News of the 8mpd promotion when using Citi cards on Apple Pay first emerged in late April, so if you’re learning about this for the first time you’re already at least 1.5 months late. But as they say, better late than never – you’ve gotta make hay while the sun shines, right?

The good news is that we still have some time to ‘make hay’ before the promo ends on 31 July 2018. The clock is starting to tick on this one, so it only makes sense to make sure we’re making the most of this opportunity.

This guide aims to help you do just that – it’s structured to cater to existing users and newbies alike. The former can probably just skim through the first two sections and check your current Citi / Apple Pay strategy; the latter can potentially benefit by reading through the entire post.

Which card(s) to use on Apple Pay

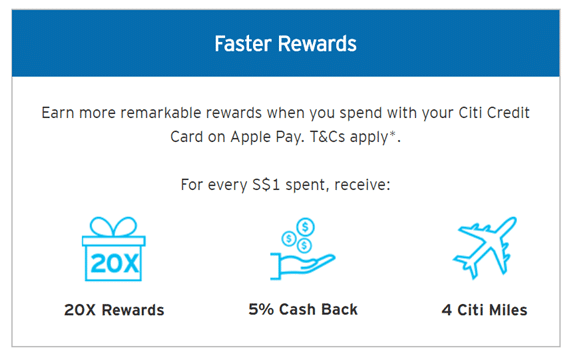

The full list of eligible cards can be seen in this image (extracted from the full T&C), but for the travel hacker, only four (mile/point-earning) cards really matter – the ULTIMA card, the Prestige card, the Rewards Visa/Mastercard and the PremierMiles Visa.

Card earn rates explained

It’s important to note that not all transactions are eligible for the Apple Pay promo – as a rule of thumb, only transactions that do not usually earn bonus points are eligible. Depending on the card, bonus points might not be awarded depending on whether you are paying in foreign currency (FCY) or spending at a Citi Rewards bonus-eligible (CR 10x) merchant – officially, this covers shoes, bags, clothes and department stores; though you might want to check out the HWZ crowdsourced spreadsheet for a more extensive list (that includes plenty of exceptions).

The four cards and respective miles earning rates are listed below, with Apple Pay promo bonus figures in blue.

| SGD | FCY | |||

| CR 10x merchants | Other merchants | CR 10x merchants | Other merchants | |

| ULTIMA | 8mpd | 8mpd | 2mpd | 2mpd |

| Prestige | ||||

| Rewards | 4mpd | 8mpd | 4mpd | 8mpd |

| PremierMiles | 4mpd | 4mpd | 2mpd | 2mpd |

Knowing this, I’d suggest making use of the cards in the following manner:

If you have the ULTIMA/Prestige card

Use this for all SGD spend – you get 8mpd for pretty much everything, so it’s quite fuss-free. Points earned don’t expire, either.

If you have the Rewards Visa/Mastercard

You’ll get either 4mpd (on CR 10x merchants) or 8mpd for pretty much everything. Use this for all your FCY spend.

If you don’t have the ULTIMA or Prestige card, you should use this for SGD spend as well. One exception to this strategy would be if you’re in danger of hitting your $12k annual spend limit for 4mpd on the Citi Rewards card – if so, it could be worthwhile earning the 4mpd on the PremierMiles Visa instead.

If you have the PremierMiles Visa

Unfortunately, the card only earns a rather anaemic (as compared to the others) 4mpd on local spend, so it might not actually see any Apple Pay usage during this promo period. As suggested above, you might choose to use it if you’re in danger of busting the $12k annual spend limit, or perhaps if it’s your only Citi card and you’d rather not spread your miles earning too thinly over multiple cards.

Terms & conditions highlights

The promo webpage can be found here, with links to the full T&C and FAQs. A few key highlights are listed below.

Excluded transactions

Spend that usually earns bonus points is not eligible – this has been covered above. Additionally, most of the usual exclusions are also ineligible for earning bonus miles/points – people have often asked about transit-related transactions, so you might want to take note that it’s clearly excluded from earning bonus points.

“Qualifying transactions” means a retail purchase charged to an Eligible Card via Apple Pay which does not arise from any Equal Payment Plan purchases, refunded, disputed, unauthorised or fraudulent retail purchases, Quick Cash transactions and monthly transactions, transit-related transactions, cash advance, balance transfers, annual card membership fees, funds transfers using the Eligible Card as source of funds, (for example, payments via Citibank Online or via any other channel or agent (such as a third party agent for payment of bills) whether for bill payments or otherwise), interest, goods and services taxes, late payment fees and any other form of service / miscellaneous fees.

It’s also worth noting that in-app and web (Safari) payments made using Apple Pay are eligible for the bonus as well, unlike with the OCBC Titanium Rewards.

No cap on bonus miles/points

The T&C make no mention of any cap on bonuses earned during this period; users have reported being able to earn 8mpd despite having reached the $12k annual spend limit for Citi Rewards.

Up to 4 devices per card

You can add your Citi card on more than one device, up to a limit of 4 devices per card – this could be useful for granting a virtual supplementary card to a trusted family member, for instance.

Transaction limits

If you’re tapping via NFC terminals, there is typically a S$100-S$200 limit, unless otherwise indicated by the bank providing the Terminal services. There is no transaction limit for online payments, subjected to the credit limit of the card.

In practice, it seems like plenty of retailers have newer terminals set with higher limits – cashiers might be able to advise accordingly, or you could request to just give it a try if it’s convenient.

Citi Rebate will be earned

For those of you clocking Citi Rebate (e.g. 10% at Starbucks), the FAQ makes clear that you can only redeem your Citi Rebate on transactions using your physical Citi Credit Card. At the same time, Apple Pay transactions continue to earn Citi Rebate, though for Apple Pay transactions, Citi Rebates earned will take up to 3 days after transaction date to be credited. Upon crediting, you may redeem your Citi Rebate using your physical Citi Credit Card.

Maximising your spend

Aaron’s already written about how to maximise your 8mpd so I won’t repeat too much here, but essentially you might want to consider…

- Always checking if ‘payWave’ is accepted

(technically inaccurate, but it’s what most local cashiers would recognise) - Purchasing specifically from merchants that accept Apple Pay

- Helping family/friends make payments (esp. for large purchases)

- Pre-paying bills – e.g. Singtel (combo with Dash) / M1 via automated kiosks

- Buying vouchers – e.g. FairPrice, Qoo10 (addendum: YMMV for the latter)

- Topping up prepaid cards – e.g. Suica for Japan, IKEA

You can also reference the weekly #FTR summaries (or go direct to the source by joining the Milelion Telegram group / Facebook group) for more ideas on how to make the most of this promo.

Monitoring bonus points

For those of you interested in checking if all your transactions are properly earning 8mpd, Jon’s previously shared on how to check your points breakdown on the Citi website – check out his post for the step-by-step guide.

The points usually take some time to reflect on the system – typically 2-3 working days, after the transaction(s) are posted. They are consolidated on a daily basis, so you’ll need to do a little maths to keep up. Additionally, there’s even more calculation required to figure out how many dollars’ worth of spending had been awarded bonus points:

ULTIMA

Earned: 4 per dollar

Bonus: 16 per dollar

Prestige

Earned: 3.25 per dollar

Bonus: 16.75 per dollar

Rewards

Earned: 1 per dollar

Bonus: 19 per dollar

PremierMiles

Earned: 1.2 (miles) per dollar

Bonus: 2.8 (miles) per dollar

Supported devices

You can check out the list of supported devices here, but essentially you’ll need to be using one of the following:

- iPhone X / 8 / 8+ / 7 / 7+ / 6s / 6s+ / 6 / 6+ / SE

- any Apple Watch

You can also use Apple Pay on newer iPads and Macs, but only for app or web (via Safari) payments – you won’t be able to use them in stores.

Setting up Apple Pay

Apple has a useful guide on how to set up Apple Pay – you can just refer to it for help on how to set up Apple Pay on the various device types.

Getting a device

If you’re thinking of purchasing a device just to make use of Apple Pay during the promo period, you’re probably looking at getting an iPhone (since the Watch requires an iPhone to set up Apple Pay).

The cheapest compatible iPhone available from retail is the iPhone SE, which you can get from Apple at S$568. Rather ironically, though Apple accepts payment via Apple Pay, it’s quite likely that you won’t have a device capable of making this payment while earning 8mpd.

The more economical option is to get a second hand device from a site like Carousell or Lazada (oh hey isn’t there another 8mpd promo going on now) – I’ve seen used iPhone 6/SE handsets going for about $200-300. Given that you’ll probably be able to sell it off without too much depreciation after 1.5 months, this would probably minimise actual monetary cost incurred.

(Addendum: You might be able to find an even cheaper used phone on Qoo10 at less than $200; even less when if using vouchers)

Where’s the best place to top up petrol with this promotion?

SPC and Caltex accept

Caltex gives a terrible discount to Citi cards.. can’t remember the amount, but it’s really bad..

Not sure as am getting 20% + 8 miles i am happy

At Esso, you can use Apple Pay at pump, but not at cashier inside.. 10% discount for Citi Prestige..

Have you tried and tested? I tried previously and it didnt work (Samsung Pay) and there’s always a note saying Mobile Payments not accepted.

Not sure how you do it, as indoor dont accept paywave, outdoor dont accept mobile payment. maybe am wrong

Tried to make payment with Apple Pay at ESSO on 21st Jun 2018. Was told that all ESSO stations in Singapore have not begun accepting Apple Pay or Paywave at the pump or at the counter. Please provide verified facts. Thank you.

Do I need to make a video of myself making a payment at an esso oump in Singapore using Apple Pay with my Citibank Prestige Mastercard?

I dive up to pump, slot in and out my Esso Smiles Card, then Apple Pay for $150 pre authorization (was $100 up to A few days ago), after pumping I get my receipt. I’ve already redeemed 4 ‘electronic air fresheners’ this way.. do the math on how much I’ve pumped with Apple Pay at Easo.

Watch what accusations you make, verify the facts them before making them..

Just so you understand the difference between incapable and unable, @Troll Hunter, and even though I had just filled up the tank yesterday (yes, 21 Jun 2018), I went to Esso again this morning and videod the whole process of using Apple Pay at the pump and have emailed the video to Aaron. Maybe you should change your name from Troll Hunter to Fact Hunter (inept)..?? Don’t make accusations where you’re none-the-wiser or ignorant of the facts.

Can use shell. Discount 14%. But their terminals only accept up till $100. Some cashiers are very nice and they can split the bill for you which is what I normally ask them to do!

BHP and Caltex Malaysia accept paywave and paypass too, in case any bro/sis visiting Malaysia anytime soon : )

Thanks everyone!

tested? remember saw mobile payment not accepted on pump.

I’ve been using this for weeks now, and just did it again about an hour ago.. I’ve been using it long enough to know too that the max used to be $100, but now max is $150..

Is bhp/Caltex Malaysia correct? Tap and pump, need to set amount at pump? Apple pay on outdoor pump correct?

Sorry for late reply, for Caltex you have to press on screen “payment” button, then place your phone next to the reader, BHP is much simpler, just scan.

Can share which Esso kiosk u pumped? Btw, in this case how many % discount on petrol do you get? I have been paying with DBS Esso Card

I’ve done so at more than one station.. please don’t expect me to make multiple videos and send them all to Aaron.. The discount is 10%.. less than DBS Esso Mastercard/ Speedpass, which I also have and had been using for years until I discovered how sucky the Miles earning rate was.. with current Citi Apple Pay promo + Smiles card, the theoretical rate would be approx 8.5mpd.. tho to be honest, I haven’t checked my Citi statements in detail, I’ve just been assuming that Citi hasn’t been cheating on it.. but at approx 8.5mpd, I don’t mind paying more… Read more »

What are the in-app/online websites where we can purchase air tickets via apple pay? For direct purchase, I’m aware that SQ and Cathay accept apple pay. For OTAs, I understand that there is Alternative Airlines. Are there any others? Thanks,

I’ve seen the trip.com app suggested on the Milelion Telegram group; otherwise, this FlyerTalk thread (specifically, the wiki section) is probably worth checking out.

A couple of notes:

7-11’s website specifically says that Qoo10 gift cards cannot be paid with credit cards. I guess those who were successful were lucky.

I bought a second hand iPhone 6 from Qoo10 for $180. I think you can get them cheaper now especially when they have coupons.

Yes, quite many people have been lucky.

Where is the TNC saying that in-app/online transaction earn bonus miles? Are all online(safari) transactions eligible?

Just to clarify, this refers specifically to in-app/online transactions made using Apple Pay – I’ve updated to make that clearer. The T&C does not exclude them, and in fact defines Apple Pay as “… in stores, within mobile applications or on the web” (point 1c).

(Plus, actual user experience.)

All such transactions, other than those in the exclusions, should be eligible. Same caveats with FCY / 10x merchants apply.

Mmm – AP with PM card does not earn anything near 4MPD at GTM terminals…

Yup! As specifically highlighted in the post, the T&C excludes transit-related transactions from earning bonus points.

It might really depend of Citi’s interpretation of word ‘transit’ – is airfare from A to B a transit? How about shinkansen ticket costing $500? List can go on.

How do you prepay M1 bill? When I key in my account, I get the statement charges for the month. Can you change the amount you want to pay?

Yup, there should be an option on the self-service kiosk to adjust the amount to pay (unless they’ve changed it recently).

I’ve only been able to use Apple Pay at M1 stores by specifically asking the staff for it, who then bring out a card reader that can handle contactless. At Bugis they have a SGD200 transaction limit, but are happy to give you multiple transactions. At Parkway, it was a real hassle: It took me literally an hour to convince the staff to allow me to do multiple transactions. Also, their limit is SGD100 per transaction – or at least it was 3 weeks ago when I last went there.

Did anyone try topping up suica card using citibank apple pay and got the 20X points last month?