When the history books of this era are written, the StanChart X Card will surely go down as one of oddest things mankind ever created.

Launched in July 2019 to great fanfare and an unprecedented 100,000 miles sign-up bonus, it quickly lost its way and became the laughing stock of the market due to its fulfilment issues, the annual “guys we’re serious no waivers this year!” farce, and the general incredulity that Standard Chartered expected cardholders to pay almost S$700 for essentially two lounge visits. It basically went from promising to punchline in the space of less than a year.

Well, Standard Chartered has finally put the X Card out of its misery by rebranding it as the mass-market “Journey.”

So much for don’t stop believing!

Overview: StanChart Journey Card

StanChart Journey Card StanChart Journey Card |

|||

| Apply | |||

| Card T&Cs | |||

| Sign-up Bonus T&Cs | |||

| Income Req. | S$30,000 p.a. | Points Validity | No expiry |

| Annual Fee (Inc. GST) |

S$194.40 (first year fee waiver option) |

Min. Transfer |

25,000 points (10,000 miles) |

| FCY Fee | 3.5% | Transfer Fee | S$27 |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2 mpd | Lounge Access? | Yes |

| Special Earn | 3 mpd on online groceries, food delivery, transport (SGD) | Airport Limo? | No |

Effective 19 May 2023, the StanChart X Card has become the StanChart Journey Card.

The income requirement has been reduced from S$80,000 to S$30,000, and the annual fee reduced from S$702 to S$194.40. In other words, it’s basically an entry-level general spending card. Talk about a fall from grace!

With the downgrade comes other cuts. The card will no longer come in metal cardstock, printed instead on “carbon neutral plastic”. It will also switch from a Visa Infinite to a Visa Signature, one tier lower.

| ❓ Does the switch to Visa Signature matter? |

|

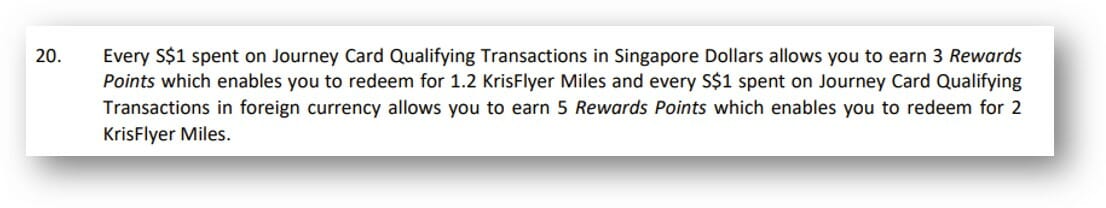

You may remember that StanChart has a two-tiered rewards system, with Visa Infinite cardholders enjoying a KrisFlyer conversion rate of 25,000 points = 10,000 miles, versus 34,500 points = 10,000 miles for non-Visa Infinite cardholders.

However, the T&Cs assume that the Journey Card will still have a rate of 2.5 points = 1 mile, so maybe StanChart is finally harmonising the rates internally? |

If you have an existing StanChart X Card, it will start functioning as a Journey Card effective immediately.

In other words, everything below applies to you too. StanChart has provided a list of FAQs for existing X Cardholders.

Earn rates

Just like the X Card, the StanChart Journey Card will continue to earn an uncapped:

- 3 points per S$1 spent locally (1.2 mpd)

- 5 points per S$1 spent overseas (2 mpd)

Points will continue to be evergreen, with no expiry date, and can be transferred to 10 different loyalty programmes including KrisFlyer, United MileagePlus, Qatar Privilege Club and IHG One Rewards.

What’s new is a bonus category of 7.5 points per S$1 spent (3 mpd) for online transactions made in SGD with the following MCCs:

- Grocery/food-stores with MCCs 5411, 5462, 5499 and 5921

(E.g. NTUC FairPrice Online, NTUC FairPrice app, Lazada Redmart, Watson’s Singapore and Nespresso Singapore) - Food deliveries with MCCs 5811, 5812 and 5814

(E.g. Foodpanda, Deliveroo, McDonald’s, KFC, Pizza Hut, Dominos Pizza, Chilli Api Catering and Qi Ji Catering) - Transport merchants with MCCs 4111, 4121, 4411 and 4789

(E.g.Grab, Gojek, Cabcharge Asia, Tada, Ryde Technologies, Royal Caribbean Cruises and Easybook.com )

Do note that the examples are not exhaustive; all that matters is the MCC.

This is capped at S$1,000 per statement month, and valid till 31 December 2023. As mentioned previously, even existing X Card members are eligible for this too.

Frankly, I see very little to get excited about here, since you could earn 4-6 mpd with competing cards as an evergreen benefit. Perhaps if you maxed out the caps, but otherwise…

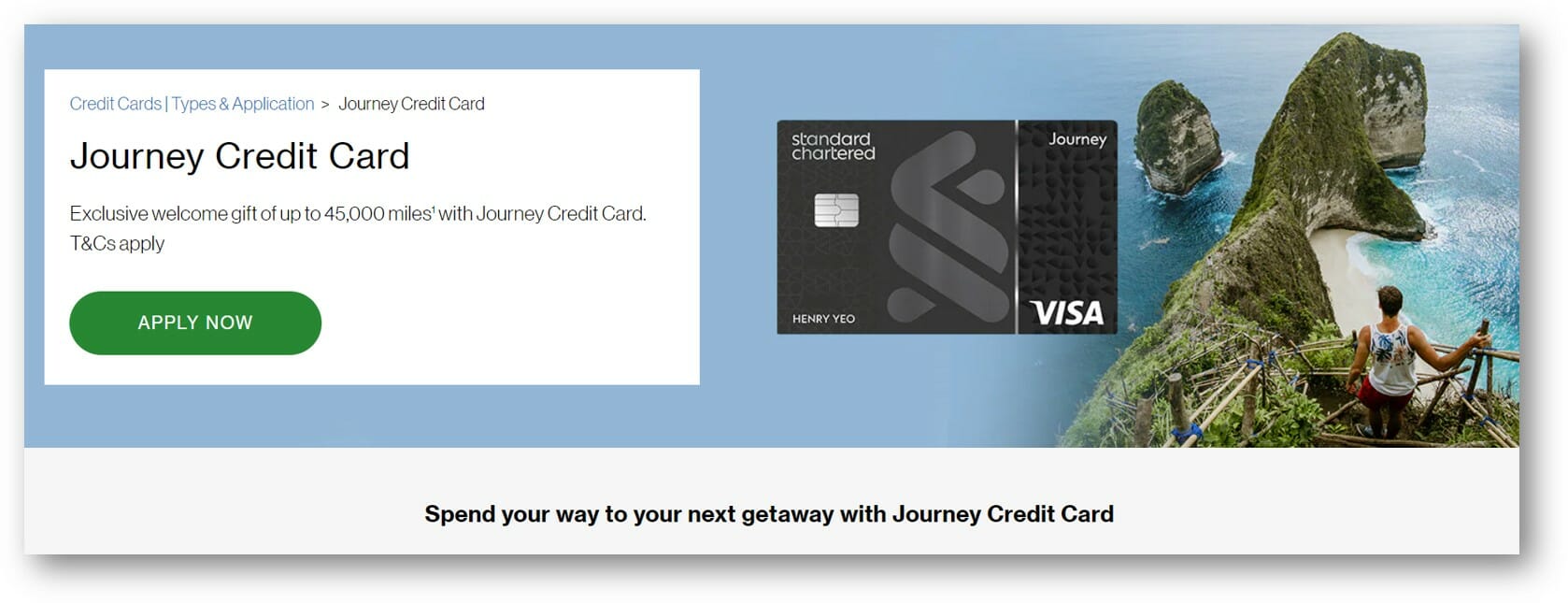

“Up to 45,000 miles” sign-up offer

From 19 May to 30 September 2023, the StanChart Journey Card is offering an “up to 45,000 miles” welcome gift for new-to-bank customers, defined as those who do not currently hold a principal Standard Chartered credit card, and have not cancelled one in the past 12 months.

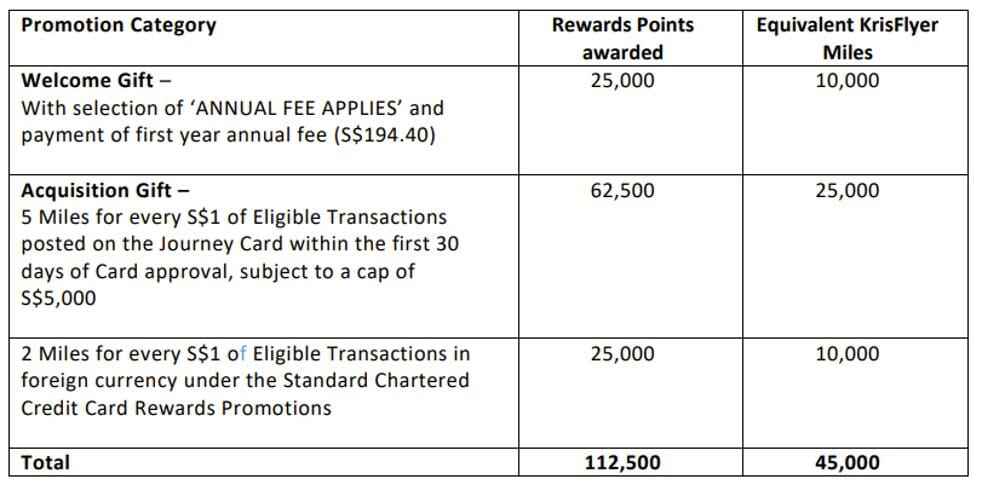

However, it’s somewhat less impressive once you break it down:

- Cardholders will earn an additional 5 mpd on up to S$5,000 spend within the first 30 days (25,000 miles)

- Cardholders will receive 10,000 miles for paying the first year’s S$194.40 annual fee

- Cardholders who spend the full S$5,000 in foreign currency will receive 10,000 miles (based on S$5,000 @ 2 mpd)

If you don’t want to pay the annual fee, and don’t want to use the StanChart Journey Card overseas, then you’re looking at basically 6.2 mpd (5 mpd bonus + 1.2 mpd base) on the first S$5,000 spend. That’s decent, but you’ll also need to factor in the opportunity cost of not spending on a 4-6 mpd card.

The bonus 5 mpd will be credited two months after the approval month.

| Card Approval | Gift credited by |

| May 2023 | 31 July 2023 |

| June 2023 | 31 August 2023 |

| July 2023 | 30 September 2023 |

| August 2023 | 31 October 2023 |

| September 2023 | 30 November 2023 |

Terms & Conditions

You can find the T&Cs of this offer here.

3.5% FCY fee rebate

The StanChart Journey Card is offering a rebate of the usual 3.5% FCY transaction fee for overseas spend made and posted during:

- June 2023

- July 2023

- November 2023

- December 2023

No registration is required, and cashback will be credited according to the following timelines:

| Eligible FCY transactions made and posted | Cashback credited by |

| 1 June to 31 July 2023 | 30 September 2023 |

| 1 November to 31 December 2023 | 29 February 2024 |

Now this is something I like. 2 mpd with zero FCY fees and no cap is an excellent deal, although you could earn more miles by pairing the right card with Amaze and paying a ~1.5% fee. It boils down to how much you’re willing to pay.

Terms & Conditions

You can find the T&Cs of this offer here.

Other benefits

StanChart Journey Cardholders will continue to enjoy two complimentary lounge visits per membership year, via Priority Pass.

They can also redeem a S$10 Grab transport promo code (SCCHANGI) for rides to and from Changi Airport, valid for the first 2,000 redemptions made by 31 December 2023.

Complimentary travel insurance is provided, though the maximum coverage has been cut from S$1 million to S$500,000.

Conclusion

StanChart Journey Card StanChart Journey Card |

|||

| Apply |

Standard Chartered has finally admitted defeat in its attempt to build a credit card for “affluent millennials”, killing off the X Card and relaunching it as the mass-market Journey Card.

Earn rates for general spending remain the same, though a limited-time 3 mpd bonus category has been added for online grocery, food delivery and transport transactions till the end of 2023.

Cardholders will continue to enjoy two lounge visits as before, and can also enjoy an uncapped 2 mpd on FCY transactions for June, July, November and December 2023- pretty good if you ask me.

What exactly was the plan for the X Card, only the Standard Chartered will ever know. I would so love to get the inside story on this.

RIP X Card.

NEXT..

Will the FCY rebate also apply to X card holders? T&Cs seem to specifically mention journey cards only. And what happens to the travel insurance benefits of the X card? Does it still apply (current and previous spending)?

Doesn’t the 6.2 mpd seems attractive?

What am I missing here?

First 5k only. After that then what?

Still decent cos uncapped. But it’s limited categories. If I have to pay $194, then hv to call to cancel card (finally) lol

Actually the more I think about it the more I see a potential use case for those who can jump in jump out. Will share in a separate post

Hope we’ll one day see a good miles card in SG with 0% FCY fee. A good first baby step.

Only tricky thing is that they’ll credit the FCY rebate by September.

Most X card holders will have their annual fee due in July or August. It they refuse to waive then you’re stuck with paying, or cancelling and not getting the FCY rebate.

If you think about it, some people now have the unique privilege of the only metal stock card with a $200 annual fee.

Great write-up as always Aaron. Any thoughts about this card vs Citi Premiermiles? They seem largely similar except for the fact that Journey is Visa while Premiermiles is Mastercard.

On an ongoing basis, Citi PM would have the edge for me thanks to PayAll. Journey has its sweet 5 mpd introductory offer, but beyond that the earn rates aren’t compelling- no sense earning “just” 3 mpd on transactions that could easily garner 4-6 mpd