The Krisflyer UOB account has undergone some product promotions since it stumbled onto the market last year like a drunken uncle at reunion dinner, not understanding why everyone was asking him to sit down and trying to pretend he wasn’t from their side of the family.

Well, it seems that there have been some further product tweaks that apparently took place recently (UOB doesn’t exactly send me press releases). The product’s T&C have been updated here, but let’s run through the new enhancements and see what’s what.

Introduction of Krisflyer UOB Mighty FX

This is an interesting development. I’ll lead with the video, which gives a high level overview of how this works:

Krisflyer UOB Mighty FX is conceptually very similar to the DBS MCA that I covered some time back. You have a choice of 11 foreign currencies (SGD, USD, JPY, GBP, HKD, EUR, CAD, AUD, CHF, NZD, CNH) which you can load onto your Krisflyer UOB debit card to use when spending overseas, with 0 foreign transaction fees (CNH can’t be used for transactions overseas). You can also withdraw cash from your FX wallet at ATMs overseas with no foreign exchange fees, but a S$5 withdrawal charge will be payable for non-UOB ATMs.

The exchange process is done entirely online through the UOB app, you get the funds instantly and there’s a useful feature that lets you set alerts when your preferred currency pairing hits a particular value, or even execute the exchange automatically when that happens.

As always, you’ll need to compare the rates that UOB Mighty FX offers vis a vie those at good moneychangers, but assuming it’s competitive, this is another way you can avoid carrying around large amounts of cash when traveling. I’d personally keep a few credit cards around for 4 mpd opportunities, though.

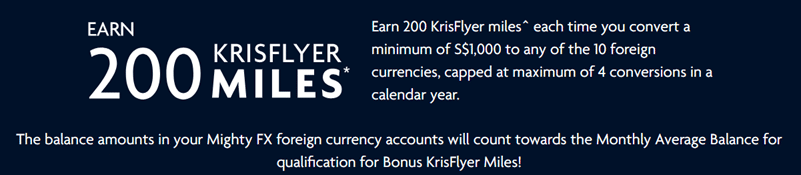

Krisflyer UOB is offering 200 miles for every conversion of minimum S$1,000 to any of the 10 foreign currencies (11 minus CNH), capped at 800 miles per calendar year. You can look at this as a rebate on the exchange rate spread UOB implicitly charges.

I’ve read the T&C carefully and my reading is that the 200 miles are awarded on a per conversion basis, where each conversion is a minimum of S$1,000. In other words, if you do one conversion of S$2,000, you earn 200 miles not 400 miles. You’re better off breaking up your conversions into S$1,000 increments if you’re going to take advantage of this offer.

Why I find this so interesting is that you now have an opportunity to earn miles on overseas card spending while avoiding foreign currency transaction fees. Do keep in mind, however, that if you want to earn miles via the Krisflyer UOB account you’ll need to spend a minimum of S$500 per month AND your bonus component (1/3/5 mpd depending on your account balance) is capped at 5% of the MAB. Have a read of this post if you want more details on how the cap works.

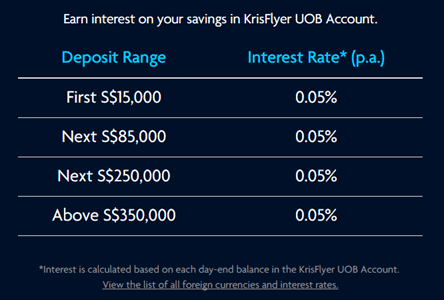

Earn 0.05% interest on your savings

One of the most ridiculous things about the original Krisflyer UOB account was the expectation that customers would be alright with completely forgoing interest in exchange for the opportunity to earn miles on a debit card. Granted, the market benchmarks for interest rates on savings accounts are close to 0, but I guess that all the more begs the question: then why not just match it then?

Thankfully that’s no longer the case, and your account now earns interest as per the schedule below:

These rates are more or less in line with the market, at least on the lower end (DBS seems to offer higher interest rates on amounts >$250K, but honestly if you’re parking that much money at such low rates you don’t really need it). Again, this isn’t so much an enhancement as it is bringing the product more in line with market reality.

S$10 off Grab Rides

Krisflyer UOB account holders will receive S$10 off a ride to or from the airport when they enter the following code: KFUOB. Payment must be made with a Krisflyer UOB debit card via GrabPay, and this is valid on all Grab rides except Shuttle and Hitch. Each cardmember can redeem one code each half year period (29 Jan to 30 June 2018/ 1 Jul to 31 Dec 2018)

Think of this as a S$10 rebate for each six month period you hold the account.

S$10 off Changi WiFi

For the uninitiated, Changi WiFi is a WiFi hotspot rental service that lets you loan a portable hotspot when you travel. Rates are fairly competitive, and if anything it’s one less thing to do when you land at the airport overseas. I personally still prefer Starhub’s Happy Roam service though because it’s much cheaper.

UOB Krisflyer account holders can get a S$10 voucher off rentals with Changi WiFi by doing the following:

- SMS KFUOB<space>16 digits card number to 77862 to get a unique e-Cash redemption code

- Enter the unique e-Cash redemption code when you make your booking for ChangiWiFi at www.changiwifi.com.

Rejigging the Scoot convenience fee waiver

The UOB Krisflyer account used to proudly trumpet a “convenience fee waiver”, but it was one of the most ham-fisted “benefits” ever.

You had to spend a minimum of S$250 on a Scoot booking in a single transaction, after which you’d get a fee waiver voucher that could be used on your next booking, and the best part is- you got one a year!

Thankfully UOB have come to their senses regarding this and updated the language regarding the convenience fee waiver. Unfortunately, this only applies to your ticket- your booking mates will still be hit by the fee.

You will enjoy a S$10 convenience fee waiver per sector per transaction for bookings made via the dedicated site www.flyscoot.com/KrisFlyerUOB. For the avoidance of doubt, this benefit applies to the principal cardmember only, and does not extend to other member(s) of the travelling party, even if payment for such flight was made on the Card in the same booking

Overall thoughts

The recent promotions we’ve seen plus the current ongoing ones like offering return tickets to Phuket lead me to believe that UOB is trying to make the Krisflyer UOB account value proposition more palatable to customers without dramatically overhauling the product.

These changes seem to be more of the same, because with the exception of offering interest on account balances, the other benefits are more or less external tacked-on promotions that don’t change the fundamental product. I wouldn’t count the Mighty FX tie up as a fundamental product change, because that was always something available to other UOB customers- it’s more like they’ve just integrated the two products more closely now.

I still hold the opinion that as long as UOB caps the bonus miles at 5% of the MAB, it will never be a product that can attract serious miles chasers. Perhaps UOB is taking baby steps towards product evolution, but this needs more of a revolution to change my mind.

For a student that’s going on exchange.. Would the UOB Krisflyer account be better or the DBS MCA account be better

depends on what your objectives are. but now that uob krisflyer has a MCA-style feature in MIGHTY, you might want to consider it (assuming you can hit the minimum spend required each month to earn miles)