Why can’t I just use one card for everything?

If you read that question, shook your head and said “duh”, then congratulations, this article isn’t for you!

But it’s something I hear all the time. Someone tells me that they want to start earning miles but, BUT, they just want to use one card. “Just tell me the best miles card to use,” they say, not realising what an impossible question that is.

So I’m going to write a post explaining the shortcomings of a one-card strategy, which I can then refer people to instead of tearing out what remains of my hair every time it’s asked.

Why one card just isn’t enough

It’s completely understandable why many people prefer to stick to a single card for everything.

It’s more convenient, for one. Multiple cards mean multiple bills to pay each month, multiple points to track, and multiple ibanking logins to remember. They might worry about having to pay multiple annual fees (though fee waivers are easy for most entry-level cards), or that multiple cards will hurt their credit score (it doesn’t, so long as you use them responsibly).

But if you’re collecting miles, using one card for everything is a major handicap, like being stuck in the slow lane.

You miss out on sign-up bonuses

If you stick to just one card, you miss out on the opportunity to enjoy multiple sign-up bonuses.

Sign-up bonuses are lump sums of miles awarded to new cardholders who spend a certain amount within a certain period of approval. The offers change every month, but to give you an idea of what’s available at the time of publishing:

| 💳 Credit Card Sign-Up Bonuses (sorted by payoff ratio) |

|||

| Spend (AF) | Miles^ | Payoff | |

DBS Altitude Card DBS Altitude CardApply Ends 31 Aug 25 |

S$800 (S$196)* |

38K NTB |

47.5 |

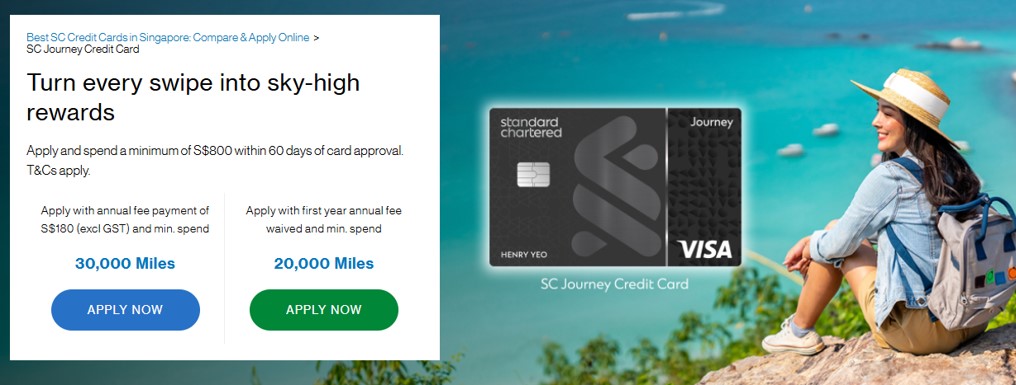

StanChart Journey StanChart JourneyApply Ends 30 Jun 25 |

S$800 (S$196)* |

30K + S$180 NTB |

37.5 |

Citi Premier Miles Citi Premier MilesApply Ends 31 Jul 25 |

S$800 (S$196)* |

30K NTB |

37.5 |

Apply Ends 30 Jun 25 |

S$1K (S$196) |

33.6K NTB 21.6K ETB |

33.6 NTB 21.6 ETB |

Citi Prestige Citi PrestigeApply Ends 30 Jun 25 |

S$2K (S$545) |

50K NTB ETB |

25 |

StanChart VI StanChart VIApply (NTB) Apply (ETB) Ends 30 Jun 25 |

S$2K (S$600) |

50K + S$100 NTB 50K ETB |

25 |

Citi Rewards Citi RewardsApply Ends 31 Jul 25 |

S$800 (FYF) |

16K NTB |

20 |

UOB VI Metal UOB VI MetalApply Ends 30 Jun 25 |

S$4K (S$654) |

80K NTB 40K ETB |

20 NTB 10 ETB |

AMEX KF Ascend AMEX KF AscendApply Ends 30 Jun 25 |

S$2K (S$398) |

37.6K + S$50 NTB 27.6K + S$50 ETB |

18.8 NTB 13.8 ETB |

DBS Vantage DBS Vantage Apply Ends 31 Aug 25 |

S$4K (S$600) |

60K NTB |

15 |

Apply Ends 30 Jun 25 |

S$4K (N/A) |

48K NTB ETB |

12 |

AMEX Plat Charge AMEX Plat ChargeApply Ends 30 Jun 25 |

S$8K (S$1,744) |

93.8K + S$50 NTB ETB |

11.7 |

StanChart Beyond StanChart BeyondApply Ends 30 Jun 25 |

S$20K (S$1,635) |

100K NTB ETB |

5 |

| ^Does not include base miles *Fee waiver option available, with smaller number of bonus miles. See below for full details. NTB New-to-bank customer | ETB Existing customer |

|||

That’s a lot of miles up for grabs, and if you have an upcoming wedding, renovation, birth, or anything that involves a significant amount of spending, you should be thinking about which sign-up bonuses you can take advantage of.

You miss out on specialised spending bonuses

Welcome bonuses aside, using just one card means missing out on specialised spending bonuses.

Specialised spending bonuses are awarded to categories of spending that banks want to incentivise, such as dining or shopping. It can even cover entire mediums of spending, such as online or contactless payments.

You can earn up to 4 mpd by using the right card in the right situation, accumulating miles significantly faster than someone earning 1.2-1.6 mpd by using the same general spending card everywhere.

Illustration: One card vs multiple cards

Here’s a simple illustration that shows how much you lose by sticking to one card and one card only.

Suppose you’re just getting started in the miles game, and want to use one card for everything. So you pick the UOB PRVI Miles Card, because it’s the “highest limitless miles card” (or so the advertisements say!).

This card earns 1.4 mpd on local spending, 2.4 mpd on foreign currency spending, and 3 mpd specifically for spending in IDR, MYR, THB and VND, which is great for a general spending card— much more than alternatives like the DBS Altitude or Citi PremierMiles Card anyway.

Now, assume you spend S$20,000 over the course of a year, 80% of it locally and 20% of it overseas in those four currencies. You’ll earn 34,400 miles in total, enough for a round-trip Economy Class ticket to Hong Kong or Taipei.

But consider the alternative. Suppose you instead sought to max out sign-up offers and specialised spending bonuses. Based on what was available in May 2025 (and yes, the situation will probably have changed by the time you read this post, but this is meant to be illustrative rather than prescriptive), you could have applied for:

| Card | Spend | Total Miles (Base + Bonus) |

AMEX KF Card AMEX KF CardApply Ends 28 May 25 |

S$1,000 | 23,000 |

Citi Rewards Citi RewardsApply Ends 31 Jul 25 |

S$800 | 19,200 |

DBS Altitude Card DBS Altitude CardApply Ends 31 Aug 25 |

S$800 | 29,040 |

StanChart Journey StanChart JourneyApply Ends 30 Jun 25 |

S$800 | 20,960 |

| Total | S$3,400 | 92,200 miles |

That’s 92,200 miles from just S$3,400 of spending, and I’ve been careful only to select the cards which offer a first year fee waiver. The remaining S$16,600 could be put on various 4 mpd cards (all of which also have first year fee waivers) for a total of 66,400 miles, in a best case scenario.

Your total haul? 158,600 miles, enough for a round-trip First Class ticket to Tokyo. It really is night and day.

Now, you could point out that someone who follows this strategy will have to pay a few conversion fees, as their points would be spread across banks. That’s true, and maybe it’ll come up to S$100 in total. But I reckon that if you stood at the check-in counter and offered Economy Class passengers to Hong Kong a chance to change their flight to First Class to Tokyo for S$100, you’d have no shortage of takers.

What this illustrates, I hope, is that the convenience of a one card strategy comes at a hefty cost.

But I REALLY want to stick to one card!

Now, if in spite of everything I’ve said you absolutely must use one card for everything, first of all I hate you, second, the KrisFlyer UOB Credit Card is probably your best bet.

This card normally earns 1.2 mpd on general spending, but supplements that with numerous bonus categories including:

- An uncapped 3 mpd on Singapore Airlines, Scoot, KrisShop, Kris+

- An uncapped 2.4 mpd on dining, food delivery, online shopping and travel, and transport

The full mechanics can be found in my review; suffice to say it’s probably the best general/specialised spending hybrid card out there.

All you need to do is spend at least S$800 (S$1,000, if your card was approved or renewed from December 2024 onwards) on Singapore Airlines, Scoot and KrisShop in a membership year to trigger the 2.4 mpd for dining, food delivery, online shopping and travel, and transport.

I want to be clear: this isn’t optimising by any means. It’s making the best of a sub-optimal situation, and you’ll still end up with far fewer miles than someone who uses more than one card.

Conclusion

Look, it’s not that miles chasers love complicating their lives. If there were really a card that gave you awesome earn rates on everything, we’d ditch everything else and just use that (Citi Rewards x Apple Pay, anyone?).

Unfortunately, that’s not how this works, and the implicit deal is that a free flight is worth some short-term headaches in applying for, tracking and maintaining multiple cards.

But trust me, when you’re sitting in Business Class with a glass of champagne, that’s the last thing you’ll think about.

Another awesome piece, Aaron.. If only I had this piece five years ago… That’s okay tho… not wasting/ throwing away miles anymore.. or at least much much less (when using wrong card, or get caught by wrong MCC)…

Thanks, Aaron! 🙇🏻♂️🙇🏻♂️🙇🏻♂️

haha we all make mistakes when we first start. i remember how happy i was putting everything on my trusty ol’ capitaland debit card…

Hi thanks for sharing.

So what are the top three card do you use personally?

on a day to day basis probably my uob ppv (contactless), boc elite miles (love hate relationship with it, but need the spending for bonus on my boc smartsaver) and whatever specialized spending card the situation dictates

Thanks for replying.

PPV is my first go to card. although general spending is UOB priv so i can consolidated all the Uni. 90N for oversea for now.

Oh yes forgot the 90n. Yup that’s my default for fcy

Hi Aaron what is the updated version now of the cards you use?

Hi Aaron, I’m curious on your dryer situation. Do you intend to switch out the 2-in-1 machine for a stand-alone dryer?

The amount of non-miles information I’ve gained from reading your article is immense.

Hahahaha yes. Moving to my permanent house in dec and a stand alone dryer is awaiting delivery. Never again with the combination machines

also with separate dryers and washers you can do 2 loads at once!

Just wondering, what about those who is not a high spender who only spend $700 / month + only travel once a year? If using multiple card strategies, will there be a risk of orphaned miles?

I belived multiple card strategies will only work if you are a big spender (e.g $1500 to $2000 / month) because there is a minimum block of miles (e.g 10,000 miles) required to perform a transfer?

fair point- your equation will change a bit if you’re spending $700 a month. however, even if you are you still shouldn’t be using one card- try and focus your spending with a bank that pools points, eg uob. uob prvi miles + uob pp visa + uob lady’s card (if you qualify) would already be much better than just uob prvi miles.

Noted. For DBS case would be DBS Altitude + WWMC. Right?

Bingo

WWMC is only 12 months validity.

Need to keep a watch and ensure you have sufficient to redeem the min block.

Yea noted. The 1 year validity of WWMC is pretty much risky, in case if cannot hit the 10,000 miles block within a year.

I redeemed what DBS points I could in March to take advantage of the spontaneous escapes, but it still means I have some points expiring in Dec this year. Is DBS flexible about extending the miles validity?

I have the exact same spending pattern as you, except that most of my spending is in a non-bonus category (google play in-game purchase). So I’ve stuck to using PRVI miles so far. UOB did send me the woman’s card, so I’ll probably use it for simplygo (now that I know UOB pools points).

I am not sure you’ve covered this before, but is there a CC offering rental car insurance coverage? A lot of North American cards do have this feature, not sure about local ones?

I’v been travelling a lot in Europe lately and paying extra for the insurance does add up.

we dont have that in SG. world elite mastercard used to offer, but not anymore.

The ultimate goal is to have enough financial strength to just spend on 1 card, and still have all the miles you could ever need 🙂