UOB has launched a new promotion for the UOB PRVI Miles cards. From 18 Oct till 31 Dec 2019, cardholders will earn a total of 4.4 mpd on:

- Overseas dining, shopping (including online shopping) and accommodation transactions, capped at S$3,000 for the entire period

- Bus or train rides paid via SimplyGo, capped at S$80 per month (only for Visa and Mastercard)

The T&C do not directly address this, but based on past promotions I’m assuming that the caps apply on a per card basis, which is to say that if you hold both the UOB PRVI Miles Mastercard and Visa, your cap is effectively doubled.

The T&C do not directly address this, but based on past promotions I’m assuming that the caps apply on a per card basis, which is to say that if you hold both the UOB PRVI Miles Mastercard and Visa, your cap is effectively doubled.

Thankfully, unlike some of UOB’s recent promotions, spending on supplementary cards will be combined with the principal card and earn the same bonus.

Registration is required and can be done by sending the following to 77862:

| PRVI<space>Last 4 alphanumeric digits of your NRIC or Passport Number (e.g. PRVI 222D) |

Overseas spend promotion

Registered cardholders who spend on eligible overseas transactions will earn the equivalent of 4.4 mpd on their UOB PRVI Miles card, split into:

- UNI$6 per S$5 spent on eligible overseas transactions (2.4 mpd- the base miles)

- UNI$5 per S$5 spent on eligible overseas transactions (2 mpd- the bonus miles)

The maximum bonus miles you may earn for the entire promotion period (i.e until 31 Dec 19) is UNI$3,000 (or S$3,000 worth of spending). Bonus miles will be credited by 31 March 2020.

Do take note that not every overseas transaction is eligible- UOB is defining this as dining, shopping (including online shopping) and accommodation. Here are the relevant MCCs for your reference

| Category | Eligible MCCs |

| Dining | 5441 Candy, Nut, and Confectionery Stores 5451 Dairy Product Stores 5462 Bakeries 5499 Miscellaneous Food Stores — Convenience Stores and Specialty Markets 5812 Eating Places and Restaurants 5813 Drinking Places (Alcoholic Beverages) — Bars, Taverns, Nightclubs, Cocktail Lounges, and Discotheques 5814 Quick Payment Service — Fast Food Restaurants 5912 Drug Stores and Pharmacies 5921 Package Stores — Beer, Wine, and Liquor |

| Shopping | 5309 Duty Free Stores 5310 Discount Store 5311 Department Stores 5331 Variety Stores 5399 Miscellaneous General Merchandise 5611 Men’s & Boys’ Clothing and Accessory Stores 5621 Women’s Ready-to-Wear Stores 5631 Women’s Accessory and Specialty Stores 5641 Children’s and Infants’ Wear Stores 5651 Family Clothing Stores 5655 Sports and Riding Apparel Stores 5661 Shoe Stores 5681 Furriers & Fur Shops 5691 Men’s and Women’s Clothing Stores 5697 Tailors, Seamstresses, Mending, Alterations 5698 Wig & Toupee Shops 5699 Miscellaneous Apparel and Accessory Stores 5732 Electronics Stores 5733 Music Stores — Musical Instruments, Pianos, and Sheet Music 5735 Record Stores 5941 Sporting Goods Stores 5942 Book Stores 5943 Stationery, Office and School Supply Stores 5944 Jewelry, Watch, Clock, and Silverware Stores 5945 Hobby, Toy and Game Stores 5946 Camera and Photographic Supply Stores 5947 Gift, Card, Novelty, and Souvenir Stores 5948 Luggage and Leather Goods Stores 5949 Sewing, Needlework, Fabric, and Piece Good Stores 5950 Glassware and Crystal Stores 5970 Artist Supply and Craft Stores 5971 Art Dealers and Galleries 5977 Cosmetic Stores 5993 Cigar Stores & Stands 5994 News Dealers & Newsstands 5999 Miscellaneous & Specialty Retail Stores |

| Accommodation | 3500 – 3999 Lodging 7011 Lodging–Hotels, Motels, Resorts–not elsewhere classified |

It’s also important to remember that if your transaction is processed within Singapore, it won’t qualify. This is more an issue with online shopping, as there are certain websites which may charge you in foreign currency, but process the transaction within Singapore. Unfortunately there’s no comprehensive list of sites which do this, but if you’re buying things on websites like Amazon USA you should be safe.

You also won’t earn any bonus if your transaction is processed in DCC, so please, please don’t fall victim to it.

Some of you may wonder how this compares to the OCBC 90N Card. From now till 29 Feb 2020, the OCBC 90N is offering an uncapped 4 mpd on all foreign currency spending. Here’s the key differences between that promotion and this one:

Although the UOB PRVI Miles earn rate is higher, remember that UOB has a 3.25% FCY fee on the PRVI Miles card, whereas the OCBC 90N charges 3%. This means that your cost per mile is roughly equivalent, and I’ll probably stick with the OCBC 90N for convenience and to avoid the pitfalls of payment processor location.

Bus/train rides promotion

Registered cardholders who use their UOB PRVI Miles card on eligible transit transactions via mobile contactless will earn the equivalent of 4.4 mpd, split into:

- UNI$3.5 per S$5 spent on locally (1.4 mpd- the base miles)

- UNI$7.5 per S$5 spent on eligible transit transactions (3 mpd- the bonus miles)

The maximum bonus miles you may earn each month is capped at UNI$120 (or S$80 worth of spending). Note that while the cap for selected overseas spend is for the entire period, the cap for transit spending is per month. Bonus miles will be credited by 31 March 2020.

You won’t earn any bonus if you tap the card directly at the gantry. To earn the bonus miles, you’ll need to add your UOB card to your mobile wallet (Apple Pay, Fitbit Pay, Google Pay, Samsung Pay) and tap in at the gantry.

Likewise, you won’t earn any bonus miles if you use your card to top up your EZ Link at physical terminals, regardless of whether it’s the physical card or your mobile wallet.

As SimplyGo only supports Visa and Mastercards, you won’t be able to use the UOB PRVI Miles AMEX for this promotion.

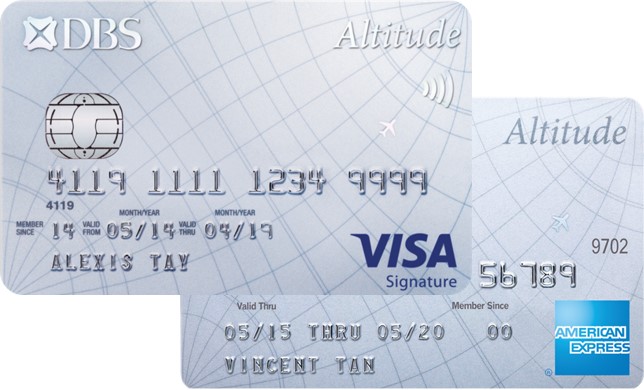

Some of you may wonder how this compares to the DBS Altitude Card. From now till 31 Dec 2019, the DBS Altitude is offering 4 mpd on public transport, taxi and Grab/gojek rides. Here’s the key differences between that promotion and this one:

Get S$100 cash with the UOB PRVI Miles AMEX

As a reminder, SingSaver is currently offering S$100 cash upon approval for the UOB PRVI Miles AMEX, regardless of whether you’re a new or existing UOB customer.

To get this, simply apply by 31 October 2019 via the link below:

Get S$100 cash when approved for the UOB PRVI Miles AMEX here

Once you’ve submitted your application, be sure to fill out the Rewards Redemption Form that will be sent to your email address. If you’re eligible, you’ll receive an email about your gift within 3 months of card activation. The S$100 cash will be dispensed via PayNow, so there’s no need to go to a physical collection centre.

Conclusion

This is a great promotion, and I’ve updated the “What Card To Use Where” guide to reflect this.

I’ll still be sticking to my OCBC 90N for foreign currency spending, because the PRVI Mile’s higher earn rate is offset by its higher FCY fee. However, I’ll be switching over to the PRVI Miles for public transportation, since it does earn 10% more than the DBS Altitude with no downside.

Will buying on points.com be awarded the 4.4?

it will always amaze me how some people will just skip straight to the comments and not even bother to read the article…

Love ur assumption, but no where can I find the MCC for points.com which I plan to buy Hilton points from to match with the list if it would be eligible.

Besides this is a online platform for people to learn and share, not for retards like you to comment

Points.com MCC 7399 – Business Services Not Elsewhere Classified

So no it isn’t going to be awarded 4.4 mpd.

Thanks, will go with dbs wmc then

according to latest reports, dbs wwmc isn’t “safe” for points.com anymore. CRV/OCBC90N safer

Don’t have either of these.. planned to use uob VS but accidentally overspend on that. Unsafe means even manual appeal also fail?

unsafe means if manual appeal fail don’t splash paint on my house 🙂

For transport using simply go, does uob award in $5 blocks of spending? So if my daily transport spend is less than $5, will I get any uni$?

They will total it up each month and award

then would you consider UOB to be better than DBS altitude? Given DBS you have to hit $1.83 or something minimum per day?

I mean just dollar for dollar it’s alr better. No brainer for me to switch

They will total it up each month even though it shows individual transactions each day on the statement?

Does your cents per mile calculation also include the spread between Visa/MC rates and mid market rate/local money changer rate? I usually spend overseas and always wonder how far behind the curve I am when using a 4mpd card vs cash vs transferwise vs a foreign currency debit card. Not exactly a simple calculation.

no, it’s a simple fee/mpd

Agree that using the N90 is more straightforward. Also avoids the $5 rounding issue of UOB cards.

You won’t earn any bonus if you tap the card directly at the gantry.

Does this also apply to the altitude card? I didn’t know about this specific ruling.

Yup

altitude card doesnt say tap card directly cannot earn bonus , please do not mislead

Altitude has no such restriction

Will booking hotels at agoda.com in USD be awarded with 4.4?

just go for OCBC 90N, it gives u 8mpd.

Aaron had done up great review over here

https://milelion.com/2019/08/24/review-ocbc-90n-card/

For the PRVI card registration via SMS, is anyone receiving a confirmation from UOB? I’ve SMS’d them but receive no reply.

Yep I did. U wanna check again if u sent in the correct number and format?

“The T&C do not directly address this, but based on past promotions I’m assuming that the caps apply on a per card basis, which is to say that if you hold both the UOB PRVI Miles Mastercard and Visa, your cap is effectively doubled.”

This is incorrect. I just called UOB and they clarified the cap is per principal cardholder – so $3,000 max spending across ALL your PRVI cards combined will earn 4.4 mpd. Apparently the call center has received subsequent clarification from the product manager.

thanks for the clarification!

Thank you Aaron for the article. Since most cards I am having (DBS/UOB/SCB/Citi) have FCY conversion fee of at least 3.25%, using Privi card is a no-brainer for overseas shopping.

yes, but note the category restrictions