholders receive 2x S$100 Airline credits every half-year that can be used with Singapore Airlines or Scoot.

A minimum spend of S$300 in a single transaction is required.

The following terms apply:

- Tickets must be purchased in-app or online at the Singapore Airlines or Scoot websites (i.e. you cannot book IAP rates via the AMEX Travel Portal, nor OTAs like Expedia)

- Tickets must be purchased in Singapore Dollars for flights departing from Singapore

- Transactions on KrisShop, Kris+ and any purchase of trip add-ons or purchases via phone, email, or other payment links will not qualify

This credit will be triggered when paying for taxes and surcharges on award tickets, but take note of the following:

- The charge must be in SGD, which means you must either redeem a one-way or round-trip ticket from Singapore (the credit would not be triggered if you redeemed a one-way LHR-SIN ticket and paid for taxes and surcharges in GBP, for example)

- The award ticket need not be on Singapore Airlines. If you were to redeem a Lufthansa award ticket via KrisFlyer, the charge would still come from Singapore Airlines (the previous point about the charge being in SGD still applies, however)

| ❓Must it really depart from Singapore? |

|

Even though the terms say that tickets must be for flights departing Singapore, there are numerous data points saying all that matters is the payment currency. If you choose to pay in SGD (SIA’s website sometimes offers the option), the statement credit will be triggered. Do note that this is a by right, by left thing, and may change at any time. |

The requirement to spend at least S$300 in a single transaction is unlikely to be a problem if you’re buying commercial tickets, but it could be an issue for award tickets. For example, the taxes and fees on a round-trip Business Class ticket from Singapore to Los Angeles and Sydney are S$95.90 and S$205.40 respectively, insufficient to trigger the credit.

So either you redeem tickets for multiple travellers, or maybe fly to London, where taxes and fees will set you back S$540.70!

As a side note, the opportunity cost involved with using the AMEX Platinum Charge for Singapore Airlines/Scoot transactions isn’t quite as bad as other categories, since you earn 1.95 mpd. Moreover, you will also trigger the very comprehensive travel insurance coverage by using your AMEX Platinum Charge to pay (even if it’s an award ticket).

FAQs

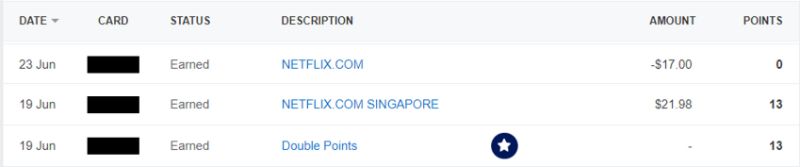

Q: Do I still earn points for the full amount of spend, or is there an offset for the amount covered by statement credits?

You will earn points for the full amount of spend; the statement credit does not lead to a deduction in points.

Q: Do supplementary cardholders enjoy statement credits?

No. Supplementary cardholders cannot register for statement credits, nor will their spending trigger the statement credits.

Q: Why wasn’t my full Global Dining credit rebated?

If you spend <S$200 on overseas dining, you might notice that not the entire amount of your spend was rebated via a statement credit.

That’s because the statement credit does not apply to the 3.25% foreign currency transaction fee that applies to all AMEX cards.

Q: Must I pay by a specific method to enjoy the statement credits?

No. Statement credits will be triggered regardless of how you pay, e.g. card swipe, tapping the physical card, adding the card to a mobile wallet and then paying with your phone.

Conclusion

The 2026 Platinum Statement Credits are a mixed bag.

On the plus side, the Table for Two benefit which replaces the Local Dining credit is much more lucrative, with six free meals for two surely outweighing the S$200 loss. Also, the consolidation of the Global Dining credit makes it easier to use, though it’s basically reverting to the 2024 situation.

On the negative side, the Entertainment and Fashion credits are gone, and the new Platinum Wine credit will be of limited use to those who don’t drink.

It may be helpful to build yourself a little Excel tracker so you don’t inadvertently forget to spend your credits (you’ll be surprised how often that happens!), especially for those awarded on a half-yearly basis.

Any questions about the AMEX Platinum Charge’s statement credits?

can the $200 local dining statement credit be stacked with the 2 x $50 JAAN vouchers?

I don’t see the offers in my app? Just got the card today

it takes about a week to appear

Does the statement credits spend add towards the qualifying 6k spend?

Am wondering the same thing

Regarding changing payment currency to SGD via SIA’s website to trigger the $200 Airline credit, I don’t find that option available now (for example if I buy an airline ticket from ICN to SIN). Any ideas or suggestions?

You are going to need a PhD soon to fully-utilize the benefits for AMEX Plat

Indeed. For a freaking premium card catered to high income earners, I need to waste my time trying to see how I can utilize the benefit (save money). What a waste!

Will be dumping this card after I redeem all my accumulated points.

I am glad to have given up and cancelled my card in December. Instead of making our lives easier, this is causing way too much administrative and logistics hassle. Ideal for someone who doesn’t need to work, and make it Amex Charge Debit card

“Hi dear client, In your next chapter with Platinum, we look forward to bringing you more extraordinary privileges and memorable moments.” We will make sure you have a memorable moment by requiring you to look for your privilege every 6 months instead of per year. We’re doing this because really, this is a good way for us to earn. When you don’t fully utilize your credit above your annual dues.

Given all these nerfs, is there other better lifestyle cards? what keep people on this card? Kind of regret renewing for another year now just for some retention bonus..

Will be dumping this card after I redeem all my accumulated points. This has been a big time waster more than anything and it is no longer worth it to keep referring to what rewards I can avail, and whether 6 months is up or something. All this to just to get some value from the card. 👎🏻👎🏻👎🏻

Mr Porter “mrp10pmx” does not seem to work anymore. Have already tried in-cognito. Any ideas?

try this: https://t.me/milelion/1064107

there doesn’t seem to be a space to enter the promo code before check out now.

I was really disappointed about the changes, and am seriously considering changing to another premium card. Any suggestions?

OMG no more Aesop on Mr Porter!!

My card got approved recently, but the credits I’ve gotten are shown to expire in H2 2025. Does this mean theres no longer 1.5x years’ worth of credit to be utilised?

No more Aesop 🙁

No more Burnt Ends 😮💨

No more a lot of things. I’ve moved on to other cards in the segment. Will probably cancel at next AF but will wait and see what happens. They kept sending me survey requests so finally decided to spend 15 minutes on the ‘feedback’ last week listing some points of discontent.

Jem

While it’s not the main focus of this post, I wanted to briefly touch on the S$200 Lifestyle credit available to AMEX Platinum Credit Card members. This is significantly easier to use because of the wide range of participating dining and retail merchants, all of which are in Singapore. For example, you could spend the Lifestyle credit at 15 Stamford, Barossa Steak & Grill, Burger & Lobster, Cali, Entrepot, and Sen of Japan, to name a few. Many of the restaurants on the list are also Love Dining partners, which means you can further stack the discounts. this one is… Read more »

just Wondering if I can still use the table for two benefit if I’m intending to cancel my card in Mar2026? WilL I be liable for some charges?

The lifestyle spa credit is still there,shares the same credit as the wine.

no more lifestyle spa credit for 2026.

I saw the spa outlets as part of the participating outlets for the credits. Is that a typo or should I be quick to use it?

Try and let us know then.

Before march2026, would the old scheme for airline and lifestyle credits still be applicable?