I recently published a list of the 10 most read articles on The Milelion for 2019. Although these articles got the most traffic, there was a separate set that I particularly loved putting together.

So ICYMI, here’s my own personal favourite list from 2019:

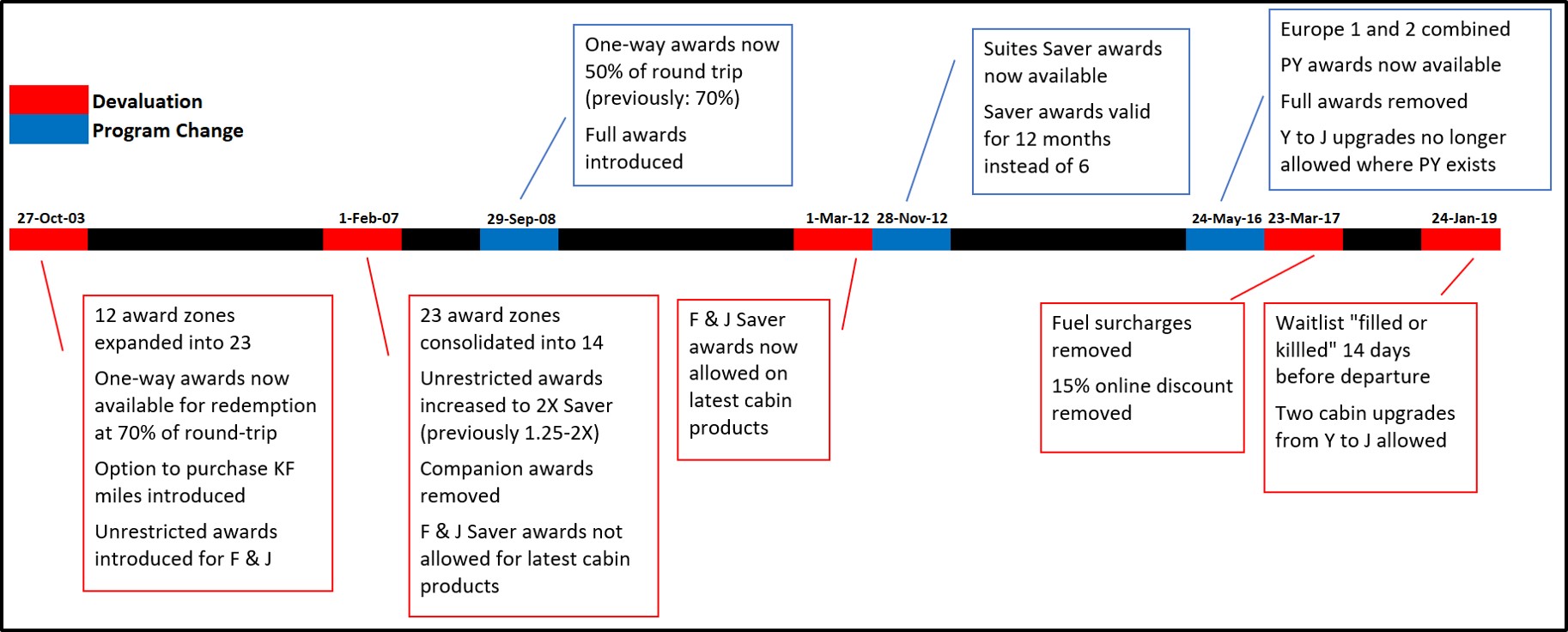

(1) Tracking 15 years of KrisFlyer devaluations and program changes

In light of the KrisFlyer devaluation that took place earlier this year, I started thinking: how often do devaluations happen, and how bad are they? Is it possible to predict future devaluations based on what we’ve seen in the past?

The first thing I needed was data, which I duly set out to compile. After hours of digging through old Flyertalk threads and messing around with the Wayback Machine, I assembled 15 years’ worth of Singapore Airlines award charts, from 27 Oct 2003 to 24 January 2019.

I won’t spoil all the surprises, but the data suggests that the pace of devaluations has accelerated. Other fun tidbits I uncovered include the fact that the price of buying miles from SIA hasn’t changed since 2003, and that the 15% online redemption discount that got canned in December 2017 lasted for 14 years.

This was easily the article I enjoyed writing the most this year, and well worth a read if you haven’t already done so.

(2) I spun the Chope birthday wheel 2,739 times. Here’s what happened

In June this year, Chope celebrated its 8th Birthday with a “Take the Cake” spin-the-wheel game. Players redeemed tokens for spins, with staycations, air tickets, dining vouchers, gojek/Lazada promo codes and bonus Chope dollars up for grabs. Bonus tokens could be earned by referring friends, and I ended up with 2,700 tokens after posting an article about the game.

Armed with a macro generator and email parser, I set out to discover just how lucky I was. Would I win the fabled super vibrator massage? You’ll have to read to find out.

(3) Does anyone remember the Young Explorer Club, Singapore Airlines’ FFP for kids?

From 1994 to 2006, Singapore Airlines ran a frequent flyer program just for kids- the Young Explorer Club. I came across my ancient Young Explorer passport earlier this year while doing some spring cleaning, which gave me serious feels.

Unfortunately, there’s hardly any information about Young Explorer available online, but I set out to piece together whatever I could find.

Young Explorer had its very own membership card and four elite tiers, getting younglings forever hooked on the status chase. You earned status by accruing kilometers (Passages, the precursor to KrisFlyer, was kilometer-based at the time), and while these couldn’t be redeemed for flights, they did lead to some snazzy requalification gifts.

Young Explorers got cockpit visits, quarterly magazines and invitations to special events, among other perks. It was a fun program for a simpler time, and if you ever held that passport, you’re going to want to take this walk down memory lane.

(4) Analyzing 20 months of KrisFlyer Spontaneous Escapes: which destinations are likely to feature?

“Will [insert destination here] be available for next month’s Spontaneous Escapes?”

That’s a common question I get. We’ve now had more than two dozen editions of Spontaneous Escapes, which presents a great opportunity to tease out trends and insights. Which destinations commonly feature? Which destinations don’t? When can we expect Spontaneous Escapes to be released? How many destinations can we expect to see during peak travel periods?

Pulling together 20 months of data took a while, but I’ve done it so you don’t have to.

(5) How do banks round credit card points, and what’s the minimum spend to earn them?

The only thing harder than splitting the atom is reconciling credit card points. Do you round your transaction up or down? Are points awarded per S$1 or per S$5? Do banks give fractional points? It’s enough to make you pull your hair out.

Fortunately, there are people who religiously track their points, and thanks to The Milelion Community, I managed to piece together the Excel formulas for some of the most popular general spending cards on the market.

The BOC Elite Miles World Mastercard, for all its flaws, is actually the most generous in terms of calculating points. It awards them down to the last cent of spending, even keeping track of fractional points. The UOB PRVI Miles is the worst, penalizing you twice- once on the rounding down of transactions to the nearest S$5, and again by rounding down fractional points.

Get access to the formulas and an easy-to-use calculator in the full article.

(6) How to track bonus points on specialized spending cards

If you thought reconciling points on general spending cards was hard, wait till you get a load of specialized spending ones. Not only do you have all the calculation issues of general spending cards, you also have to deal with delayed crediting- base and bonus points don’t usually post together!

Once again, the trusty Milelion Community comes to the rescue, and in the post you’ll find detailed formulas explaining how you derive bonus points for each of these cards.

(7) Miles Game Starter Pack: Four credit cards you need to get going

I’ve been writing The Milelion for 4 going on 5 years, but not once did I come up with a “starter pack” for those just getting into the miles game.

The good news is you don’t need 10 or 20 different credit cards to optimize your spending; in fact, just four or five carefully chosen ones will more than suffice. A card each for dining, contactless and online sending, plus a catchall card for general spending, and you’re all set.

Review your starter pack options in the full article below.

(8) When is it okay to redeem miles for Economy Class tickets?

Ah, the cardinal sin of the miles game- redeeming miles for Economy Class. Time and time again, I’ve advised people not to “waste” their miles this way. After all, you could buy Economy Class tickets if you really had to; wouldn’t it be much better to use your miles for an otherwise unattainable First or Business Class experience?

But as it turns out, there are situations where the back of the plane can make sense. When you’re looking at one-way or last minute travel, where fuel surcharges are minimal or non-existent, or where you need the flexibility to change your plans in the future, Economy Class redemptions give you something the cheapest revenue tickets won’t.

In the article, I also lay out some examples of Economy Class sweet spots in KrisFlyer and other frequent flyer programs.

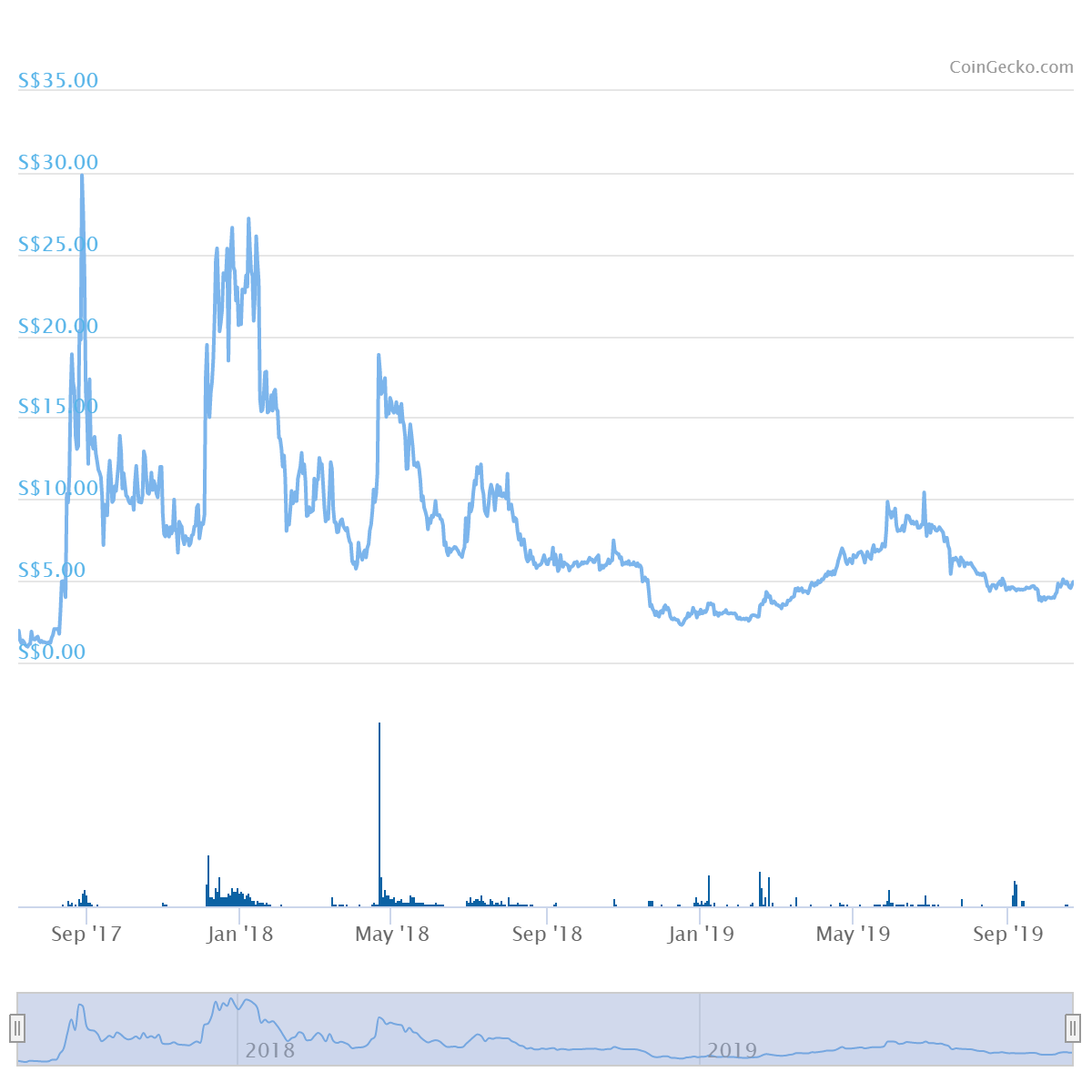

(9) Why I wouldn’t touch the MCO Visa (and neither should most people)

On the surface, the MCO Visa has a lot of things going for it. Unlimited lounge access! 100% rebates on Spotify and Netflix! 10% rebates on Airbnb and Expedia! No fee ATM withdrawals and interbank exchange rates for FCY transactions!

But to enjoy most of those benefits, you’re going to need to buy and hold MCO, a cryptocurrency which price movements are one big black box. Your stake could be worth double by the time your lock-in period ends. It could be worth nothing. Is that a risk you’re willing to take?

Unfortunately, crypto.com have been aggressively marketing the MCO Visa in mainstream lifestyle and travel sites like Expat Living and The Travel Intern. What should be a specialized product only used by knowledgeable investors is being pushed as a “lifestyle card” suitable for “deal-loving travelers”, with nary a mention about the very real risks of dabbling in crypto.

That’s just not right, and if your friends are thinking of jumping in, you may want to point them to this article.

(10) Here’s the cheapest (and most expensive) airports to redeem award flights from

Although KrisFlyer no longer imposes fuel surcharges on Singapore Airlines/SilkAir award redemptions, you’re still on the hook for taxes and fees imposed by the relevant government and airport authorities. Depending on jurisdiction, this can range from less than $10 to almost $400.

This means location matters- if you hate the idea of paying more for your “free” ticket than the cost of a cab to the airport, there are certain cities you’ll want to avoid flying out of. Europe shows great variation, with geographically close cities having differences of $300+ in taxes. The USA is generally cheap, with taxes on non-stop flights no more than $8. Where East Asia is concerned, it’s more expensive to fly out of Japan and cheaper to fly out of Seoul, although it’s worth noting that “expensive” is relative- it’s still much cheaper than Europe.

Read the full analysis and get the costs of flying out of each airport in the link below.