Frequent readers of the site will know that I’m no big fan of the Voyage card. Although I applaud OCBC for offering something different in the form of a miles earning card that lets you spend your miles like currency on any airline, I felt that the overall haircut you’d take on miles earning (~16-30% lower local spending rates), the relatively low valuation of Voyage Miles plus the hefty, non-waivable annual fee (S$488) meant it wasn’t worthwhile.

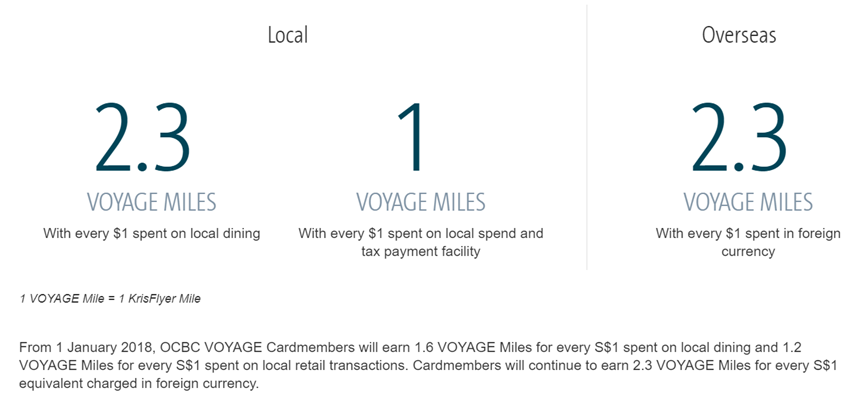

However, as per The Shutterwhale, from 1 January 2018 there will be some key changes to the Voyage Card’s earning rates.

| Currently | From 1 Jan 2018 | |

| Local Spend | 1.0 VM /$1 | 1.2 VM/ $1 |

| Overseas Spend | 2.3 VM/ $1 | 2.3 VM/ $1 |

| Dining Spend | 2.3 VM/ $1 | 1.6 VM/ $1 |

The biggest change for me is the miles awarded from local spend increase by 20% from 1 VM/$1 to 1.2 VM/$1. This puts the Voyage card on par with other general spend cards like the DBS Altitude/Citibank Premiermiles Visa. In fact, given that 1 VM is worth more than 1 Krisflyer mile (because a VM can be converted into a Krisflyer mile at a 1:1 ratio plus can be used as currency to offset revenue ticket costs on any airline), you could argue that the Voyage card is better for general spending than the Altitude/Premiermiles.

Earning on dining spend is reduced from 2.3 VM to 1.6 VM per $1, but that doesn’t really bother me because I wouldn’t be using the Voyage card for dining spending anyway. You could use the UOB Preferred Platinum AMEX, Mileslife + UOB PPV, UOB PPV (where Paywave is accepted), Maybank Horizon Visa Signature or HSBC Revolution and come away with more miles on dining than with the Voyage’s revised rate.

Overseas spending remains unchanged at 2.3 VM per $1. I’ve never had an issue with that, because it’s a very competitive rate. The DBS Altitude/Citibank Premiermiles Visa offer 2 mpd, and although the UOB PRVI Miles slightly edges the Voyage at 2.4 mpd, we again come to the conceptual point that a VM is worth slightly more than the regular miles that other bank cards earn.

The revised earning rates make the Voyage a viable general spending card in my mind, if you’re ok with paying the $488 annual fee. It should be noted that you could get a UOB PRVI Miles card that would match/outperform the Voyage card in terms of sheer miles earning plus have an annual fee that is about half that of the Voyage (and, in my experience, can be waived). Also, for a slightly higher annual fee ($535) you’d be in the ballpark for a Citibank Prestige card, which is for all intents and purposes a solid $120K income card, providing benefits that the Voyage doesn’t have like unlimited lounge access through Priority Pass plus limo transfers at a lower spending requirement ($1.5K for Prestige vs $3K for Voyage). EDIT: Have been reminded that the $1.5K for Prestige is foreign currency spending, whereas for the Voyage it can be spending of any sort

All things considered I am glad that OCBC has reoriented the Voyage card to be more competitive with the other offerings on the market. I’m planning to do an updated article on how the OCBC Voyage card now compares to traditional miles cards in view of this year’s Krisflyer devaluation so be on the lookout for that.

Looking forward to a more in-depth piece on the OCBC Voyage card!

So what if the voyage miles are ‘more valuable’, essentially we are paying more as well not forgetting the forgettable service levels for ocbc. Moreover, that annual fee is a straight no no for me…

I think what Aaron means is you would have gotten the same miles for general spend if you used the Altitude or PM cards, but with additional flexibility of the VM to redeem for any airline. How much you value this flexibility is personal, but it is an additional benefit over the other cards mentioned.

aye. basically this. however, you need to consider the annual fee diff between an altitude/PM (which can be waived) vs that for the voyage (which can’t)

The biggest problem is that nobody has any idea what is the number of Vmiles required for a particular redemption. It is a milky way, you have to call for EVERY leg and the rates vary like weather in Melbourne. In this disruptive era whereby 99% of redemptions are done online, ocbc is still in tyranny of old ideas for a mile card. Not to mention the call center is more difficult to reach than god, even for reporting a lost card.

They are banned by me.

kind of like delta’s “the price is the price”, huh?

Hey, annual fee will be waived if annual spending exceed 60k, only first year annual fee cannot be waived

I am getting VM for my telco bills, might be intended , can anyone confirm on this?

Looking forward to your next voyage detailed post!

I have gotten my annual fees waived for 2 years running, automatically, supplementary cards included as well.

Hey Chester, do you mind sharing how much spend you put on the card (to get the fee waived)?

OCBC just offered me the Voyager card and waived the initial annual fee. They also said that for subsequent years, this can be waived subject to bank’s approval (which, as we all know, is as predictable as the lottery). I’m currently on Citibank Premiermiles but I do like Voyager’s unlimited access to lounges (Plaza Premium) vs Citibank’s 2 entry limit (Priority Pass). Any thoughts on whether I should stick to Citibank or hop over to OCBC?

the annual fee is currently the main barrier that’s stopping me from adopting the card after the general spend rate is revised to 1.2 mpd. if they are indeed waiving it then i’d be inclined to take the plunge, from what I hear it’s becoming quite the decent card to have in terms of other benefits.

Thanks, Aaron. That makes sense. But between the lounge passes, which is better? Priority Pass or Plaza Premium? Any idea?

priority pass for sure. you can’t compete with the reach.

Thanks again, Aaron!

Love your articles. Keep ’em coming 🙂

OCBC Voyage unlimited lounge access (+1 guest) has also been extended until the end of 2018.

From OCBC:

The Cardmember will be entitled up to unlimited complimentary visits to any Plaza

Premium Lounge till 31 December 2018. Usage of the complimentary visits can include the

scenario of use by Cardmember and 1 accompanying guest. Accompanying infant (aged 2

below) is free of charge.

Is CardUp part of OCBC Voyage exclusion list? It would be interesting if this is could be use for CardUp payments

Cardup seems to think they’re ok as included in the calculator with updated (from 1st Jan) mileage earning.

https://cardup.co/homes/calculator

i wouldn’t trust this calculator though, it’s producing some weird results and some things we know for sure are factually wrong (eg when you put DBS altitude and $100 spend it says 1.17 mpd)