While the blue StanChart Priority Visa Infinite may be less well known than its brown StanChart Visa Infinite cousin, it boasts a much superior lounge access perk.

StanChart Priority Visa Infinite Cardholders receive up to 24 annual lounge visits via Priority Pass, four times the allowance for StanChart Visa Infinite Cardholders. What’s more, the first year fee is waived, and subsequent year’s fee waivers are possible if you’re a “fully funded Priority Banking client”.

Unfortunately, Standard Chartered is going to nerf this benefit significantly from 1 August 2023.

StanChart cutting lounge visits for Priority Visa Infinite Cardmembers

From 1 August 2023, Standard Chartered will be cutting the lounge visit entitlement for Priority Visa Infinite Cardholders, as well as tightening the qualification criteria.

Visit entitlements

| 💳 StanChart Priority Visa Infinite Lounge Visits |

||

| Till 31 Jul 23 | From 1 Aug 23 | |

| AUM ≥S$200,000 | 24 | 12 |

| AUM< S$200,000 | 4 | 2 |

| Priority Private or Private Banking | Unlimited + 1 guest | |

| Lounge visits are awarded to principal cardholders only | ||

While StanChart Priority Private or Private Banking cardholders will retain their unlimited visits, Priority Banking clients will see their visit entitlement cut by 50%:

- Customers with AUM of <S$200,000 will see their allowance cut from four visits to two

- Customers with AUM of ≥S$200,000 will see their allowance cut from 24 visits to 12

Do note that the change applies to first-time applications or renewals from 1 August 2023; if you applied or renewed your Priority Pass membership prior to this date, you’ll continue to enjoy the current visit entitlements until your next renewal comes round.

As before, visits can be shared with guests, with each guest counting as one visit.

Qualification criteria

The visit entitlement is entirely dependent on your AUM with Standard Chartered.

How that’s calculated is the second part of the nerf- not only is Standard Chartered cutting the visit allowance, it’s also making it more difficult to qualify for the higher tier of Priority Pass entitlements.

Renewals of Priority Pass

| 💳 StanChart Priority Visa Infinite Lounge Visits |

||

| Till 31 Jul 23 | From 1 Aug 23 | |

| AUM evaluation period | 3 months | 12 months |

If you’re renewing the Priority Pass membership from your StanChart Visa Infinite Card, from 1 August 2023, Standard Chartered will look at your AUM over the past 12 months, instead of the past three.

In other words, you will need to park an average balance of at least S$200,000 with Standard Chartered for 12 months to qualify for 12 lounge visits, instead of S$200,000 for 3 months to qualify for 24 lounge visits now.

If you were the sort who moved short-term funds into Standard Chartered just to qualify for lounge visits and then promptly shifted them elsewhere, you won’t be able to do that come August.

First-time applicant for Priority Pass

If this is your first time applying for a Priority Pass through the StanChart Priority Visa Infinite, the criteria remains unchanged:

- StanChart will look at the AUM for the three calendar months preceding the month in which you apply for the Priority Pass membership

- If you have been a Priority client for less than three months prior to the date of application for the Priority Pass membership, StanChart will look at the AUM for the month in which you apply for the Priority Pass membership

Registering for Priority Pass

To register for your StanChart Priority Visa Infinite Priority Pass, the principal cardholder needs to send the following SMS:

| 📱 SMS to 77222 |

| PBVI<space>PP<space>last 4-digits of StanChart Priority Banking Visa Infinite Card e.g. PBVI PP 1234 |

Cardholders will receive a unique code within 14 business days that they can use to register for a Priority Pass membership at this link.

The code will be generated based on your AUM, so you’ll either get 4/24 visits (for registrations prior to 1 August 2023) or 2/12 visits (for registrations from 1 August 2023).

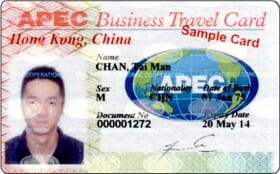

APEC Business Travel Card fee reimbursement remains

|

| ABTC Homepage |

| FAQs |

Fortunately, there are no changes to the APEC Business Travel Card (ABTC) benefit. Standard Chartered Priority Banking customers will continue to be eligible for a reimbursement of the S$100 application fee for the ABTC.

For a full guide on applying for an ABTC, refer to this post.

No changes to the regular StanChart Visa Infinite

For the avoidance of doubt, there are no changes to the lounge entitlements for the StanChart Visa Infinite. Cardholders will continue to receive six lounge visits each membership year as they did before.

It’s relatively underpowered for a $120K card, but there you have it. For a rundown of the credit cards with the most lounge visits in Singapore, refer to the post below.

Conclusion

Standard Chartered is cutting the number of complimentary lounge visits for StanChart Priority Visa Infinite Cardholders, and tightening the renewal criteria.

Cardholders will now receive half as many visits as before, and will need to maintain an average AUM of at least S$200,000 over the past 12 months if they wish to receive the maximum number of visits.

If lounge visits are what you’re after, you might want to consider a HSBC Premier relationship instead (min. AUM S$200,00). HSBC Premier customers can enjoy a HSBC Visa Infinite for an annual fee of S$492.56 (usually S$656.08), which comes with unlimited lounge visits for the principal cardholder and up to five supplementary cardholders.