| The following is a sponsored post by Fave. The opinions expressed are those of The MileLion |

Fave will be a familiar name to most people in Singapore, especially those in the miles and points game. Their bright pink stickers are a common sight at cashiers ranging from shopping malls to hawker centres, and a reminder of the opportunity to earn both credit card rewards and partner cashback every time you pay.

But Fave is more than just payments. Fave also offers Deals, eCards and Gift Cards, enabling customers to save even more money on their purchases. In fact, Fave estimates that since its launch in 2017, users have saved more than S$550 million.

In this post, we’ll look at all that Fave has to offer, and tackle a commonly asked question: “What’s the best card to use with Fave?”

FavePay and FavePay Online

FavePay allows users to make payments both in-store and online, earning regular credit card rewards on top of partner cashback of up to 10%. FavePay is available at many popular merchants including:

- Anya Active (3% Cashback)

- Dian Xiao Er (3% Cashback)

- Fei Fei Wanton Noodles (10% Cashback)

- Harvey Norman (1% Cashback )

- Jolibee (5% Cashback)

- Kenko Wellness (10% Cashback)

- Marks and Spencer (2% Cashback)

- N20 Nail Spa (10% Cashback)

- Poke Theory (5% Cashback)

- Sino Ferry (10% Cashback)

- Tong Fong Fatt Hainanese Boneless Chicken Rice (5% Cashback)

Paying with Fave is as simple as scanning the merchant’s QR code (or if you’re online, clicking the FavePay option and scanning the generated QR code with your Fave app), picking your preferred card, and hitting the pay button. Once done, you’ll see the partner cashback credited to your account immediately, which you can then use on your next transaction with the same merchant.

| ❓ How does Fave cashback work? |

|

Fave has three different kinds of cashback.

|

What’s particularly great about FavePay is that it offers an opportunity to earn credit card rewards at smaller mom-and-pop merchants which might only accept cash or PayNow otherwise. If you’re buying a big ticket item like a mobile phone from a neighbourhood shop, for instance, you’ll be glad to have that option.

FavePay also supports payments with GrabPay and eGIRO, but these shouldn’t be your first choice unless you don’t have access to a credit card.

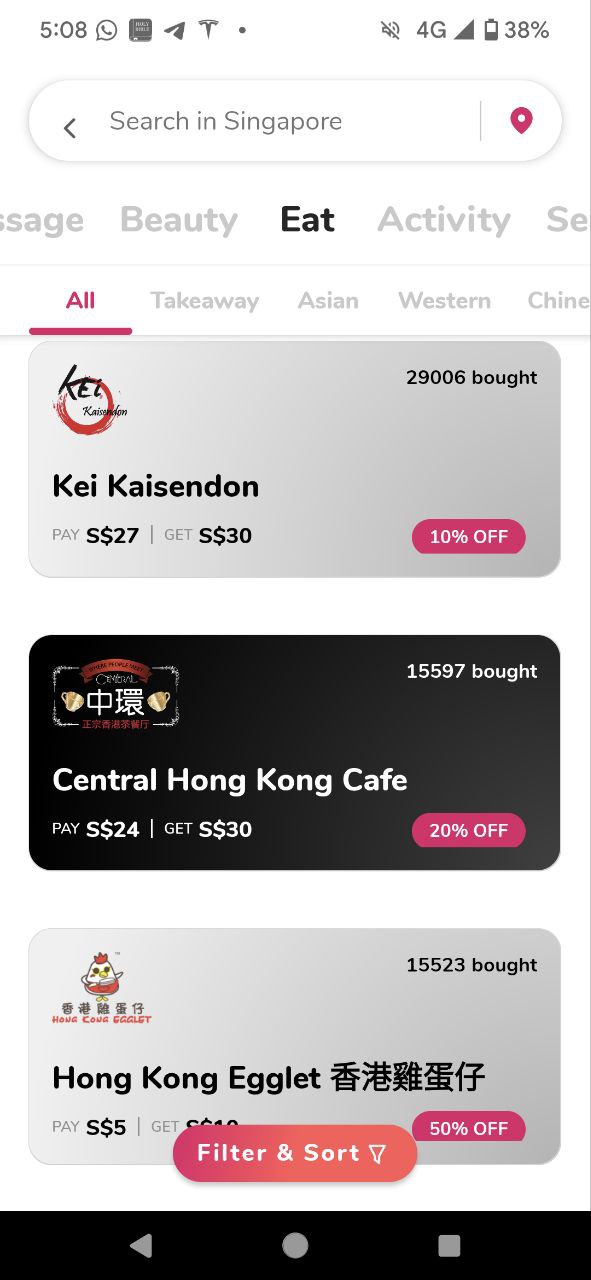

Fave Deals

Fave Deals are specially curated offers from food & beverage, beauty & wellness, activities, and retail merchants. Customers can save up to 90% off by pre-purchasing a deal in advance, ranging from spa treatments to dining vouchers.

For instance, you can purchase a S$150 House of Seafood dining voucher for S$82.32, or a 90 minute Signature Customised Facial from Coslab for S$39.10 (keep in mind you may be required to sit through a sales pitch for beauty or spa packages). New deals are added all the time, so keep checking back for the latest offers.

Fave eCards

Fave eCards are store credits offered at a discounted price. By pre-purchasing store credits, users can enjoy immediate savings at over 1,400 stores islandwide.

For example, if you’re someone who often dines at Kei Kaisendon, you can purchase S$30 worth of credits for S$27, or if you frequent Jollibean, you can get S$20 worth of credits for S$17.50.

All eCard value is instantly credited to your account in the form of partner cashback, so you could buy a card while standing in line and be ready to go by the time it’s your turn.

Fave Gift Cards

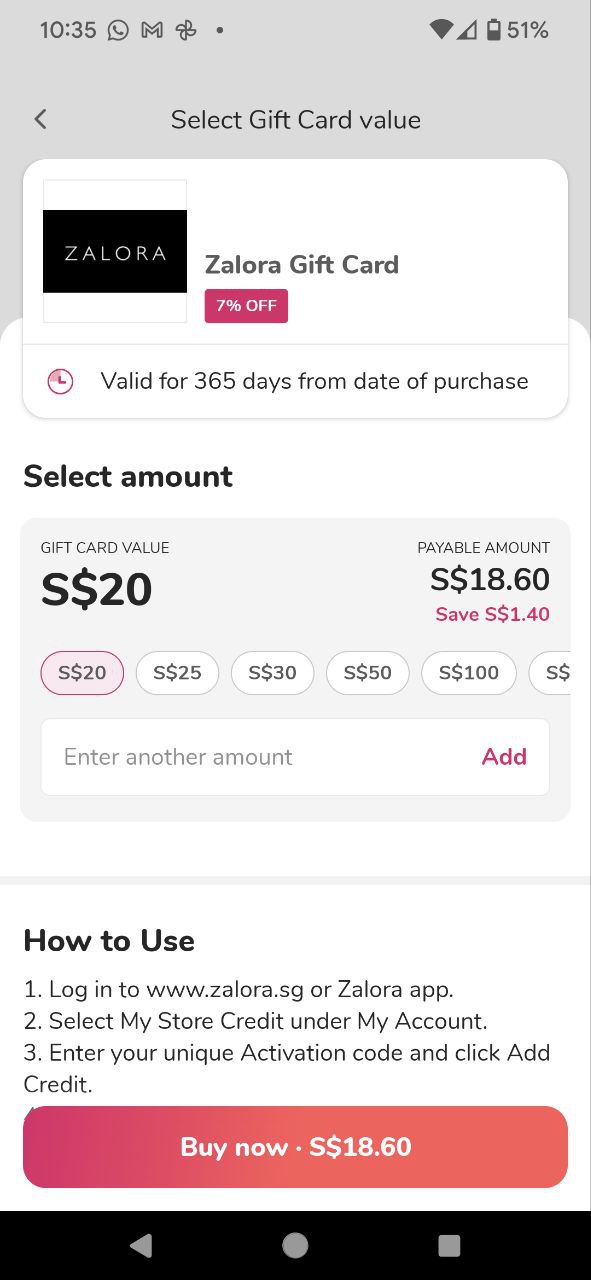

Fave offers gift cards for popular retailers such as Amazon Singapore, FairPrice, Foodpanda, Lazada and Zalora.

These gift cards are sold at a discount to their face value, which offers instant savings. Current options include:

- 5% off Deliveroo gift cards

- 1% off FairPrice gift cards

- 3% off Foodpanda Singapore gift cards

- 1% off Lazada Singapore gift cards

- 7% off Zalora Singapore gift cards

Fave is also offering instant 3% Fave Cashback on purchases of Amazon Fresh or Amazon.sg gift cards, with the code AMAZONFAVEML. This offer is available till 11 July 2024 or while stocks last.

Additional cashback on Amazon gift cards can be expected on Prime Day and various double digit sales days, so keep checking the Fave app for the latest.

What card to use for Fave?

Here’s the three most important points to note about Fave, whether you’re using FavePay, Deals, eCards or Gift Cards:

- All Fave transactions code as online spend

- FavePay retains the MCC of the underlying merchant

- The DBS Woman’s & Woman’s World Cards currently exclude rewards for Fave transactions

With regards to the MCC, the team tells me that the most common MCCs you’ll encounter with Fave are:

- Dining (MCC 5812, 5814)

- Department Stores & Retail (MCC 5311)

- Beauty, Wellness and Spas (MCC 7230, 7298)

I’ve also been provided with the following MCCs for gift card purchases:

- Amazon: MCC 5999

- Amazon Fresh: MCC 5411

- FairPrice: MCC 5411

- Foodpanda: MCC 5814

- Lazada: MCC 5311

- Zalora: MCC 5691

In general, it’s always best practice to check the MCC before making a transaction, particularly if it’s a big-ticket purchase. Here’s three ways you can confirm the MCC before making a payment:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

For a detailed guide, refer to the following article.

How to check Merchant Category Codes (MCCs) before making a purchase

Here’s my recommended cards to use with Fave.

All Fave transactions

| 💳 Best Cards for Fave (All MCCs) |

||

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Max. S$1K per s. month |

The most fuss-free option for Fave by far is the Citi Rewards Card, since you’ll earn 4 mpd by virtue of the transaction being processed online.

This assumes the transaction doesn’t fall under the mobile wallet exclusion (Fave doesn’t support Apple/Google Pay anyway) or the travel category exclusion.

Do note that the DBS Woman’s World Card explicitly excludes Fave transactions, so it won’t be the right option to use here even though it’s online.

Fave Dining

| 🍴 Best Cards for Fave (MCC 5812, 5814) |

||

| Card | Earn Rate | Remarks |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3 mpd | No cap. Min S$800 spend on SIA Group in m. year |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max. S$1K per c. month. Must choose Dining as bonus category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max. S$2K per c. month. Must choose Dining as bonus category |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | Max. S$1.1K per c. month |

| C. Month= Calendar Month | M. Year= Membership Year |

||

When paying at Fave dining partners which code under MCC 5812 or 5814, I’d recommend using either the UOB Lady’s Cards (with dining as the quarterly bonus category) or the UOB Preferred Platinum Visa, all of which will earn 4 mpd.

Fave Department Stores & Retail

| 🛍️ Best Cards for Fave (MCC 5311) |

||

| Card | Earn Rate | Remarks |

OCBC Rewards OCBC RewardsApply |

6 mpd (till 31 Dec 24) |

Max. S$1K per c month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max. S$1K per c. month |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max. S$1K per c. month. Must choose Fashion as bonus category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max. S$2K per c. month. Must choose Fashion as bonus category |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | Max. S$1.1K per c. month |

| C. Month= Calendar Month |

||

MCC 5311 is a common bonus category for specialised spending cards, so for Fave merchants which code under this MCC, you can use the HSBC Revolution, OCBC Rewards, UOB Preferred Platinum Visa, or UOB Lady’s Cards (with Fashion selected as your quarterly bonus category).

Fave Beauty, Wellness & Spas

| 💆 Best Cards for Fave (MCC 7230, 7298) |

||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max. S$1K per c. month. Must choose Beauty & Wellness as bonus category |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd |

Max. S$2K per c. month. Must choose Beauty & Wellness as bonus category |

| C. Month= Calendar Month |

||

When visiting Fave’s beauty and wellness partners which code under MCC 7230 and 7298. you can earn 4 mpd by using the UOB Lady’s Cards (with Beauty & Wellness selected as your quarterly bonus category).

How to save with Fave

Here’s an idea of how your credit card rewards and savings can start adding up with Fave.

Let’s say I’m at Huggs Coffee and my total bill is S$25. Through the Fave app, I can purchase a S$20 eCard for S$18, and use it to pay the bill instantly. I can pay for both the eCard (S$18) and the remaining balance (S$5) with my UOB Preferred Platinum Visa, earning 4 mpd and 3% partner cashback on top of my S$2 discount.

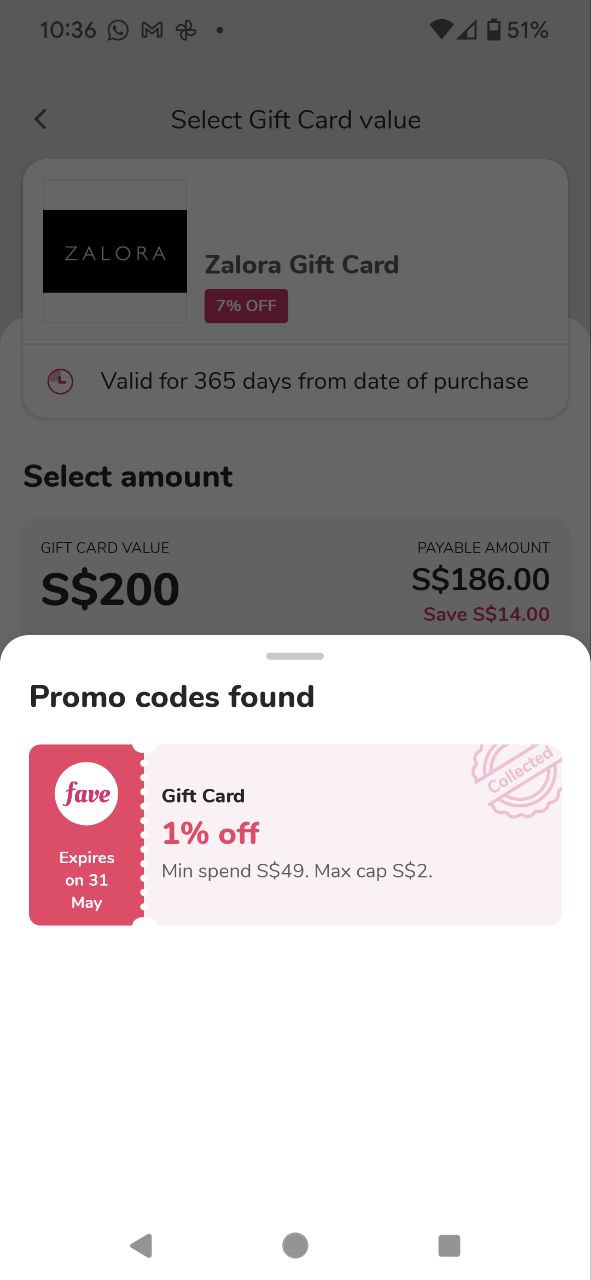

Alternatively, suppose I want to buy something from Zalora. Zalora gift cards are being sold at 7% off, so by purchasing a S$200 gift card from Fave at S$186, I would have saved S$14 instantly, not to mention earning a further 4 mpd when paying with my Citi Rewards Card.

Even better- when purchasing, the app prompts me about another 1% discount, which boosts my savings to S$15.86. Every little bit helps!

Special offers for MileLion readers

Fave is now offering some special promo codes for MileLion readers, whether you’re new to Fave or an existing customer.

| New to Fave Customer | Existing Fave Customer | |

| Code | FAVENEWML5 | FAVEML2 |

| Discount | S$5 off first transaction* | S$2 off min. spend of S$6^ |

| Valid Till | 31 July 2024 | 31 July 2024 |

| Redemption Limit | 1,000 | While stocks last |

| *Applicable for FavePay, eCards and Deals. Not applicable for gift cards ^Applicable for FavePay F&B and Deals merchants only |

||

New to Fave customers can use the code FAVENEWML5 to save S$5 off their first Fave transaction of any amount. A redemption cap of 1,000 has been set.

Existing Fave customers can use the code FAVEML2 to get S$2 off any Fave transaction of at least S$6. No explicit redemption cap has been set, but Fave says that “limited quantities” are available for redemption.

Both codes are valid for use till 31 July 2024.

Conclusion

FavePay is a great opportunity to stack extra cashback on top of credit card rewards, but that’s not the only thing Fave has to offer. On the Fave app, you’ll find additional ways to save with eCards, gift cards and deals, so be sure to check back periodically to see the latest deals and offers.

Using the right credit card with Fave can earn you up to 4 mpd extra on all these purchases, and now you know exactly which one to use in each situation.

Thanks for the existing users promo code Aaron! I guess it really pays to read articles, even the ones which I already knew of the information beforehand

Can you do one for shopback pay pls!

there is one already- google milelion shopback pay