I think we’re all fairly accustomed by now to UOB’s style of sign up bonus:

| The first X customers who are approved and spend $Y in the first Z days will receive a bonus. Everyone else gets nothing. Oh, and there’s no way of knowing whether you’re still inside the first X so please stop calling our CSOs and bugging them because they don’t know either. Just spend $Y and hope for the best. Isn’t life exciting that way? #yolo |

It’s frustrating, but not surprising by now. And sometimes it even gets so absurd that you just have to laugh.

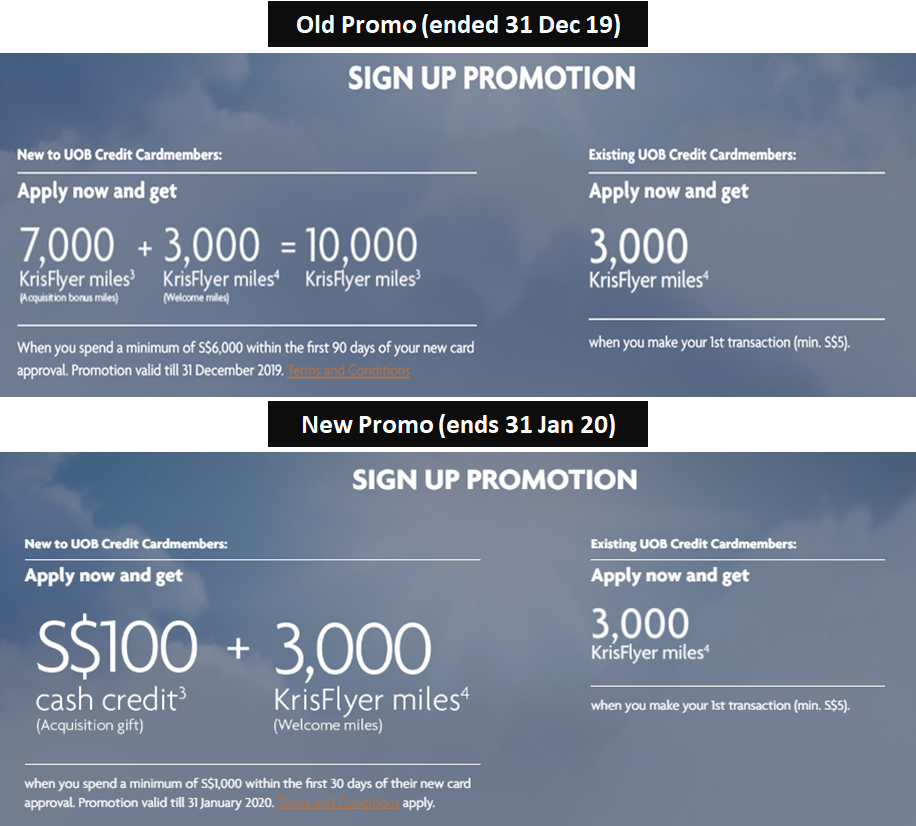

Case in point: until 31 December 2019, UOB actually had a pretty decent bonus on the KrisFlyer UOB and UOB PRVI Miles AMEX cards. New-to-bank customers who spent S$6,000 on either card in the first 90 days received 10,000 bonus miles. There was no cap; it was that simple.

Well, it seems like UOB’s knocked some sense into whoever was responsible for that gaffe, because the latest promotion is much more familiar territory.

The new KrisFlyer UOB/ UOB PRVI Miles sign up gift

From 1-31 January 2020, both new-to-bank and existing customers who get approved for the KrisFlyer UOB credit card will receive 3,000 miles after their first transaction of at least S$5. That’s the same as before.

What’s changed is that instead of 7,000 bonus miles with S$6,000 spending, new-to-bank customers can get a S$100 cash credit when they spend S$1,000 in the first 30 days of approval.

This is the same gift being offered on the UOB PRVI Miles cards (existing customers get nothing here).

“Wait a minute,” you say, “that sounds pretty sweet! Getting a S$100 cash credit on S$1,000 spending is a 10% rebate. I don’t care how much you love your miles, I’d take that over spending S$6,000 for 7,000 miles any day of the week.”

Oh, but we haven’t even gotten to the good part yet…

About that S$100 cash credit

Here’s how that S$100 cash credit works. From 1-31 January 2020, the first 200 new-to-bank applicants who are approved for a principal UOB credit card and spend S$1,000 in the first 30 days will get a S$100 cash credit.

| UOB defines new-to-bank as anyone who does not currently hold a UOB principal credit card, and has not done so in the 6 months prior to 1 Jan 2020. |

That’s right- “a principal UOB credit card”. This 200 cap is shared among the following cards:

- UOB PRVI Miles Visa

- UOB PRVI Miles Mastercard

- UOB PRVI Miles AMEX

- KrisFlyer UOB Credit Card

- UOB ONE Card

- UOB Lady’s Card

- UOB Lady’s Solitaire Card

- UOB YOLO Card

- UOB Visa Signature Card

- UOB Preferred Platinum Visa Card

- Metro-UOB Card

- UOB UnionPay Card

- UOB JCB Card

- Singtel-UOB Card

Let me say that again: you have to be among the first 200 people within this group to fulfill the criteria, which means that miles chasers are competing with cashback chasers and Metro chasers and Singtel chasers and whoever applies for UnionPay and JCB cards. It’s all one bucket, and a tiny one at that. How many new cardholders do you think a bank the size of UOB signs up each day?

I don’t know about you, but I’d find it hard to trade my new-to-bank status for what’s basically a lucky draw where the odds are stacked very heavily against me. For those who don’t have any UOB credit cards yet, there’s surely got to be a better time to jump in.

If, by some miracle, you’re within the first 200 customers, you’ll get your S$100 cash credit by 30 April 2020. The full T&C of this promotion can be found here.

Conclusion

For all intents and purposes, there is no sign up bonus on the KrisFlyer UOB or UOB PRVI Miles cards right now. Thankfully, the period for this “promotion” is fairly short, and perhaps we’ll see a better offer after 31 January 2020.

It’s good that UOB’s T&Cs indemnify the bank from responsibility for any injury resulting in connection with this promotion, because I can see some people getting a strain from rolling their eyes.

“Whoever applies for JCB cards”

Hey! That card has decent lounge benefits OK? (granted, can’t use in Singapore, but when traveling abroad you can use their lounges)

heh heh, yes…

https://milelion.com/2016/10/04/is-it-worth-getting-the-jcb-card-for-a-single-trip-to-japan/

and I just cancelled the JCB cards recently. Haha..