With the Citi / Apple Pay 8mpd promo going on until the end of July (T&C here), I figured this would be a great time to review the Citi Prestige Card.

With the Citi / Apple Pay 8mpd promo going on until the end of July (T&C here), I figured this would be a great time to review the Citi Prestige Card.

For some time now I’ve believed the Citi Prestige Card to be the best general spend card available in Singapore. In an attempt to verify this belief, I decided to take a closer look at the benefits it offers.

The Citi Prestige Card was the winner of Aaron’s $120k credit card showdown last year, but the hyper-rational among us might still feel that humbler general spend cards (with annual fees that are more easily waived) such as the DBS Altitude Visa or Citibank PremierMiles Visa more than suffice for the job.

That’s true enough (what value does a shiny silver Mastercard World Elite logo have, really?), but the Citi Prestige Card comes with so many benefits, I suspect most travel hackers would easily be able to get their money’s worth from paying the annual fee.

Citi Prestige Benefits at a Glance

The $535 annual fee can’t be waived (there’re rumoured exceptions, but even those are linked to incorrectly-published info on a third party site), so what exactly do you get in return for this fee?

The card website lists its many benefits, but here’s a quick summary of the key benefits I find noteworthy:

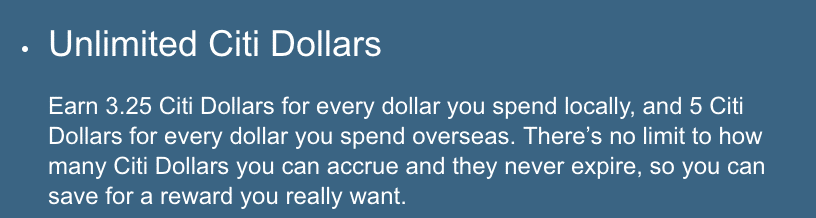

- 1.3mpd local spend / 2.0mpd foreign spend

- (Up to) 0.12mpd bonus depending on banking relationship

- Wide range of airline transfer partners

- 25,000 miles with annual fee payment

- Unlimited Priority Pass (including up to one guest)

- Complimentary Boingo Wi-Fi

- 4th night free offer for hotel bookings

- Complimentary airport limousine transfers

- Complimentary travel and purchase insurance

- Discounted dining and entertainment event invitations

(The card actually accrues points in the form of Citi Dollars, but I’ve listed the mile equivalent for easy comparison.)

I’ll go into more detail below.

Good (general spend) mileage earn rate

The Citi Prestige Card earns 1.3mpd on local spend and 2.0mpd on foreign currency spend. That’s not the best out there, but it’s marginally better than the industry standard of 1.2mpd / 2.0mpd for general spend cards.

In fact, many of the other cards boasting higher earn rates also come with a list of sneaky terms and conditions that put me off using them:

| Card | Earn rate | Caveat(s) |

| HSBC Visa Infinite | 1.25mpd / 2.25mpd | These rates are only available from the second year onwards, requiring you to spend $50,000 on the card in the preceding year – otherwise, it’s merely 1mpd / 2.0mpd. Miles expire after ~3 years. |

| Standard Chartered Visa Infinite | 1.4mpd / 3.0mpd | The rates are only available if you spend at least $2,000 on the card during the month – otherwise, it’s merely 1.0mpd. Higher foreign exchange fees of 3.5%, as compared to industry standard of 2.8%. |

| UOB PRVI Miles AMEX / Mastercard / Visa | 1.4mpd / 2.4mpd | Miles awarded per block of $5 and expire after 2 years. Reports of sneaky miles deductions in lieu of annual fee payment. |

Thanks, but no thanks. In comparison, I rather like Citi’s straightforward per-dollar mileage earning system, its rather average 2.8% foreign exchange fee and reward points that don’t expire.

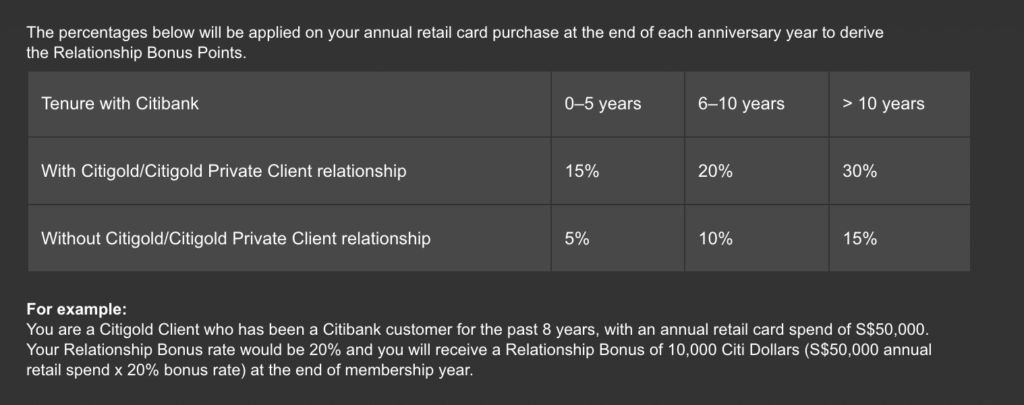

Bonus miles based on relationship status

Before we begin waxing lyrical on the how transparent Citibank is, let’s talk about the Relationship Bonus Points that the card earns.

I’ve lost track of the number of times I’ve seen people excitedly pointing at these figures and talking about how wonderful it is for a veteran Citigold member to earn 1.69mpd (1.3mpd with 30% bonus) on general local spend, and that 1.365mpd (5% bonus) isn’t too bad for a fresh customer, either. Unfortunately, that’s not how it works.

As it turns out, the percentage is applied to the dollar spend amount (e.g. 5% bonus means you’ll be awarded 0.05 Citi Dollars for each dollar spent, or 0.02mpd). Quite frankly I consider this to be sheer sophistry, but if you know what you’re getting into, the true effective bonus rate (applicable to both local and foreign spend) isn’t totally insignificant:

| Relationship | 0-5yr | 6-10yr | >10yr |

| Citigold | +0.06mpd | +0.08mpd | +0.12mpd |

| Non-Citigold | +0.02mpd | +0.04mpd | +0.06mpd |

It’s much more significant if you’ve been with the bank for more than 10 years and hold at least Citigold status (min. AUM: $250k); if you’re new to the bank and don’t have any status, your Citi Prestige Card will effectively be earning 1.32mpd / 2.02mpd.

Wide range of airline transfer partners

Of all the local card issuers, Citibank has probably the most extensive range of airline transfer partners (American Express being another with more than the typical KrisFlyer / Asia Miles options). This gives you a much greater variety of programmes to play with – although I’d exclusively redeemed on KrisFlyer when starting out in the miles game, over the years I’ve come to really value the flexibility.

- KrisFlyer (Singapore Airlines)

- Asia Miles (Cathay Pacific)

- Qantas Frequent Flyer (Qantas)

- Privilege Club (Qatar Airways)

- Flying Blue (Air France / KLM)

- Etihad Guest (Etihad)

- Royal Orchid Plus (Thai Airways)

- Executive Club (British Airways)

- Enrich (Malaysia Airlines)

- Infinity MileageLands (EVA Air)

- GarudaMiles (Garuda Indonesia)

- Miles&Smiles (Turkish Airways)

(Plus, how’d we have briefly gotten the chance to get a 60% discount for Miles&Smiles if not for Citibank’s generosity? ?)

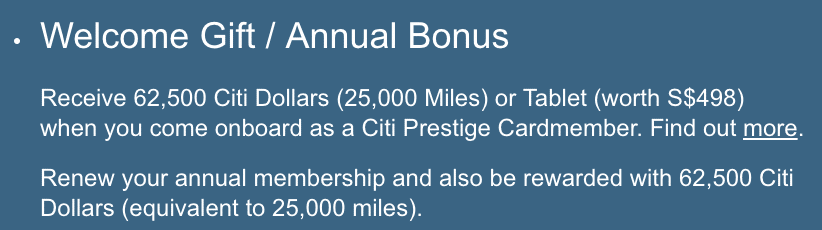

25,000 miles with annual fee payment

At this point in time, we can start addressing the whole annual fee thing. The annual fee for the Citi Prestige card is not insignificant at $535; it also can’t be waived. Thankfully, unlike some other cards, you do get something in return.

I’m currently entering my fifth year as a cardmember now so I’ve long stopped considering the tablet as an option – it’s usually the cheapest (non-mini) iPad model; I’ve heard that you could request for an electronics store voucher instead and use it to subsidise something else that you might prefer. I’ve also heard that you can request for the tablet when renewing; assuming you can liquidate it at 10% below retail price (i.e. ~$450) you’ll still be out $85.

The default option for renewal would be 25,000 miles – that’s not too bad, but somewhat expensive at 2.14¢ per mile. You can get better rates elsewhere. Assuming you value miles at 2¢ per mile, you’ll be out $35.

To me, what this means is that the effective annual fee isn’t really all that high; even using the larger figure above, I’d just need to wring out $85 worth of additional benefits for the card to be worthwhile.

Unlimited Priority Pass (cardholder & guest)

Aaron has previously listed out cards with complimentary Priority Pass access, and you can see that the Citi Prestige Card’s unlimited Priority Pass access (for main cardholder + one guest) is comparatively very generous.

The HSBC Visa Infinite provides a different approach by providing unlimited visits to each cardholder (including supplementary cardholders), allowing the benefits to be used even when not travelling together. That might be preferable for some, but I prefer the Citi Prestige Card’s implementation, which allows the main cardholder to guest people in other than the supplementary cardholder(s).

Complimentary Boingo Wi-Fi

It’s not that well-advertised, but World Elite Mastercard holders can register for a complimentary Boingo Wi-Fi account. This essentially gives you complimentary unlimited Wi-Fi access at Boingo hotspots worldwide – based on my experience thus far, I’ve found it most useful when travelling in the USA, especially at their airports. On some airlines, you can gain access to their in-flight Wi-Fi as well.

Cardholders can register for an account via this site.

4th night free for hotel bookings

This is often seen as the killer feature of the card – even if you don’t particularly value the other benefits listed thus far (though others might feel they already justify the annual fee), it’s not hard to imagine how using this feature even once could help to tip the scales in your favour, as far as value proposition goes.

The full terms and conditions of this programme can be viewed here, but in short – when you make a reservation of 4+ nights at a hotel via the Citi Prestige Concierge, you’ll get the cost of one night (averaged out, minus taxes) credited to your card account.

Based on experience, the concierge is able to book via OTA (I’ve been quoted rates from Expedia before) or directly with hotels (so you gain full stay/point credit) – essentially, any publicly available rate should work.

It’s also rather easy to get done – I usually just drop them an email (or call if it’s urgent) with what I want and they’ll get it booked (if it’s for a specific rate I usually include a screenshot) and they’ll reply with booking confirmation and a note on the statement credit to be awarded.

Two points I’d like to highlight regarding the statement credit given by the bank, which is usually credited 1-2 months after the actual charge is made:

- The statement credit is essentially invisible to the hotel, so you’ll get full points credited to your hotel loyalty programme (e.g. Hilton Honors)

- The statement credit will likely appear on a separate statement, something worth taking note of if you’re claiming expenses for the stay(s).

This is best maximised by booking stays of exactly four nights, combined with ongoing sales – remember, the concierge is able to book any publicly available rate, so with some strategising you can net some really good deals like snagging Conrad Tokyo at about S$220 per night…

Airport limousine transfers

There are other cards that offer complimentary airport transfers (which Aaron has previously already written about), but in my opinion the Citi Prestige Card’s offering is among the most attractive. Extracted from the post:

Thanks for the detailed review Louis. Personally, I find the complimentary fourth night and limo service alone to be worth the annual fee, and Citi concierge is a joy to work with.

Haha yes, there’re so many benefits I found it difficult to decide which to present as the core benefits and which as the icing on the cake. With some cards I struggle to decide whether to renew or not – for this one, the decision’s really easy!

I have the American version of this card, which is rather similar (US$450, S$600 annual fee) and if you travel more than a couple of times a year the 4th night free benefit will pay the annual fee quickly! Although the reservations have to be made through the concierge (your email example looks identical to what I receive), this minor inconvenience is worth the savings.

I would honestly get this card only for this benefit. Everything else (which includes some great benefits by the way) is just gravy!

You forgot another benefit jetquay lounge at cip terminal

I don’t actually consider it to be a noteworthy benefit though, as I find the Priority Pass lounges in SIN to be superior options (and without the hassle of having to book).

Do you have a good experience using JetQuay to share, though? I’ve only tried it once, and was extremely unimpressed then.

The lounge itself is unremarkable but the free chance to experience the benefits of the cip terminal is not insignificant

Now I’m curious what I’ve been missing – I thought the buggy ride was pretty fun, but that’s lost its novelty factor now. Otherwise… lacklustre lounge, no significant increase in clearance speed…

I guess you get to skip the crowds, but is there anything else that really makes it worth experiencing?

For booking the hotels for the complimentary fourth night, does it have to be official hotel website? Or can it be via agents like Expedia if their prices are cheaper than official website?

Yes, OTA works fine. I think they use Expedia by default, unless you specify otherwise.

If I’m using the 4th night free benefit, will I still be able to earn SPG points and clock 4 elite night credits? If I’m on an SPG Platinum Challenge, will this count as a qualifying stay?

Yes

Hi Ryan. You get all your points, and credit for all the nights and for the stay. The 4th night benefit is between you and Citi, and is invisible to the hotel. You pay your hotel bill and get all your points/nights/stay, then Citi credits you later. I used this benefit 5 times last year and will use it at least 6 times this year (all at Starwood properties), and as someone else has noted, this benefit alone is worth the annual fee.

I am wondering, if book through Citi Concierge to qualify the 4th night free, do you earn the SPG elite stay / night? As it is booking through OTA rather than hotel website? Thanks.

The Concierge books directly with the hotel where possible so you get everything! Non-chain hotels or those cheaper via OTA they’ll book through Expedia (you do not get Expedia points). I’ve used it several times.

Think the post and various comments have already addressed your query, but I’ll update the post so it’s even clearer.

The short version:

-they are able to source prices via OTA (believe Expedia is their default)

-they can book directly with the hotel as well, and you’ll get full stay/points credit

Hi Louis, I wished I had paid closer attention to this benefit previously as I would have gotten this card for my upcoming Tokyo trip. Anyway, the T&C and it states that this benefit cannot be for back to back stay within the same city. Eg. if you stay in Hotel A in tokyo for 4 nights, you will get reimbursed for 1 night, but it won’t work if stay in Hotel B in tokyo immediately after you check out from Hotel A. Am I right?

Yup, that’s right!

Just to check is the 120k annual income very strict? I want to apply this card, but salary is way below the criteria.

All I can say is that when the card first launched, they were very strict about income requirement. The HWZ forum seems to indicate that is still the case.

If you try it out and find otherwise, be sure to update us! =)

At the application portal if you entered anything less than $10k monthly salary it won’t proceed any further.

FTR, a friend tried to join with an NOA of $114k and got rejected.

Just went to Citi branch. They told me if salarynis about $110k they will will process the application. But anything lesser than that, they won’t accept the application

I’d always suggest applying through one of the booths near MRT stations. I got the card the next day. As YC mentioned, if the income is slightly lower than 120k, it should be ok. Better to produce your income tax assessment and include other sources of income rather than just salary.

Hi Louis. Agree this card is worth the annual fee.

Just want to ask – it seems that you have omitted the OCBC Voyage card. Would you consider it given that it gives 1.6mpd (for Premier/BOS cards)?

Forget about ocbc. Their customer service is atrocious and inflexible. Offerings are worse than citi.

It depends on how much you value that 1.6mpd. I’ve not really found the features of the card worthwhile other than the earn rate , so find it hard to justify paying $488 for 15,000 miles annually.

For me, since I try to get 4mpd wherever possible, I’m ok with earning my 1.36mpd (including bonus) on the transactions that do end up being put on general spend…

interesting you brought this up, because i’m currently exploring the concept of voyage miles again. given that VMs are an inherently different instrument from krisflyer miles, you can’t do a 1:1 comparison. more on that in a future post…

Hi Louis, although the OCBC Voyage has been reviewed before previously on Milelion, the post did not touch on the part where Premier Banking Clients get 1.6mpd for local spend, outright, and 2.3mpd overseas. The annual fee is $488 with 15000miles. I think it is worth making a comparison between the Citi Prestige (Citigold and above) to OCBC Voyage (for premier banking and above). Cheers 😉

Refer to Aaron’s response (and mine) in the comments thread!

(In short: I don’t think the OCBC is as attractive an option, but Aaron’s spotted some use cases that makes it pretty appealing. Currently waiting for his take to roll out!)

Thanks Louis. Didn’t see the last comment before i posted mine. Will wait for Aaron’s post 🙂

if i am a supp card holder..do i get all the benefits listed, esp. the 4th night free?

You can turn to the terms and conditions for the specifics, but short answer: no.

For any credit card, pretty much all benefits apply only for primary card holder, unless otherwise specified.

Unlike HSBC’s VI Airport Limo benefit, where only the principal cardholder is entitled to use it, Citi Prestige’s benefit may be used by either Main or Supp cardholder.. hence between the wife and I, we get 16X p.a.

Interesting! I know the supp cardholder can use the limo rides, but the T&C seems to indicate that the quota is limited to principal cardholder only -> “Citi Prestige Principal cardmembers (“Cardmembers”) will be entitled to 8 (eight) complimentary one-way Airport Transfers during the Programme Period, capped at 4 (four) per calendar quarter (as defined in paragraph 4 below). The usage of these entitlements cannot be brought forward beyond the Programme Period.”

I take it you’ve already utilised more than 8x without additional charges, right?

Hi Louis, What do you mean by “I take it you’ve already utilized more than 8x without additional charges, right?”

I’ve ‘burst quota’ on Quartwr before.. and I could never “be charged for additional use” because I always track my usage.. once both our quarterly quotas were burst, I went onto HSBC VI.. ?

Simply put – you’ve booked more than 8x airport transfers in a year without being charged, right? Certainly sounds like it! Good to know.

Lol, somethings wrong here. If what you said is true, its another of loopholes in Citi’s card.

The TnCs clearly state that only Principal cardholder is eligible for limo rides.

One can book those limo rides through a supplementary cardholder, but the quota is expected to be the same.

“Citi Prestige Principal cardmembers (“Cardmembers”) will be entitled to 8 (eight) complimentary one-way Airport Transfers during the Programme Period, capped at 4 (four) per calendar quarter (as defined in paragraph 4 below).”

– Thats from Citi SG TnC.

https://www.citibank.com.sg/prestige/terms-benefits.html?lid=SGENCBLEWCATLClickHerebPCCD

How did you do it Ken? Please share? I’m sure my supps all come under my quota of 8x transfers per year and max 4 per quarter.

@Zack and @Louis.. Don’t get confused.. no loophole.. both of us as Main cardholders and made the other Supp cardholders.. We each have 8x per year.. therefore 16x a year total.. for either to ‘make use of’.. Get it?

Ok, understood. The 8x quota is still tied to principal cardholder, but since supp cardholder can make use of it, you can share 16x between a couple by having two main cardholders nominate each other as supp cardholders.

Correct!

This might interest those who’d like to get this card but don’t qualify. I enquired online and by phone if I could apply for it as a secured card and they said yes both times, so I went down to one of their branches. Staff double checked with the card centre then allowed me to apply for it. No income documents needed. They estimated a wait of 5-7 working days. I’m currently holding PM and Rewards MC as secured cards. You need a minimum deposit of $15k with Citibank, with $10k as a time deposit (FD).

Update: it took almost 3 weeks, but my application was approved today.

Congrats! Would you share… ? did they give your a credit limit of $10k? $15k? or other?

The credit limit is the full FD (min 10k).

Given Citi prestige earns Citi Dollar rather than Citi miles, does it enjoy the same as many airline partner as Citi PremierMiles? Thank you.

It’s the exact same transfer partners, as listed in the post. No differentiation there.

Thanks for the complete and comprehensive review Louis. I just received my card and had a few questions still:

*Do I understand correctly that I do not have to first reach the $1,500 threshold before a free airport transfer can be booked but that the threshold simply needs to be reached by end of the Quarter if not a 50SGD charge is applied for each transfer booked?

*I assume the Priority Pass membership is simply mailed or do I need to subscribe to somewhere as per the Boingo deal?

Thank you once again! Cheers.

Yes, correct – can book airport transfer first and meet the spend requirement by end of quarter.

For PP, it’s been awhile but I’ve seen recent reports of it being automatically sent later, ranging from a week to a month. Might want to give the concierge a call if you need it urgently!

May I ask what is the concierge email address for hotel bookings? Thanks.

You should just call the concierge (number at back of card) to ask before emailing the first time – I remember needing to do some set up first (e.g. associating card number with email address).

Ok, thanks Louis

I’ve got three questions regarding your article 1. You mention with the fourth night free, we will usually have no issue hitting the $1500 overseas spending requirement for that particular quarter for the Limousine transfer, where is the link here? 2. You mention that the Concierge is able to book any publicly available rates. Does that mean to say you can request for the Concierge to book through a specific travel website/agent for a specific price your hotel of choice? 3. You mention Bonus miles is base on relationship status, in this example of the percentage is applied to the… Read more »

1) This assumes that the hotel booking is of substantial value, the stay is not prepaid (or is paid in the same quarter), and the remaining FCY spend for your vacation will comfortably allow you to hit $1500 that quarter. This may or may not apply for various situations – I imagine it won’t really work if you’re staying 4 nights at JB, for instance. 2) Any publicly available rate on official hotel website. For OTA, I believe only Expedia is allowed. 3) I think the post had already explained the reason, but to highlight this again – the percentage… Read more »

Thank you, now i understand. May i ask if it is worth it to book on the official hotel website since the purchase would be of foreign currency to help meet the Limousine quota and earn Citi dollars at the same time or Expedia for it’s savings

I believe you can opt to pay in foreign currency on Expedia as well (that’s probably the default actually); can specify to concierge if you want to be sure.

So the choice is probably really between potential savings on Expedia and chain loyalty benefits (if applicable)… it’ll really depend on how much you value the latter, then!

Indeed.. Citi Prestige Concierge has been super so far, on using whichever (hotel’s own or OTA) depending on which makes more sense TO THE CARDHOLDER (NOT the bank). I’ve so far only used the 4th night free benefit 3 times and twice it was booked direct with hotel (for stay/points benefit) and once with Expedia.. and yes, charging in foreign currency helps towards the $1500 per Q to unlock up to 4 Airport Transfers in the same Q..

Speaking of insurance, I stumbled across the World Elite MasterCard APAC website, which talks of the travel insurance that comes with MasterCard:

https://www1.mastercard.com/content/world-elite/apmea/en/pom.html

Does anyone know if this insurance also comes with the Prestige card? The benefits seems to be significantly better, and it offers collision damage waiver, which seems to be completely missing from the Prestige card insurance.

Hi, I am just wondering if you happen to know whether I will accrue citi$ if I use this card to fund my trading account?

[…] has written an extensive analysis of the Citi Prestige’s value proposition, suffice to say that the discounted event invitations and other occasional perks offered by the […]

Dear Louis, I need your valuable advice. You had been awesome with your advice on Hilton membership. I have applied for the Citibank Prestige Card via Milelion/Singsaver today as I have a trip coming up in November where I will be in Paris and London. My plans are to stay in Paris from 10-13 Nov before travelling to London. My questions are: 1. I plan to ask the concierge to book Hilton in Paris from 10-14 November (4 nights) but I will checked out on 13 November night before taking the Eurostar. Will this qualify for the 4th night rebate?… Read more »

This I can answer on behalf.. your points 1 and 2.. there’s no overlap.. checking out on same date in one city and checking in in another city, is absolutely normal, and there’s no overlap.. and.. even if there was.. Meaning if you check out on 13th, and has check in date on 12th.. doubt it’ll be an issue.. it would be silly.. but unlikely an issue.. All your other points are yes, yes and yes.. with point 4, seeing dates are in November, that all falls within Q4 of calendar year.. Just for illustration sake.. if your trip started… Read more »

Thank you Ken for your valuable advice. :))

Think Ken’s responses already address most of your queries. Some additional thoughts: 1&2) Shouldn’t be any issue on the Citi Prestige side (and you can just double-check with concierge when booking to be 100% sure). HOWEVER you might want to take note that the Hilton system might register the two stays as overlapping and not automatically award the second stay’s points/nights. I think you can appeal to Hilton after the fact and explain the reason for seemingly overlapping stays and request for second trip to be credited. To be safe, might even want to contact them beforehand. But just thought… Read more »

Hmmm… I guess maybe I did get one thing wrong.. and apologies.. it does sometimes gets a bit confusing….

Citi Prestige MC.. Priority Pass (I won’t use “PP” as Plaza Premium is also “PP”… and, yes, it may also be debateable that Priority Pass = “PP” and Plaza Premium Lounge, should be “PPL”…..

But the truth is that these are something’s thag are beyond our control…

Can you upgrade easily from Citi premier? And world that involve paying another annual fee? (I have had the premier card for 13 months so just paid the fee recently)

Hi Jamie.. My suggestion is to phone Citi and ask.. tell them what you want and ask if it’s possible.. My short assessment is that of course it’s possible for you to get a refund on your recently paid AF and sign up for the Citi P MC.. but it also depends on how you get on the line.. Case in point is that I’ve all but given up phoning SQ KF for anything but really simple things to do.. but anything more complicated.. like stopovers.. I now don’t even bother and will go down to Ion Orchard to short… Read more »

Thanks!

Just a note that the two cards use different currencies (Citi Miles vs ThankYou Points) that I suspect would not be convertible. Said ‘upgrade’ would probably involve redeeming your Citi Miles, cancelling the old card and applying for a new one – essentially the same process as normal, but perhaps with less hassle as an existing cardmember.

1 & 2) Check with concierge. I had sprayed a wide range of bookings at them and they called me weeks later asking if I knew about all these clashes. Why wouldn’t you just book from 10-13 though, unless you need the room all the way into the night? Because while you get the room rate refunded, you still pay the taxes and fees – so it is not exactly a free room. 3) They can book whatever is showing on their Expedia portal (they use a corporate portal, according to what they told me), or whatever they can book… Read more »

@Other Phil has nailed it! All points most concise.. 4th-night-free isn’t exactly getting your 4th night free, and like all benefits/perks.. not just 4th-Night-Fre but even 3rd-Night-Free with the occasional Amex’s FHR promos.. One must still do own homework and see if each promo/ benefit/ perk is ‘really as it seems’ and which way makes most sense to YOU.. For example, Amex’s 3rd-Night-Free are mostly at higher end hotels.. and therefore one will have to weigh whether he/she is cool with forking out S$500 a night/ S$1000 for three nights, in BKK, when there are tons of hotels, very decent… Read more »

[…] has written an extensive analysis of the Citi Prestige’s value proposition, suffice to say that the discounted event invitations and other occasional perks offered by the […]

[…] The Citi Prestige card is an obvious candidate here, with its $120,000 annual income requirement and $535 annual fee. You can read a detailed listing of the card’s benefits here. […]

[…] has written an extensive analysis of the Citi Prestige’s value proposition, suffice to say that the discounted event invitations and other occasional perks offered by the […]

As you are using Aspire lifestyle can you get hotel loyalty status with “4th night free for hotel bookings” or is considered an OTA and you don’t earn loyalty with hotels??

Aspire Lifestyle isn’t an OTA.. they are a Conceirge Service.. when you make your booking, let them have your Hotel Membership number.. and.. your 4th night free has nothing to do with the hotel.. it’s a benefit from your card, and the free night will be tken off your bill later, not at hotel.. and yes, you should get your stay points with your hotel membership.. Do note tho.. that you should still compare rates with other avenues.. Aspire generally uses Booking.com to benchmark.. but may use Hotel website too.. the three or four times I made bookings thru Aspire,… Read more »