Following its relaunch in August 2020, the HSBC Revolution has become a virtually essential card for miles chasers, with 4 mpd on dining, groceries, travel, shopping and transport. The absence of an annual fee and complimentary copy of The Entertainer are just the icing on the cake.

While the list of bonus categories is substantial, it’ll unfortunately be parred down from 1 January 2024, with the loss of several travel-related merchants.

HSBC Revolution narrowing bonus whitelist

|

|||

| Apply |

Per an update to the HSBC website, MCCs 4722 and 7011 will no longer be eligible to earn 4 mpd from 1 January 2024 onwards.

|

Starting from 1 January 2024, there’ll be changes in the qualifying transactions or eligible purchases. The Merchant Category Codes (MCC) 4722 and 7011 will be removed from the list of eligible transactions and no longer be rewarded with 10× Reward points. Please refer to our credit card FAQ page for the changes in detail. -HSBC |

Instead, these transactions will earn 0.4 mpd, like all other non-bonus categories.

MCC 4722 refers to Travel Agencies & Tour Operators, which includes:

| 🏖️ MCC 4722 (Travel Agencies & Tour Operators) (non-exhaustive) |

|

|

|

This is a big loss for cardholders, no doubt. It means the end of 4 mpd for all major OTAs, as well as activities booking platforms like KKday, Klook and Pelago. And if you’re the kind of person who books travel through a traditional travel agency like Chan Brothers or Dynasty, you’re out of luck too.

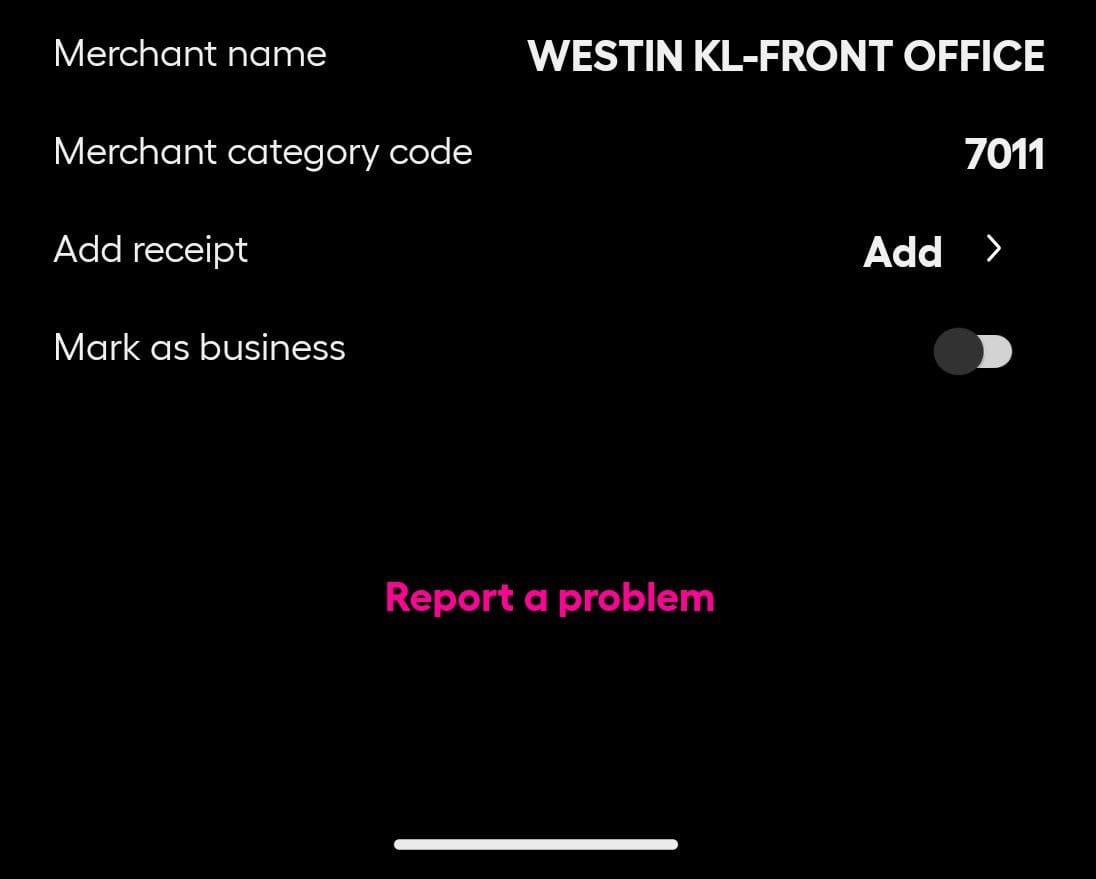

MCC 7011 refers to Lodging- Hotels, Motels and Resorts, which includes:

| 🏨 MCC 7011 (Lodging- Hotels, Motels and Resorts) (non-exhaustive) |

|

|

|

Most major hotel chains have their own unique MCCs in the 3500-3999 range (refer to this document for more details), such as Hilton (MCC 3504), Hyatt (MCC 3640), Marriott (MCC 3509), and Wyndham (MCC 3722). However, real-world data points suggest it’s still possible for individual properties to code under MCC 7011, as the screenshot below shows.

Moreover, there are a substantial number of medium-sized chains and independent hotels which fall under MCC 7011, not to mention Airbnb.

What’s slightly ironic is that when the HSBC Revolution got rebooted in August 2020, MCC 7011 wasn’t on the whitelist. It was only after I contacted HSBC asking about this omission that it was subsequently added. Back to square one, I guess…

One potential workaround for the 4722/7011 nerfing is to pay with a BNPL service like Atome, where accepted. This codes as MCC 5999, which is still on the HSBC Revolution’s whitelist.

If you’re uncertain about the MCC of a particular merchant, here’s three ways of looking it up prior to purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

Alternative cards to use

Fortunately, despite the nerf, there are still other cards which can earn you 4-6 mpd on these MCCs.

| 💳 Best Cards for MCC 4722 & 7011 | ||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

6 mpd |

Max S$1K per c. month. Must choose Travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

6 mpd |

Max S$3K per c. month. Must choose Travel as bonus category Review |

DBS WWMC DBS WWMCApply |

4 mpd |

Max S$2K per c. month Review |

The UOB Lady’s Cards will earn 6 mpd on MCC 4722 and 7011, provided Travel is selected as your quarterly bonus category.

Explained: Which MCCs are included in the UOB Lady’s Card “Travel” category

Likewise, the DBS Woman’s World Card will earn 4 mpd on MCC 4722 and 7011, provided the transactions are processed online. In the case of hotel bookings, this means your reservation must be fully prepaid at the time of booking, not at the time of check-in/out.

To the extent that you’re able to pay in-person at a contactless terminal, the UOB Preferred Platinum Visa or UOB Visa Signature are also potential options for 4 mpd.

HSBC Revolution revised bonus categories

Despite the nerf of MCCs 4722 and 7011, the HSBC Revolution will continue to have a good-sized whitelist.

| Category | MCCs | Examples (non-exhaustive) |

| Airlines, Car Rental, Lodging, Cruise Lines | 3000 to 3350, 3351 to 3500, 3501 to 3999, 4411, 4511 | Singapore Airlines, Scoot, Cathay Pacific, Emirates, Royal Caribbean, Avis, Hertz |

| Dept. Stores & Retail Stores | 4816, 5045, 5262, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5655, 5661, 5691, 5699, 5732 to 5735, 5912, 5942, 5944 to 5949, 5964 to 5970, 5992, 5999 | Amazon, Best Denki, Book Depository, Harvey Norman, Lazada, Qoo10, Shopee, Taobao |

| Supermarkets, Dining & Food Delivery | 5411, 5441, 5462, 5499, 5811, 5812, 5813, 5814 | Cold Storage, Deliveroo, NTUC FairPrice, Sheng Siong, foodpanda, GrabFood, WhyQ |

| Transport & Membership Clubs | 4121, 7997 | Comfort, Grab, gojek, TADA, Ryde, Fitness First |

| Bonuses apply regardless of whether spend is in SGD or foreign currency | ||

This covers major spending categories such as restaurants, supermarkets, ride-hailing services, airlines, cruise liners, car rental, food delivery, and most kinds of shopping.

So even though the nerf is annoying, it’s far from a fatal blow. You’ll still find plenty of use cases for the HBSC Revolution, and will simply have to redeploy MCCs 4722/7011 to other cards.

Conclusion

From January 2024, the HSBC Revolution will be narrowing its list of travel-related merchants, with MCCs 4722 and 7011 no longer eligible to earn 4 mpd.

This means you’ll need to find an alternative card for Klook, Pelago and most OTAs, as well as Airbnb and selected hotels. But in an ideal scenario, you’d be using the UOB Lady’s Card or DBS Woman’s World Card for such bookings in the first place.

Any other big losses from the exclusion of MCC 4722/7011?

(HT: Roger)

So this means that hotel dining transactions are not dubious again , as wasn’t it one of the revo’s beauty that hotel or restaurant would not have been a problem previously right?

true. this means you’ll need to exercise a bit of caution when dining at hotels because if it codes as 7011 you won’t earn points. you can still test the MCC with the instarem block card method, but it’s a bit more ma fan.

Think testing with a blocked DBS visa card is better, since MCC may differ for Visa as opposed to Mastercard

I suppose this affects flight ticket purchases via OTA (Trip, Traveloka) as well?

That’s disappointing.

Most of time I only use this card for Dining… local/overseas.

Hotels I usually paid using UOB VS (>1k FCY), if the Lady’s card exhausted the 3k cap.

Also to add, if anything fail, will fall back to general spending cards

Thank you Aaron. I just saw email and wondering what was 7011 thought of TML….but OMG….exclusions are worse than I thought 😳

Guess my Revo card will stay home for future trips.

Me too. I dislike this type of bait trick and somewhere along the line they pull the carpet from under you.