| ⚠️ Story update: Maybank has published a new set of T&Cs (dated 26 January 2026) which removes the exclusion for CardUp and ipaymy. I’m trying to get official confirmation from a spokesperson, but in the meantime I would assume that the exclusion was never meant to be there in the first place. |

Back in October 2025, Maybank announced that it would be adding new rewards exclusions with effect from 1 December 2025, including utility bills, janitorial services, various quasi-cash transactions, and top-ups of prepaid accounts.

However, there was one major new exclusion that the bank failed to highlight— Maybank has now joined Bank of China and HSBC in excluding rewards for all CardUp and ipaymy payments.

This additional exclusion quietly went into effect the same time as the rest of the changes, and I only became aware of it thanks to a tip in the comments. And while Maybank cards weren’t great options for such transactions in the first place, it’s never a nice feeling to have something snuck in under your nose.

Maybank excludes rewards for CardUp and ipaymy

On 24 October 2025, Maybank published a notification on its website alerting cardholders about an upcoming revision to its rewards programme.

| ⚠️ Revision to Maybank Cards’ TREATS Points Rewards and Cashback Programmes | ||||||||||||||||||||

|

From 1 December 2025, all transactions under the following Merchant Category Codes (“MCC”) listed in Table 1, as well as transactions matching the transaction descriptions listed in Table 2, will no longer be eligible to earn TREATS Points or Cashback on all personal Maybank Credit and Debit Cards.

|

||||||||||||||||||||

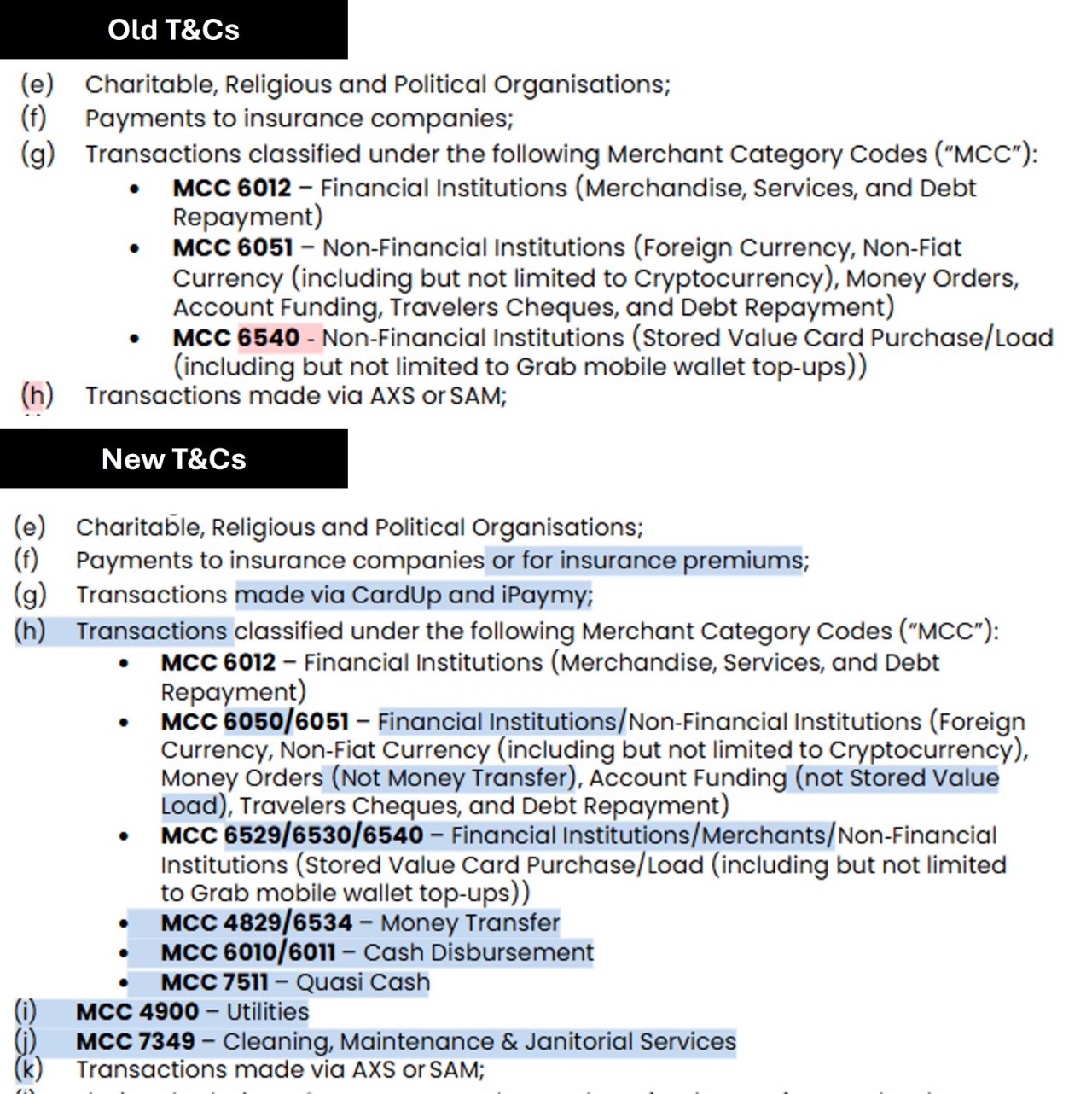

However, when the updated TREATS T&Cs were published on 1 December, the revised document wasn’t completely in line with what had been announced.

I’ve uploaded both documents side-by-side here for an easier comparison, but here’s the crucial bit. While the new T&Cs largely reflect what was announced, there is an additional exclusion for CardUp and ipaymy, found at 2.2 (g), that came out of nowhere!

The other interesting thing is that despite being mentioned in the announcement, MCCs 5960, 6381 and 6399 are not explicitly listed in the revised TREATS T&Cs. I would assume they fall under the catch-all of 2.2(f), Payments to insurance companies or for insurance premiums.

Do note that you can still earn miles on in insurance transactions with the Maybank Visa Infinite, Maybank Horizon Visa Signature and Maybank Visa Platinum, subject to those respective card T&Cs (e.g. a maximum of S$3,000 per month for the Maybank Visa Infinite).

Exceptions

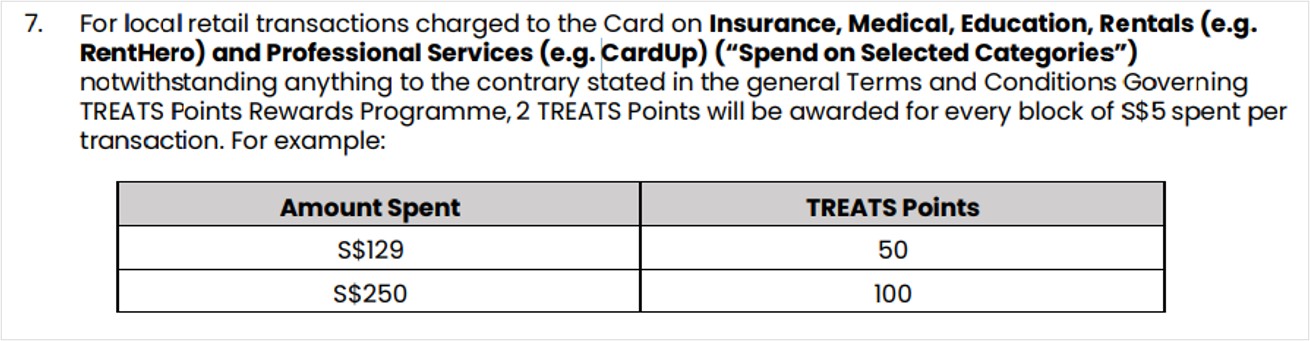

What complicates the picture even further is that a specific exception has been carved out for the Maybank Horizon Visa Signature.

Professional services, of which CardUp is explicitly mentioned, are defined as part of a group of so-called Selected Categories which earn 0.16 mpd, capped at 480 miles per month.

Of course, this is effectively an exclusion, because no one in their right mind would pay CardUp’s admin fee to earn just 0.16 mpd (much less a capped 0.16 mpd)!

Likewise the Maybank Manchester United Card awards 0.4 mpd on professional services charged in SGD (regardless of Manchester United performance). There is no cap to this earn rate, but again, it’s hard to see anyone willing to pay the admin fee for a mere 0.4 mpd.

Does this even matter?

In one sense this isn’t a major loss. The only Maybank card that one might consider using with CardUp/ipaymy is the Maybank Visa Infinite, and at 1.2 mpd, it pales in comparison to alternative cards which offer 1.3-2 mpd.

Maybank Visa Infinite Maybank Visa Infinite |

|

| Payment Type | Cost Per Mile |

| Homeowner recurring payments 1.77% |

1.45¢ |

| First payment for new user 1.79% |

1.47¢ |

| Recurring income tax, property tax & stamp duty 1.8% |

1.47¢ |

| Rental 1.83% |

1.50¢ |

| Recurring payments 1.85% |

1.51¢ |

| Renovation 2.1% |

1.71¢ |

| All payments ex. tax 2.35% |

1.91¢ |

On the other, I don’t see why Maybank decided to tiptoe around this exclusion, instead of just being upfront about it.

That said, if I know anything about banks, the CardUp/ipaymy exclusion was probably decided on after the initial announcement, and one team simply didn’t talk to the other to get the website updated. Not that it excuses anything, mind you, but it’s that old chestnut about incompetence vs malice…

Conclusion

Maybank has added CardUp and ipaymy transactions to its rewards exclusions list, a change which went into effect on 1 December 2025. Because Maybank didn’t explicitly call this out in its October notification, it’s likely to have slipped under the radar for many people (well, for me at least!).

I’m doubtful that many people were using Maybank cards with these platforms in the first place, but if you were, now’s the time to swap them out for something else.

Strange ???…As my cardup transaction (3k plus) on Maybank Visa Infinite on 4 Dec 2025 were awarded treat points and limo airport ride too which I used in Jan 2026!!!.

you’re not the only one, 2 other people have said their december transactions were awarded points. i’m digging more into this

Hi Aaron. Just read through the T&Cs, and the CardUp exclusion seems to have been taken out. Might want to double-check again. Thanks!

yup, they published a new version dated 26 january 2026 which removed the cardup exclusion. checking with them what’s going on