It’s not often we see banks giving away free money, but Standard Chartered is doing just that for new-to-bank customers who sign up for a SCB Smart Card by 31 July 2022.

Standard Chartered sign-up offer

|

| Apply Here |

From now till 31 July 2022, new-to-bank customers will receive S$300 cashback and a three-month Disney+ subscription when they activate their SCB Smart Card within 30 days of approval.

| ❓ New-to-bank |

| New-to-bank customers are defined as those who do not currently hold a Standard Chartered principal credit card, and have not cancelled one in the past 12 months. |

No minimum spend is required, but I should call your attention to a few sections of the T&Cs that might affect you if you’ve previously held a Standard Chartered card at any point.

5a. Subject to these terms, if you satisfy all the eligibility criteria set out in Clause 2(c) through 2(f) and Clause 4(a) above, you will be eligible to receive S$300 cashback (“New CC Cashback”), subject to the Previous Cashback Cap (as defined below in Clause 8(c) below) if you have previously cancelled credit cards more than 12 months ago. … 8a. The Current Cashback Cap and Previous Cashback Cap (each as defined in Clauses 8(b) and 8(c) below): (i) includes any cashback; but 8b. The maximum aggregated amount of cashback that you may receive for this Promotion and all your subsequent credit card application(s) (where relevant) combined is capped at S$300 (“Current Cashback Cap”) for Smart Credit Card and S$100 (“Current Cashback Cap”) for all other Eligible Card. 8c. If you have previously applied for credit card(s) with the Bank, the relevant cashback cap applicable for purposes of determining the cashback you will get under this Promotion is the cashback cap in place when your very first application for credit card(s) with the Bank was approved (“Previous Cashback Cap”). For the avoidance of doubt, this Previous Cashback Cap may be lesser or greater than the Current Cashback Cap. i. If you have not reached the Previous Cashback Cap as determined by the Bank in its sole discretion, the cashback you will receive pursuant to this Promotion is the lower of:

ii. If you have reached the Previous Cashback Cap as determined by the Bank in its sole discretion, you will not be entitled to any further cashback under this Promotion. For the avoidance of doubt, this is the position regardless of whether the Previous Cashback Cap is greater or less than the Current Cashback Cap. |

That’s a lot to digest, so let me try and offer my interpretation.

It seems to me that Standard Chartered is trying to counter gamers by introducing a lifetime “cashback cap” concept. If you previously signed for an SCB credit card and received cashback from Standard Chartered as your welcome gift, that amount will be offset from the S$300 cashback this time round.

To be clear, you can ignore all this if:

- you’ve never held a Standard Chartered principal credit card in your life

- you previously signed up through an affiliate like SingSaver, and it’s been more than 12 months since you cancelled that card

- you previously signed up through Standard Chartered, but didn’t get a cashback gift and it’s been more than 12 months since you cancelled that card

If you’ve maxed out the cashback cap and it’s been more than 12 months since you cancelled your last Standard Chartered credit card, you can consider applying via SingSaver instead, where you’ll have a choice of the following gifts:

- Dyson AM07 Tower Fan (worth S$499)

- Xiaomi Mi Robot Vacuum-Mop 2 (worth S$399)

- S$300 cash

Do note that a minimum spend of S$350 applies for applications via SingSaver. You can find the full details in this post.

With regards to the 3-month Disney+ subscription, eligible cardholders will receive their Disney+ promotion redemption code within 60 working days of the date of activation of the physical card. This must be used within 3 months.

The T&C of the offer can be found here.

Recap: Standard Chartered Smart Card

| ||

| Apply Here | ||

| T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$30,000 p.a. | None | 3.5% |

| Regular Earn | Bonus Earn | Cap |

| Up to 0.64 mpd | 5.6 mpd/7.7 mpd on fast food, streaming, public transport | S$818 per statement month |

The Standard Chartered Smart Card has a S$30,000 income requirement and no annual fee.

Cardholders normally earn a very underwhelming 1.6 rewards points per S$1 spent (equivalent to 0.46/0.64 mpd depending on whether you hold a Standard Chartered Visa Infinite or X Card- see the explainer below) on all spending.

| ❓ Got Visa Infinite? |

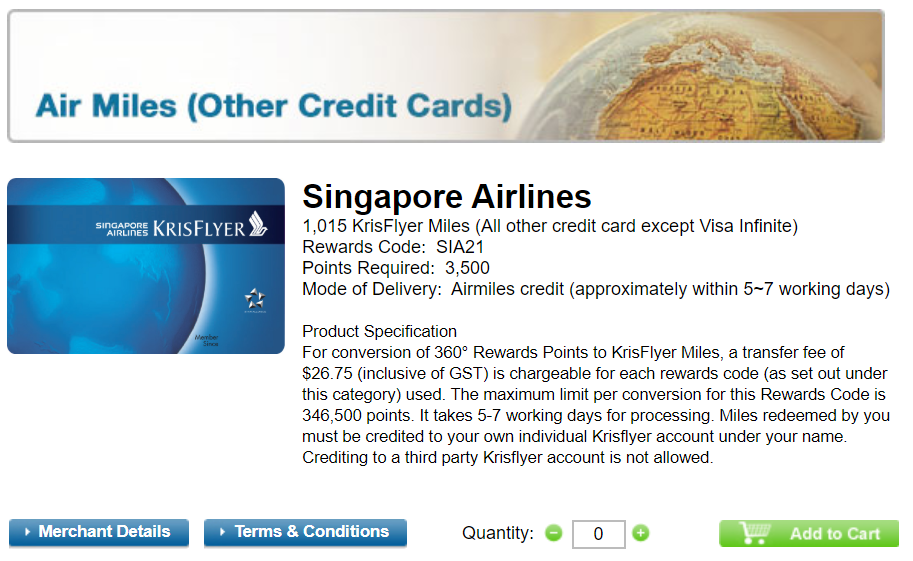

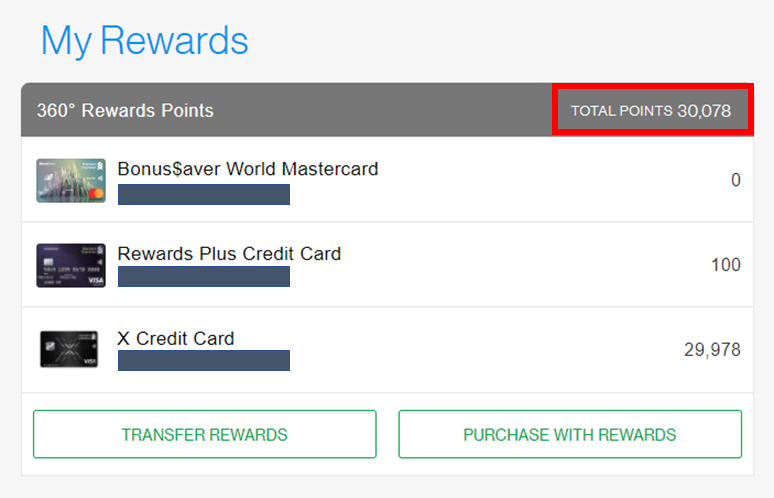

StanChart’s rewards ecosystem is much more favourable to those with a Standard Chartered Visa Infinite or Standard Chartered X Card. These cardholders can redeem KrisFlyer miles at an enhanced rate of 2,500 points = 1,000 miles. All other cardholders redeem KrisFlyer miles at a rate of 3,500 points= 1,015 miles. Here’s the fun part. If you have a Visa Infinite or X Card, all your rewards points can be redeemed at the 2,500 points = 1,000 miles rate. You can see this illustrated in my example below- the 100 points on my Rewards+ card are pooled with those from the X Card. tl;dr: 1 SCB rewards point= 0.4 miles for Visa Infinite cardholders, and 0.29 mpd for all others. |

However, if cardholders spend on fast food, streaming entertainment or public transportation (no min. spend required), they’ll earn:

- the regular base rate of 1.6 rewards points per S$1 (0.46/0.64 mpd)

- a bonus of 17.6 rewards points per S$1 (5.10/7.04 mpd)

This means a total earn rate of 19.2 rewards points per S$1 (5.57/7.68 mpd), capped at S$818 per statement month. That’s actually very good if you frequently spend on these categories.

| Category | Merchants |

| 🍔 Fast Food |

|

| 📺 Streaming Entertainment |

|

| 🚆 Bus/MRT |

|

For comparison, the best alternative cards would earn “only” 4 mpd on such transactions (e.g. UOB Preferred Platinum Visa for mobile payments at fast food merchants, or the Citi Rewards for monthly streaming subscriptions).

This bonus rate is valid till 31 December 2022.

Conclusion

If you qualify as a new-to-bank customer (and haven’t maxed out your cashback cap), then signing up for this offer is a no-brainer. S$300 cashback and a free Disney+ subscription for zero spend is almost too good to be true.

You’ll also find the SCB Smart Card a useful companion in any case, thanks to its upsized earn rate on fast food, streaming and public transport. Moreover, if your main card is a Standard Chartered X Card or Visa Infinite, it’s a no brainer to add the Smart Card to your wallet too (since there’s no annual fee and the points pool anyway).

thanks for the heads up.

I did not notice the new clause 8 when i submitted my application few days ago.

Might just contact the bank and ask them to stop processing for my application.

Guessing cash back cap is an unknown formula.

Does it mean after this $300, in subsequent NTB campaigns, we won’t get any more cashback for those (even after cancelling for 12 months prior)?

Also, can’t seem to find in the T&C; is there a minimum holding period of the card before I can cancel without any clawback of the $300?

So having got the 100,000 miles sign up for the X-Card and cancelling it a couple of years back shouldn’t impact this $300? Hope churning isn’t the next target, the ever growing cc exclusions are bad enough.

what is the minimum spending to earn points on this card? would affect smaller transactions like simplygo?

Applying for singsaver is also not an absolute solution – I had applied for CIMB credit card via Singsaver, did the required spend, only to be told several months later I didn’t meet the bank’s criteria (vague) and to go ask the bank (hopeless). I gave up eventually.

Seems like the $300 offer got extended to end Sept 😮

Hi, have anyone managed to get the $300? Or spending the min $500 and able to claim from one of the rewards from singsaver?

If so, does it means I can hit a min of $500 in anything? (Not in a single transaction but probably within the first 30 days)

Got the $300 but didn’t sign up via Singsaver. The ‘cashback’ was in the form of credit in your card from Standard Chartered itself.