Back in May 2023, Standard Chartered decided to put the X Card out of its misery by relaunching it as the entry-level StanChart Journey Card. And while the X Card was a bit of a train wreck, its successor has a lot more going for it.

In addition to the excellent welcome offer of 35,000 miles & up to S$140 cash (plus a further 10,000 miles if you’re willing to pay the S$194.40 annual fee), those with year-end travel plans can take advantage of a zero foreign currency (FCY) fee promotion for FCY transactions.

This is basically an opportunity to earn an uncapped 2 mpd on all FCY spending for November and December 2023, sans fees.

StanChart Journey Card 3.5% FCY cash rebate

From 1 November to 31 December 2023, StanChart Journey Cardholders will receive a 3.5% cash rebate on all FCY transactions, whether online or in-person.

- No registration is required

- No minimum spend required

- No cap on cash rebate

- Transactions must be made and posted within the promo period

- Cashback will be automatically credited by 29 February 2024.

This cash rebate offsets StanChart’s usual 3.5% FCY fee, allowing Journey Cardholders to earn 2 mpd on FCY transactions essentially fee-free.

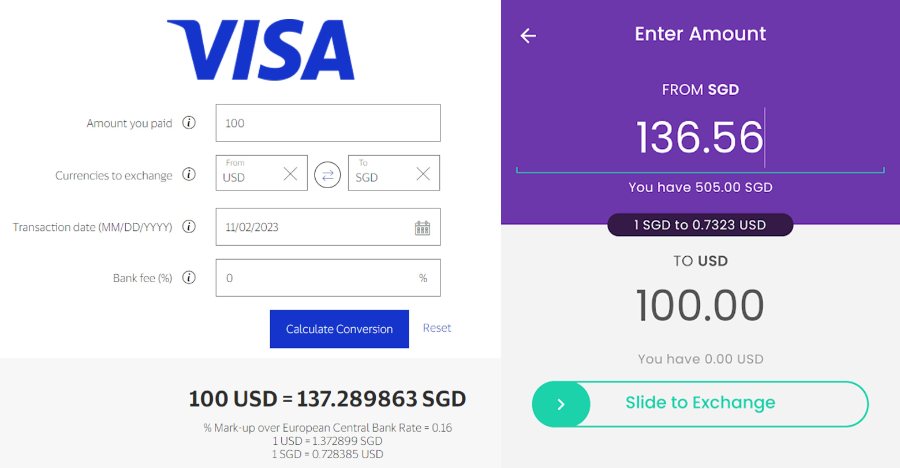

Well, fine. If you want to be technical about it, there’s still a Visa spread of around 0.5%, so in that sense you’d still be paying more than with Revolut or YouTrip. However, neither of those options will give you miles.

Do note that only transactions which are made and posted during the promotional period will be eligible for the 3.5% cash rebate. If you’re spending towards the end of December, take extra care because your transactions may not post in time (you should generally buffer 2-3 days for posting, though there’s no way to know for sure).

Exclusions

Eligible FCY transactions include both online and offline retail spend. A list of excluded transactions can be found in the T&Cs at point 11.

Some key ones to note include:

- Charitable Donations

- Education

- Government Services

- Insurance Premiums

- Prepaid Account Top-ups

If you do happen to have overseas donations, education or insurance premium payments to make, don’t worry: the Maybank Horizon Visa Signature is offering an uncapped 3.2 mpd on these categories, with a minimum spend of S$800 per month.

How does this compare to Amaze?

The inevitable question that comes up when dealing with FCY promotions is how it compares with Amaze.

By pairing the right card with Amaze, you could earn 4-6 mpd on your FCY transactions, with an implicit FCY fee of ~2% (due to Amaze’s spread over Mastercard rates).

| 💳 Amaze Card Pairings |

||

| Card | Earn Rate | Cap |

UOB Lady’s Card UOB Lady’s Card |

6 mpd1 | S$1K per c. month |

UOB Lady’s Solitaire UOB Lady’s Solitaire |

6 mpd2 | S$3K per c. month |

Citi Rewards Card Citi Rewards Card |

4 mpd3 | S$1K per s. month |

OCBC Titanium Rewards OCBC Titanium Rewards |

4 mpd4 | S$1.1K per c. month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

3 mpd5 | No cap |

| 1. Pick 1: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 2. Pick 2: Beauty & wellness, dining, entertainment, family, fashion, transport, travel (T&Cs) 3. All transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) (T&Cs) 4. Electronics, clothes, bags, shoes and shopping (T&Cs) 5. Dining, shopping, travel, transport. Must spend at least S$800 on SIA Group transactions in a membership year (T&Cs) |

||

Assuming you have a StanChart Journey Card, the question is whether an incremental 2-4 mpd (Amaze rate minus 2 mpd) is worth a 2% fee. I think for most people the answer will be yes, since that’s effectively 0.5-1 cents per mile.

With the year drawing to an end, we’re also seeing other limited-time options for FCY spending, summarised in the table below.

| Card | Earn Rate | FCY Fee | Cost Per Mile |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

3.2 mpd* | 3.25% | Unadj: 1.02 Adj: 2.6 |

Citi PremierMiles Card Citi PremierMiles Card |

4 mpd^ | 3.25% | Unadj: 0.81 Adj: 1.63 |

Citi Prestige Card Citi Prestige Card |

4.5 mpd@ | 3.25% | Unadj: 0.72 Adj: 1.3 |

| Unadj= Unadjusted, Adj= Adjusted for StanChart Journey earn rates | |||

| *Validity period depends on whether you’re a new or existing cardholder. Min. spend of S$800 per calendar month, no cap. Read more here. ^Till 31 January 2024. Min. spend of S$5,000 per calendar month, capped at S$5,000 per calendar month, in-person only. Read more here. @Till 31 January 2024. Min. spend of S$8,000 per calendar month, capped at S$5,000 per calendar month. Read more here. |

|||

You’ll notice I’ve provided two cost per mile figures:

- Unadjusted: FCY fee divided by the earn rate

- Adjusted: FCY fee divided by the incremental earn rate

For example, the Maybank Horizon Visa Signature earns 3.2 mpd on FCY spending with a 3.25% fee, so the cost per mile (ignoring the Visa spread for simplicity) is 1.02 cents.

But suppose I have both a StanChart Journey Card and a Maybank Horizon Visa Signature. If I choose to spend on the latter, I’ll earn an incremental 1.2 mpd, but at the cost of a 3.25% fee. This means the adjusted cost per mile is a less-attractive 2.6 cents.

Factor in the minimum spend requirements, and I’d say most people would be better off with Amaze or the StanChart Journey Card.

StanChart Journey Card welcome offer

Up to 45,000 miles

|

|||

| Apply (Fee Waiver) | |||

| Apply (Fee Paying) |

StanChart’s welcome offer is valid for applications submitted from 7 August to 31 December 2023 by new-to-bank cardholders, defined as those who:

- Do not currently hold a principal StanChart credit card, and

- Have not cancelled a principal StanChart credit card in the past 12 months

Cardholders will be eligible to earn up to 45,000 bonus miles, as shown below.

| 💳 StanChart Journey Card Sign-Up Offer (apply bet. 7 Aug to 31 Dec 23) |

||

| Rewards Points | KrisFlyer Miles | |

| Pay S$194.40 annual fee (optional) |

25,000 | 10,000 |

| Spend S$3,000 in first 60 days of approval | 87,500 | 35,000 |

| Total | 112,500 | 45,000 |

Do note that this 45,000 miles figure includes the 10,000 miles from paying the first year’s S$194.40 annual fee. This works out to a cost of 1.94 cents per mile, which is on the high side given cheaper alternatives for buying miles like CardUp and Citi PayAll.

However, you don’t have to pay the annual fee if you don’t want to. Regardless of whether they pay the annual fee, cardholders will receive 35,000 bonus miles for spending at least S$3,000 in the first 60 days of approval. That’s the real headline here, as it represents an excellent return on your spend.

Bonus miles are on top of the StanChart Journey Card’s regular earn rates of 1.2-3 mpd, so assuming you spend the full S$3,000 on local, non-bonused transactions, you’re looking at an additional 3,600 miles (S$3,000 @ 1.2 mpd), for an overall haul of up to 48,600 miles.

Up to S$140 cash

New-to-bank customers who apply for a StanChart Journey Card via SingSaver by 30 November 2023 will be eligible to receive an extra S$140 in cash:

- S$120 cash: For approval (no minimum spend)

- S$20 cash: For spending at least S$500 and making a transaction of at least S$20 with Shopee, Lazada, Taobao, ezbuy, Qoo10, Carousell or Netflix within 30 days of approval

Since I imagine you’d be spending S$3,000 on this card to meet the sign-up bonus anyway, the S$500 minimum spend should be no deterrent. Also note that both the fee-paying and fee-waiver options are eligible for the extra S$140 cash.

Conclusion

The StanChart Journey Card is offering an uncapped 3.5% cash rebate on all FCY spend for November and December 2023, which allows you to earn 2 mpd without any fees

However, those willing to pay a small fee for additional miles may find that it’s still more worthwhile to use Amaze, paired with a 4-6 mpd card.