SC EasyBill allows Standard Chartered customers to pay taxes, rent, insurance and education bills with their credit cards, earning rewards points in exchange for a small fee.

This is particularly lucrative for StanChart Beyond Cardholders with Priority Banking or Priority Private status, who earn 2 mpd on all local payments. Given the 1.9% admin fee, the cost per mile is just 0.95 cents, well within the “strike price” for many people.

But if that was your main use case for StanChart cards, I have some bad news. Last month, Standard Chartered quietly added a new restriction to EasyBill, which limits the number of payments you can make with the service each month.

Standard Chartered adds new cap on SC EasyBill

|

| SC EasyBill |

For context, SC EasyBill currently supports four categories of payments.

| Category | Examples |

| Tax Payments |

|

| Education |

|

| Insurance |

|

| Rent |

|

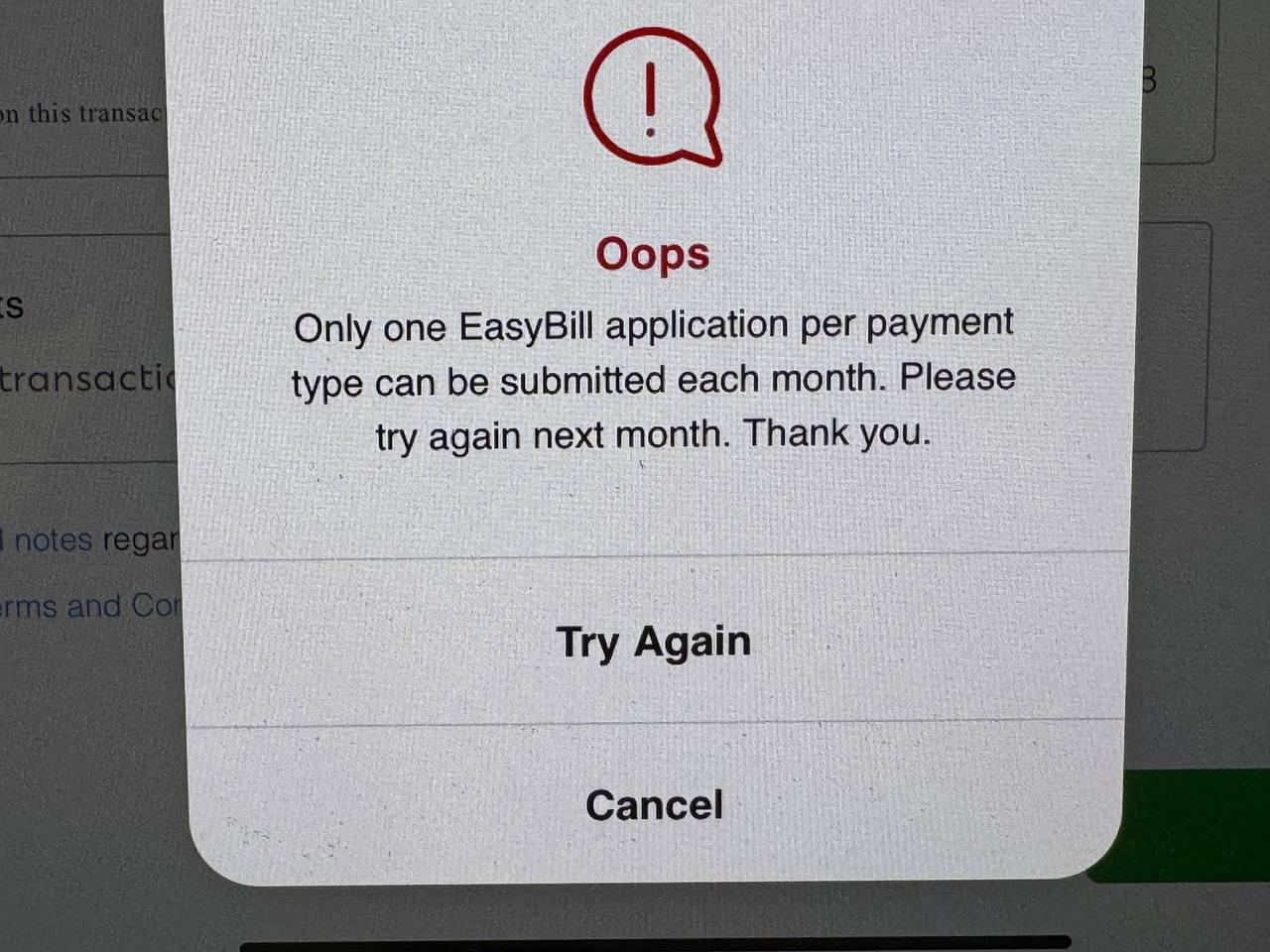

While there previously wasn’t any restriction on the frequency of EasyBill use, at some point in December 2025, Standard Chartered added a cap of one bill payment per category, per month.

This new restriction can be found in clause 7 of the EasyBill T&Cs.

7. The Qualified Cardholder is limited to 1 SC EasyBill application per payment type (as defined in Clause 2 above) every calendar month.

-Standard Chartered

This has huge implications for cardholders, as it significantly limits the opportunities for using EasyBill. For example, in the same month, you won’t be able to pay:

- Rent for more than one property

- Life and medical insurance

- Fees for more than one enrichment class

- Income tax and property tax

If buying cheap miles was a big reason why you signed up for a StanChart credit card (*ahem Beyond ahem*), I can imagine you’ll feel rather aggrieved by this development!

Are there workarounds?

If there are, I’d certainly like to know!

That said, I can tell you what won’t work: getting a supplementary card. Standard Chartered, for reasons I still don’t understand, assigns the same card number to principal and supplementary cardholders.

Basically, if the principal cardholder has already made a payment in the tax category for the month, getting a supplementary card won’t make a second tax payment possible.

What’s the cost per mile with SC EasyBill?

Here’s a quick reminder of the cost per mile when paying bills through SC EasyBill.

| Card | Earn Rate | Cost Per Mile (1.9% admin fee) |

StanChart Beyond Card StanChart Beyond Card(PB & PP) |

2 mpd | 0.95¢ |

StanChart Beyond Card StanChart Beyond Card(Regular) |

1.5 mpd | 1.27¢ |

StanChart Visa Infinite StanChart Visa Infinite(Step-Up Rate) |

1.4 mpd* | 1.36¢ |

StanChart Journey Card StanChart Journey Card |

1.2 mpd | 1.58¢ |

StanChart Visa Infinite StanChart Visa Infinite(Regular Rate) |

1 mpd* | 1.9¢ |

StanChart Priority Banking Visa Infinite StanChart Priority Banking Visa Infinite |

1 mpd | 1.9¢ |

| *1.4 mpd with min. S$2,000 overall spend in a statement month, otherwise 1 mpd |

||

While StanChart Beyond Cardholders enjoy the best deal on EasyBill, it can still be attractive for StanChart Visa Infinite Cardholders who spend at least S$2,000 per statement month (including SC EasyBill).

It’s a bit more marginal with the StanChart Journey Card, and I probably wouldn’t consider it beyond that.

Conclusion

SC EasyBill now limits customers to one bill payment per category, per month, with effect from December 2025.

This payment platform was already fairly limited in scope, compared to alternatives like CardUp and Citi PayAll, and adding a further usage cap is no doubt going to frustrate many cardholders.

Yes, I noticed it last month when trying to pay both income and property taxes. I think just have to plan ahead and pay some in advance e.g. 2 months of income tax instalments at once, or spread out the insurance premiums. At 0.95 cents it is a very good deal, while it lasts.

Additionally, there is a value cap, such as SG$10k for rent. My rent exceeds this amount, and it appears I can no longer split the rent into multiple payments to bypass the cap. This is unfortunate. I would be okay with only one payment per category each month, but with both the value payment limit, I will need to look for other options for my rent payments. Tax seems to be uncapped, so not an issue here.

Oh dear – my insurance is $40k – not sure if got cap. Do they ask for rental agreement for rent?

I was just going to put the trigger for the Beyond card yesterday. Luckily there were some hiccups with the application and it didn’t happen. Now I have to re-evaluate. I still got at least $40k expenditure a month despite the limitation, but I will not be able to churn millions of miles a year I was expecting before this development. Aaron, can share if this method requires much documentation for the bill payment. I always find Cardup documentation a pain.