Kris+ users can now convert Citi Miles and ThankYou rewards points instantly into KrisPay miles, making it the third credit card rewards programme after DBS and UOB to be added to the platform.

KrisPay miles can be transferred to KrisFlyer at a 1:1 ratio (within seven days of accrual, after which they’re stuck in Kris+ forever), so it’s basically a no-fee, instant way of transferring Citi Miles and ThankYou points to KrisFlyer.

There’s a catch, of course: just like DBS and UOB, Citibank customers will have to accept a 15% haircut in terms of value. This makes the use cases marginal at best- even with KrisFlyer’s ongoing 15% transfer bonus.

Convert Citi rewards points into KrisPay miles

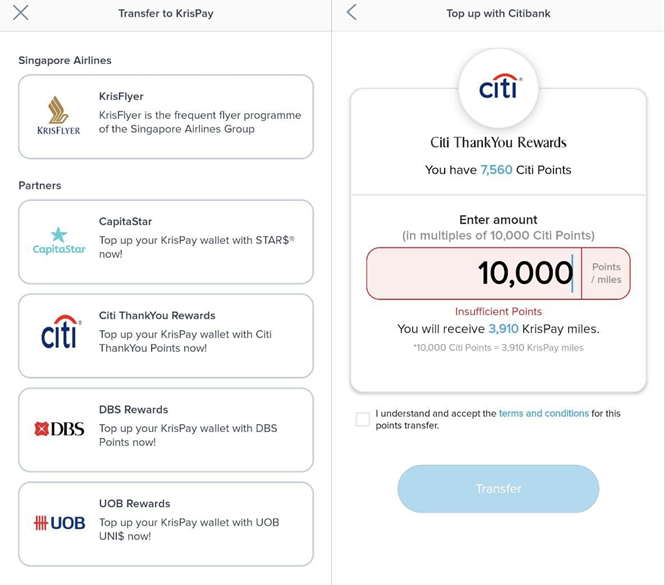

To convert Citi Miles and ThankYou points, open the Kris+ app and tap on the Wallet icon at the bottom. Tap Transfer, and you’ll see the option to link your Citi account.

Here’s the rate you’ll receive when converting Citi Miles and ThankYou points to KrisPay miles. For the sake of comparison, I’ve also included the relevant rates for DBS Points and UNI$.

| Bank | Transfer Ratio |

| 4,000 Citi Miles: 3,400 miles 10,000 TYP: 3,400 miles |

|

| 100 DBS Points: 170 miles | |

| 1,000 UNI$: 1,700 miles | |

| Note: From 26 Oct to 22 Nov 2021, a 15% bonus applies to the above rates | |

The sharp-eyed amongst you will notice that 4,000 Citi Miles or 10,000 ThankYou points are normally worth 4,000 miles, but you only get 3,400 miles through this route. That’s a haircut of 15%, and par the course for the rest of Kris+’s bank partners.

Where Citi performs more poorly, however, comes in the minimum transfer required. While DBS and UOB allow you to transfer just 170/1,700 miles, the minimum block size for Citi is 3,400 miles.

Therefore, there’s very little reason why this should be your regular method of transferring points to KrisFlyer. To illustrate, a Citi PremierMiles Card member earns 1.2 mpd on all local transactions, but if he/she opted to convert Citi Miles to Kris+, the effective earn rate would be 1.02 mpd (i.e. 85% of 1.2 mpd).

Even with KrisFlyer’s ongoing 15% transfer bonus, you’ll still be worse-off because it requires a 17.6% bonus to offset a 15% haircut (the math works out, I promise).

Why would you use this?

So given the rather dire value proposition, is there any reason why you’d opt for this? Here’s what I see as the main advantages of converting credit card points via Kris+.

Conversions are instant

While Citi is generally fast with points conversion requests (2-3 working days), transfers of Citi Miles or ThankYou points via Kris+ are instant.

Imagine a scenario where you want to lock in an award booking right away, but don’t have sufficient miles. Depending on how many miles you’re short of, the ability to instantaneously transfer Citi Miles or ThankYou points may be worth a 15% penalty. It’d certainly be better than buying miles from Singapore Airlines at a rate of US$40/1,000 miles, anyway.

Conversion blocks are smaller

While Citi’s conversion blocks to Kris+ are larger than DBS and UOB, it’s still smaller than what you’d have to deal with on the Citi rewards portal. The minimum conversion block on the rewards portal is normally 10,000 Citi Miles or 25,000 ThankYou points, versus 4,000 Citi Miles or 10,000 ThankYou points via Kris+.

This means it’s useful for cashing out orphan points, in a scenario where you’re intending to close your Citi credit card. Alternatively, it’s good for small top-ups, where you don’t to transfer a full 10,000 miles.

No transfer fee

Transferring Citi Miles/ThankYou points via Kris+ is clearly not a good idea for large amounts, because the 15% haircut becomes more significant (in absolute terms) the more you transfer.

However, if you’re only intending to transfer a small amount, a 15% haircut may be superior to paying Citibank’s S$26.75 transfer fee. Assuming a 1.8 cents per mile valuation, the maximum number of miles you should be willing to forego is ~1,486 (S$26.75 divided by 0.018).

Transfer out within 7 days!

If you nonetheless decide to convert Citi rewards points (or DBS/UOB for that matter) to Kris+, it’s crucial that you remember to transfer any miles to KrisFlyer within seven days. Fail to do so, and they will be stuck in KrisPay with a mere 6-month validity (and worth just 0.67 cents each).

Seriously, don’t forget to do this.

Conclusion

Citi cardholders can now transfer rewards points to Kris+ instantly and without any fees, although the 15% haircut is the main stumbling block.

Unless you’re pressed for time, need to transfer just a small number of miles or have an orphan points balance to cash out, this shouldn’t be the go-to option. And it goes without saying that you shouldn’t be transferring Citi points to Kris+ for spending, since you get an abysmal 0.67 cents per mile when doing so.

I have a feeling that your insistence that people transfer their Kris+ miles immediately stems from a bad experience…

I have transferred krisflyer miles into Kris+ during top up lucky spins. I can get average ~1.05 cents value in Kris+ per mile. After that just wait for Kris+ redemption cashback promo (~30%) to get NTUC voucher. Ended up managed to get ~1.5cents per mile which I feel still reasonable, especially with citi payall to buy mile for less than 1 cent. 🙂

Anyone knows the customer service contact for issues with Kris+ account?

I ended up writing to SIA using their Help Form, do let me know if there is a more direct way to reach out to the relevant people.

Thanks.