When Standard Chartered launched the now-defunct StanChart X Card, it also expanded its list of transfer partners significantly. Instead of just KrisFlyer, cardholders could now transfer points to 11 new airline and hotel partners, including Etihad Guest, Qatar Privilege Club, and Accor Live Limitless.

Although we lost a couple of these along the way (Miles & More and Enrich), the new partners were eventually made available to all StanChart cardholders as well. StanChart cards have never been known for their jaw-dropping earn rates, so transfer partner variety was one way of making up for this.

Unfortunately, that will change in March, when the StanChart transfer partner ecosystem gets scaled down considerably.

Standard Chartered axes nine transfer partners

From 24 March 2024, StanChart will be removing nine airline and hotel partners from its SC EasyRewards programme.

Per an update on its website:

From 24 March 2024, please note that we will be discontinuing hotel partner points and airline partner miles transfer under our SC EasyRewards Programme. This includes Etihad Guest, United Airlines MileagePlus, AccorHotels and others.

Rest assured you may continue to redeem your 360° Rewards Points for e-Vouchers, Cash, or Miles, on our Rewards Redemption platform via Online Banking and SC Mobile.

-StanChart

Here are the nine programmes that are affected:

| ✈️ Airlines | ||

| Partner |

Conversion Ratio (SC Points: Partner) |

|

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 2,500 : 1,000 |

||

| 3,000 : 1,000 |

||

| 3,500 : 1,000 |

||

| 3,500 : 1,000 |

||

|

3,500 : 1,000 |

|

| 🏨 Hotels | ||

| Partner |

Conversion Ratio (SC Points: Partner) |

|

| 2,500 : 1,000 |

||

| 5,000 : 1,000 | ||

It’s true that some of these ratios were fundamentally unattractive- why transfer points to Etihad Guest and Qatar Privilege Club at higher rates than what Citibank would charge?

At the same time, there were other partners with reasonable ratios and good use cases, such as EVA Air (which sometimes gets better access to SIA awards than KrisFlyer members!) and Flying Blue.

StanChart also offered occasional transfer bonuses that boosted the value for certain partners; I personally cashed out my X Card welcome offer on Accor Live Limitless points when a 100% bonus was dangled at the start of COVID.

How to cash out your points

StanChart is providing one month’s notice of these changes, so you still have time to redeem your points for these nine partners if you wish.

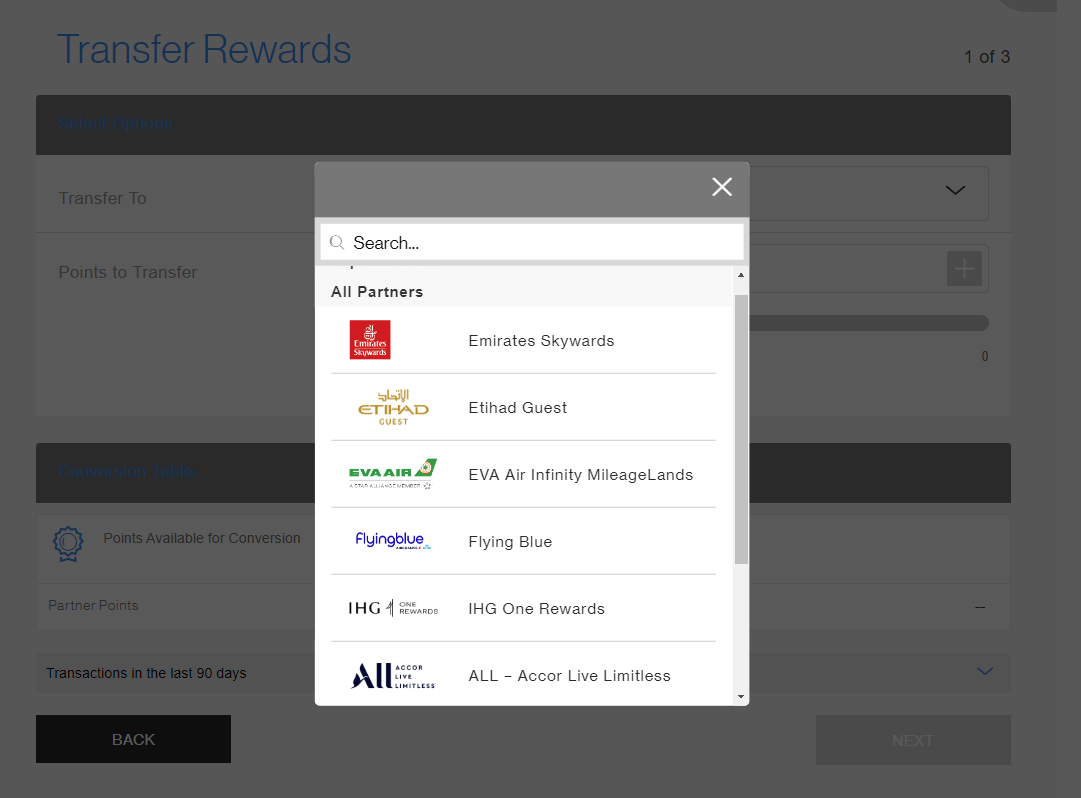

This must be done via the SC EasyRewards portal (not the 360° Rewards portal), which is only available on desktop (app functionality was removed some time back).

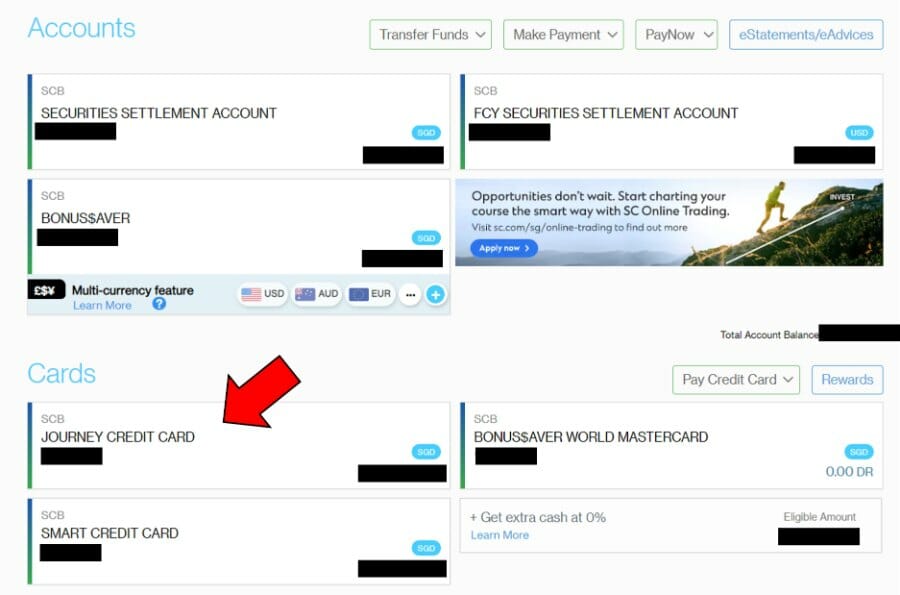

First, login to internet banking and click on your credit card.

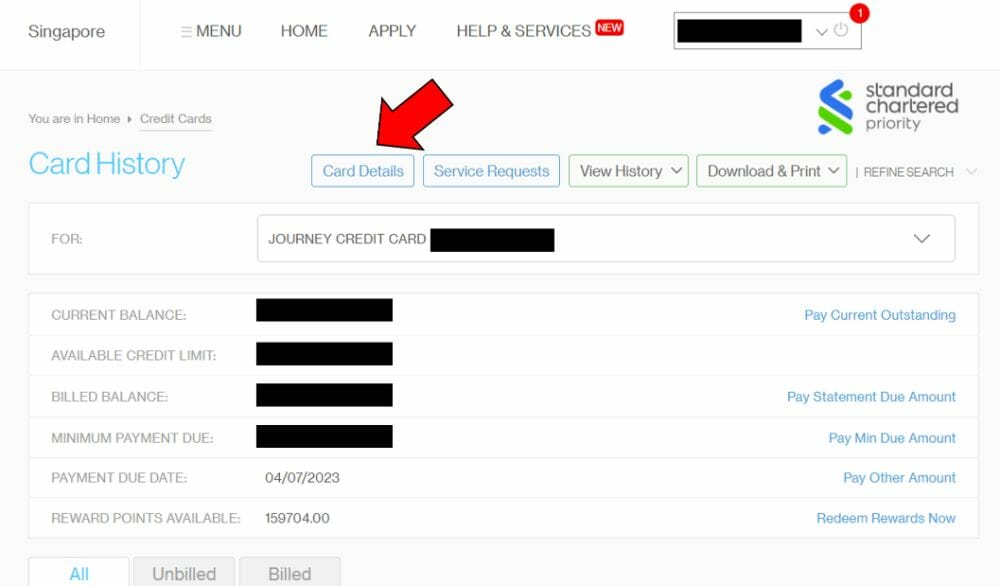

Next, click on the Card Details button.

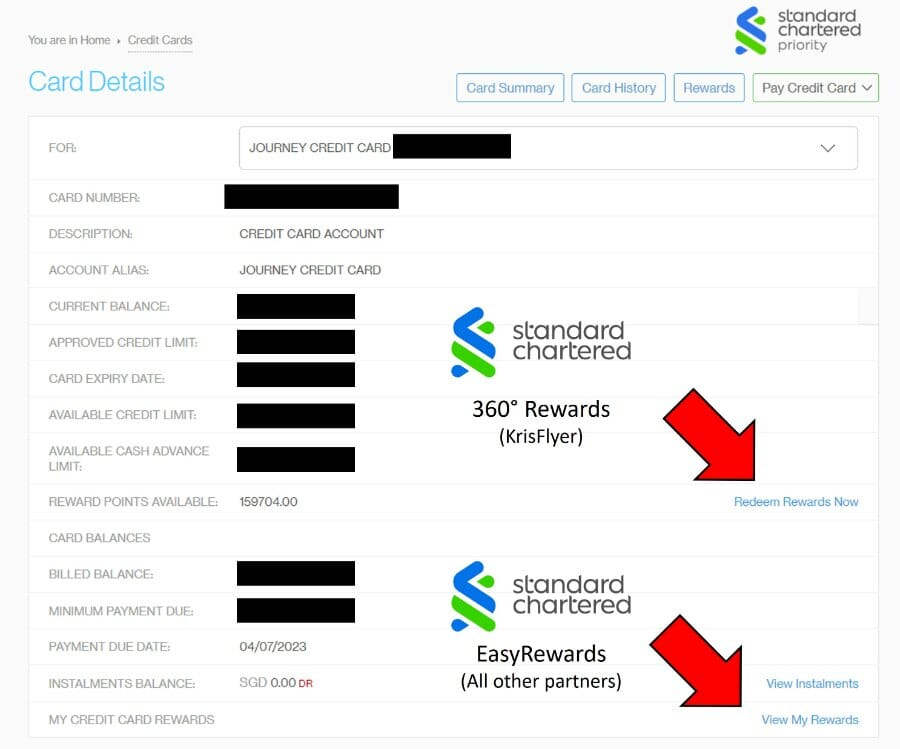

This expands the interface, showing you two options:

- Redeem Rewards Now (which brings you to SC 360° Rewards)

- View My Rewards (which brings you to SC EasyRewards)

Click on View My Rewards, and you’ll then see the nine partners available for transfer.

If you find this confusing, you’re not alone. I’ve been quite vocal about what a hot mess StanChart’s rewards system is. It’s understandable if a bank needs to temporarily operate two separate rewards platforms due to legacy issues, but the complete lack of documentation and explanation on their website has caused so much needless confusion over the past few years.

Standard Chartered’s 360° Rewards & EasyRewards: A hot steaming mess

Many customers have gone away thinking that StanChart no longer offers conversions to KrisFlyer (because they end up on the EasyRewards portal), or that StanChart no longer offers anything other than KrisFlyer (because they end up on the 360° Rewards portal).

Well, the latter will be true soon, more or less…

KrisFlyer transfers remain; Asia Miles added

StanChart cardholders will continue to have Singapore Airlines KrisFlyer as a transfer partner, with transfers available via the 360° Rewards portal. It also looks like Asia Miles has been added to the stable- a long overdue move if you ask me, since StanChart is the only bank in Singapore whose rewards programme doesn’t offer this programme.

I’ll cover this more in a separate article, but here’s a quick overview of the conversion ratios:

| Frequent Flyer Programme |

Conversion Ratio (SC Points: Partner) |

|

| Visa Infinite & Journey | All others | |

|

25,000 : 10,000 | 34,500 : 10,000 |

|

25,000 : 10,000 | 34,500 : 10,000 |

Basically, the ratios follow KrisFlyer, where a 25,000 points = 10,000 miles ratio is enjoyed by:

- StanChart Journey Card

- StanChart Visa Infinite Card

- StanChart Priority Banking Visa Infinite Card

All other cards have a 34,500 points = 10,000 miles ratio.

Conclusion

From 24 March 2024, StanChart will be axing nine of its airline and hotel partners

I can only speculate as to what’s going on, but it’s worth noting that these nine partners were provided by Ascenda Loyalty, the same company that powers transfers for the HSBC TravelOne Card and OCBC STACK. Perhaps the two couldn’t come to an agreement, or StanChart simply looked at the figures and saw that people didn’t really want anything else other than Asia Miles and KrisFlyer.

Either way, you have a month to cash out whatever balances you have for these partners, so make a note to do so if you’re interested.

Any changes to the conversion fee?