UOB has been experimenting with many different PRVI Pay fees in 2019:

- From Jan-Feb, the fee was 2%

- From Mar-Jun, the fee was hiked to 2.1%

- For Jul, a 1.8% fee was offered

- From Aug-Nov, the fee was revised to 2%

And now, for those still following, UOB has lowered the PRVI Pay fee to 1.9% until the end of 2019.

This means you can buy miles at 1.9 cents each, down from the previous 2.0 cents. A difference of 0.1 cents may not sound like much, but when you’re buying hundreds of thousands of miles, it really helps.

How does PRVI Pay work?

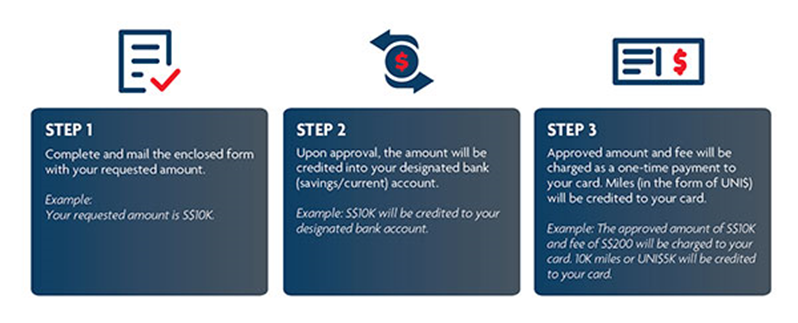

PRVI Pay is UOB’s “no-questions-asked” miles buying facility. Unlike similar facilities offered by Citibank and SCB, you don’t need a tenancy agreement, IRAS NOA, MCST invoice or any sort of documentation.

Cardholders can opt to charge any amount (subject to their credit limit) to PRVI Pay. The amount is deposited into their bank account, and charged together with an admin fee to their UOB PRVI Miles card.

Cardholders will earn UNI$2.5 for every S$5 charged to the facility (the admin fee does not earn UNI$). These UNI$ can be converted into either KrisFlyer or Asia Miles at a rate of 1 UNI$= 2 miles.

Even though the amount you can charge to PRVI Pay is capped by your credit limit, there’s nothing stopping you from “topping up” your credit limit by pre-paying your card account through ibanking.

How does this compare to other ways of buying miles?

The cost of buying miles in Singapore has fallen significantly over the past 12 months, so much so that I’ve revised my valuation of a KrisFlyer mile down from 2 cents to 1.8 cents each.

The table below summarizes your options for buying miles. Do keep in mind that not every option will be available to you, as some have income restrictions (e.g the SCB Visa Infinite’s tax payment facility requires a $150K p.a. SCB Visa Infinite card), and others require having particular types of payments (e.g. you can’t use RentHero unless you have a rental bill to pay).

[table id=4 /]

UOB PRVI Pay’s main advantage is that it’s a “no questions asked” facility, hence suitable for those without bills to pay. At a 1.9 cents per mile cost, it’s on par with other “no questions asked” facilities like the OCBC VOYAGE and UOB Reserve Visa Infinite.

However, if you do indeed have bills to pay, you’re going to want to consider the following cheaper options:

| Rent | Tax | ||||

| Method | Fee | Price Range | Method | Fee | Price Range |

| RentHero | 1.85% | 1.14-1.51 cpm | SCB VI | 1.6% | 1.14- 1.6 cpm |

| CardUp | 1.9% with SAVERENT19 |

1.17-1.55 cpm | HSBC VI | 1.5% | 1.2-1.5 cpm |

| Citi PayAll | 2% | 1.25-1.67 cpm | Citi PayAll | 2% | 1.25-1.67 cpm |

| SC EasyBill | 2% | 1.43- 2 cpm | SC EasyBill | 2% | 1.43- 2 cpm |

| Condo Fees/ Electricity/ Education/ Insurance | ||

| Method | Fee | Price Range |

| CardUp | 1.95% with EVERY4FREE | 1.20-1.59 cpm |

| Citi PayAll (no insurance) | 2% | 1.25-1.67 cpm |

| SC EasyBill (no condo fees & electricity) | 2% | 1.43- 2 cpm |

| General note: Do not make the mistake of comparing admin fee % to determine which is the lowest cost option! For example, Citi PayAll has a fee of 2%, but when paired with the Citi Prestige card (1.3 mpd) can generate miles at 1.54 cents each. UOB PRVI Pay has a fee of 1.9%, but earns 1 mpd with the UOB PRVI Miles card for 1.9 cents each. Same fee, different cost. Always refer to the table above for the relevant workings |

Conclusion

A 1.9 cents per mile fee makes PRVI Pay a very good option for those who can’t access cheaper payment facilities. It’s also a useful way to top up your UNI$ to UOB’s minimum transfer block of UNI$5,000 (10,000 miles).

If nothing else, it’s much cheaper than buying miles from Singapore Airlines at about 5 cents each.

(HT: I_F)