If you collect miles and points, you’ll know that they can be as valuable as cash.

Even if you’re not paying for them directly (e.g. buying miles and points from the loyalty programmes, or through services like CardUp and Citi PayAll), there’s still an implicit cost involved, in the sense that you could have swiped a cashback card instead.

The problem is, travel insurers rarely see things the same way. In fact, the vast majority of policies explicitly exclude frequent flyer miles and points.

|

We will not pay for the following: |

Therefore, if a medical or family emergency prevents you from taking your trip, you won’t get reimbursed for award flights or hotel stays- unless you have a policy which provides such coverage.

Aren’t miles and points bookings refundable?

Wait a minute, you say. Aren’t miles and points bookings usually refundable? And if travel insurance only covers non-recoverable costs, why would you need it to cover miles and points in the first place?

It’s true that miles and points bookings are generally refundable, but there are exceptions. It depends on the loyalty programme, as well as when the cancellation is made.

Singapore Airlines KrisFlyer

KrisFlyer’s policies are actually quite lenient. You can cancel your flight anytime up till the scheduled departure time and pay a US$75 (Saver) or US$50 (Advantage) fee per passenger to get your miles and taxes refunded.

Even if you fail to show up for your flight altogether, you can still get a refund of your miles, subject to paying a no-show fee on top of the refund fee.

| Cabin | No-show fee |

| Economy Class | US$100 |

| Premium Economy Class | US$200 |

| Business Class | US$300 |

| First Class | US$300 |

For example, if you book a Business Class Saver award and miss your flight, you’ll need to pay US$375 (US$300 no-show fee + US$75 refund fee) to recover your miles.

However, Promo awards – such as those offered during Spontaneous Escapes, or the KrisFlyer Global Redemption Sale – are strictly non-changeable and non-refundable. If you can’t fly, you forfeit your miles. While Singapore Airlines may make exceptions in extenuating circumstances, these are not guaranteed.

| ⚠️ Exception: Flights to/from the USA |

| Flights to/from the USA can be cancelled within 24 hours of booking without penalty, per the US Department of Transportation policy. This applies to award tickets as well, even Spontaneous Escapes (though you might still need to push for it). |

Other mileage programmes

Most mileage programmes allow you to cancel award tickets and get a full refund of your miles, provided the cancellation is made before departure time. However, certain airlines, like British Airways and Etihad, have stricter policies.

Here’s a summary of the more popular programmes in Singapore:

| Programme | Cxl Fee | Cxl Window |

| Alaska Mileage Plan | None* | Before scheduled departure time |

| Asia Miles | US$120 | Any time within ticket validity |

| British Airways Club | Taxes and fees or £35, whichever is lower | >24 hours before departure |

| Emirates Skywards | Up to US$75 | Before scheduled departure time |

| Etihad Guest | 25-75% of miles | >24 hours before departure |

| EVA Air Infinity MileageLands | None^ | Before scheduled departure time |

| Flying Blue | €70 | Before check-in deadline for flight |

| Qatar Privilege Club | US$25-100 | >3 hours before departure |

| *Alaska Mileage Plan charges a US$12.50 partner award booking fee per direction of travel which is non-refundable if cancelled ^If cancelled online, otherwise US$50 fee applies |

||

If you booked an award ticket with British Airways Club, and a bad case of food poisoning hits on the morning of your flight, you would already be inside the no-refund window. Travel insurance would therefore be necessary to cover the cost of the ticket.

Hotels

With hotel loyalty programmes, the cancellation window will vary depending on property. In some cases, it may be 24 hours before arrival, in the case of popular resorts like the Maldives, it may be as much as three months or more.

Cancelling outside this window results in a penalty that is usually charged in cash, not points. With Hilton Honors, Marriott Bonvoy and World of Hyatt, you’ll receive a full refund of your points, but you will need to pay at least the first night’s cash rate, if not more.

Which travel insurance policies cover miles and points?

The way I see it, there are two main scenarios where your airline or hotel award booking may fall outside the cancellation window.

- Trip Cancellation: When a covered event causes you to have to cancel your trip before it begins (e.g. falling sick the day of departure)

- Trip Curtailment: When a covered event causes you to have to abandon your original trip and return home (e.g. death of a family member mid-way through your trip)

Before we talk about specific policies, here’s a few general points to note.

First, compensation can only be claimed if your miles/points are not recoverable. If it’s possible to pay a cancellation fee and get your miles/points back (e.g. Saver or Advantage awards on KrisFlyer), you cannot make a claim for the miles/points under your travel insurance policy (though you might be able to claim the cancellation fee).

Second, your trip must have been cancelled/disrupted for a covered reason. Changing your mind is not valid grounds for a claim, unless you purchase a policy with a “cancel for any reason” clause- which even then usually pays you only 50% of the expenses incurred, with a cap and a maximum of one claim per period of insurance.

Third, the general approach that insurers take when valuing miles and points is to look at the retail value of the flight ticket or hotel booking. That actually works out in your favour- I’d rather be reimbursed for the cash value of a Business Class ticket than at 1-2 cents per mile!

| ⚠️ Important Note |

|

Despite what the policy wording may say, the MileChat contains a data point from a Singlife customer who was reimbursed for his KrisFlyer miles at 1.5 cents per mile. What’s funnier is how this value was derived. Based on the email, all Singlife did was Google “”what is the value of a KrisFlyer mile”, found NerdWallet’s website (I know because they included a screenshot of it) and took the value there- not realising that NerdWallet, as a US-based site, was quoting in USD! I would certainly push back on that, if I were the customer. |

Fourth, even though cancellation policies are stated in black and white on most airline/hotel websites, most insurers will still require you to contact the loyalty programme and get written confirmation that your miles/points cannot be refunded. I imagine they do this to minimise their own liability, in the off chance that the loyalty programme decides to grant a one-off exception due to extenuating circumstances.

Miles and points coverage is not a common feature among travel insurance policies in Singapore, but I’ve managed to find several which do.

AMEX My Travel Insurance

|

|

| Apply | |

| Policy Name | My Travel Insurance |

| Loss of Frequent Flyer Miles or Points |

|

| Policy Wording | Link |

AMEX My Travel Insurance, underwritten by Chubb, provides up to S$20,000 of coverage for the loss of loyalty points and miles in the event of trip cancellation.

Section 23 If, during the Period of Insurance, the Insured Person purchase an airline ticket (or other travel and/or accommodation expense) using frequent flyer points or similar reward points and the airline ticket (or other travel and/or accommodation expense) is subsequently cancelled as a result of any Specified Cause (as defined in Section 15) and the loss of such points cannot be recovered from any other source, the Company will indemnify the Insured Person the retail price for that ticket (or other travel and/ or accommodation expense) at the time it was issued up to the Benefit amount specified in the Certificate of Insurance subject to the terms and conditions of this Policy, provided always that this coverage is effective only if this Policy is purchased before the Insured Person becomes aware of any circumstances which could lead to the disruption of his Journey.

Relevant section

There’s currently an ongoing promotion that offers additional gifts like eCapitaVouchers (eCV) or Samsonite luggage for those who purchase at least a Standard plan.

| Single Trip | Annual Multi-Trip | |

| Essential | – | – |

| Standard | S$20 eCV^ | S$80 eCV |

| Superior (APAC)# |

S$40 eCV^ | S$150 eCV |

| Superior (Worldwide)* |

S$40 eCV^ | S$50 eCV + Samsonite Cubuz Spinner 28″ |

| ^ Except for journeys which only include Malaysia # APAC includes Australia, New Zealand, China, Taiwan, Hong Kong SAR, Macao SAR, Mongolia, Japan, South Korea, India, Sri Lanka, and Southeast Asia. * Includes both Worldwide (ex USA, Canada and Cuba) and Worldwide (ex Cuba) |

||

In addition to this, American Express cardholders who purchase their plans via my referral link will receive an extra S$5-20 statement credits (if the link has expired, drop me a note in the comments and I’ll update it).

For avoidance of doubt, you’ll receive one welcome gift and one referral gift per policy purchased, so for example, someone who buys 2x single-trip Superior plans will get 2x S$40 eCapitaVoucher + 2x S$5 statement credits.

DBS TravellerShield Plus

|

|

| Apply | |

| Policy Name | TravellerShield Plus |

| Loss of Frequent Flyer Miles or Points |

|

| Policy Wording | Link |

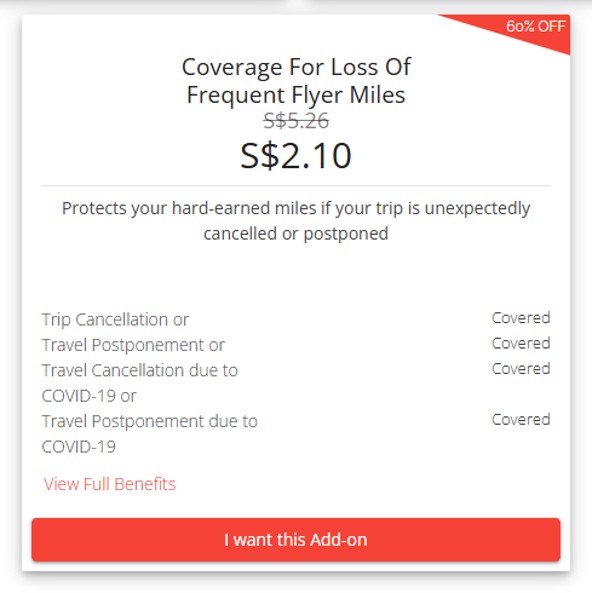

DBS TravellerShield Plus provides up to S$7,500 of coverage for the loss of frequent flyer miles and hotel loyalty points in the event of trip cancellation.

Do note that the cap here is per individual; if you purchase the family plan, the aggregate coverage goes up to S$22,500.

Section 21 If, during the Period of Insurance, You purchased an airline ticket or other travel and/or accommodation expenses using frequent flyer miles and/or similar reward points and the airline ticket (and/or other travel and/or accommodation expenses) are subsequently cancelled as a result of any Specified Cause (as defined in Section 19) and the loss of such points cannot be recovered from any other sources, We will indemnify You the retail price for that ticket (and/or other travel and/or accommodation expense) at the time it was issued up to the Benefit amount specified in the Certificate of Insurance subject to the terms and conditions of this Policy, provided only if this Policy is purchased before You become aware of any circumstances which could lead to the disruption of Your Journey. Where a claim under Section 19 – Journey Cancellation, Section 20 – Loss of Advance Payment due to Insolvency or Bankruptcy of Travel Agency, Section 21 – Loss of Frequent Flyer Miles and/or Hotel Loyalty Points and Section 22 – Journey Postponement results from the same occurrence, this Policy will pay for the claim under one (1) Section only.Relevant section

DirectAsia TripSaviour

|

|

| Apply | |

| Policy Name | TripSaviour |

| Loss of Frequent Flyer Miles or Points |

|

| Policy Wording | Link |

Citibank sells a policy underwritten by DirectAsia called TripSaviour, which provides coverage for frequent flyer miles or hotel points of up to S$25,000 for the annual Platinum plan. The coverage can be as much as S$62,500 on a family basis, making this one of the highest coverage plans.

Section 7.1 If the airline ticket, entertainment ticket or accommodation was booked using frequent flyer points (membership programme by any commercial airline) or similar reward points we will pay you the retail price for that ticket or accommodation at the time it was issued, providing the loss of such points cannot be recovered from any source.

Relevant section

The Platinum tier also has a “cancel for any reason” clause that allows you to recoup 50% of the non-recoverable expenses, capped at S$5,000 (individual) or S$12,500 (family). This is claimable once per period of insurance.

In other words, if you’ve booked a trip with miles and points but decide not to travel, and the reason is not a covered reason, you can invoke this clause and get reimbursed for 50% of the cost of any non-recoverable miles and points.

Great Eastern TravelCare

|

|

| Apply | |

| Policy Name | GREAT TravelCare |

| Loss of Frequent Flyer Miles or Points |

|

| Policy Wording | Link |

Great Eastern TravelCare offers up to S$15,000 of coverage for loss of frequent flyer points, though it does have some interesting restrictions.

First, you are explicitly capped at Economy Class flights– the first time I’ve seen a policy stipulating cabin limits for coverage. There’s no cap for hotel redemptions though, so… St. Regis Maldives, anyone?

Second, there is no coverage for points redeemed within three days before the event that led to the trip cancelled or postponed. I suspect this is an anti-gaming provision to prevent a situation where someone falls sick and says “well, might as well use this opportunity to cash out my points!”

Section 27 If you have to cancel or postpone your trip as a result of a claim covered under section 16 or 17, we will reimburse up to the maximum limit that applies to this section for your selected plan (as shown in the summary of benefits) for the non-recoverable travel expenses (economy class), accommodation costs and entertainment tickets that you paid for in advance using frequent flyer points. We will reimburse you for the loss of the frequent flyer points used. The amount we reimburse will be based on the retail price for the non-recoverable travel expenses (economy class), accommodation costs or entertainment tickets at the time they were paid for with the frequent flyer points. For example, if the flight ticket costs $300 and you paid $200 using frequent flyer points, we will reimburse you the $200 under this section. What is not covered 2. Any costs which can be recovered from any other sources. 3. Any flight tickets for travelling in a higher class than economy class. 4. For flights (economy class), accommodation or entertainment tickets, any additional costs that are higher than the retail price of the original flight, booking or ticket. 5. Any complimentary service, or any free access, meal or upgrade provided by a reward scheme

Relevant section

This section does not cover loss or damage caused by the following.

1. The value of frequent flyer points used within the three days before the event that led to the trip being cancelled or postponed.

HLAS Travel Protect360

|

|

| Apply | |

| Policy Name | Travel Protect360 |

| Loss of Frequent Flyer Miles or Points |

|

| Policy Wording | Link |

HLAS Travel Protect360 offers an optional add-on to cover up to S$15,000 for the loss of frequent flyer miles. To be clear, this is not included by default; you must select it when purchasing your policy.

My concern here is that the wording only seems to cover frequent flyer miles and not hotel points, because it explicitly talks about non-refundable costs of air tickets. If in doubt, contact their customer service before making a purchase.

Section 45 In the event Your Trip is cancelled or postponed due to the events covered under: We will reimburse You for the unused, pre-paid, and non-refundable costs of the air ticket You purchased using Your frequent flyer miles, up to the Benefit Limit of the applicable section provided that You are unable to recover Your lost frequent flyer miles from any other source.

Relevant section

Section 19 – Travel Cancellation or

Section 22 – Travel Postponement or

Section 40 – Travel Cancellation due to COVID-19 or

Section 41 – Travel Postponement due to COVID-19

You must submit proof of Your frequent flyer miles redemption for Your scheduled Flight at the time of claim. We will convert the frequent flyer miles into Singapore dollars at a rate to be determined by Us.

Klook Protect

|

|

| Apply | |

| Policy Name | Klook Protect |

| Loss of Frequent Flyer Miles or Points |

|

| Policy Wording | Link |

Klook Protect, underwritten by Zurich Insurance, provides up to S$7,500 of coverage for travel cancellation, which includes the loss of any rewards points.

9. We will reimburse You or the Insured Person to cancel the Journey up to the Benefit amount specified in the Policy for administrative fees incurred when: 1. Full payment was made by the Insured Person (includes redemption from any personal loyalty or rewards programmes) and is not recoverable from any other sources.

Relevant section

2. Fees are those for which the Insured Person is legally liable.

3. Fees are not recoverable from any other source

Singlife Travel Insurance

|

|

| Apply | |

| Policy Name | Travel Insurance |

| Loss of Frequent Flyer Miles or Points |

|

| Policy Wording | Link |

Singlife offers up to S$20,000 of coverage for trip cancellation, and S$15,000 for trip interruption, which also includes the loss of frequent flyer points.

a) Loss of Frequent Flyer Points, Hotel Points and Credit Card Points

Relevant section

Also note that the Plus and Prestige tiers have a “cancel for any reason” clause that allow you to recoup 50% of the non-recoverable expenses, capped at S$5,000 (Plus) or S$7,500 (Prestige). This is claimable once per period of insurance. In other words, if you’ve booked a trip with miles and points but decide not to travel, and the reason is not a covered reason, you can invoke this clause and get reimbursed for any non-recoverable miles and points.

Other policies

There are a few other policies on the market which cover the loss of miles and points, but their coverage amounts are so insubstantial that I don’t think they would make good choices.

| Provider | Miles & Points Coverage |

| AIG TravelGuard Direct | S$0 to S$750 |

| Etiqa Travel Infinite | S$100 to S$750 |

| Tokio Marine TM Xplora | S$100 to S$300 |

Conclusion

If you plan to pay for your holiday with miles and points, you should absolutely get a travel insurance policy which covers them, just in case.

I’m quite curious to know how travel insurers actually value miles and points, so if you have any experiences with claims, do share them.

Any other travel insurance policies with miles and points coverage?

That’s very informative.. I would have missed that coverage out if I did not see your article. Thanks

I second @Leo… Another fantastic topic to cover, Aaron! ??

It certainly made me dig up my AIG Policy wordings right away as I didn’t think of it either… Chubb’s (your example) wording are more favorable for the policy holder, but AIG’s does cover too (a good thing!)… but with AIG, I find the wording a bit not-so-clear… I’ll email a screenshot to you… can you be a champ and see if you can figure out what it mean, in the few scenarios you came up with?

Thanks in advance!

when i researched this post AIG, Aviva and Chubb were the only 3 policies that covered miles and points. let me know if you see anything else.

I hold Sompo travel insurance and all its plan categories cover miles and points. The exact wording is as below: Frequent Flyer Points: We will pay for loss of frequent flyer or similar travel points used by the Insured Person as a registered member to purchase an airline ticket following the Trip Cancellation or Postponement if the Insured Person is unable to recover the lost points from any other source. The payment for lost points will be calculated based on the following, whichever is the lower: 1. Cost of an equivalent class airline tickets based on the quoted retail price… Read more »

Thanks for that, my insurance broker specifically recommended Sompo as well

I used to get Chubb for its higher coverage, then switched over to Sompo as it was generally cheaper with the promotions. However, I just did a comparison between Sompo and Chubb for an upcoming trip to Japan and found Chubb is slightly cheaper. Probably wise to check the price difference before buying – just my 1 cent worth of opinion 🙂

Annoyingly, Sompo doesn’t offer annual travel insurance when I was shopping around for one

So it seems lately that Chubb no longer covers miles and points. Not sure if you would be making an update to this blog post, but if you do, then it might be worth noting

Thanks for the heads up, Eugene!

I bought my Chubb insurance on 15 Feb and the wording policy still covers Loss of Frequent Flyer points. Is this a recent change?

@M.. Mine, from last Apr, is still ‘in force’ .. but had renewed ‘in advance’ for the laggauge giveaway.. but will not not go ahead with it..

From a quick check, Just Sompo and Aviva still cover award redemptions, with wording and benefits slightly different.. I’ll look into both and then decide..

I looked at AIG and they (as of today’s wordings) still exclude miles..

Quite sad.. but oh well…

quick question: where are you seeing this? i’m seeing them as still covered on the site

https://www.chubbtravelinsurance.com.sg/aceStatic/Doc/SG/Cti/PolicyWording.pdf

https://amex.chubbtravelinsurance.com.sg/aceStatic/ACETravel/AMEXSGR/files/PolicyWording.pdf

https://www.chubbtravelinsurance.com.sg/aceStatic/Doc/SG/Cti/PolicyWording.pdf

Hey Aaron..

First link.. the greenish document..

Page 23 of 40.. What’s not covered.. Point #4..

ah, i see. it’s under lifestyle cover. but in any case i was talking about amex chubb travel insurance, not chubb per se. amex chubb still covers right?

Hmmm….. now THAT’S interesting… and gosh, I don’t know… odd tho, no..? that Chubb would word the two differently? Now I’m confused.. 😰

Was out and about earlier… Now that I’ve looked at both a bit more, it certainly looks like Chubb has two different products instead of what I though was ‘one-product-replacing-another’… It certainly looks like the Travel Insurance product that is marketed by Amex is as per what you were referring to in this post, and the one I’ve got.. 😊

So Aaron and team – you are getting closer on the travel insurance topic but I have yet to see you doing a comprehensive comparison of travel insurance that are either part of the credit card or independent 3 party options and it is thoroughly needed for us here in SG

Gosh you’re an idiot.. do you seriously believe you walk on water and the world owes you something?

Whau – did not think people would write like that on this forum.

“A little jab” is something between you and a friend.. maybe even you amongst other friends… I assume you have these… but not on a public forum where people are (mostly) sincerely trying to help… for the greater good… your “little jab” was like crispy chicken rendang.. and not just by me.. or are you also so thick you don’t see it… own it.. for being an idiot.. then move on..

Sune, your sense of entitlement is overwhelmingly astonishing. 🙂

Thank you, Aaron and team. You guys are doing an excellent job!

Sune, perhaps you can do up the comprehensive comparison that is thoroughly needed and then Aaron and team can comment on your work. Afterall, didn’t he start the community pages for people that have valuable insights to share but don’t have the ability to commit to be a regular writer?

actually, I did do something on this once upon a time but it’s quite outdated. https://milelion.com/2016/01/10/credit-card-travel-insurance-compared/ the problem with articles like this is that there are many different facets to compare and very subtle differences. eg one provider may cover $1,000 per 6 hours for a delayed flight, but define delay as >6 hours. another may cover $500 per 4 hours, but define delay as >4 hours. there’s no real standardized metric for some of these which makes a nice snappy comparison table difficult to put together. others may have different definitions of key terms. how do you factor that… Read more »

Hi Aaron Thank you for reposting this one. Seems my little jab above got a lot of people rubbed the wrong way though which was unintended as you and the team always keep a joking tone and I had jabbed you a while back on same topic incl for suggested item for the big event you had recently. But water under the bridge and so on. This link is good in shedding light on the conondrum that getting right insurance and right coverage is not easy and that programs offered by credit cards are eye wash at best and guess… Read more »

Hi, if i don’t have any of the above AMEX cards, then which card should I use for the purchase. If I recall correctly, a number of banks have explicit excluded insurance as an eligible transaction. I have DBSWWC (max out), UOB PPV, CITI Rewards, CITI Premiermiles etc. Please advise.

Ok, i got the answer to my own question, so i thought i will share. Can’t charge insurance to DBS/UOB cards – won’t get a single mile. Only way is to charge to Citibank where you will get 1.2miles/dollar or HSBC revolution card at 2 miles/dollar. Please correct me if I am wrong. I learn it the hard way. sigh!!

Hey Aaron thanks for doing this — I hadn’t realised that most policies don’t cover the loss of miles! On a related topic, if you have the time and inclination to do so, could you also research and write an article on coverage for missing connections on separate tickets? So far I’ve found only World Nomads would cover missed flights under separate PNRs, but there’s a hefty US$100 deductible.

Nice topic to post about. As with most policies in Singapore, does the insurance issued only cover bookings originating in Singapore? Will the insurance apply if I book a one-way return award and I encounter any of the covered conditions?

I have checked and confirmed with my agent that with AIG, the maximum they would compensate, if miles-redemption tickets, would be $500.. ?

So guess who’s going to drop AIG and will sign up Chubb??

Thanks, Aaron!! ??

When there’s a delay and the airline gives us a voucher for accommodation, can one still claim for the delay? Another point is that when they divert because of weather and one misses the connecting flight, they don’t give out written statements – so how does one prove the delay/missed connection? I was caught at Atlanta once and all the flights to SFO had left. We were all told to use the banks of phones they had set up and the staff on hand were surly and not helpful – as far as the airline was concerned it was a… Read more »

Technically speaking, your insurance policy is suppose to cover you “in event..” and regardless of what said airline does/acts to compensate/mitigate the event… so you should be able to successfully claim, should you be able to prove “the event”… The one that I still don’t get.. given the number of nasty incidents in the past… is that airlines do not prepare better for “when the s**t hits the fan”.. I would imagine that this would not be too difficult to do/train/role-play..? I mean, it’s happened countless number of times, right? Videos are all over social media all over the world,… Read more »

I can’t thank Aaron enough for the write up… Fortunately, I didn’t wind up holding on the the short end of a stick, but that’s what Insurance policies are for, right? and “the bad” could very well have happened and it could happen in the future… well… thanks for Aaron, it won’t be happening to me! ? Just to show that it could well have happened just last month, I made a trip to NZ on redemption SQ F with my elderly mum… and being elderly, of course, at any time, her health could’ve taken a turn for the less-than-good… Read more »

[…] A reminder that tickets issued under the Spontaneous Escapes promotion are non-changeable and cannot be cancelled as well. This is unlike regular award tickets which at least allow you to refund your booking for a fee. Thus, your travel plans have to be very firm before taking advantage of this promotion (or you should buy a travel insurance policy that covers miles and points bookings). […]

[…] A reminder that tickets issued under the Spontaneous Escapes promotion are non-changeable and cannot be canceled as well. This is unlike regular award tickets which at least allow you to refund your booking and miles for a fee. Thus, your travel plans have to be very firm before taking advantage of this promotion (or you should buy a travel insurance policy that covers miles and points bookings). […]

[…] A reminder that tickets issued under the Spontaneous Escapes promotion are non-changeable and cannot be canceled as well. This is unlike regular award tickets which at least allow you to refund your booking and miles for a fee. Thus, your travel plans have to be very firm before taking advantage of this promotion (or you should buy a travel insurance policy that covers miles and points bookings). […]

Will you be reviewing the current complimentary travel insurance by AMEX Platinum card in current times?

Does Amex Platinum card insurance cover this?

What card to use for travel insurance?

Sompo was reviewed in the 2018 review but omitted in this review. Have they stopped providing cover for air miles?

https://milelion.com/2018/10/12/3-travel-insurance-options-that-cover-airline-miles-and-points/

Looks like it’s no longer covered. https://www.sompo.com.sg/docs/default-source/products-downloads/products/travelcovid19/travelcovid19.pdf

Chubb no longer covers $20k max for miles and points.. I think now just $500 max.. cheeky buggers!

Amex Chubb is still covering for upto $20k for miles and points – clearly stated in the policy document.

My first priority with Travel Insurance is how difficult it is get the payout, whether they make you go through the loop or actually will pay. Also the terms and conditions. Some insurance give out a lot of rewards but the T&C screw you. So make sure you read the fine print.

Chubb is one of those companies that make life very very difficult. They are famous of making headlines refusing to pay.

Avoid this company.

Aaron, just one thing to note on the DBS policy is that they only cover reimbursement for cancellation or the loss of points. So if you book a holiday with hotels and other paid tickets, the policy forces you to claim from one section only so you will be at a loss.

Hi Aaron, it seems that the (citi)DirectAsia policy does not cover miles, per section 7 of their terms. https://www.directasia.com/sites/default/files/2023-08/DirectAsiaTravelPolicyWordingforCitibankDetails_v4_1Sept2022.pdf

Also, your referral link for amex has expired

weird. read 7.1, it says quite unambiguously that they will compensate the loss of frequent flyer points. maybe a bad copy paste job?

amex link:https://www.americanexpress.com/en-sg/insurance/referral/invitation/8a822db2-465c-40f7-b1e9-eaee8afb434b/

thanks!

Thanks Aaron, btw your AMEX link has expired.

thanks! you can use this: https://www.americanexpress.com/en-sg/insurance/referral/invitation/3c69ae42-dc5d-4091-8038-485cfc0746f0/

Hi Aaron, thanks for the comprehensive research. I would like to check if the travel insurance dates need to cover the date of redemption of the flights or only the actual flight dates itself.

If only the latter then a following question would be say you already know beforehand that you would want to forfeit the trip and you are able to get coverage under the direct Asia platinum tier then must you wait to only your travel dates when the insurance policy is in effect to cancel the trip.

Hi Aaron, please refresh the referral link for AMEX.

One thing that many may not realize is that some insurers are more “niao “ than others when it comes to claims. Due to different travel patterns, my wife and I took up travel insurance separately with 2 different insurers. Recently me and my wife encountered a flight delay due to bad weather. The official time of touch down was 5hrs 46mins late but due to the late arrival of the plane it took another 15 mins taxiing to the gate and the luggages were also slow in coming on to the carousel. So we filed travel delay claim to… Read more »

Singlife “Cancel for any reason” clause is extremely hard to achieve for mile bookings made 355days before. You need to purchase the policy at least 7days after making the initial flight redemption. That means if you are buying a single trip policy, must buy min 348days before your trip. If you are on an annual plan, it is even worst. You need to have a plan purchased both within 7days of initial booking + of course plan is valid during the trip. Thus for example if your annual plan renews 1sept, and it is now 17sept2025 and you redeem a… Read more »

Just to add a recent travel insurance experience that may be a bit relevant. I have previously used AIG for my yearly multi trip travel insurance and they have been quite reasonable – both in price and processing of a claim. A claim during covid and then in June this year – I fell ill traveling back to Singapore and had to go into hospital that day. Claim was processed and I received the full amount that I was entitled to. In March I had received marketing from HSBC about a travel insurance they were marketing with MSIG. Price was… Read more »

Thanks for sharing Sam. Good to learn from your experience. Cheers!

Hi Aaron, please kindly refresh the referral link for AMEX.

hi, try this: https://www.americanexpress.com/en-sg/insurance/referral/invitation/1c5df60d-916d-41fc-a3c5-7145e8540f3e/

Hi Aaron, I click on the link to purchase 2x APAC standard multi trip plan and it states that there is a 1x $80 eCV gift. I wonder is this correct since your example stated “you’ll receive one welcome gift and one referral gift per policy purchased”

buy your plans one at a time.

Hi, I have redeemed flights via the KrisFlyer Global Redemption Sale, about 9 months in advance of departure. Some of the miles I used are expiring within a year, and I can’t purchase travel insurance yet as the travel period is still too far ahead. In the event of a claim (e.g. trip cancellation or disruption), would travel insurance still cover these miles?

Would appreciate any advice or if anyone has had similar experiences. Thank you!

Would appreciate any advice or if anyone has had similar experiences for travel insurance on expiring miles. Thank you!

i was reading through the policy for Great Eastern and under section 16, 17 and 18 listed this:

We will not pay you for:

• any travel expenses or accommodation costs you have paid for using mileage points, holiday points or

any reward schemes; or

Lol GE TravelCare’s policy wording has been refreshed to $500/$1000 only

Hi Aaron, the Amex referral link is no longer working for me – mind reposting?

try this: https://www.americanexpress.com/en-sg/insurance/referral/invitation/842a3c39-741f-4381-8856-db554b177a45/

thanks!

Hi Aaron, link is expired. New link please?

try this please: https://www.americanexpress.com/en-sg/insurance/referral/invitation/9f789cde-214a-4b7b-9ce6-94c714df115c/

thank you!

edit: do note that the promotion mentioned in this article has expired, and the joining gift is now awarded in the form of statement credits (15% rebate)

thank you!