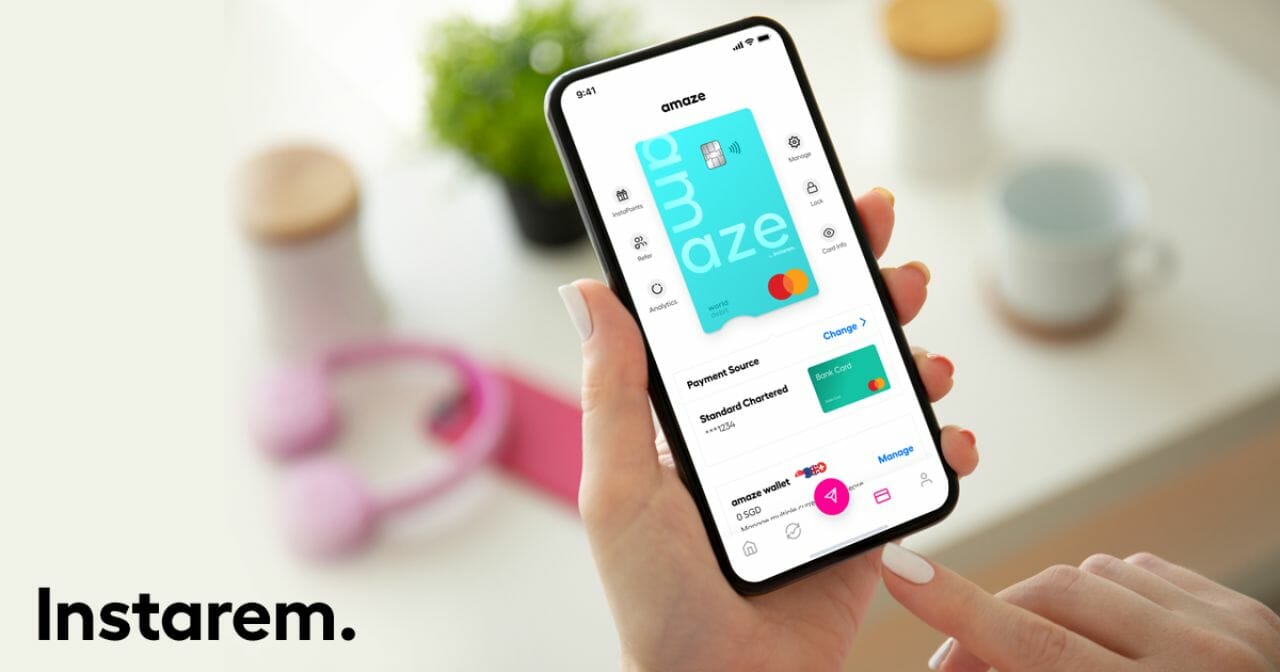

Amaze has launched a new campaign called Spend to Fly, which offers cardholders 1,000 KrisFlyer miles when they spend at least S$1,088 in foreign currency (FCY) between now and 31 March 2026.

Cardholders will also be entered into a lucky draw to win 88,000 KrisFlyer miles, enough for a round-trip Economy Class redemption between Singapore and Europe.

The catch? Only the first 500 cardholders who meet the minimum spend will qualify for the spending bonus and lucky draw. That said, both wallet-linked and card-linked Amaze transactions are eligible, so you should be able to participate without having to change your usual spending behaviour.

Amaze Spend to Fly campaign

|

| Apply here |

| Review |

The Spend to Fly campaign runs from 12 February to 31 March 2026, and is open to all Amaze cardholders.

During this period, the first 500 cardholders who spend at least S$1,088 in FCY will receive:

- 1,000 KrisFlyer miles (awarded as 3,000 InstaPoints)

- 1x lucky draw entry for 88,000 KrisFlyer miles (awarded as 264,000 InstaPoints)

It’s worth noting that the S$1,088 minimum spend is just slightly above the S$1,000 monthly cap on the Citi Rewards Card, which will no doubt be the most popular card to pair with Amaze.

However, you could make up the difference by pairing Amaze with alternative cards like the Maybank XL Rewards or OCBC Rewards Card, depending on MCC (more on this below).

What counts as qualifying spend?

The minimum spend of S$1,088 in FCY can consist of both online and offline spending. Both wallet-linked and card-linked Amaze transactions will be eligible.

Any transactions with the following MCCs will be excluded:

| MCC | Description |

| 4111 | Railroads, Transportation Services |

| 4784 | Tolls and Bridge Fees |

| 4900 | Utilities: Electric, Gas, Water, and Sanitary |

| 5047 | Medical, Dental, Ophthalmic and Hospital Equipment and Supplies |

| 5199 | Nondurable Goods (Not elsewhere classified) |

| 5960 | Direct Marketing: Insurance Services |

| 5993 | Cigar Stores and Stands |

| 6012 | Financial Institutions: Merchandise, Services, and Debt Repayment |

| 6211 | Security Brokers/Dealers |

| 6300 | Insurance Sales, Underwriting, and Premiums |

| 6513 | Real Estate Agents and Managers: Rentals |

| 6540 | Non-Financial Institutions – Stored Value Card Purchase/Load |

| 7299 | Other Services (Not elsewhere classified) |

| 7349 | Cleaning, Maintenance and Janitorial Services |

| 7523 | Parking Lots, Parking Meters and Garages |

| 8062 | Hospitals |

| 8211 | Elementary and Secondary Schools |

| 8220 | Colleges, Universities, Professional Schools, and Junior Colleges |

| 8241 | Correspondence Schools |

| 8244 | Business and Secretarial Schools |

| 8249 | Vocational and Trade Schools |

| 8299 | Schools and Educational Services |

| 8398 | Charitable Social Service Organisations |

| 8661 | Religious Organisations |

| 8675 | Automobile Associations |

| 8699 | Membership Organisations |

| 9211 | Court Costs, including Alimony and Child Support |

| 9222 | Fines |

| 9223 | Bail and Bond Payments |

| 9311 | Tax Payments |

| 9399 | Government Services |

| 9402 | Postal Services |

What about base InstaPoints?

The Spend to Fly campaign is on top of the regular base InstaPoints, which can be earned on SGD or FCY spend.

| Transaction Currency | Wallet-Linked | Card-Linked (Credit or debit) |

| SGD | 0.5 InstaPoints per S$1 | N/A |

| FCY | ||

| A minimum spend of S$10 is required to earn base InstaPoints |

||

Do note that base InstaPoints are only awarded for wallet-linked transactions, ever since March 2025 (to be clear: the minimum spend for the Spend to Fly campaign can be either wallet-linked or card-linked).

What card should I pair with Amaze?

While there are many potential card pairings for Amaze (just avoid DBS and UOB), the Citi Rewards Mastercard remains the most fuss-free option. Pairing the two enables you to earn 4 mpd on all FCY spend (with the exception of travel-related transactions and in-app mobile wallet payments– though the latter restriction will be circumvented by the Amaze pairing), capped at S$1,000 per statement month.

However, you can also earn 4 mpd with the Maybank XL Rewards Card or OCBC Rewards Card, depending on MCC. Refer to the article below for the full rundown of options.

Beware of orphan InstaPoints!

|

|

| InstaPoints | KrisFlyer miles |

| 1,200 points | 400 miles |

| No conversion fees; all conversions are instant | |

InstaPoints can be converted into KrisFlyer miles in fixed blocks of 1,200 points = 400 miles.

Any points outside these blocks are effectively orphaned— so in a sense, Instarem is being a bit sly here. Even if you do earn the spending bonus, you’ll have at least 600 orphaned InstaPoints (3,000 InstaPoints – 2x blocks of 1,200 InstaPoints).

To be fair, you can also use InstaPoints to offset the cost of overseas money transfers (100 InstaPoints = S$1.25 fee offset, capped at S$5), but not everyone will have use for that.

To learn more about earning and using InstaPoints, refer to the guide below.

Terms & Conditions

The T&Cs for the Spend to Fly campaign can be found here.

Conclusion

Amaze has launched a new Spend to Fly campaign, which offers 1,000 KrisFlyer miles for spending S$1,088 in FCY, plus a chance to win 88,000 more in a lucky draw.

Granted, the eligibility cap of 500 cardholders means none of this is guaranteed, but since card-linked spending is included, you won’t need to change your usual spending behaviour to participate. Keep spending as you normally do, and perhaps you’ll get a nice surprise down the road.

love!