Now that you understand the structure of KrisFlyer, the various elite tiers and the program’s key policies, let’s take a look at how you go about earning KrisFlyer miles.

Remember: if your goal is to try Singapore Airlines’ most amazing First and Business Class cabins, then you’re going to have to use the KrisFlyer program- these products can’t be redeemed through partner frequent flyer programs.

Flying with Singapore Airlines and its partners

Obviously, you’ll earn KrisFlyer miles when you fly with Singapore Airlines or any of its partners.

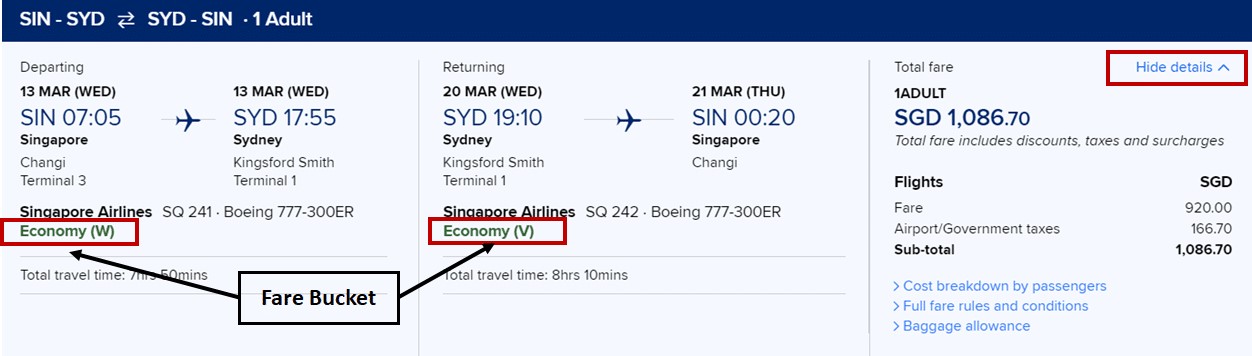

The number of miles earned depends on your fare bucket. You can see the fare bucket when you buy a ticket; for Singapore Airlines, it’s the single letter that appears in brackets next to the cabin class. For example, in the screenshot below my Economy Class SIN-SYD flight is booked in W on the outgoing leg and V on the incoming leg.

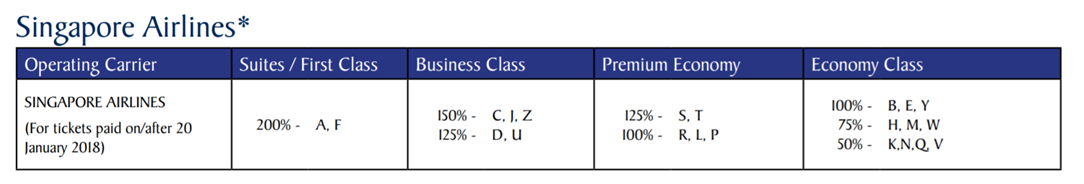

These W and V fare buckets will earn me 75% and 50% of the miles actually flown, as the table below indicates:

To earn miles on your flights, simply provide your KrisFlyer membership number during check-in and the miles should be credited to your account within a couple of days. If you forget to give your number, don’t worry. You can file a retro mileage claim within 6 months of your flight. You can even file a retro claim for Singapore Airlines/SilkAir flights taken up to 6 months before joining KrisFlyer.

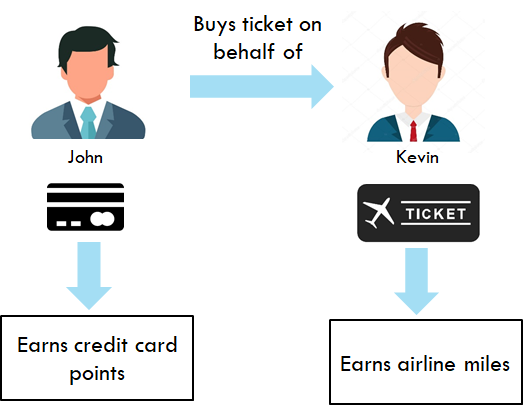

Only the person whose name is on the ticket can earn miles from flying. In other words, if John buys a ticket for himself and his brother Kevin, John will only be able to earn miles from the ticket with his name on it.

Do remember, however, that John will also earn miles from his credit card by buying the tickets, and he’ll earn them on the full purchase price of two tickets.

Unless you travel regularly for work, it’s unlikely you’ll accumulate a sufficient critical mass of miles just by flying alone. Therefore, it’s important to know how to earn KrisFlyer miles without stepping foot on a plane.

Credit Cards

It’s almost impossible to build your miles without a good credit card strategy. Most people stumble here by adopting a “one and done” mentality, i.e. using a single card everywhere. It may be more convenient in the short term, but you really lose out in the long run.

| Want to know what card to use when? Check out The Milelion’s Credit Card guide |

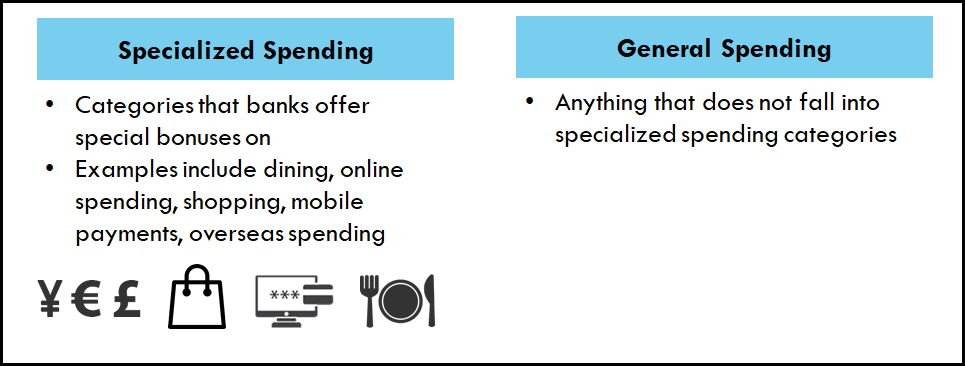

That’s because of specialized spending bonuses. Conceptually, you should think of all spending in two broad categories: specialized and general.

Specialized spending refers to categories in which banks offer bonus miles, like dining and shopping. You can earn up to 4 miles per dollar (mpd) by pairing the right card with the right type of spending.

General spending refers to all other categories where bonuses are not available. You can usually earn between 1.2-1.5 mpd with most of the general spending cards on the market.

| General Spending | Specialized Spending | |

| Examples |

|

|

You can now see why someone who uses one card for everything (1.2-1.5 mpd) will be accumulating miles much more slowly than someone who uses the right card in the right situation (up to 4 mpd).

Do not use general spending cards for specialized spending. You’re just hamstringing yourself. Similarly, do not use specialized spending cards for general spending. The Citi Rewards Visa may be a great card for online shopping (4 mpd), but it’s a terrible one for buying lunch (0.4 mpd). Using a specialized spending card in a category it’s not meant for is like trying to open a beer bottle with a corkscrew.

Booking hotels

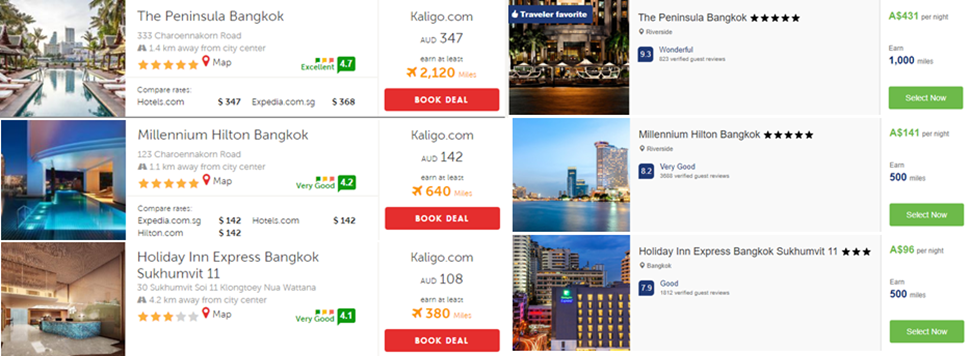

If you’re looking for a hotel and don’t care too much about brand, consider booking through an OTA like Kaligo or Rocketmiles.

Both these platforms reward you with airline miles when you book hotels. In my personal experience, I find Kaligo to be more generous with the miles, as the screenshot below illustrates. However, it’s generally best practice to compare prices with other OTAs like Hotels.com and Expedia to ensure you’re not paying over the market rate.

If you’re more brand-conscious, you can still earn 500 KrisFlyer miles per stay at the following chains, simply by providing your membership number at check-in.

- Anatara, AVANI & Tivoli

- Chatrium Hotels & Residences

- Dusit Hotels & Resorts

- Fullerton & Sino Hotels

- Harbour Plaza Hotels & Resorts

- HPL Hotels & Resorts

- Hyatt Hotels & Resorts

- Kempinski Hotels

- Langham Hospitality Group

- Mandarin Oriental

- Melia Hotels International

- Meritus Hotels & Resorts

- Millennium Hotels and Resorts

- New Otani Hotels

- Okura Hotels & Resorts

- Pan Pacific & PARKROYAL

- The Peninsula

- Rotana

- Taj Hotels, Palaces, Resorts and Safaris

- Wharf Hotels

- Worldhotels

Hotel points from programs like Hilton Honors, Marriott Bonvoy, IHG Rewards Club and Le Club AccorHotels can also be transferred into KrisFlyer. It’s generally not advisable to do this because the conversion rates are poor (you end up losing value in the exchange), but if you must, pick Marriott Bonvoy. Marriott Bonvoy allows you to convert 60,000 Bonvoy points into 25,000 KrisFlyer miles, the best ratio of all the hotel programs.

KrisPay

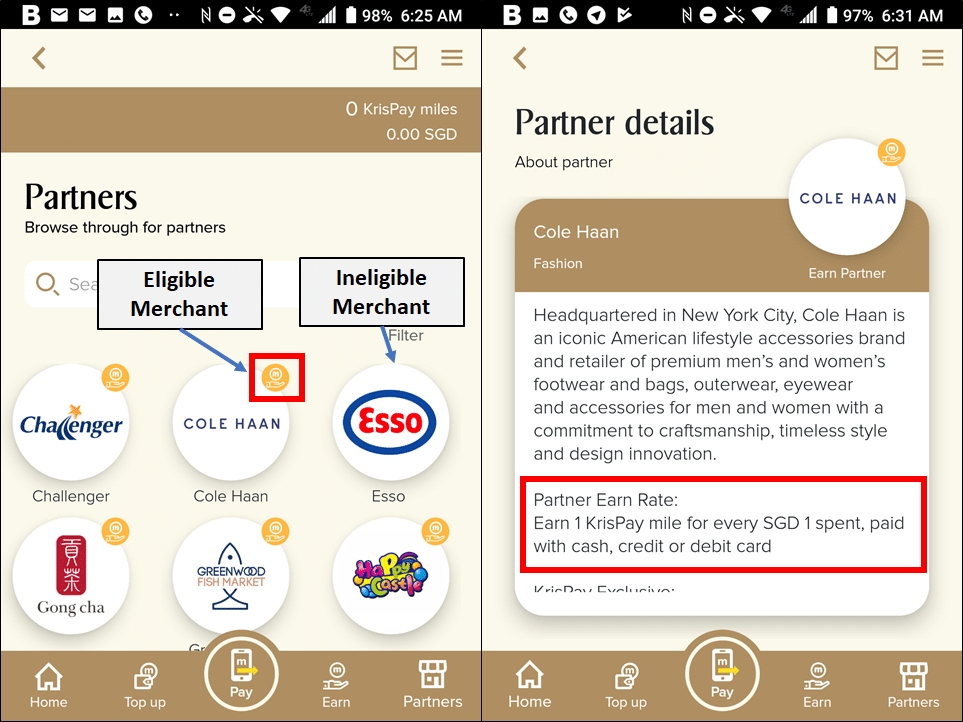

In March 2019, KrisPay finally added an earning function, allowing users to earn up to 2 mpd at selected merchants like Cole Haan, Gong Cha and Challenger. Eligible merchants can be identified by a symbol in the top right hand corner:

Given that fewer than 30 merchants offer earning opportunities, you’re not going to be racking up a lot of miles through KrisPay. That said, if you’re going to make a transaction at one of these merchants anyway, there’s no reason not to pick up some miles.

Rental Cars

Don’t forget to provide your KrisFlyer membership number when renting a car, because every car rental with the following chains earns you 500 KrisFlyer miles

- Avis

- Europcar

- Hertz

- Sixt

You can also use rental car agglomeration sites like Rentalcars.com and EasyRentCars.com to earn 1.5-2 miles per US$1.

KrisFlyer Spree

Singapore Airlines runs an online shopping portal called KrisFlyer Spree. Conceptually speaking, it works the same as any other cashback site, only that you get rewarded with miles instead of cashback.

Popular merchants like Booking.com, Groupon, Book Depository and more can all be accessed through KrisFlyer Spree. The earning rates vary, but are generally between 1-3 miles per US$1. You’re going to need to weigh the tradeoff between earning cashback through a portal like Shopback versus earning airline miles- here’s where knowing the valuation of a mile really comes in handy!

Pumping petrol

If you pump petrol at Shell or Esso, be sure to join the Escape or Smiles loyalty program.

At Shell, you earn 1 point per litre of fuel (V-Power earns 1.2), and 350 points can be converted to 250 KrisFlyer miles. At Esso, you earn 1 point per litre of fuel, and can convert 110 points to 100 KrisFlyer miles.

Dining in or out

Chope is the de facto reservation platform of choice in Singapore, and each reservation earns you between 100-175 points. These can be exchanged at a rate of 1,200 points to 1,000 KrisFlyer miles.

If you don’t feel like dining out, consider foodpanda. You’ll earn 1 mpd on your total order value so long as you spend a minimum of $35.

Grab

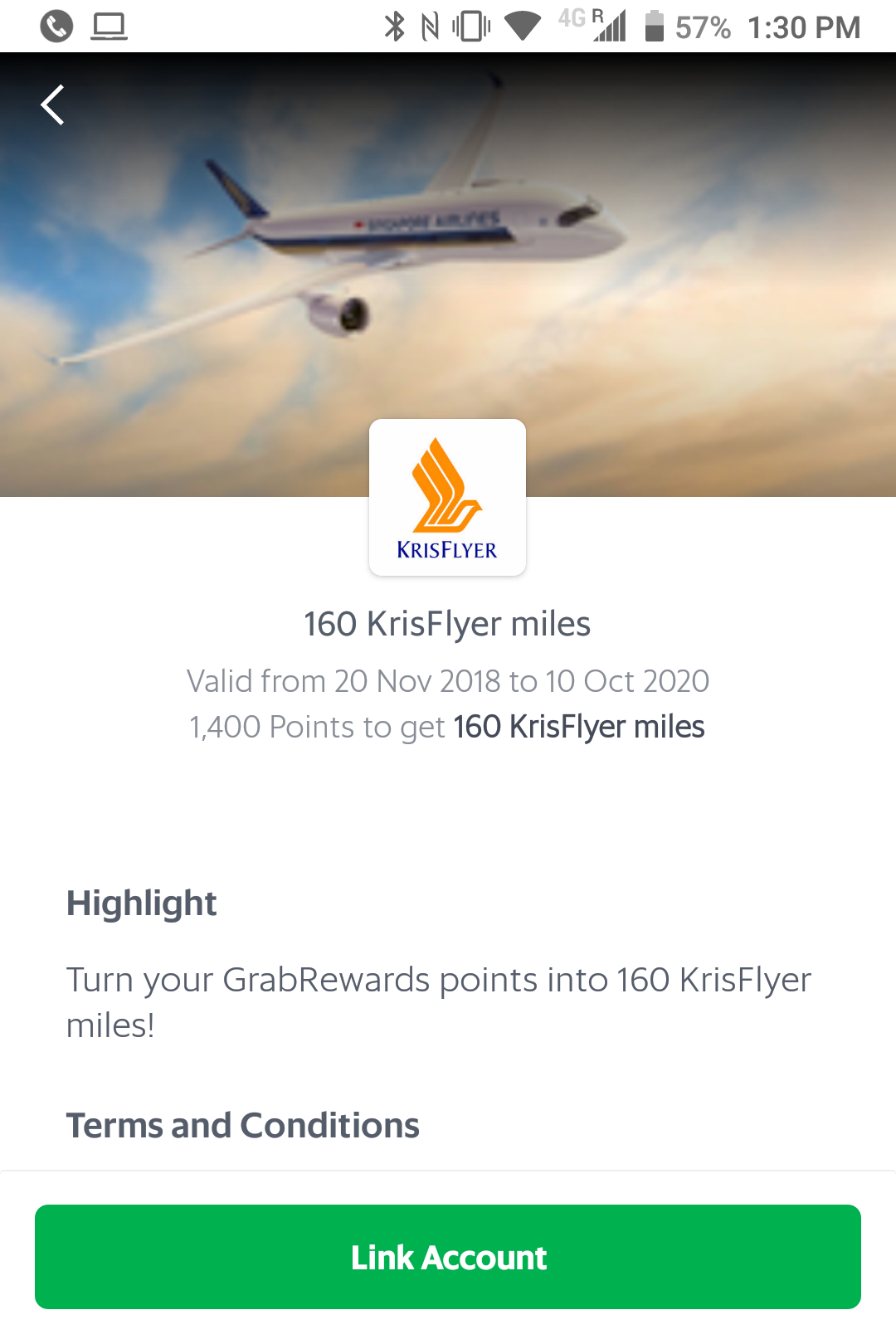

Anyone who uses Grab for rides, food delivery or mobile payments will know about GrabRewards, the platform’s loyalty program. GrabRewards points can be converted to KrisFlyer miles at a rate of 1,500 points to 160 miles (1,400 points for Platinum members)

Shopping

There are numerous ways of earning KrisFlyer miles when you shop online and offline

- Earn 5 miles per S$5 spent at ZALORA

- Buy fashion products from Club21 and convert Club21 points into miles at 5,300:2,000

- Shop at Changi Airport to earn Changi Rewards points and convert them into miles at 3,000:500

- Get a PAssion card, earn TapForMore points at Cold Storage, Giant and Guardian and convert them into miles at 2.3:1

Conclusion

There’s no shortage of ways to earn KrisFlyer miles in Singapore. For an exhaustive listing, be sure to refer to the SQ website.

In our next guide, we’ll look at the options you have for redeeming KrisFlyer miles.

can you elaborate on how to get 500 kf miles upon check in at hotel chains listed above? does this mean sacrificing your normal hotel membership points?

generally, no. you’ll earn hotel points as well as krisflyer miles. all you need to do is provide your frequent flyer number at check in

Does it need to be a cash stay? Would points awards or free nights still be eligible?

you’ll need to check individual program T&Cs for that. do note that some of the hotel chains mentioned don’t have their own loyalty program so it’s a moot point.

specifically for hyatt hotels, can we do so? was told by the staff that they will only credit one type of points..

read this: https://world.hyatt.com/content/gp/en/rewards/air-auto.html

it seems to suggest that you can double dip on both hotel points and airline miles. i know that hilton stopped this double dip in 2018, but not sure if others followed suit.

Thanks for this post Aaron. I live in india, so most of the earning methods dont work for us, but kaligo/rocketmiles looks interesting!

I used to work in India a couple years back. Remember the Citi premiermiles and the hdfc regalia were pretty decent. Not sure if that’s still the case