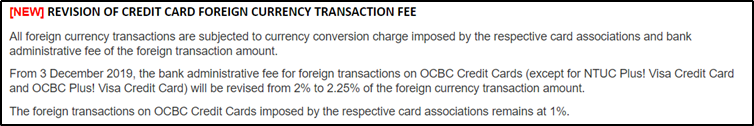

From 3 December 2019, OCBC will increase its foreign currency transaction (FCY) fee from 3% to 3.25%. This affects all credit cards except the NTUC Plus! Visa and OCBC Plus! Visa, and marks OCBC’s second fee increase this year, after the March 2019 hike.

What this essentially means is that we’ve seen OCBC’s FCY fee go from 2.8% to 3.25% in the space of a year, a worrying trend in a market where only a handful of banks still have sub-3% FCY fees.

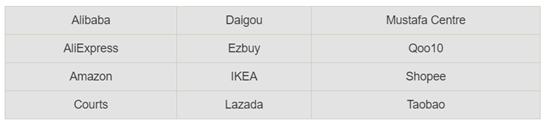

[table id=3 /]

As the table above shows, from December 2019 OCBC will have the second highest FCY fee in the market, on par with DBS, selected UOB cards and possibly Citibank.

| On 15 Dec 19, Citi is supposedly increasing its FCY fee from 3% to 3.25%. I do not see this on its website, but some people have sent me screenshots from their e-statements. I’ll do a separate post on this if/when it’s confirmed |

FCY fees are on the rise in Singapore

JD Power’s 2019 Credit Card Satisfaction Study showed that 70% of Singaporeans prefer not to use their credit cards while traveling overseas, citing high transaction fees as the main deterrent.

If that’s the case, Singapore banks really aren’t doing much to address those concerns. In the past couple of years, we’ve seen every bank except AMEX and SCB (already the highest in the market) increase their FCY fees, some more than once.

- On 1 Apr 18, Maybank increased its FCY charge on Visa Diamante, Visa Infinite and World Mastercard from 2.5% to 2.75%

- On 4 Oct 18, Citibank increased its FCY charge from 2.8% to 3%

- On 1 Nov 18, HSBC increased its FCY charge from 2.5% to 2.8%

- On 1 Jan 19, CIMB removed the admin fee waiver for FCY transactions on the Visa Signature and Platinum Mastercard, thereby increasing the fee from 1% to 3%

- On 2 Jan 19, DBS increased its FCY charge from 2.8% to 3%

- On 15 Jan 19, BOC increased its FCY charge on Mastercard transactions from 2.5% to 3% (Visa fees increased from 2.5% to 3% on 1 Dec 18)

- On 15 Mar 19, OCBC increased its FCY charge from 2.8% to 3%

- On 4 Sep 19, UOB increased its FCY charge from 2.8% to 3.1%

- On 1 Nov 19, DBS increased its FCY fee from 3% to 3.25%

Although these fee hikes are sometimes accompanied by increases in FCY earn rates (e.g. Citi boosted the overseas earn rate on the PremierMiles card to 2.4 mpd from October to December 2018), the increase is usually temporary, while the fee hike is permanent.

The upshot is that it’s becoming increasingly expensive to use your credit cards overseas, even after rewards are taken into account. Given this trend, it’s unsurprising that multi-currency cards like YouTrip and Revolut are gaining ground. These can be an option for you, assuming you’re willing to forgo rewards points in favor of lower transaction costs.

Is it still worth using your OCBC cards overseas?

It can be- if you use the right card.

Here’s what the fee hike does for the cost per mile on OCBC’s miles and rewards cards:

The good news is that it’s still definitely worth using the OCBC 90N for all your foreign currency spending, at least until 29 Feb 2020. After that, the overseas earning rate reverts to 2.1 mpd, and the cost per mile increases to 1.55 cents each- still a decent price, but definitely more marginal than at the existing 0.75 cents.

The fee hike causes the OCBC VOYAGE’s cpm figure to increase from 1.25 to 1.35, and it’ll increase further to 1.41 from 1 Jan 2020 when the 2.4 mpd rate reverts to 2.3 mpd.

If you’re making eligible online shopping transactions on the OCBC Titanium Rewards, you’ll continue to earn 4 mpd regardless of whether they’re in local or foreign currency. The fee hike marginally increases the cpm from 0.75 to 0.81 cents.

Conclusion

For the moment, the cost/rewards structure of credit cards still makes it worthwhile swiping your plastic overseas. However, fees are slowly but surely inching up, and unless these are accompanied by permanent boosts in rewards earning, consumers are eventually going to start switching to lower cost alternatives.

Hi Aaron thanks for the heads up. Now that OC rate is so high, it’s no longer better off to use OC 90N for overseas right?

I rem you comparing the UOB PRVI Miles 4.4 miles promo cents per miles rate is 0.74, vs OC90N has jumped to 0.81?

mathematically speaking, yes.

but remember: UOB PRVI miles has the rounding issue (transactions rounded down to nearest $5, problem on smaller transactions), the 4.4 mpd rate is capped, and you have the annoying “payment processor location” restriction too.

Icic. But to clarify, Ocbc doesn’t award for DCC transactions or if the payment gateway is in Singapore too right? This is prevalent for all banks

The banks are just killing themselves by pushing us towards fintechs like youtrip and dash. Imagine, they could just lower their fees and wipe out those fintechs but they certainly arent doing that.

The banks just blame MasterCard and Visa to allow such fin techs to flourish. So they jack up forex surcharge for MasterCard and Visa.

YouTrip is nonsense, give Revolut a try, its better. UK Revolut account can trade US stocks without any commission, not sure if they have such feature for Singapore account.

I think the fee increase is for all OCBC cards, NTUC/OCBC Plus! Visa Credit Cards are not affected by the revised Cash Advance Fee from 6% to 8%.

https://www.ocbc.com/assets/pdf/cards-fee-charge.pdf

People don’t understand that it is that expensive to operate cross border payment transactions. The only reason Revolut and YouTrip don’t charge transaction fees is because they subsidize it using venture funding and operate at HUGE losses.