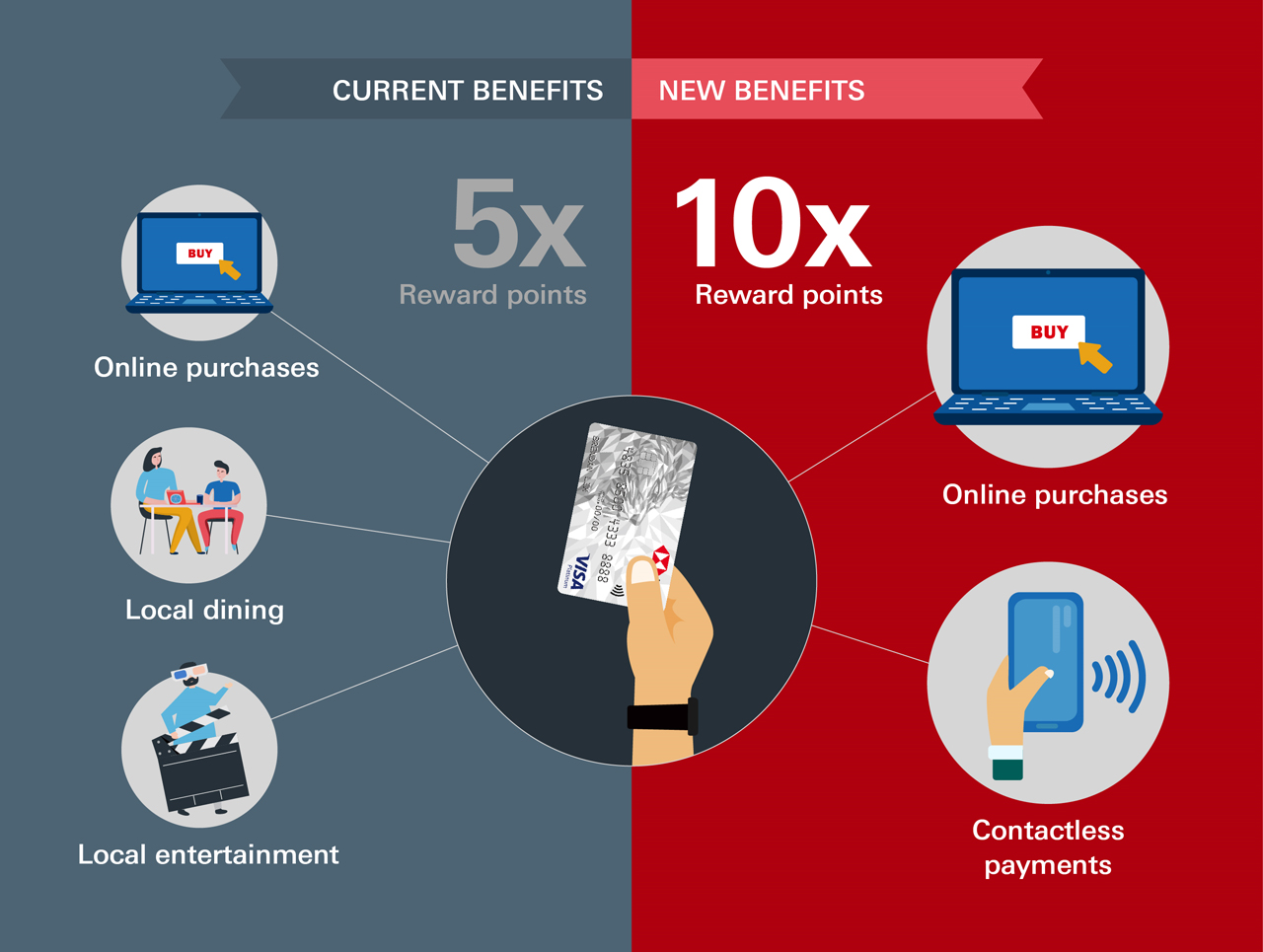

In May 2020, the HSBC Revolution looked like it was on the fast lane to irrelevance, as HSBC announced that it would be excluding insurance, education and utilities from its rewards programme- categories for which the HSBC Revolution earned 2 mpd.

With those no longer in the picture, the card would become virtually pointless, as its 2 mpd on online transactions, local dining and entertainment was easily outclassed by 4 mpd alternatives from competing banks.

And then, a revolution. HSBC retooled the Revolution to earn 4 mpd on a wide range of online purchases and contactless transactions, and scrapped the annual fee in the process, turning it from impending relic to wallet essential overnight.

All was good for a few years, but the party started winding down at the start of 2024, when HSBC started chipping away at the Revolution’s bonus whitelist. It started with a trickle, by removing Airbnb, travel agencies and many hotels, then progressed to a flow, with the removal of groceries, food delivery and fast food, and now has become a torrent, with the nerfing of bonuses for all in-person transactions just a few weeks away. Oh, and there’s more to come in January 2025, when travel transactions get erased from the whitelist too, because at this point, why not?

Unfortunately, it looks like the HSBC Revolution will end the way most revolutions do: at the guillotine.

Recap: HSBC Revolution upcoming changes

Here’s a summary of the upcoming changes to the HSBC Revolution, for those who haven’t been paying attention.

From 15 July 2024, cardholders will no longer earn 10X points (4 mpd) on in-person transactions, as the contactless clause gets removed. Instead, bonuses will only be awarded for in-app or online transactions made at merchants with the following MCCs.

| ✅ HSBC Revolution Bonus Whitelist (Till 31 Dec 2024) |

|

| Category | MCCs |

| Airlines, Car Rental, Lodging, Cruise Lines | 3000 to 3350, 3351 to 3500, 3501 to 3999, 4411, 4511 |

| Department Stores & Retail Stores | 4816, 5045, 5262, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5655, 5661, 5691, 5699, 5732 to 5735, 5912, 5942, 5944 to 5949, 5964 to 5970, 5992, 5999 |

| Dining | 5441, 5462, 5811, 5812, 5813 |

| Transport & Membership Clubs | 4121, 7997 |

| Bonuses apply to both SGD & FCY spend | |

Any in-person spending will earn only 1X points (0.4 mpd) at best.

From 1 January 2025, the bonus category for travel, comprising of airlines, car rental, lodging and cruises, will be removed altogether.

| ✅ HSBC Revolution Bonus Whitelist (From 1 Jan 2025) |

|

| Category | MCCs |

| Department Stores & Retail Stores | 4816, 5045, 5262, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631, 5641, 5651, 5655, 5661, 5691, 5699, 5732 to 5735, 5912, 5942, 5944 to 5949, 5964 to 5970, 5992, 5999 |

| Dining | 5441, 5462, 5811, 5812, 5813 |

| Transport & Membership Clubs | 4121, 7997 |

| Bonuses apply to both SGD & FCY spend | |

This means that in the space of just a year, the HSBC Revolution will have lost a shocking number of bonus categories.

| ❌ Former HSBC Revolution Bonus Categories | |

| MCC | Examples |

| MCC 4722 Travel Agencies Excluded 1 Jan 24 |

Agoda, Expedia, Hotels.com, Klook, Pelago, Trip.com |

| MCC 7011 Lodging Not Elsewhere Classified Excluded 1 Jan 24 |

Airbnb, Millennium Hotels & Resorts, Pan Pacific Hotels |

| MCC 5411 Supermarkets Excluded 1 May 24 |

Cold Storage, Giant, Little Farms, NTUC FairPrice, Sheng Siong |

| MCC 5499 Misc. Food Stores Excluded 1 May 24 |

7-Eleven, Crave, Cheers, Hockhua Tonic, iHerb, Nespresso |

| MCC 5814 Fast Food Excluded 1 May 24 |

Burger King, KFC, McDonald’s, Starbucks, Subway |

| MCC 3000-3299 MCC 4511 Airlines Excluded 1 Jan 25 |

Singapore Airlines, Scoot, Cathay Pacific, Emirates |

| MCC 3300-3499 Car Rental Excluded 1 Jan 25 |

Avis, Hertz, Sixt, Europcar |

| MCC 3500-3999 Lodging Excluded 1 Jan 25 |

Accor, Hilton, Marriott, Hyatt |

| MCC 4411 Cruise Lines Excluded 1 Jan 25 |

Royal Caribbean, Princess Cruises, Celebrity Cruises |

What now?

If you’re holding out hope that HSBC will realise the error of its ways and reverse course, I’m here to tell you that’s not going to happen. HSBC has obviously fallen out of love with the Revolution — it’s always telling when SingSaver and Moneysmart stop offering acquisition gifts — and the reason for that will become even clearer in the near future.

Suffice to say, the Revolution has had its time in the sun, and HSBC is hoping that the min-maxers who squeezed every cent out of this card each month will now begin an orderly departure.

But if you consider yourself one of the designated survivors, who wants to stay on for whatever reason, here’s my advice for making the best of a bad situation.

Dining

The dining category is already hobbled by the fact that MCC 5814 Fast Food was excluded in May 2024- the MCC that food delivery platforms like GrabFood, foodpanda and Deliveroo often use.

With the switch to online-only bonuses from 15 July 2024, it gets even trickier. You can still earn bonuses when physically dining in a restaurant if the merchant:

- Accepts FavePay (follows merchant’s MCC)

- Accepts Kris+ (follows merchant’s MCC)

- Accepts ShopBack Pay (follows merchant’s MCC)

- Has a QR-code ordering system like Oddle (follows merchant’s MCC) that requires you to pay on your phone before submitting your order

All of these convert in-person transactions into an online ones, earning you 4 mpd assuming the merchant’s MCC falls under one of the following categories.

| MCC | Examples |

| 5811 Caterers |

Eatz, Neo Garden, Stamford Catering |

| 5812 Restaurants |

Crystal Jade, Jumbo Seafood, Paradise Group |

| 5813 Bars & Nightclubs |

Brewerkz, Brotzeit, Harry’s |

| 5441 Candy, Nut, Confectionary Stores |

Candy Empire, See’s Candies, TWG |

| 5462 Bakeries |

Bread Talk, Bengawan Solo, Four Leaves |

Shopping

Once the online-only restriction kicks in from 15 July 2024, you can continue to earn 10X points (4 mpd) on all your usual e-commerce platforms like Amazon, Lazada, Qoo10, Shopee and Taobao, as well as electronics stores like Best Denki and Harvey Norman, to the extent that you buy via their websites.

If you want to shop in physical stores, however, you can:

- Buy gift cards on platforms like HeyMax (MCC 5311) or Wogi (MCC 5947), which can be used in-store at Best Denki, Challenger, Courts, iStudio, Isetan, TANGS etc.

- Buy eCapitaVouchers or Frasers Digital Gift Cards on Wogi (MCC 5947), which can then be used at any CapitaLand Mall or Frasers Mall in Singapore

- Pay with Atome (MCC 5999) at supported merchants

- Pay with FavePay (follows merchant’s MCC)

- Pay with Kris+ (follows merchant’s MCC)

- Pay with ShopBack Pay (follows merchant’s MCC)

All these have the effect of turning offline transactions into online ones, and will earn 4 mpd with the HSBC Revolution provided the MCC codes under one of the following.

| MCC | Examples |

| 4816 Computer Network/ Info Services |

Godaddy, Twitch, Peatix |

| 5045 Computers & Software |

Asus, Dell, HP |

| 5262 Online Marketplaces |

Shopee, Qoo10 |

| 5309 Duty Free Stores |

DFS, KrisShop, The Shilla |

| 5310 Discount Stores |

Brands Delicatessen, Daily Treats, Lotte Mart |

| 5311 Department Stores |

Taobao, Isetan, Marks & Spencer |

| 5331 Variety Stores |

Muji, Mustafa, Miniso |

| 5399 Misc General Merchandise |

Iuiga, Japan Home, Comgateway |

| 5611 Men’s Clothing |

Benjamin Barker, Dockers, Superdry |

| 5621 Women’s Ready to Wear |

bYSI, Coast, Forever21 |

| 5631 Women’s Accessories |

Bimba Y Lola, Chomel, Coach |

| 5641 Children’s and Infants’ Wear |

Abercrombie Kids, Cotton On Kids, Kidstyle |

| 5651 Family Clothing |

ASOS, Bossini, Desigual |

| 5655 Sports Apparel |

Adidas, Nike, Lululemon |

| 5661 Shoe Stores |

ALDO, Bata, Birkenstock |

| 5691 Men’s and Women’s Clothing |

Prada, G2000, Ezbuy |

| 5699 Accessory and Apparel |

LeSportsac, Crumpler, Esprit |

| 5732-5735 Electronics, Music Stores, Computer Software |

Apple, Audio House, MealPal |

| 5912 Drug Stores and Pharmacies |

Guardian, NTUC Unity, Watsons |

| 5942 Book Stores |

Book Depository, Kinokuniya, Books Actually |

| 5944-5949 Jewelry, Watches, Toys, Camera, Gift Cards, Leather Goods, Sewing |

Cartier, Action City, Canon |

| 5964-5970 Direct Marketing Merchants, Art Supply Stores |

Linkedin, WSJ, YouTube, Alex Photo, Adorama, Song Brothers |

| 5970 Art Supply Stores |

Art Friend |

| 5992 Florists |

Blissfulthots, Easyflowers, Flower Advisor, Noel Gifts |

| 5999 Misc. and Specialty Retail |

Atome, Amazon, eBay |

Travel

From 15 July 2024, you’ll no longer be able to use your HSBC Revolution to pay in-person for air tickets, hotels, cruises or car rentals, so be sure to pay for all your bookings online in order to earn your bonuses.

In any case, this category will be nerfed entirely from 1 January 2025.

Transport

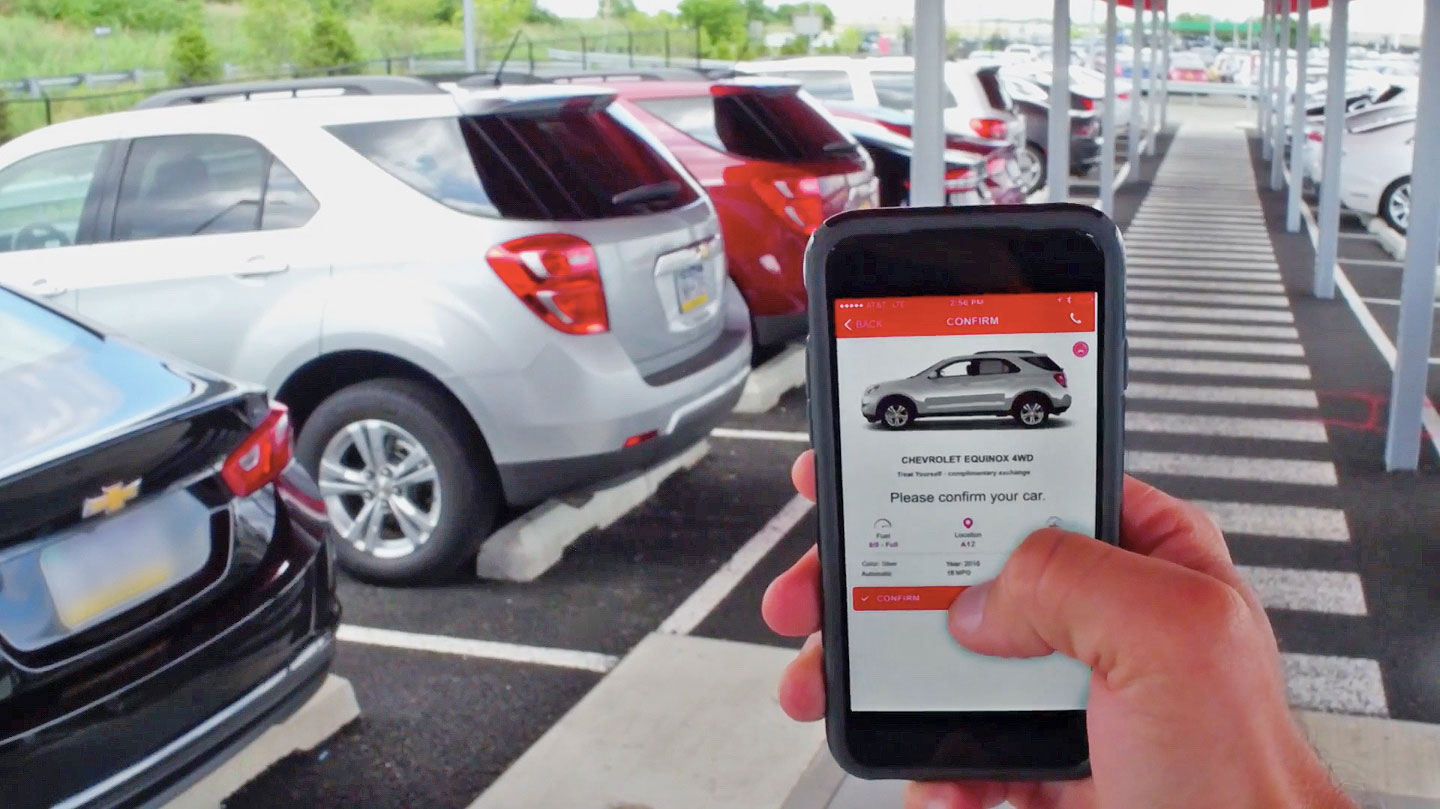

There’s not a lot to say about MCC 4121, other than from 15 July 2024, don’t use your HSBC Revolution to pay when you’re riding a taxi unless you’ve paired your ride with the CDG ZIG app.

As before, you can continue to earn 4 mpd with Gojek, Grab, TADA and Ryde.

Membership Clubs

There’s not much to say for MCC 7997 either. From 15 July 2024, if you’re making payment for your gym or other club membership, make sure it’s processed online.

Don’t forget that some gyms may partner with Atome (e.g. Anytime Fitness, True Fitness), so that’s another option to convert the transaction into an online one.

Conclusion

The HSBC Revolution is pretty much a dead man walking at this point, and unless you regularly max out the bonus caps on blacklist cards like the Citi Rewards, DBS Woman’s World Card and UOB Preferred Platinum Visa/Visa Signature, I see very little reason to keep it on staff.

If you decide nonetheless to retain the card, your goal will be to try and turn offline transactions into online ones, in order to circumvent the removal of contactless bonuses come 15 July 2024. FavePay, ShopBack Pay and Kris+ are good options for this, as are buying gift cards through platforms like HeyMax and Wogi.

Last one to cancel, please turn out the lights.

Are you suggesting they will launch something new?

Do wait for the mileage fee programme refunds to come in before cancelling!

And when is this refund coming in ?

Should be end June I believe!

I have experienced that I paid Soup Restaurant using shopback and the MCC as per (Heymax Visa Maximiser) it became 5814. Hence after that, I avoid using that card to pay any shopback merchant.

Similar to FoodRepublic Food Court, as per Heymax it is 5812, but amaze is showing it is 5814 after I paid using Amaze + CRMC.

Ah thanks for the heads up. Shopback told me that mcc is preserved but will make a note

Does HeyMax use Visa as reference for its MCC?

they have a visa option yes.

Any other decent card alternatives for low spenders (<$500), no annual fees? I already have CIMB & SC Smart. Not even considering EVOL due to the nerf. Thanks

Will cancel. Too many hoops to jump through and may need to deal with orphan miles..

Aaron, how do we exit and still get value for our orphan miles? Please advise or point to any of your articles that can address this. Thank you..

if you have at least 10,000 miles, there’s no question of orphan miles to begin with.

otherwise you’ll need to spend a bit more on the revo to get up to 10k miles, it’s not *that* much at 4 mpd. just try and do it before the july nerf.

since hsbc points pool, possible to apply another hsbc card (e.g. travelone) and cancel the revolution card?

I have the same issue 35000 points, 15000points more to hit the 10k miles

How about paying for the meals in Kopitam charged in the NTUC app? It also can earn bonus miles for the dinning part, right?

NTUC FP app MCC coded as 5814 Fast Food Restaurants.

No 10X (4 mpd) for HSBC Revolution – MCC not in whitelist.

hey aaron, thanks for sharing! im currently holding only this hsbc credit card with hsbc. If I cnacel it now, would my points disappear together?…thanks

I think there is a change of management idea. I see a trend of HSBC rejecting or taking a long time to accept applicants. It maybe their idea is to sieve through the applicants to see if there are folks they could accept to cross sell other products especially to individuals who are of higher networth. But only the gods in HSBC knows.

Unfortunately there is no change, HSBC was always slow on that and everything else, even for higher networth. Now they just lost the plot entirely

Another potential reason to keep Revo for awhile longer is to delay the conversion to Krisflyer miles, so that the KF miles will expire later? But that also runs the risk of HSBC points devaluation :/

i will hang onto it till 31 Jan 25 when the free conversions stop. Then axe it after.

Does using HSBC revoluation with online applepay count?

any other card to replace revolution card can use tap transaction reward 4mpd?

Given that HSBC revolution is no longer as useful as it is, any recommendations on card that can replace it?

I’m interested in this too! I’m pretty low-spending and was quite happy to sign up in January this year after years of not getting much from DBS LiveFresh, so these nerfs are pretty annoying. 😒 Would love to figure out a replacement card 😃

Low spending just focus on cashback, dont waste time on miles… will take forever

So I have about 10,000 points in orphan. How do I maximize this? I don’t have enough to redeem miles or hotel and I certainly don’t want to spend more to try and hit 25,000 points for redemption. Please advise!

Tried using Krispay-Canton Paradise (5812) but it seems no 10x since it is not considered “online”.

PSA: Paying for Hilton stay online using app booking and payment upfront also don’t qualify for 9x points. Was told that transaction was coded as MCC 7011 Lodgings – Hotels, Motels, Resorts, and NOT 3500-3599.

This card is truly useless now.

Would buying Accor Plus membership code under lodging and gain 4mpd for the Revolution?

Hi, if I plan to cancel the HSBC card, after Jan 2025. What other cards can be a good replacement, that can earn 4mpd for general spending and online shopping?

I currently have the Citi rewards, and UOB preferred platinum.