When the Standard Chartered Rewards+ Card debuted in May 2018, I called it “deeply disappointing”. Although the card promised 10X points on foreign currency (FCY) spending and 5X points on local dining, this wasn’t the 4 mpd/ 2 mpd that most people expected.

The reason was simple: Standard Chartered has a two-tier rewards system:

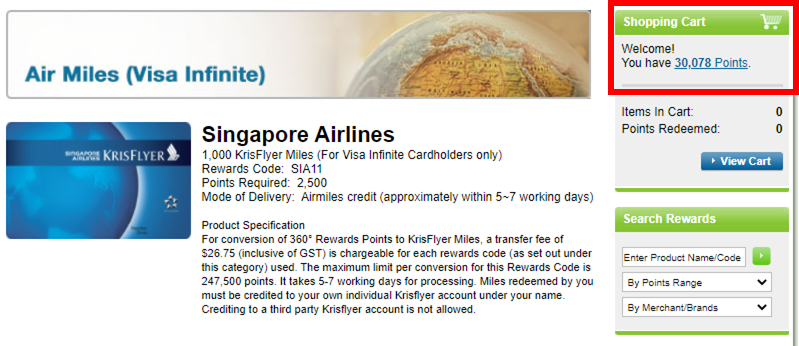

- Visa Infinite-tier cards transfer points to KrisFlyer at a ratio of 2,500 points: 1,000 miles

- All other cards transfer points to KrisFlyer at a ratio of 3,500 points: 1,015 miles.

Therefore, 1X points with a non-Visa Infinite card was the equivalent of just 0.29 miles, and the Standard Chartered Rewards+ Card earned a paltry 2.9 mpd on foreign currency spending and 1.45 mpd on dining, with an annual bonus cap of 20,000 points (just 5,800 miles!). That was woefully underpowered compared to the 4 mpd opportunities offered by competing cards.

But I’ve recently become aware of something that could change the equation, for those who hold a Standard Chartered Visa Infinite or X Card (if you don’t, you can stop reading here because the Rewards+ Card is indeed useless to you).

Standard Chartered now pools points across all cards

First, some quick context. Standard Chartered launched a new rewards platform together with the X Card, which adds 10 more airline and hotel transfer partners.

| Old Rewards Platform | New Rewards Platform |

|

|

This platform was originally exclusive to the X Card, but later in 2019, support was rolled out for the Visa Infinite. It now appears that the platform is accessible to all Standard Chartered cardholders.

| 💳 How do I access the new rewards platform? |

|

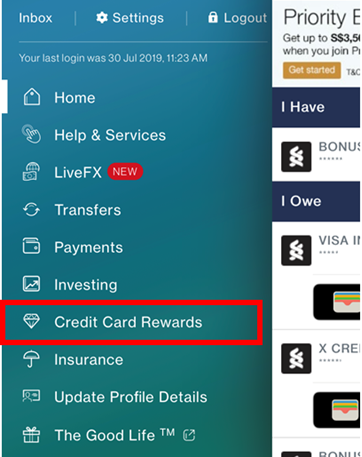

The easiest way to do this is to login on the mobile banking app and look for “Credit Card Rewards” in the left hand side menu.

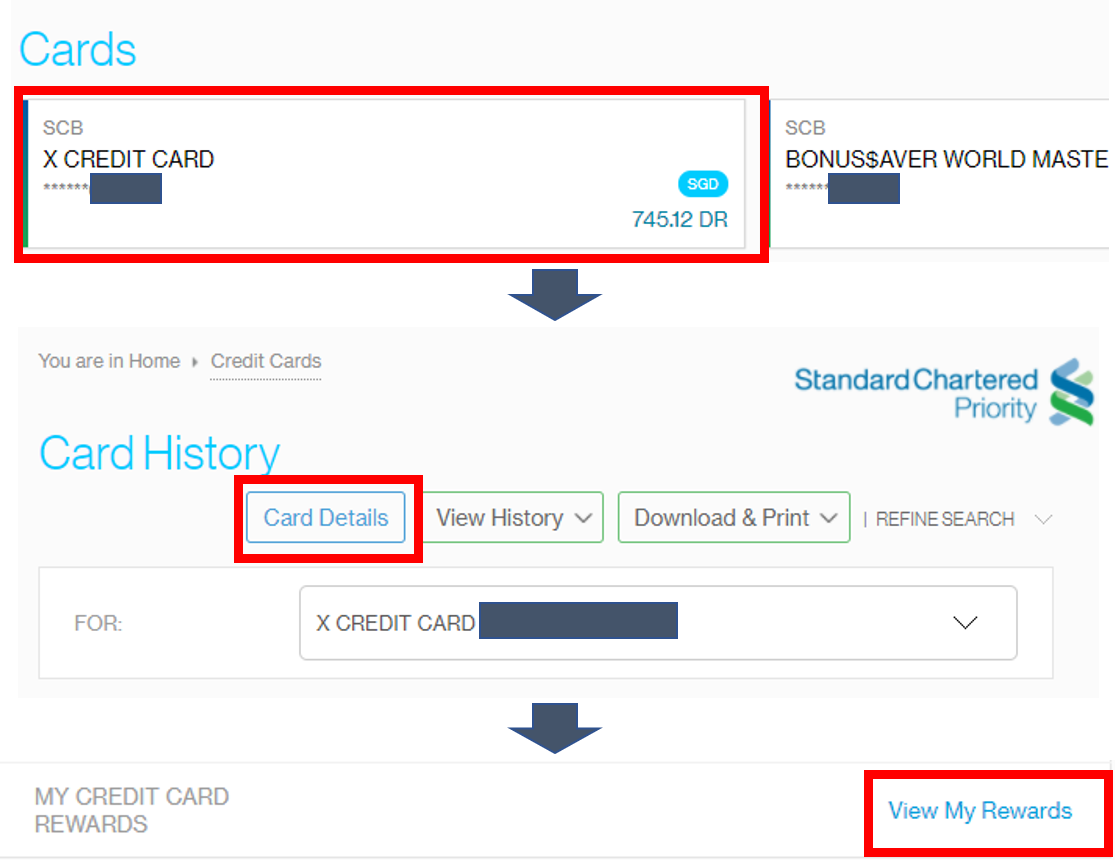

If you’re on desktop, click on your card on the home page, then “Card Details”, then “View My Rewards”

You will not be able to make KrisFlyer transfers through the new platform. Should you wish to do this, you’ll need to visit the old rewards portal instead. |

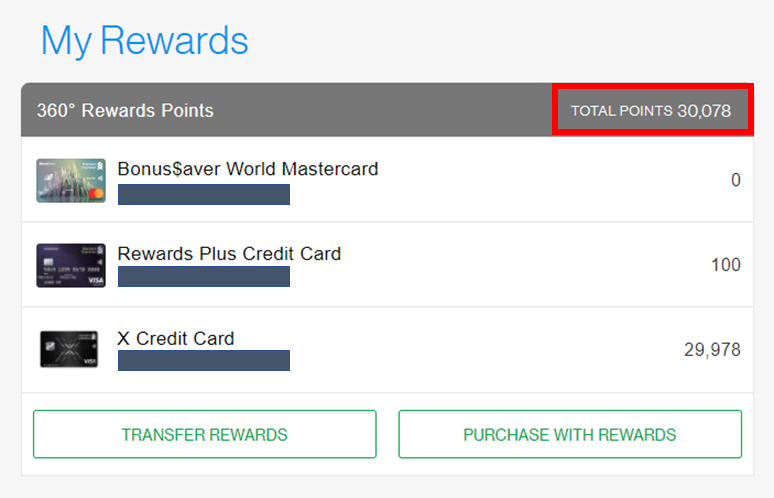

The implications are big. It means you can pool your Rewards+ points with those of the X Card/Visa Infinite, and transfer all of them at the more favorable ratio (and to the new partners). This is illustrated below- note how I have 100 points on my Rewards+ card and 29,978 on my X Card, for a grand total of 30,078 points.

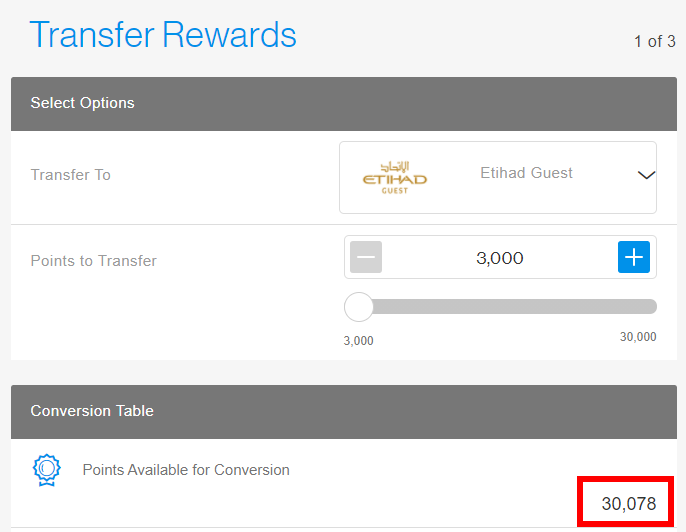

I’m able to transfer all 30,078 of these to any of the 10 transfer partners available on the new portal.

Want to transfer to KrisFlyer instead? Navigate to the old rewards portal, and you’ll see your points balances combined too. These points can be transferred to KrisFlyer at the enhanced ratio of 2,500 points: 1,000 miles, effectively boosting the Standard Chartered Rewards+ earn rate to 4 mpd on foreign currency spending and 2 mpd on local dining.

Use cases for Standard Chartered Rewards+ Card

What this means is that those with the Standard Chartered X Card or Visa Infinite should absolutely get a Rewards+ Card to boost the miles they earn on FCY transactions.

|

|

|

|

| Rewards+ | X Card | Visa Infinite | |

| Local Dining | 2.0 mpd | 1.2 mpd | 1.4 mpd* |

| FCY Spend | 4.0 mpd | 2.0 mpd | 3.0 mpd* |

| All others | 0.4 mpd | 1.2 mpd | 1.4 mpd* |

| *With min S$2K spend per statement period, otherwise 1 mpd | |||

The Rewards+ Card and X Card both impose a 3.5% FCY fee, but the Rewards+ Card earns double the miles the X Card does on FCY transactions. Even if you’re holding on to a Visa Infinite card, the Rewards+ rate is still better than the 3.0 mpd you’d otherwise get (plus, no minimum spend required).

There are certainly superior options available for dining- you could earn 4 mpd with the HSBC Revolution and UOB Lady’s Card. However, if you’re trying to accumulate miles with programs other than KrisFlyer or Asia Miles, then the Rewards+ Card is your best alternative.

Remember that the 20,000 annual bonus points cap is shared between dining and FCY spending, so you’d max it out with:

- S$2,222 of FCY spend OR

- S$5,000 of local dining spend

The Standard Chartered Rewards+ Card has no annual fee for the first 2 years, and I don’t foresee much difficulty getting it waived after that.

| Get S$30 free cash with the SCB Rewards+ Card |

|

| Apply here |

| Apply for the Standard Chartered Rewards+ Card through SingSaver and you’ll enjoy S$30 cash upon approval. |

As an added bonus, from now till 31 March 2021, all new Rewards+ cardholders will also earn 10X points (4 mpd, if you have the X Card/Visa Infinite) for online shopping and groceries, defined as follows:

| Shopping | Groceries |

|

|

The maximum bonus points can be earned across both categories is capped at 20,000, i.e S$2,222 of spending. This is in addition to the regular 20,000 bonus points for FCY spending and local dining.

The offer is only available to those who have not cancelled a Standard Chartered Rewards+ Card in the last 12 months; you do not need to be completely new to Standard Chartered credit cards. Bonus points will be credited to your account by 30 June 2021 (the T&C say 30 June 2020, but presumably that’s a typo).

The full T&C can be found here.

Conclusion

Like I said at the onset, the Rewards+ Card won’t be useful to everyone. But if you hold a Standard Chartered X Card or Visa Infinite, it really helps you round out your mileage accumulation strategy.

Standard Chartered is one of the only banks that awards points for charitable donations, and I do a few of these in FCY every month. I was previously using the X Card for 2 mpd, but I’ll now be able to double that to 4 mpd – effectively halving the cost of my miles.

When the X Card annual fee does not get waived, will you be pairing the Rewards+ card with your Priority Banking VI instead?

will cross that bridge when i come to it…but obviously won’t be paying X card AF short of them introducing something fantastic

are points transferred on a LIFO or FIFO basis? Eg. If I already have 100k points on X card and just earned 10k points on Rewards+, and just wish to transfer 50k, would the points from Rewards+ be utilised?

the points expiring first are used, i.e rewards+

if you have 2 cards which points don’t expire e.g X card, visa infinite, the system will take points from the card with the largest balance.

Wow thanks, I think you’re more knowledgeable than most CSOs

Thanks for sharing Aaron. Whilst the points will be pooled together, reward points earned from the rewards card would have the usual 3 year expiry from approval right? Not unlike X and VI where there are no expiry date.

Thats correct. Like Dbs woman and Dbs altitude, to use another example

just an update, this is no longer is the case, I have rewards points which is expiring but when redeeming KrisFlyer points using the visa infinite rate, the X card points were deducted.

Curious what FCY transaction you were paying with the X card, that couldn’t be paid with another 4mpd card, but now could be paid with the rewards+ card.

charitable donations

i think the other added advantage is the only 4 mpd card for FCY on the market is the UOB VS, which requires min $1k spend per month. this has no min spend (of course, we’re assuming it doesnt fall into specialised spending categories that could earn 4 mpd regardless of currency eg amazon USA)

May I say this is the best foreign spending card after first 2K spending (UOBVS) while we are in next ATB trip!

I’ve read the T&C a few times, and consulted their example as well, can I check if the FCY with bonus points is for any FCY transaction (other than the exclusions)? The example cited in the T&C gave the example of the transaction both being a Qualifying Dining Transactions (with the right dining MCC) as well as it being transacted in FCY. I’m unsure if I should only interpret it any FCY that also falls under the Qualifying Dining Transactions MCC. Or any FCY that does not fall under the exclusions. Searching in the T&C for “Qualifying Rewards+ Card Transactions”… Read more »