| 💵 Update on Interest Rates |

| Etiqa has reduced the crediting rate from 2.0% p.a to 1.8% p.a (1% guaranteed, 0.8% non-guaranteed) for all signups from 19 November 2020 onwards. Any user who submitted an application before this date will continue to enjoy the 2.0% p.a rate |

Ever since interest rates on bank accounts started getting nerfed, I’ve been looking for alternatives to park my short-term funds.

So far I’m using Singlife and Dash EasyEarn to hold S$10,000 and S$20,000 respectively. The Singlife Account earns 2.5% on the first S$10,000 (until 1 November, when it gets cut to 2%- but you can continue earning 2.5% for a limited time via the Save Spend Earn campaign). Dash EasyEarn gives 2% on the first S$20,000 during the first year (this was lowered to 1.8% for sign ups after 24 September).

Now comes another challenger in the form of GIGANTIQ, which offers up to 2% on the first S$10,000.

GIGANTIQ Overview

| Underwriter | Min Amount | Max Amount |

| Etiqa Insurance | S$50 | S$200,000 |

| Returns | Lock-in Period | Withdrawal Cost |

| Up to 2% p.a | None | S$0.70 per withdrawal (S$0.50 for DBS/POSB) |

| Policy Wording | FAQs | ||

GIGANTIQ a single-premium, non-participating universal life plan that’s underwritten by Etiqa Insurance. It’s protected under the Policy Owners’ Protection (PPF) scheme administered by the SDIC, so your capital is guaranteed.

GIGANTIQ offers 2% p.a (1% guaranteed + 1% non-guaranteed) on the first S$10,000 in the first year, and 1% p.a on any amount above that.

| Amount | Interest Rate |

| First S$10K | 2% p.a for first year |

| Above S$10K | 1% p.a for first year |

The projected interest rate will be 1% p.a for the entire balance from the second year onwards, but you can always withdraw your funds with no penalty when that happens.

There’s no lock-in period, and withdrawals cost 70 cents each (50 cents if you withdraw to a DBS/POSB account). This really shouldn’t be a big deal, provided you’re not intending to use this like a bank account with frequent withdrawals. There’s also no “block requirement” for withdrawals (Dash EasyEarn requires that all withdrawals be in blocks of S$100, for example).

Since this is an insurance savings plan, there’s a protection element included. For GIGANTIQ customers, 105% of the account value will be payable in the event of death. It’s clearly not the primary attraction of this policy, however, and you should have additional term or whole life insurance coverage from elsewhere.

You need to keep a minimum average daily balance of S$50 in the account; the policy will be deactivated otherwise. Each individual can only hold a maximum of 1 GIGANTIQ policy.

Be sure to read the product summary and policy wordings before applying, and consult a financial adviser if necessary.

Additional offers for PolicyPal customers

If you’re planning to sign up for GIGANTIQ, do it through the PolicyPal mobile app for some additional goodies.

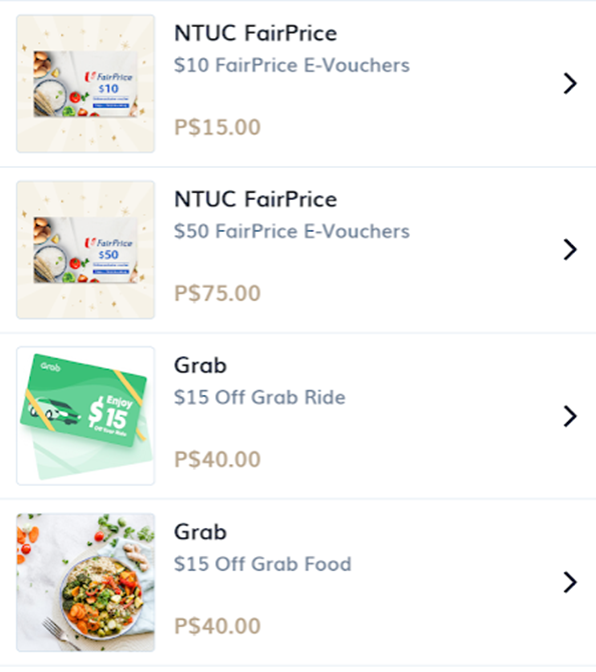

The first step is to register for a PolicyPal account. If you don’t already have one, registering with the referral code MILELION gets you $10 in PolicyPal credits (that can be used to redeem NTUC/Grab vouchers).

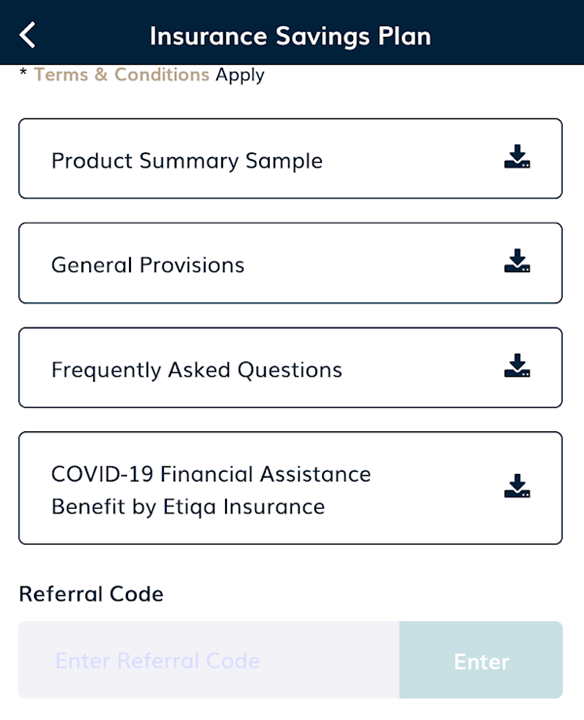

After that, proceed to purchase a GIGANTIQ policy through the PolicyPal mobile app

Purchase GIGANTIQ via PolicyPal

From now till 18 November 2020, PolicyPal is offering a 0.2% bonus for every friend referred to GIGANTIQ, capped at 20 friends. Feel free to share your own referral code with friends after you apply, but for your initial application, I’d appreciate it if you used the code MILELION.

In addition to this, those who purchase further policies from PolicyPal in addition to GIGANTIQ will earn a 1% bonus per policy.

| Eligible policies include Term Life, Whole Life, Retirement, ILPs, Endowment/Savings (Regular Premiums), Critical Illness and Motor with a minimum total premium amount of S$2,000 |

The maximum bonus you can earn is 8%, capped on a total premium of S$10,000.

| Bonus | Max Bonus | |

| Refer friend to GIGANTIQ | 0.2% | 20 referrals x 0.2%= 4% |

| Buy additional policy from PolicyPal | 1% | 4 purchases x 1%= 4% |

All bonuses are credited in the form of PolicyPal credits, which can be used to redeem NTUC, Grab, and other vouchers via the PolicyPal mobile app. The full T&C of the referral program can be found here.

Is this a good way of buying miles?

Back in June, I wrote about how it was possible to generate miles at a very decent 1.35 cents each using a combination of UOB PRVI Pay and Singlife. The basic idea was that you’d charge a certain amount to UOB PRVI Pay with the 12-month repayment option (2.7% fee), park the funds you received from UOB in Singlife, and use the 2.5% interest earned to offset the cost of the miles.

UOB PRVI Pay is currently not offering a 12-month repayment option, but OCBC VOYAGE Pay is. If you have an income tax bill to pay, it’s possible to apply for a 12-month VOYAGE Pay facility with a fee of 2.85%.

Straight away you should see that the math won’t be as favorable, because:

- The interest rate now is 2% instead of 2.5%

- For a 12-month repayment period, VOYAGE Pay charges an admin fee of 2.85% instead of 2.7%

But if you’re curious, here’s how the repayment schedule works:

| Month | Charged to Card | VOYAGE Miles^ | GIGANTIQ Balance |

Interest from GIGANTIQ @ 2% p.a |

| 0 | S$10,000 | |||

| 1 | S$1,118* | 833 | S$9,167 | S$16.67 |

| 2 | S$833 | 833 | S$8,333 | S$15.28 |

| 3 | S$833 | 833 | S$7,500 | S$13.89 |

| 4 | S$833 | 833 | S$6,667 | S$12.50 |

| 5 | S$833 | 833 | S$5,833 | S$11.11 |

| 6 | S$833 | 833 | S$5,000 | S$9.72 |

| 7 | S$833 | 833 | S$4,167 | S$8.33 |

| 8 | S$833 | 833 | S$3,333 | S$6.94 |

| 9 | S$833 | 833 | S$2,500 | S$5.56 |

| 10 | S$833 | 833 | S$1,667 | S$4.17 |

| 11 | S$833 | 833 | S$833 | S$2.78 |

| 12 | S$833 | 833 | S$0 | S$1.39 |

| S$10,285 | 9,996 |

S$108.33 | ||

| *The S$285 admin fee is charged in full with the first installment ^Although OCBC has switched to S$5 earning blocks on the VOYAGE card, to my knowledge the tax payment facility still awards miles on a S$1 basis |

||||

You’ll earn a total of S$108.33 of interest and pay an admin fee of S$285, so your net outlay is S$176.67. For this, you earn 9,996 miles (not exactly 10,000, due to rounding), yielding an overall cost of 1.77 cents per mile.

Given the relatively low volume of miles, this probably won’t be worth the time. Besides, the use case is extremely limited- you need to be an OCBC VOYAGE cardholder with an income tax bill of at least S$10,000.

How does this compare to other Insurance Savings Plans?

Dash EasyEarn Dash EasyEarn |

Singlife Singlife |

||

| Returns | Up to 2% p.a | 1.8% p.a^ | Up to 2.5% p.a* |

| Breakdown | First S$10K: 2% Above: 1% |

First S$20K: 1.8% | First S$10K: 2.5% Next S$90K: 1% |

| Initial Deposit | S$50 | Min S$2K Max S$20K |

S$500 |

| Min Balance | S$50 | S$2,000 | S$100 |

| Max balance | S$200K | S$20K | None (but no interest earned for >S$100K) |

| Lock-in | None | None | None |

| Withdrawal penalties | None | None | None |

| Withdrawal blocks | None | S$100 | None |

| Withdrawal fees | 70 cents/ 50 cents (for DBS/POSB) | 70 cents (free to Dash Wallet) | None |

| Life insurance coverage (% of account value) | 105% | 105% | 105% + terminal illness |

| Capital Guarantee | Yes | Yes | Yes |

| *Returns for first S$10,000 will be reduced to 2% p.a from 1 November 2020 ^Those who signed up on/before 24 September 2020 will earn 2% p.a |

|||

As the table above shows, GIGANTIQ is more than competitive vis a vis the other insurance savings plans on the market. You can expect similar liquidity, capital protection and insurance coverage, and there’s very little to separate them (Dash is a bit less flexible with withdrawals thanks to its S$100 block requirement).

But it’s not like you have to choose anyway. Depending on the size of your emergency stash, there’s nothing stopping you from signing up for all three. Here’s my current allocation, which allows me to earn much more interest than I would with a traditional bank account, with no hoops to jump through.

| Amount | Interest | |

| Singlife | S$10,000 | 2.5%^ |

| Dash EasyEarn | S$20,000 | 2%* |

| GIGANTIQ | S$10,000 | 2% |

| Blended Rate on S$40,000 | 2.125% | |

| ^Cut to 2% from 1 November 2020 *1.8% for those who signed up after 24 September 2020 |

||

I basically replicate the same for The Milelioness, and that’s S$80,000 earning 2.125% p.a- not too bad in the current environment.

Conclusion

GIGANTIQ is a straightforward way to earn 2% p.a on S$10,000 of your emergency funds/warchest, while enjoying the liquidity and protection of a bank account (these insurance savings plans go to great lengths to emphasize they’re not bank accounts, but they serve a very similar purpose in my mind).

Given that I earn at best 1.08% p.a on my OCBC 360 and even less on my DBS Multiplier, these alternatives are obvious choices for me.

Buy S&P 500 index. S27

30% dividend tax. I rather buy CSPX on LSE.

r/milelionbets

r/milelionwealthmanagement

Do they replenish the ntuc vouchers? It’s all gone 🙁

from FAQ, one point seems a bit worrying is that “We (Etiqa) reserve the right to delay the payment of the surrender benefit for up to a period of 6 months from the date of the surrender request. ”

what is your idea on this, pls

this is quite a standard clause you find across their policies like easyearn and elastiq. i don’t think it’s anything to be worried about, probably legal team being kiasu

Hi Aaron, have indicated your referral code.

Strange they’re not as fast as Singlife / Dash where the funds are immediately reflected.

thank you! i think it took less than a day for policypal to reflect the plan for me.

You’re welcomed. I need to create and log in to Tiq by Etiqa to view my policy though. I’ve parked an additional $10k in Singlife account in the meantime for the 1% interest. Not a great deal but better than the banks for now.

One more difference to Singlife/Dash: GIGANTIQ via PolicyPal is only available to Singapore Citizens/PRs.