Here’s The MileLion’s review of the AMEX HighFlyer Card (also known as the AMEX Singapore Airlines Business Credit Card), which is the quintessential example of why you should make hay while the sun shines.

Back in the day, this card offered outrageous value. The first year’s annual fee was waived, effectively giving you a complimentary Accor Plus Explorer membership. On top of that, you could earn miles on almost everything— charitable donations, school fees, insurance premiums, hospital bills, utilities, even GrabPay top-ups!

I fondly remember clocking the minimum spend for my welcome bonus entirely through GrabPay top-ups, then using GrabPay to pay my income taxes and top-up my CPF Special Account via AXS. It was literally free miles, so no wonder everyone was rushing to register their side hustles with ACRA, just to get the UEN required for applications.

Fast forward to today, and the picture is much more grim. There’s no longer a first year fee waiver, and no more miles for GrabPay top-ups (not that AXS accepts GrabPay anymore). Earn rates have been nerfed, lounge access removed, and to add insult to injury, American Express increased the annual fee to S$400 in April 2025.

Despite this, the AMEX HighFlyer Card still remains a decent corporate card — which actually says a lot about how dismal corporate cards are in general — but if you’re able to use personal cards for business spending instead, then there’s very little reason to get it.

AMEX HighFlyer Card AMEX HighFlyer Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

|

| What do these ratings mean? |

|

| The AMEX HighFlyer Card suffers from poor earn rates and lacklustre benefits, and there’s little reason to use it — unless your only alternative are corporate cards. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: AMEX HighFlyer Card

Let’s start this review by looking at the key features of the AMEX HighFlyer Card.

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$400 |

Min. Transfer | N/A |

| Miles with Annual Fee |

6,000 | Transfer Partners | 1 |

| FCY Fee | 3.25% | Transfer Fee | None |

| Local Earn | 1.2 mpd | Points Pool? | N/A |

| FCY Earn | 1.2 mpd | Lounge Access? | N/A |

| Special Earn | 2 mpd on SIA Group* | Airport Limo? | No |

| *An additional 6 mpd can be earned on Singapore Airlines commercial tickets, depending on fare type | |||

| Cardholder Terms and Conditions | |||

How much must I earn to qualify for an AMEX HighFlyer Card?

The AMEX HighFlyer Card has an annual income requirement of S$30,000 p.a., the MAS-mandated minimum to hold a credit card in Singapore.

The real barrier isn’t the income requirement, however. Because this is a business credit card, you’ll need a valid Unique Entity Number (UEN) to apply. This means registering your business with ACRA, be it a sole proprietorship, limited liability partnership or company.

American Express does not require a minimum turnover nor number of employees. If you’re running a home business, giving tuition or engaged in some other side hustle, registering your business with ACRA would qualify you to apply.

In fact, the S$30,000 minimum income need not come from the registered business itself. For example, I could earn S$30,000 from my day job with Company A, and have a separate side hustle with my own Company B. I could then apply for an AMEX HighFlyer Card on behalf of Company B, using my income from Company A to qualify.

How much is the AMEX HighFlyer Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$400 | First 2 waived, 3rd onwards S$100.85 |

| Subsequent | S$400 | First 2 waived, 3rd onwards S$100.85 |

The AMEX HighFlyer Card has an annual fee of S$400, with effect from 23 April 2025 (prior to this, it was S$304.59). All approvals and renewals from this date onward will be charged the higher fee.

The first two supplementary cards are free for life. A fee of S$100.85 applies to the third and any additional supplementary cards.

While the first year’s annual fee cannot be waived, subsequent years’ annual fees can potentially be waived, subject to appeal. Fee waiver approvals are based on your total spend and overall tenure with AMEX, and there is no published eligibility criteria that I’m aware of.

Cardholders who pay the annual fee will receive an Accor Plus Explorer membership code each year, along with 6,000 HighFlyer points from the second year onward. These benefits are forfeited if the annual fee is waived.

What welcome offers are available?

The AMEX HighFlyer Card is currently offering a welcome bonus of 30,000 HighFlyer points, available to customers who spend at least S$1,000 on Singapore Airlines and Scoot flights within the first 60 days of card approval.

To be eligible for this offer, you must pay the S$400 annual fee, and not have cancelled an AMEX HighFlyer Card for the same company in the past 24 months.

This offer is available for applications submitted by 31 March 2026, and the T&Cs can be found here.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.2 mpd | 1.2 mpd | 2 mpd on SIA Group (+ 6 mpd for selected SIA tickets) |

SGD/FCY Spend

AMEX HighFlyer Cardholders earn:

- 1.2 HighFlyer points every S$1 spent in Singapore Dollars

- 1.2 HighFlyer points every S$1 spent in Foreign Currency (FCY)

1 HighFlyer point is worth 1 KrisFlyer mile, meaning an equivalent earn rate of 1.2 mpd for local and FCY spend. This represents a 33% reduction from the previous earn rate of 1.8 mpd, which was in effect until 22 April 2025.

The bottom line is that the AMEX HighFlyer Card just isn’t that competitive compared to other consumer cards anymore.

| 💳 Earn Rates for General Spending Cards (Income Req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles Card UOB PRVI Miles Card |

1.4 mpd | 3 mpd IDR, MR, THB, VND 2.4 mpd All Others |

BOC Elite Miles BOC Elite Miles |

1.4 mpd | 2.8 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude Card DBS Altitude Card |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | 2.2 mpd |

StanChart Journey Card StanChart Journey Card |

1.2 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

AMEX HighFlyer Card AMEX HighFlyer Card |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.1 mpd |

However, if we compare this to corporate cards, then the picture changes significantly, because most corporate cards have quite dismal earn rates!

- Citi Corporate Card: 0.4 mpd

- DBS Platinum Business Card: 0.4 mpd

- DBS World Business Card: 0.3 mpd (1 mpd on local dining, entertainment, travel, 2 mpd on FCY spend)

- Maybank Business Platinum: 0.4 mpd

- OCBC Business Credit Card: Up to 3% cashback

- UOB Empire World Business Mastercard: 1.5% cashback

- UOB Regal Business Metal Card: 1.5-2% cashback

All FCY transactions are subject to a 3.25% FCY transaction fee, so overseas spend represents buying miles at a very unattractive 2.71 cents each.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

SIA Group Spend

AMEX HighFlyer Cardholders earn an uncapped 2 mpd on SIA Group spend, with no minimum spend necessary. The SIA Group is defined as transactions with:

- Singapore Airlines

- Scoot

- KrisShop

For the avoidance of doubt, this does not include transactions with Kris+ or Pelago.

Now, here’s where a lot of confusion arises, because American Express advertises up to 8 mpd on Singapore Airlines and Scoot tickets. This figure needs some explaining:

| 💳 From HighFlyer Card | ✈️ From HighFlyer Account |

|

Bonus for HighFlyer Cardholders

|

The extra 6 mpd is comprised of:

- The usual 5 mpd awarded to HighFlyer Base and Silver members (or 6 mpd for Gold and Platinum)

- A bonus 1 mpd awarded to HighFlyer members with an AMEX HighFlyer Card

The HighFlyer account does not award points on tickets issued in the V or K booking classes (Economy Lite). Tickets issued in the Q or N booking classes (Economy Value) will only be eligible for 50% accrual.

| Fare Type | Fare Code | HighFlyer Accrual |

| Economy Lite | V, K | 0% |

| Economy Value | Q, N | 50% |

| All others | All others | 100% |

To simplify things, here’s a summary of how many miles you can expect to earn as a Base/Silver HighFlyer member, depending on the ticket type.

| Fare Type | Total Earn Rate (Base/Silver)* |

| Economy Lite or Award Tickets | 2 mpd |

| Economy Value | 5 mpd |

| All Other Commercial Tickets | 8 mpd |

| *Gold and Platinum members should add 1 mpd to the figures shown here | |

The AMEX HighFlyer Card will earn 2 mpd on taxes and surcharges for KrisFlyer award tickets, whether with Singapore Airlines or other partner airlines.

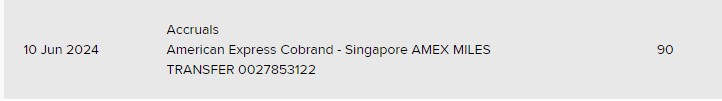

When are HighFlyer points credited?

HighFlyer points are credited when your transaction posts, which generally takes 1-3 working days.

How are HighFlyer points calculated?

Here’s how you can work out the HighFlyer points earned on your AMEX HighFlyer Card.

| Local Spend | Multiply transaction by 1.2, then round to the nearest whole number |

| FCY Spend |

Multiply transaction by 1.2, then round to the nearest whole number |

The minimum spend to earn points is therefore S$0.42.

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (X*1.2,0) |

| FCY Spend |

=ROUND (X*1.2,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for HighFlyer points?

When the AMEX HighFlyer Card first launched, it was very liberal with awarding points. There were virtually no rewards exclusions, and you could even earn miles for topping up your GrabPay account!

Sadly, those days are now over, and the exclusions list is similar to any other bank.

Exclusions

a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date.

b) Cash Advance and other cash services.

c) Finance charges – including Line of Credit charges and Credit Card interest charges.

d) Late payment and collection charges.

e) Tax refunds from overseas purchases.

f) Balance Transfer.

g) Instalment plans, except where American Express determines otherwise.

h) Annual membership fees.

i) Amount billed for purchase of HighFlyer Points to top-up your points balance.

j) Purchase and top-up charges for EZ-Link cards using American Express Cards.

k) Bill payments and all transactions via SingPost (e.g. SAM kiosks, mobile app, online

portal);

l) Payments to insurance companies (except payments made for insurance products purchased through American Express authorized channel);

m) Payments to Singapore Petroleum Company Limited (SPC) service stations;

n) Payments for public transit in Singapore, including transactions on public trains and

buses, and all transactions bearing the merchant description “BUS/MRT”;

o) Payments for the purpose of stored value card purchase / load / top-ups and/or the topping-up or loading of currency (or equivalent) for digital wallets, including but not limited to GrabPay and ShopeePay (with effect from 30 September 2025);

p) Payments to utilities merchants;

q) Payments to public/restructured hospitals, polyclinics and other public/restructured healthcare institutions and facilities;

r) Transactions relating to education and other non-profit purposes (including charitable donations);

s) Charges at merchants or establishments that are excluded by American Express at its sole discretion and notified by American Express to you from time to time.

While American Express does not exclude CardUp transactions from earning rewards, the AMEX HighFlyer Card will not work with CardUp. Refer to the article below for more information.

What do I need to know about HighFlyer points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 3 years | N/A | None |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| N/A | 1 | Once a month |

Expiry

HighFlyer points expire after three years on the last day of the equivalent month in which they were earned. For example, all HighFlyer points earned from 1-31 July 2023 would expire on 31 July 2026 at 2359 hours Singapore time (GMT+8).

However, once HighFlyer points are converted into KrisFlyer miles, they will be valid for a further three years. Therefore, in total you have up to six years— though it’s never a good idea to sit on miles for too long, since that leaves you vulnerable to devaluations!

Pooling

If your organisation has multiple AMEX HighFlyer Cards, all the points earned will be pooled into a central account.

Transfer Fees & Partners

HighFlyer points earned from the AMEX HighFlyer Card are batched and automatically credited to your HighFlyer account once per month, on the statement closing date. No transfer fees apply.

HighFlyer points can be instantly converted into KrisFlyer miles for nominees at a 1:1 ratio, also without transfer fees.

Each nominee can receive a maximum of 150,000 miles per calendar year from HighFlyer points transfers. While there was previously a limit of five nominees per HighFlyer account, that cap was removed on 1 July 2024.

What else can you do with HighFlyer points?

In addition to KrisFlyer miles, HighFlyer points can also be used for the following redemptions.

| Item | Cost |

12-month KrisFlyer Elite Gold membership 12-month KrisFlyer Elite Gold membership |

100,000 points* |

LoungeKey pass LoungeKey pass |

6,500 points |

S$50 KrisShop voucher S$50 KrisShop voucher |

5,000 points |

S$10 off SIA tickets or S$10 Scoot voucher S$10 off SIA tickets or S$10 Scoot voucher |

1,000 points |

| Award chart | |

SIA Academy courses SIA Academy courses |

Not stated |

| *The regular price of 125,000 HighFlyer points is reduced to 100,000 HighFlyer points for AMEX HighFlyer Cardholders |

|

None of them are particularly attractive options, if you ask me. You’re getting at best 1 cent per point in value, when you could get much more had you converted those points to miles.

Other card perks

Business offers

AMEX HighFlyer Cardholders are eligible for the following business offers:

- S$4,000 annual spending credits for Meta Ads Campaign Management fees with First Page Digital

- S$4,000 annual spending credits for Google Ads Campaign Management fees with First Page Digital

- 10% off Fiverr for first hire

- 6% off monthly AWS bills and up to 90% off Amazon CloudFront through AppSquadz

- 20% off iStock new subscriptions

- S$350 credits for Mailchimp partner services with Ematic

- S$500 credits for Shopify partner services with Ematic

If these were credits for Meta, Google Ads, AWS etc., they’d be fantastic. But they’re not. Instead, you’ll need to engage one of the respective vendors to use the credits, and I have little knowledge about their services or standards.

The only codes valid for direct use are Fiverr and iStock, and even that’s a one-time discount. So even though I use some of these services myself, I personally don’t place much value on these business offers.

10,000 bonus points for first SIA flight booking

10,000 HighFlyer points will be awarded to cardholders upon completing their first flight booking made through the Singapore Airlines corporate portal, within the first 12 months of enrolment in the HighFlyer programme.

This benefit is only available to AMEX HighFlyer Cards approved from 23 April 2025 onwards.

ALL Accor+ Explorer membership

Principal AMEX HighFlyer Cardholders receive a complimentary ALL Accor+ Explorer membership (formerly known as Accor Plus).

This normally retails for S$299, and includes the following:

- 2 Stay Plus free nights across Asia Pacific (2x buy 1 night, get 1 night free)

- Up to 50% off member exclusive room rates with Red Hot Room offers

- 15% off Accor hotel stays worldwide

- 30% off dining across Asia Pacific for up to 10 pax

- 15% off drinks across Asia Pacific

- 30 status nights each year

The big draw here are the two Stay Plus free night certificates, each of which needs to be redeemed in conjunction with a single paid night (the more expensive of the two nights will be free).

The 30 status nights are sufficient for Gold status, though you need to moderate your expectations because most of its benefits — including room upgrades, early check-in and late check-out — are subject to availability.

Given all the changes that have happened during the transition from Accor Plus to ALL Accor+ Explorer, I would strongly encourage you to read the article below to get up to speed.

With effect from 23 April 2025, American Express has made it mandatory to pay the annual fee in order to enjoy the ALL Accor+ Explorer membership. If your annual fee is waived, your membership will not be renewed.

KrisFlyer Elite Gold fast track

Principal AMEX HighFlyer Cardholders can enjoy a fast-track to KrisFlyer Elite Gold when they spend at least S$15,000 on Singapore Airlines or Scoot tickets within the first 12 months of card approval. If you miss that opportunity, you won’t get another chance to try in the following membership year.

Do note that KrisShop transactions no longer count towards the minimum spend requirement, effective 23 April 2025.

Eligible spending includes both commercial tickets, and paying for taxes and surcharges on a KrisFlyer award ticket with your card (whether the award flight is on Singapore Airlines or one of its partners).

Crucially, these tickets need not be flown by the cardholder. Think about the scenario of someone who often buys air tickets for his entire organisation. He can’t accrue the Elite miles on their tickets (only the person whose name is on the ticket can), but can nonetheless achieve KrisFlyer Elite Gold through his total card spending.

Fast Track T&Cs: AMEX HighFlyer Card

|

|

“Eligible Card Members” (as defined below) who charge a cumulative amount of S$15,000 or more on “Eligible Flight Bookings” (as defined below) within the first 12 months of Card Membership, will be eligible for an upgrade to the KrisFlyer Elite Gold membership tier “KrisFlyer Elite Gold Upgrade”) or to nominate a registered corporate traveler to receive the KrisFlyer Elite Gold Upgrade. To be an “Eligible Card Member”: (a) you must be a new Basic American Express Singapore Airlines Business Credit Card Member; (b) you must not have previously received the KrisFlyer Elite Gold Upgrade through the American Express Singapore Airlines Business Credit Card at any time (for the avoidance of doubt, an individual who previously received a KrisFlyer Elite Gold membership tier upgrade will not be eligible, even if he/she cancelled, subsequently reapplied and is approved for the American Express Singapore Airlines Business Credit Card); and (c) you must be the first Basic American Express Singapore Airlines Business Credit Card “Eligible Flight Bookings” refer to:

The KrisFlyer Elite Gold Upgrade will not be available to nominees who are existing PPS Club or KrisFlyer Elite Gold members. For the avoidance of doubt, if there is more than one Basic American Express Singapore Airlines Business Credit Card Member that is linked to a Business (as determined with reference to the Business’ unique entity number or registration number), only the first Eligible Card Member who meets all the eligibility criteria will be entitled to receive the KrisFlyer Elite Gold Upgrade (or nominate a registered corporate traveler to receive the Upgrade). The KrisFlyer Elite Gold status granted under this KrisFlyer Elite Gold Status Accelerator KrisFlyer and Singapore Airlines terms and conditions apply. Singapore Airlines reserves the right to vary their terms and conditions or terminate this benefit without prior notice at their own sole discretion. |

KrisFlyer Elite Gold status attained through this fast-track is only valid for one year; subsequently, members will need to requalify by flying at least 50,000 Elite miles in a 12-month membership period.

KrisFlyer Elite Gold grants additional benefits when flying on Singapore Airlines or Star Alliance carriers, such as:

- A 25% accrual bonus on KrisFlyer miles

- Lounge access

- Priority check-in

- Priority boarding

- Priority luggage handling and additional 20kg allowance

For more details on KrisFlyer Elite Gold benefits, refer to the post below.

Summary Review: AMEX HighFlyer Card

|

|

| Apply | |

| 🦁 MileLion Verdict | |

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

Once upon a time, the AMEX HighFlyer Card was a ridiculously good deal, rewarding everything from charitable donations to GrabPay top-ups, with generous welcome offers and a first-year fee waiver that made it a free way of getting an Accor Plus Explorer membership.

But that era is firmly in the rearview mirror. Today, the card’s allure has faded dramatically. With mediocre earn rates, a hefty S$400 annual fee, the removal of lounge access, and an ever-growing list of exclusions, the AMEX HighFlyer Card simply isn’t attractive anymore.

One caveat to that damning statement. It’s not attractive if you compare it to consumer cards. If your job allows you to use consumer cards for business expenses, then there’s really no competition. But if your only alternative are corporate cards, then the AMEX HighFlyer Card suddenly becomes a much more attractive proposition (this speaks to the sad state of corporate cards more than anything else!).

So that’s my review of the AMEX HighFlyer Card. What do you think?

FYI: If you’re a foreigner who runs their own company (which sponsors your EP/whatever in SG), you’ll need to be able to show two personal IRAS NOAs for approval.

That basically means you can only apply for this thing if you’ve spent two years in SG already.

This is a silly policy given it’s a corporate focused card to begin with. They’re not willing to accept bank statements, or form 21 from your company.

(As an aside, you can get 5.5 out of the 8 MPD for SIA spend by just signing up for SIA HighFlyer independently)

Hi

Just wonder the acra application requires any fees or annual fees?

Yes. And don’t forget filling requirements.

One should have a legit business then get the card…not purposely go to register a business just to get this card.

what makes you the gatekeeper? acra won’t say no to free $$ for nation building.

Actually there is a no annual fee option . But no bonus points will be awarded

But the points come at a cheap rate so no reason to not take

Can confirm if the following is factual ? My understanding from cso is different and I vaguely recall earning 8.5 on my 2020/2021 tickets

“HighFlyer points are not earned on award redemptions, so if you’re using the AMEX HighFlyer Card to pay for taxes and surcharges on award tickets, you’ll earn just 2.5 mpd.”

sorry for the noob question, but does the company or the individual get the credit bill? and the annual fee is paid by the company or individual?

in other words is this like a company card or is this a card for an individual who just need to be able to prove he is a director/major shareholder of a company?

Starting from Apr 4, they will be excluding grab top ups.

https://www.americanexpress.com/content/dam/amex/sg/benefits/SGexclusions_Mar2023.pdf

Can you retain your Highflyer account and CC if you dont renew your company’s registration on ACRA annually?

yes

Just received an email yesterday saying “Starting 4 April 2023, changes will be made to the list of eligible purchases for the award of HighFlyer points. For the latest list of non‑eligible transactions, please visit go.amex/sgexclusions.”

New exclusion:

“Payments for the purpose of GrabPay top-ups”

Glad I managed to clock my miles before this coming nerf!

Does this still have miles for grabpay top ups?

With the cap of Highflyer to Krisflyer (Each selected KrisFlyer account may receive a maximum of 30,000 KrisFlyer miles converted from HighFlyer points per calendar year, regardless of which HighFlyer accounts the points are converted from), will the strategy be to move all points from Amex Rewards > Krisflyer > Highflyer + Citi Rewards > Highflyer + Highflyer Card auto to Highflyer then book tickets from Highflyer site?

If you have a business can’t you just register for HighFlyer and use any other card to purchase tickets and get the 5 HighFlyer points on top of the card earn? Use a 6/4mpd card or uncapped 3mpd on UOB KrisFlyer and spend $6k per annum to get the additional 30k miles. Without using this AMEX

What if the fare category is Value for 1 sector and Standard for another. Does it apply the 50% (i.e 3mpd) across?

For SIA bookings, is it better to use Krisflyer Mastercard which has 3mpd or the highflyer card? I understand the card only gives 2.5 miles.

Hi. Has anyone checked the number of HighFlyer points credited to your HighFlyer account for SIA and Scoot flights paid with the Amex HighFlyer Card? I got 5 HighFlyer points per SGD1 base fare without the additional bonus 1 HighFlyer point per SGD1.

Just share my case. The annual fee can’t be wavied any more. The only one choice is to cancel the card, then no need to pay the annual fee.

Hey I just got my annual fee waived last week, just FYI.

Can I cancel my AMEX HIghflyer card and continue to use the Highflyer account on SQ with a different card, like the DSB Women’s card giving 4mpd below $1.5k spend