Back in January 2020, I wrote about Standard Chartered’s plan to kill off the SCB Visa Infinite from 1 February 2020. Financial comparison sites like SingSaver and MoneySmart quietly removed the card from their listings, and Standard Chartered CSOs began directing interested applicants to the SCB X Card instead. Sure enough, the application links disappeared from the Standard Chartered website soon after, and it appeared to be so long and thanks for all the fish.

But even then, the SCB Visa Infinite never truly died. Rumours persisted that the card was still offered unofficially, with a few commenters posting about their successful applications. Existing cardholders were able to retain their cards, and the very attractive tax payment facility (more on that in a bit) continued to be offered.

And now, one year on, Standard Chartered has resurrected the SCB Visa Infinite with its 35,000 miles welcome offer.

Recap: Standard Chartered Visa Infinite

Apply here Apply here |

|||

| Income Req. |

S$150,000 p.a |

Points Validity |

No expiry |

| Annual Fee |

S$588.50 | Min. Transfer |

25,000 points (10,000 miles) |

| Miles with Annual Fee |

35,000 (Y1) 20,000 (Y2 onwards) |

Transfer Partners |

•Singapore Air |

| FCY Fee | 3.5% | Transfer Fee | S$26.75 |

| Local Earn | 1.0 mpd (1.4 mpd with ≥ S$2K/month) |

Points Pool? | Yes |

| FCY Earn | 1.0 mpd (3.0 mpd with ≥ S$2K/month) |

Lounge Access? | 6x Priority Pass |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The SCB Visa Infinite was, in a word, underwhelming. Cardholders earned 1.4/3.0 mpd on local/overseas spend, but this required a minimum spend of at least S$2,000 per statement month (or else they’d earn 1.0 mpd on both).

| Spend <S$2K/month | Spend ≥ S$2K/month | |

| Local | 1.0 mpd | 1.4 mpd |

| Overseas | 1.0 mpd | 3.0 mpd |

Cardholders also received six Priority Pass lounge visits per year, but that was a pittance compared to the unlimited visits offered by competing cards like the Citi Prestige and HSBC Visa Infinite. Simply put, there was very little the SCB Visa Infinite could do that others couldn’t do better.

But it did have two bright sparks: its 35,000 miles welcome offer, and its tax payment facility.

35,000 miles welcome offer

New SCB Visa Infinite cardholders receive 35,000 welcome miles (in the form of 87,500 SCB rewards points) upon paying the first year annual fee of S$588.50. This represents an effective cost of 1.68 cents per mile, one of the lowest in the market as far as welcome miles come.

| Miles | Annual Fee | CPM | |

OCBC VOYAGE OCBC VOYAGE |

15,000 | S$488 | 3.25 |

Citi Prestige Citi Prestige |

25,000 | S$535 | 2.14 |

SCB Visa Infinite SCB Visa Infinite |

35,000* | S$588.50 | 1.68 |

HSBC Visa Infinite HSBC Visa Infinite |

35,000* | S$488 (Premier) S$650 (Others) |

1.39/ 1.86 |

| *First year only | |||

It wasn’t so great in subsequent years, however. From the second year onwards, cardholders received only 20,000 miles (50,000 SCB rewards points), while the annual fee stayed the same. You’d be paying a whopping 2.94 cents per mile- insane during pre-COVID times, much less now.

That’s why I often thought of the SCB Visa Infinite as a “one year card”. People would apply for the card to buy miles at a low cost, generate more cheap miles via the income tax payment facility (see below), cancel the card and come back later.

Income Tax Payment Facility

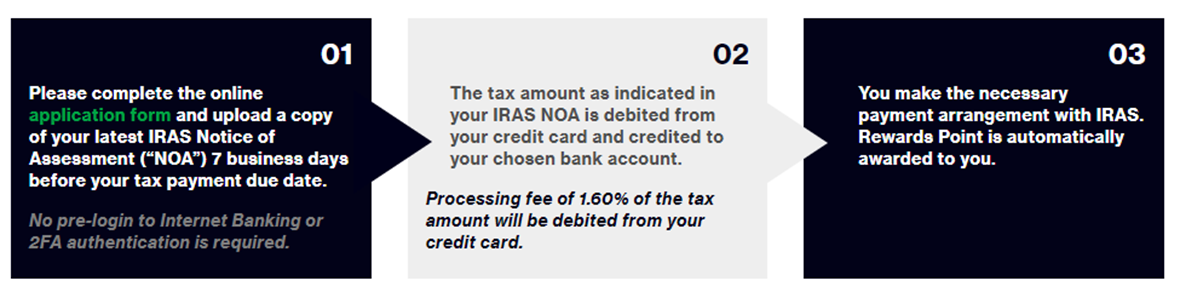

SCB Visa Infinite members can apply for a tax payment facility and pay their taxes with a 1.6% fee, earning up to 1.4 mpd in the process (assuming they spent at least S$2,000 per month; it was never clear to me whether that included the tax payment amount itself). Do the math, and it works out to 1.14 cents per mile, one of the cheapest ways of buying miles when paying taxes in Singapore.

Even better, Standard Chartered would deposit the tax due amount into your bank account, and then it was up to you to pay IRAS directly. You could still take advantage of the interest-free monthly GIRO payments, making this an all-round win.

While some customers were told the tax facility would cease from 1 March 2020, the links remain active and successful applications have been reported throughout 2020. I assume the revival also means the tax facility will continue as per normal.

What now for the SCB X Card?

Here’s where the situation starts to get fuzzy. All along, my hypothesis was that the SCB Visa Infinite, as Standard Chartered’s flagship card, put constraints on what the SCB X Card could be.

After all, the SCB Visa Infinite had been on the market for three years when the SCB X Card was launched, and there’d have been some very ticked off (and affluent) customers if the “inferior” (in terms of income requirement) SCB X Card offered better benefits. If that’s true, then the SCB X Card couldn’t have offered anything more than 1.4/3.0 mpd on local/overseas spend or six lounge visits. It basically couldn’t have anything the SCB Visa Infinite didn’t.

|

|

|

| SCB Visa Infinite | SCB X Card | |

| Income Req. | S$150,000 | S$80,000 |

| Annual Fee | S$588.50 | S$695.50 |

| Local Earn Rate | 1.4 mpd^ | 1.2mpd |

| FCY Earn Rate | 3.0 mpd^ | 2.0 mpd |

| Lounge Visits | 6 per year | 2 per year |

| Miles with annual fee | 35,000 miles* | 30,000 miles* |

| *First year only ^Min. S$2K spend per statement month, otherwise 1.0 mpd for both |

||

The canning of the SCB Visa Infinite was supposed to allow the SCB X Card to establish itself as the bank’s top tier offering, and hopefully pave the way for better benefits. But now that the Visa Infinite is back in the picture, what happens?

I’d love to know. The SCB X Card got a last minute stay of execution in July 2020, when the bank waived its second year S$695.50 annual fee. We’re six months away from the start of the third year, and barring some significant new benefits, I can’t see anyone coughing up the annual fee.

What’s the game plan here?

Conclusion

The SCB Visa Infinite is back, but questions will continue to be raised about its complicated relationship with the SCB X Card. One way or another, Standard Chartered will have to draw some distinction between the two- either by enhancing the SCB Visa Infinite’s perks, or further degrading the X Card’s (as if that were possible).

I suppose this means I’ll need to add the SCB Visa Infinite back to the 2021 version of the $120K card guide…

First black swan in 2021🤣

What happens to the points against the X Card if (when) cancelled? I have multiple cards, incl. the VI and I am confused so as to what to do in those cases. VI has the highest number of points in the pool, followed by the X thanks to 100k miles originally.

IIRC: SCB only pools points for the purposes of redemption. if you cancel one card, you will lose those points

It’s all about the tax facility. Tax bill >$75K and set up GIRO payments. Pay annual fee. Still works out well.

The moment SCB charges even $1 of annual renewal fee, everyone would call to cancel. I would. Already transferred out all the ‘X-miles’ and was only using it rarely, like paying for online donations, then then…….

Standard Chartered would deposit the tax due amount into your bank account. Can I still use Cardup to pay IRAS using another credit card to gain miles?

AFAIK yes. SCB and UOB don’t pay IRAS. You can even do all 3: SCB and UOB and CardUp/PayAll. Someone wrote an article on this I think. Anyway, for larger tax bills SCB is the best (because of AF). Miles are pretty worthless now and the future is still uncertain so I’m careful with buying too many at the moment.

Thanks for sharing. I thinking “Should I apply SCB Visa Infinite” just for tax purpose? Or CitiBank Prestige and use PayAll? Have been using CardUp to do my tax payment

No worries. I got the SCBVI for taxes too, like everyone else I know who isn’t SCB Priority Banking (the SC PB VI is useless for taxes BTW) The annual fee is unavoidable although you will get 20K miles with the fee every year. So depends on your personal valuation of a mile. For me: IRAS<$50k = no renewal; $50k<IRAS<$75k = maybe renew; IRAS>$75K – definitely renew and pay the annual fee. Anyway for the first year the answer is a definite yes since it’s a one-time 35K miles bonus. It’s easy to 5x-dip on IRAS with SCB+HSBC+UOB+OCBC+Payall/Cardup/ipaymy but only… Read more »

Thanks a lot for sharing

Did SC upgrade this VI card to a metal card? I checked the website tonight and somehow I feel the card edge is slightly different…

https://www.sc.com/sg/credit-cards/visa-infinite-card/

hold up, it does indeed look different. You might be on to something (although if they were going metal, they should really take the opportunity to give the card face a redesign too)

oh my lovely small eyes, they are so sharp, haha, looking forward to your investigation on that 🙂

Hey Aaron, have you found out anything? My tax bill is out, I am thinking if I should apply this card now…

nope…but i wouldn’t let my decision be swayed by metal or not. it’s all about the cost per mile

Cheers 🙂

Sorry to destroy your hopes but I can confirm it is 100% plastic.