Unlike cobrand cards which automatically convert your spending into miles with a particular airline, bank cards allow you to choose which airline’s FFP you’d like to transfer your points to.

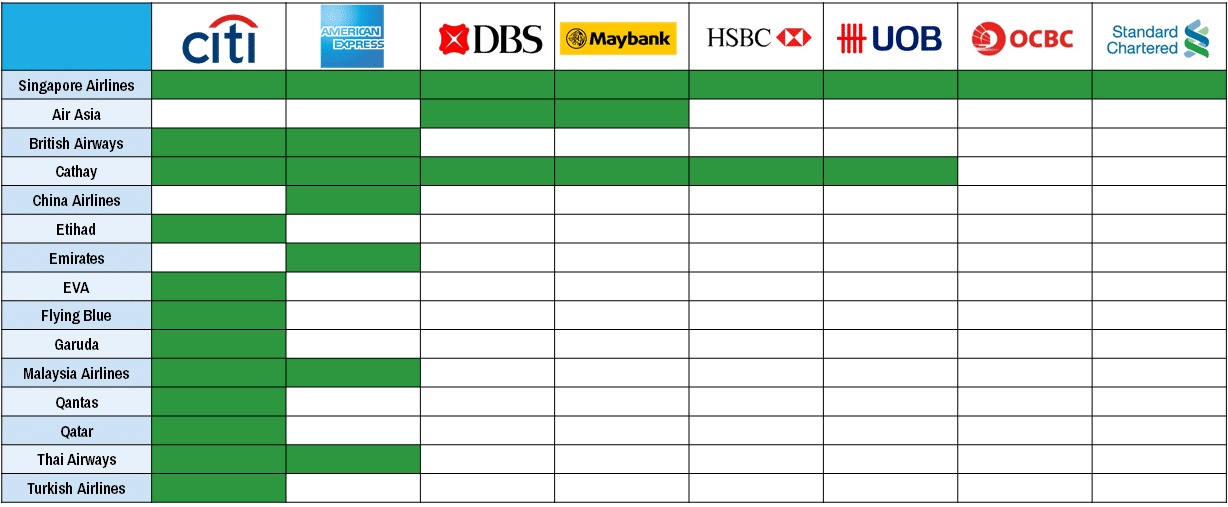

But not all banks are equal. Although every bank in Singapore partners with KrisFlyer, and almost every bank partners with Asia Miles, some banks simply have a greater variety of partner programs. The table below summarizes who partners with whom in Singapore:

No prizes for observing that Citibank has the largest variety of airline transfer partners. AMEX runs a close second, but after that it’s slim pickings. DBS and Maybank both have 3 partners each (of which 1 is a budget airline, Air Asia); HSBC and UOB have the bare minimum of KrisFlyer and Asia Miles; OCBC and Standard Chartered only offer KrisFlyer.

In a way it’s sort of understandable. I’m groping in the dark here, but I’d be willing to bet that 80% of credit cardholders will never convert their miles to anything other than KrisFlyer. Part of it has to do with the “SQ-or-bust” mentality that a lot of Singaporeans have, but I’m sure another reason is that people are generally unaware of the advantages and sweet spots of other FFPs. That would certainly make for a good article…

Here are a few other points to note:

Transfer times will differ dramatically by FFP

If you transfer credit card points to KrisFlyer, it’s pretty safe to say that you can expect to see the miles show up in your account within 3 working days or so. I know most banks quote you a few weeks, but that’s more of a “cover backside” kind of thing. I’ve done transfers with DBS, UOB, OCBC, Citibank and HSBC and in all those cases the miles showed up very quickly. I’ve noticed similarly fast times for Asia Miles, although I’ve only ever transferred UOB and HSBC points to this program.

Outside of that, it’s a bit of a crapshoot. I remember worriedly refreshing my Garuda account every hour back when they were doing the 90% off promotion once upon a time, just to see if my miles were in (they ended up taking about a week). I’ve read horror stories about other people who have had really slow transfers to Flying Blue and Turkish as well. I don’t have enough data points to comment further, suffice to say that if your goal is to cash out to Asia Miles or KrisFlyer, you don’t need to be too worried.

Transfer ratios are uniform across programs…but value may not be!

With the exception of Air Asia, which runs a very different type of FFP, banks will transfer points at similar ratios to all their program partners. That’s to say: 1 DBS point is worth 2 miles with KrisFlyer and Asia Miles; 450 AMEX Rewards points are worth 250 miles with British Airways, China Airlines, Emirates Skywards or any of their other partners etc etc.

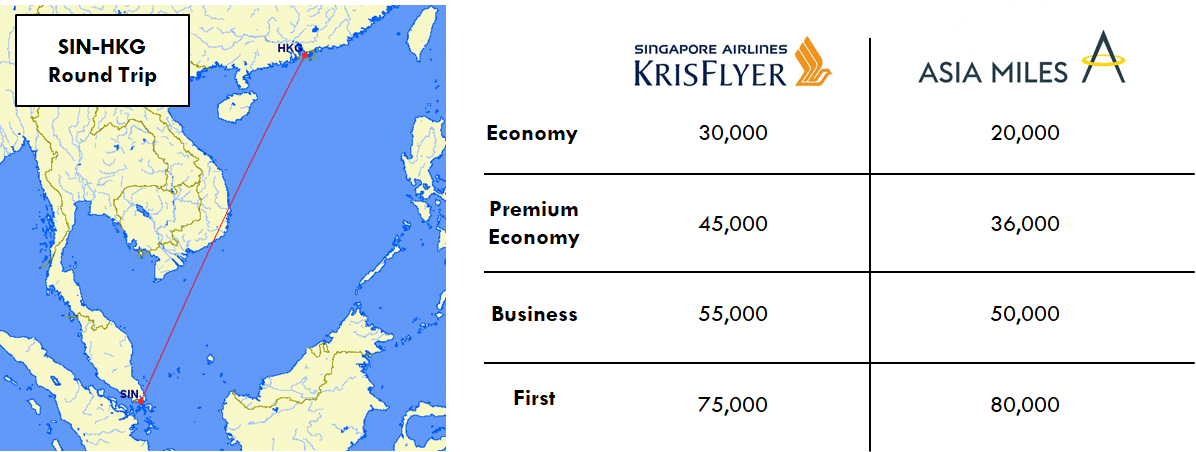

What is different is the value that each FFP has to offer. Depending on my desired destination and class of travel, certain FFPs may offer better value than others. A simple example: Suppose I want to fly from Singapore to Hong Kong. Here’s how much that flight would cost me on Asia Miles vs KrisFlyer:

Remember that my credit card points transfer at equivalent ratios to both programs. Therefore, if my goal was to fly Economy, Premium Economy or Business Class, Asia Miles would represent better value. If, however I wanted to fly First Class, KrisFlyer would be better value (this assumes you’re indifferent between the products of Cathay Pacific and Singapore Airlines). Indeed, there are other sweet spots to be found in FFPs such as British Airways Avios, but that’s another article for another time.

So that’s the landscape of transfer partners in Singapore for you! If you found this post helpful, you might be interested in attending our Miles for Beginners workshop that’s happening next Saturday, 30 June. Here’s where you’ll learn about the basics of earning and burning miles in a structured, interactive format. Tickets are available now:

What would be a good article between the FFPs is dollar charges for redemptions, particularly the BS “carrier surcharges” on top of the normal taxes and fees. It makes quite a difference. SQ is actually quite competitive in this regards since they restructured their awards chart, trading off the old 15% discount for no surcharges. Now SQ to US charges like $50-100 in taxes and fees one way, compared to CX who charged me $300+ one way for a redemption that (before the current devaluation) cost less miles than SQ. Also figuring out which partner airlines on KF and AM… Read more »

[…] Airways Executive Club, Asia Miles, Qatar Airways Privilege Club and Qantas Frequent Flyer are mileage transfer partners of credit cards in Singapore and you can redeem these miles for flights on Qatar […]