After laying to rest the hapless X Card, Standard Chartered is taking another shot at a premium credit card with the StanChart Beyond Card.

StanChart Beyond Card StanChart Beyond Card |

|||

| Apply | |||

| Income Req. | S$200,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$1,635 |

Min. Transfer |

10,000 miles |

| Miles with Annual Fee |

N/A | Transfer Partners |

2 |

| FCY Fee | 3.5% | Transfer Fee | S$27.25 |

| Local Earn | 1.5-2 mpd | Points Pool? | Yes |

| FCY Earn | 3-4 mpd |

Lounge Access? | Yes |

| Special Earn | PP only: 8 mpd on FCY dining | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

No matter what you think of the Beyond, you have to applaud Standard Chartered for at least trying something different.

This isn’t a S$120,000 card like the Citi Prestige or OCBC VOYAGE. Neither is it a S$500,000 card like the DBS Insignia or UOB Reserve. Instead, with an income requirement of S$200,000 p.a. and a S$1,635 annual fee, this is a segment that no other issuer has attempted to tackle before, except perhaps American Express with the AMEX Platinum Charge (and even that’s debatable, since it no longer has a published income requirement).

The Beyond is now in its soft-launch phase, with Standard Chartered staff invited to apply ahead of the general public in January 2025. That said, the application links on the landing page work just fine for everyone, and there’s nothing stopping you from submitting an application (whether it gets approved is another matter entirely).

But don’t be so hasty to click apply, because S$1,635 is a big money decision. And having spent most of my weekend trawling through the T&Cs, I don’t think it’s a slam dunk. In this post, I’m going to give you my take on the various perks, to help answer the all-important “is it worth it?” question.

By the way, if you haven’t read my first Beyond article yet, I’d strongly advise you to do so before this, to familiarise yourself with the key features of this card.

StanChart Beyond Card: 100,000 miles welcome offer, uncapped 8 mpd, and a S$1,635 annual fee

Which tier of Beyond will you be?

The biggest thing you need to ask before applying for the StanChart Beyond Card is: what tier of cardholder will I be?

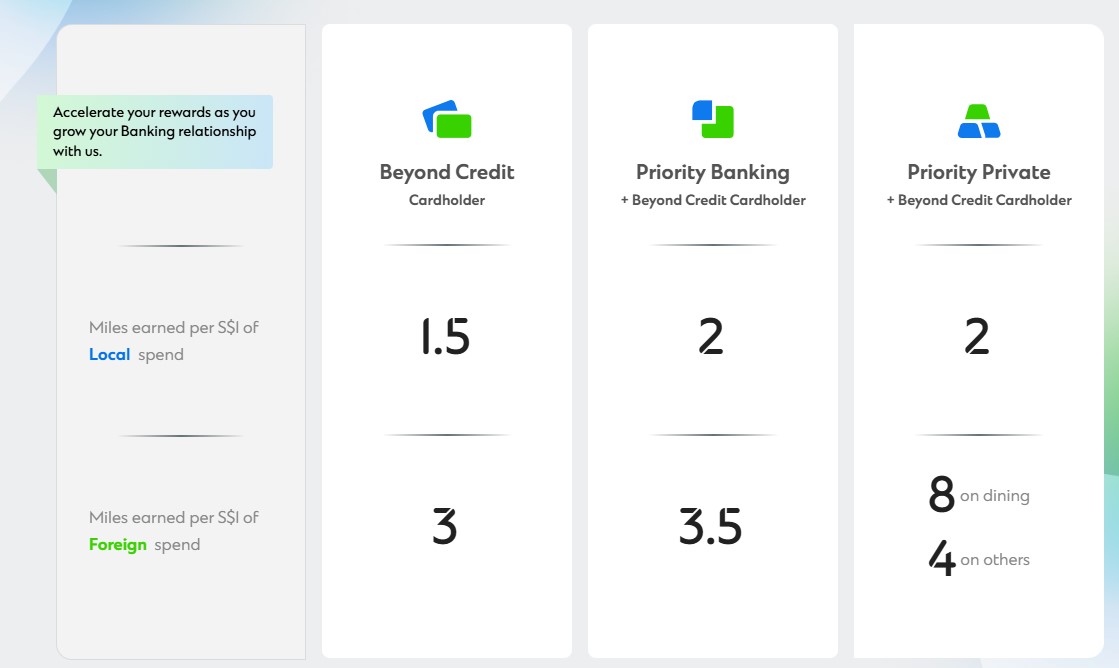

That’s because the Beyond is one product, with three tiers.

- Regular: No minimum AUM required

- Priority Banking (PB): Minimum AUM S$200,000

- Priority Private (PP): Minimum AUM S$1,500,000

All three tiers pay the same S$1,635 annual fee, but the benefits are different.

| Regular | Priority Banking | Priority Private | |

| Welcome Offer | 100,000 miles |

||

| Local Earn | 1.5 mpd | 2 mpd | 2 mpd |

| FCY Earn | 3 mpd | 3.5 mpd | 4 mpd |

| FCY Dining | 8 mpd | ||

| Birthday Meal | 1x | ||

| Business Class Upgrades | 2x | ||

| Airport Lounge | ∞ + 6 guests (Principal & Supp.) |

||

| Airport Limo | – | 2x | 10x |

| Accor Plus | – | – | Yes (Explorer Plus) |

| Mastercard Tier | World Elite Mastercard |

||

| All entitlements are per membership year, with the exception of lounge guests, which is per calendar year | |||

It’s obvious that Standard Chartered’s goal with the Beyond is to drive the acquisition of PB and PP clients, something they failed to do with the X Card. PB and PP cardholders enjoy better earn rates, airport limo rides, and in the case of PP, an Accor Plus Explorer Plus membership.

But some of these benefits aren’t as simple or as generous as they appear to be on first glance. So let’s go through them one by one, and highlight what the important things to know.

100,000 miles welcome offer

| Benefit |

|

| What you should know |

|

The StanChart Beyond Card is offering a 100,000 miles welcome bonus to customers who submit their applications by 31 August 2025, broken down into:

- 60,000 miles for paying the S$1,635 annual fee

- 40,000 miles for spending S$20,000 within 90 days of approval

My personal valuation of a mile is about 1.5 cents each, so this welcome offer would be worth S$1,500.

On the one hand, that covers almost the entire first year’s annual fee, but on the other, S$20,000 is a very high threshold to meet. For perspective, the AMEX Platinum Charge’s welcome offer requires cardholders to spend “just” S$8,000 in the first six months!

Come to think of it, if you’re eligible for welcome offers with other cards, you could potentially generate a total haul in excess of that 100,000 miles, with far less spending and lower annual fees.

| 💳 Example: 146,900 miles from S$747 annual fees and S$7,300 spend |

|

| Based on current welcome offers available at the time of writing. For the latest, refer here |

Also, at the risk of stating the obvious, this is a first-year-only benefit, so it will have no bearing on your decision to renew from the second year onwards.

Earn rates

| Benefit |

|

| What you should know |

|

The StanChart Beyond Card offers very attractive earn rates, with cardholders earning anywhere from 1.5-2 mpd on local spend, and 3-8 mpd on FCY spend.

When I first saw these figures, I assumed there had to be a minimum spend or cap lurking in the T&Cs, but there isn’t. And that’s pretty remarkable- whether you’re spending S$1 or S$1 million, the earn rate is the same.

Local earn rates

The StanChart Beyond Card earns an uncapped 1.5 mpd (regular) or 2 mpd (PB & PP) on all local spending.

1.5 mpd can be matched by the DBS Vantage Card, and there’s even a 1.6 mpd option in the form of the OCBC Premier VOYAGE Card (and the Citi ULTIMA/DBS Insignia/UOB Reserve, though their annual fee is 2-3X that of the Beyond), but an uncapped 2 mpd blows the competition out of the water.

However, if you really wanted to optimise, you could easily earn 4 mpd on most of your day-to-day expenses with the following cards:

- Citi Rewards Card (4 mpd on online spend, capped at S$1,000 per month)

- DBS Woman’s World Card (4 mpd on online spend, capped at S$1,500 per month)

- UOB Preferred Platinum Visa (4 mpd on mobile contactless spend, capped at S$1,110 per month)

- UOB Visa Signature (4 mpd on contactless spend, capped at S$2,000 per month)

| ❓ Aren’t there other options too? |

| There’s also other options like the HSBC Revolution or OCBC Rewards, but since these only award bonuses for specific MCCs, unlike the Beyond, I’ve not included them here. In other words, we should only be including the blacklist cards, the ones which award 4 mpd so long as a transaction is not explicitly excluded. |

So the Beyond Card would only come into the picture if you were spending more than S$5,610 per month, or if you were making a big-ticket purchase that could not be split over multiple cards.

There is another possible use case though: CardUp.

| Cost Per Mile (@ 1.5 mpd) |

Cost Per Mile (@ 2 mpd) |

|

| Rent (1.79%) | 1.17¢ | 0.88¢ |

| Other payments (2.25%) | 1.47¢ | 1.11¢ |

CardUp does not earn 4 mpd with the Citi Rewards Card and other specialised spending cards, so general spending cards are the next best option. Depending on the type of payment you’re making and the current promotions, your cost per mile with the StanChart Beyond Card could be as little as 0.88 cents.

Alternatively, StanChart offers an income tax payment facility (it’s currently available only to StanChart Visa Infinite Cards, but since it’s mentioned on the Beyond’s landing page I assume they’ll extend it here too) that lets you pay taxes with a 1.9% admin fee. That means a cost per mile to 0.95-1.27 cents apiece.

| Cost Per Mile (@ 1.5 mpd) |

Cost Per Mile (@ 2 mpd) |

|

| Income Tax (1.9%) | 1.27¢ | 0.95¢ |

FCY earn rates

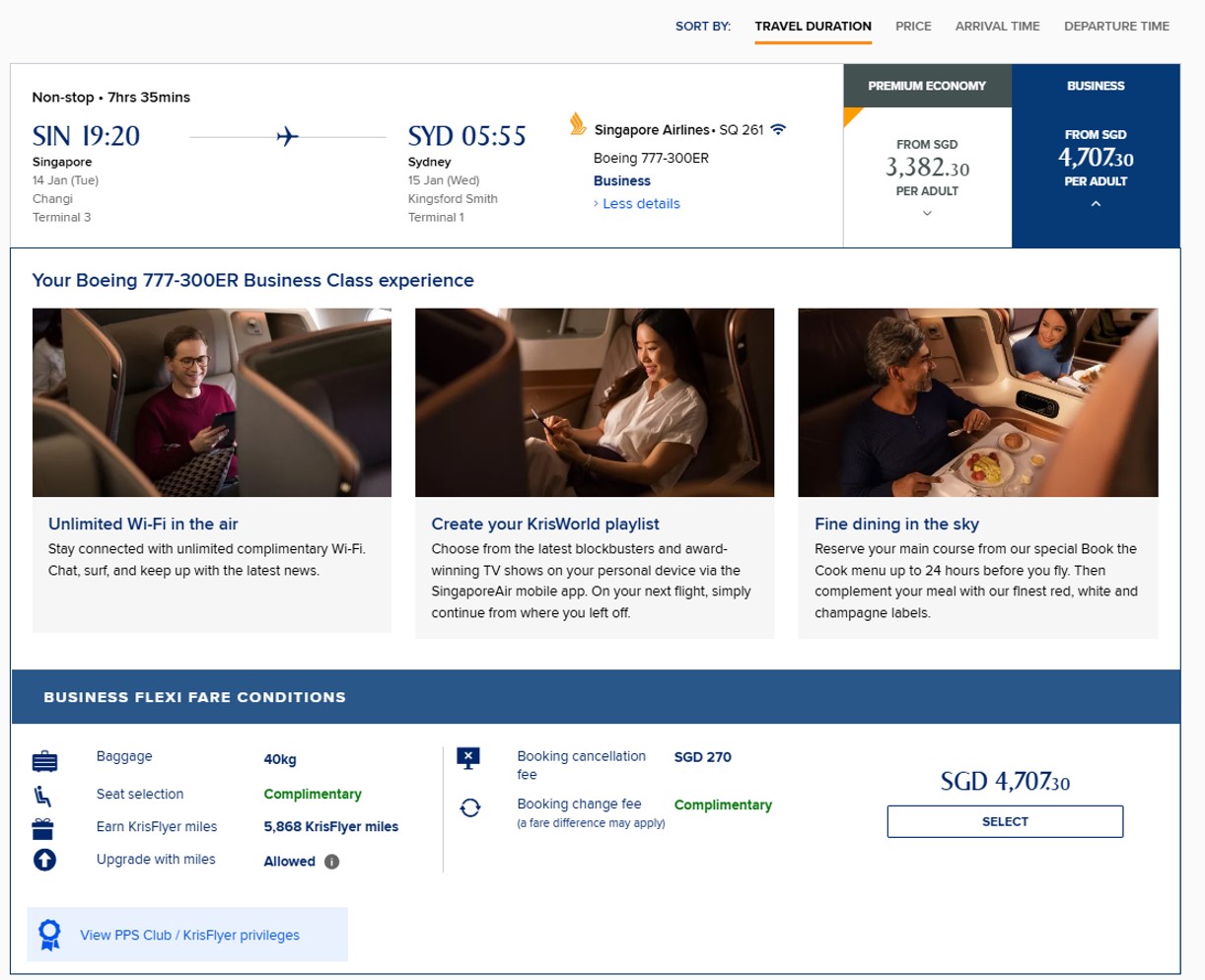

The StanChart Beyond Card earns an uncapped 3 mpd (regular), 3.5 mpd (PB) or 4 mpd (PP) on all FCY spending.

Those are impressive-sounding rates, but unlike local spending, the advantage over the market is not so clear cut here. That’s because Maybank has been stepping up their game too:

- The Maybank World Mastercard earns 3.2 mpd on all FCY spend, subject to a minimum spend of S$4,000 per calendar month (or 2.8 mpd with a minimum spend of S$800 per calendar month)

- The Maybank Horizon Visa Signature earns 2.8 mpd on all FCY spend (temporarily upsized to 3.2 mpd till 31 January 2025), subject to a minimum spend of S$800 per calendar month

Those minimum spends are a hurdle to be crossed, but if an uncapped earn rate is what attracts you, then it’s unlikely a minimum spend requirement is going to be an impediment anyway.

StanChart also has the highest FCY transaction fee in the market at 3.5%, compared to Maybank’s 3.25%, so that affects your cost per mile (CPM) too.

| Card | FCY Earn | FCY Fee | CPM |

SCB Beyond SCB Beyond (PP) |

8 mpd Dining |

3.5% | 0.44¢ |

| 4 mpd | 3.5% | 0.88¢ | |

SCB Beyond SCB Beyond (PB) |

3.5 mpd | 3.5% | 1.00¢ |

Maybank Horizon Maybank Horizon Maybank World MC Maybank World MC |

3.2 mpd | 3.25% | 1.02¢ |

SCB Beyond SCB Beyond (Regular) |

3 mpd | 3.5% | 1.17¢ |

Here’s my diagnosis:

If you’re a Regular StanChart Beyond Cardholder, Maybank cards are the superior option for FCY spend.

If you’re a PB StanChart Beyond Cardholder, Maybank Cards are marginally more expensive, but surely that difference is erased when you consider the annual fees. The Maybank Horizon has a S$192.60 fee, waived for three years, and the Maybank World Mastercard a S$261.60 fee, waived for one year. The annual fee for both cards can still be waived beyond the free period, unlike the Beyond.

If you’re a PP StanChart Beyond Cardholder, well, it’s hard to argue with an uncapped 4 or 8 mpd. I mean, if you’re a globetrotter who regularly entertains clients overseas on a company-bankrolled expense account, then this card becomes a no-brainer.

| ❌ What about reward exclusions? |

|

Another thing to consider is that Maybank has a very permissive exclusions list, and still rewards charitable donations, education, hospitals, insurance premiums and utilities bills- all categories that StanChart excludes. If these are major expense categories, and you spend them in FCY, then of course you’d go for the Maybank cards instead. |

It’s important to highlight that all Beyond Cardholders will initially earn 1.5/3 mpd on local/FCY spending. The additional miles for PB or PP customers will be awarded the month after, provided you maintain the minimum AUM at month-end.

|

26. The base Reward Points will be credited to the Beyond principal cardholder’s account in the current statement cycle date (“T statement date”) based on the Qualifying Transactions posted in that statement cycle. Additional Rewards Points based on your relationship and AUM held with the Bank will be aggregated across all Qualifying Transactions and credited to the Beyond principal cardholder’s account in the next statement cycle date (“T+1 statement date”). 27. In order to calculate the Additional Rewards Points to be awarded, the Earn Rate applicable to the Beyond Cardholder will be determined, at the point of fulfilment (T+1 statement date), by the Beyond principal cardholder’s month-end AUM in the calendar month preceding the T statement date and the Beyond principal cardholder’s relationship with the Bank (e.g. Priority, Priority Private, or Private Banking), as recorded in the Bank’s records. The Beyond supplementary cardholder’s Earn Rate will be the same as the Beyond principal cardholder’s Earn Rate. |

In other words, it’s not enough for you to have a PB/PP relationship; you must also keep it fully funded in order to enjoy the incremental earn rates. Depending on how your money is deployed with Standard Chartered, that may or may not entail a further opportunity cost.

Birthday meal

| Benefit |

|

| What you should know |

|

Principal StanChart Beyond Cardholders receive an annual complimentary birthday meal at Lerouy, a 1-Michelin Star restaurant serving French contemporary cuisine.

This is given in the form of a promo code, valid for two months from the date of issuance. Cardholders will need to make a reservation with Lerouy directly and provide the code on request.

The main thing to note here is that the free meal covers one diner only. Any additional guests will receive a 15% discount. Also, the free meal cannot be used on the eve of public holidays, public holidays, and special occasions like Valentine’s Day or Mother’s Day.

Business Class upgrades

| Benefit |

|

| What you should know |

|

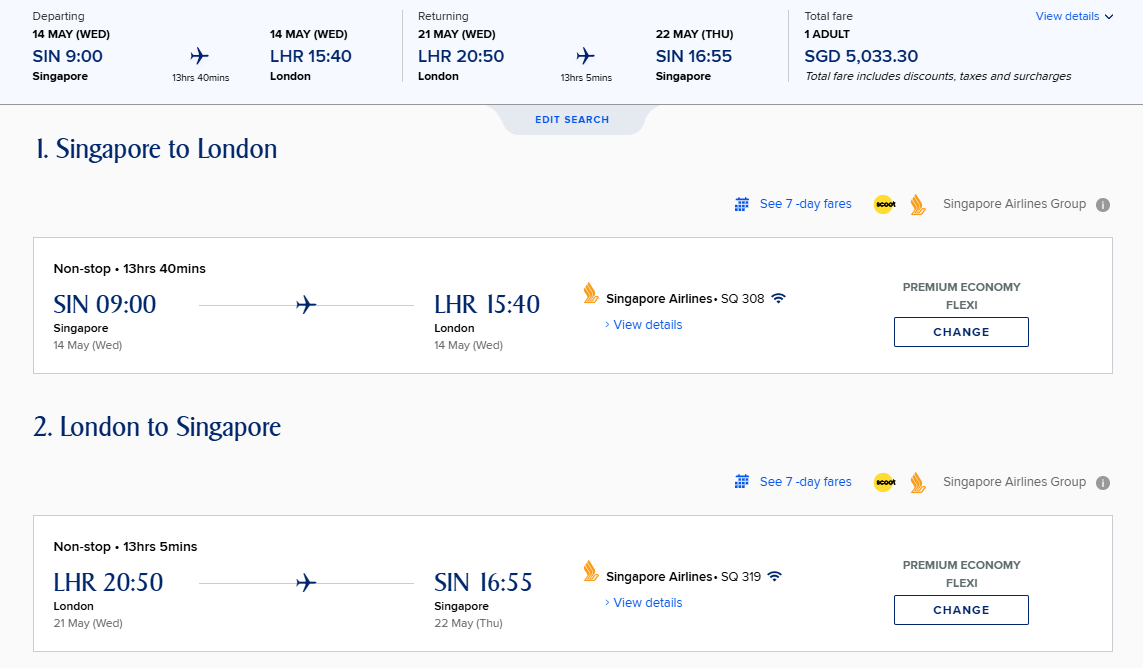

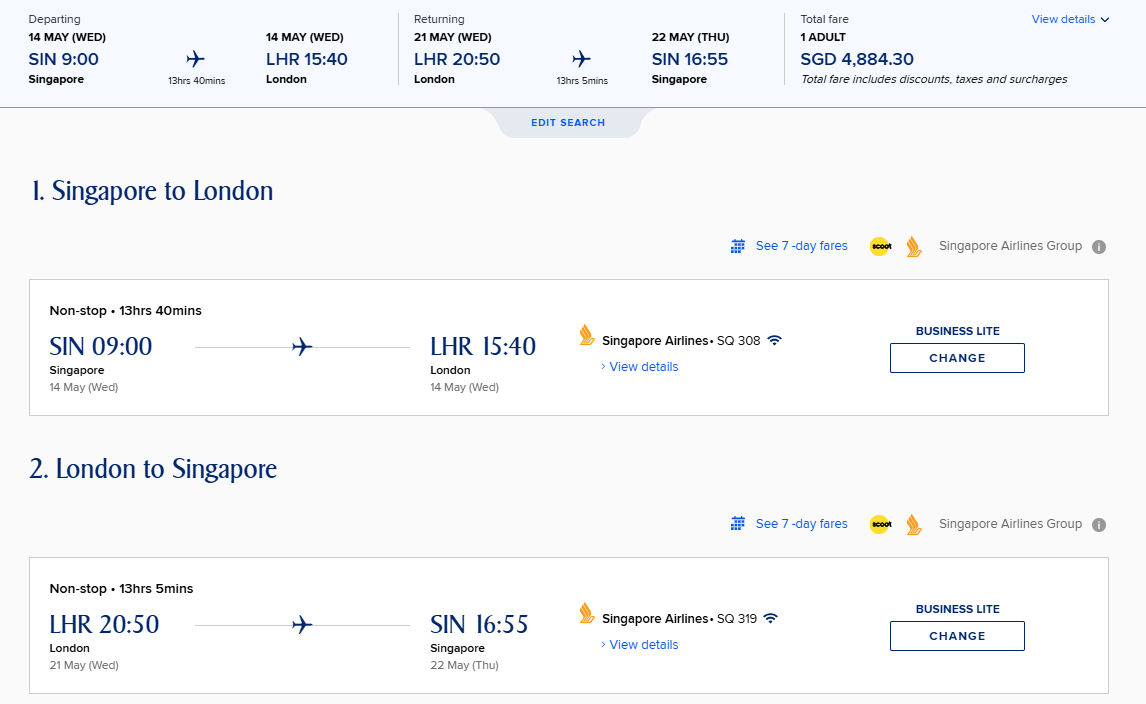

Principal StanChart Beyond Cardholders enjoy complimentary Business Class upgrades, which sounds fantastic on the surface. But when you really dive into the mechanics, you quickly realise this isn’t nearly as attractive as it sounds.

Cardholders who buy 2x Business Class tickets from the Beyond concierge have the option of buying another 1 or 2x Premium Economy Class tickets and having them upgraded to Business Class for free.

- A party of three would need to buy 2x Business Class tickets and 1x Premium Economy Class ticket

- A party of four would need to buy 2x Business Class tickets and 2x Premium Economy Class tickets

- The maximum number of upgraded Premium Economy Class tickets is capped at two, regardless of how many Business Class tickets you buy

Straight away, three problems pop into mind:

- You can’t use the benefit if you’re travelling as a couple, since a minimum of three passengers on the same itinerary is required

- You can’t use the benefit if you’re travelling on an airline that does not offer a Premium Economy product (e.g. Etihad Airways, Qatar Airways, Turkish Airlines)

- You can’t use the benefit if you’re travelling on a route where Premium Economy is not offered (e.g. Singapore Airlines flights to Adelaide, Maldives, Perth, Seoul)

Assuming you can look past this, however, there’s yet another problem. The paid Premium Economy Class ticket(s) must be in the most expensive fare class, otherwise known as unrestricted tickets, while the upgrade can only be to the least expensive Business Class fare, otherwise known as restricted tickets.

Some examples are given below.

| Airline | Least Expensive Fare Class | Most Expensive Fare Class |

| ANA | Super Value | Full Flex |

| Cathay Pacific | Light | Flex |

| Emirates | Special | Flex Plus |

| Singapore Airlines | Lite | Flexi |

Unrestricted Premium Economy Class tickets can be very expensive, and in some cases even more expensive than restricted Business Class tickets. If so, then this benefit is effectively worthless!

It should also be mentioned that if the least expensive Business Class fare is sold out, then the upgrade can’t be used too.

Finally, depending on airline, restricted Business Class fares can come with additional limitations. For example, if you were to upgrade your Emirates Premium Economy ticket to a Business Special fare (the lowest fare class there is), your ticket would have:

- No advance seat selection

- No chauffer service

- No lounge access

So you could end up in an odd situation where some members of your travelling party have lounge access and others don’t.

By the way, Air France, Finnair and KLM also don’t grant lounge access on their cheapest Business Class fares, and Finnair is particularly punitive. Business Light passengers on Finnair also don’t get any checked bags, prior seat assignments, priority check-in, priority security or priority boarding!

This upgrade benefit can be used for up to 2x Premium Economy tickets per membership year.

Airport lounge access

| Benefit |

|

| What you should know |

|

Principal and supplementary StanChart Beyond Cardholders enjoy unlimited Priority Pass lounge visits. There is also a six guest quota, shared among all principal and supplementary cards.

Each principal cardholder is capped at a maximum of four free supplementary cards (which should be plenty, quite frankly).

PP customers used to enjoy unlimited Priority Pass lounge visits with one guest each time, but that was recently cut to 24 visits per year- which I’m sure is a deliberate move to nudge customers towards this card.

Airport limo rides

| Benefit |

|

| What you should know |

|

Principal StanChart Beyond Cardholders belonging to the PB and PP tiers enjoy complimentary airport limo rides as follows:

- PB: 2x rides per calendar year

- PP: 10x rides per calendar year

While I love that no minimum spend is needed to unlock this benefit, and that rides can be used both in Singapore and 100+ overseas cities, there are two important things to highlight.

First, PP customers already enjoy 8x complimentary airport limo rides by virtue of their relationship with the bank, so the real incremental benefit of holding the Beyond is 2x additional rides.

Second, depending on what city you’re in, your actual number of rides may be fewer than 2 or 10. For example, in high-cost locations like Milan or Tokyo where the airport is far from the city, a single airport transfer may cost 2x or more entitlements.

Accor Plus membership

| Benefit |

|

| What you should know |

|

Principal StanChart Beyond Cardholders belonging to the PP tier enjoy a complimentary Accor Plus Explorer Plus membership.

Member benefits include the following:

- 2x Stay Plus certificates, each valid for a one-night free stay at participating hotels

- 10% off best available public rate

- Up to 50% off member exclusive room rates with with Red Hot Room offers

- Up to 50% off dining across 1,400 restaurants in Asia Pacific

- 15% off drinks bill in Asia

- Member exclusive More Escapes stay packages

- Early access to global Accor hotel sales

- Member exclusive experiences

- 20 status nights each year

This is a solid benefit to have, and the only thing I’d point out is that you can get an Accor Plus Explorer membership with lower-cost cards like the AMEX HighFlyer Card (annual fee: S$304.59) or DBS Vantage Card (annual fee: S$599.50).

The only difference between Explorer and Explorer Plus is the number of complimentary Stay Plus certificates (one for Explorer, two for Explorer Plus). All other benefits are the same.

World Elite benefits

| Benefit |

|

| What you should know |

|

Principal and supplementary StanChart Beyond Cardholders enjoy standard World Elite Mastercard benefits, including:

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

It’s an excellent list of perks for sure, but you don’t need a Beyond Card to enjoy them. These are generic World Elite privileges, available to any World Elite cardholder. Some World Elite cards even come with a perpetual fee waiver.

| Card | Annual Fee | Qualification Req. |

Citi Prestige Citi Prestige |

S$545 | Income ≥ S$120K |

Citi Private Client Debit Card Citi Private Client Debit Card |

N/A | Min. AUM S$1.5M |

Citi ULTIMA Citi ULTIMA |

S$4,238 | Income ≥ S$500K |

DCS Imperium DCS Imperium |

S$3,584 | Unknown |

HSBC Premier Mastercard HSBC Premier Mastercard |

S$490.50* |

Min. AUM S$200K |

OCBC Premier World Elite Debit Card OCBC Premier World Elite Debit Card |

N/A | Min. AUM S$350K |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

S$599 | Spend S$45K in 3-month period on UOB Lady’s Solitaire Card |

| *Fee waived so long as min. AUM is maintained |

||

Wildcard: What happens after the first year?

Like I said at the start, it’s clear that Beyond is part of a big push by Standard Chartered for PB and PP customers.

But not just any PB or PP customers. In addition to the requirement to fully fund your account each month with the requisite AUM to enjoy the higher earn rates, there’s another clause in the T&Cs which states that you must carry out at least one eligible investment or eligible deposit each year to retain your benefits.

|

7. In order for a Beyond principal cardholder to continue to be eligible for the programmes, or part thereof, that are specially offered to Beyond principal cardholders who have a Priority Banking, Priority Private or Private Banking relationship with the Bank, i.e. the programmes listed under Clauses 1.1, 1.4, 1.7, the Beyond principal cardholder must carry out at least one (1) Eligible Investment or Eligible Deposit with the Bank within 12 months after the first renewal of the Beyond Card and yearly thereafter. Further details of this requirement will be provided in due course. This requirement will not apply for the first 12 months after the Beyond Card is issued to you. |

This requirement is waived for the first year, and Standard Chartered has not yet specified what these eligible investments or deposits will be. One thing’s for sure though. Whatever they are, they’ll be something that generates money for the bank.

If you fail to meet this requirement, you will not be eligible for the additional benefits accruing to PB or PP customers, namely:

- (PB & PP) The upsized earn rates

- (PB & PP) Airport limo rides

- (PP) Accor Plus Explorer Plus membership

As someone who leans towards low-cost roboinvesting, I don’t particularly relish the requirement to buy overpriced investment or insurance policies.

So is it worth it?

So is the StanChart Beyond Card worth its $1,635 annual fee? Let’s look at the different scenarios.

If you’re a regular customer

If you’re a regular StanChart customer, the Beyond Card offers you:

- 100,000 miles welcome offer

- An uncapped 1.5/3 mpd earn rate

- Birthday meal

- Business Class upgrades

- Unlimited Priority Pass visits for principal cardholder, and up to four supplementary cardholders, plus 6x guests

- Generic World Elite Mastercard benefits

The 100,000 miles could certainly go some way towards covering the first year’s fee, but the S$20,000 minimum spend is a big barrier. If you’re eligible for welcome offers with other banks, that spending could generate a higher return, with lower fees.

The uncapped earn rates are impressive, but they can be equalled by competitors like the DBS Vantage for SGD spend, and bested by Maybank cards where FCY spend is concerned.

If you had a big family, then a total of four unlimited Priority Pass memberships may be appealing- but you could also get the HSBC Visa Infinite for a lot less, which comes with up to five unlimited LoungeKey memberships for supplementary cardholders (though applications are currently closed, as the card prepares for a relaunch).

I personally wouldn’t put much value on the Business Class upgrades, given how restrictive the terms are, and while the birthday meal is nice, it wouldn’t be something that sways my decision either.

So maybe if you don’t qualify for welcome offers with other cards, and maybe if you had a big family, then maybe this would be worth a one year punt.

I’m aware that doesn’t sound like a ringing endorsement, and that’s the point. Unlike the AMEX Platinum Charge, where it’s almost impossible not to come out ahead in the first year (with the current welcome offer that offers a Samsonite bag and S$900 off the annual fee, plus more than S$2,000 in dining, lifestyle and airline credits), this feels a lot more marginal.

If you’re a Priority Banking customer

If you’re a StanChart PB customer, the Beyond Card offers you:

- 100,000 miles welcome offer

- An uncapped 2/3.5 mpd earn rate

- Birthday meal

- Business Class upgrades

- Unlimited Priority Pass visits for principal cardholder, and up to four supplementary cardholders, plus 6x guests

- Generic World Elite Mastercard benefits

- 2x airport limo rides

The incremental benefits over the regular version are improved earn rates, and 2x airport limo rides.

Where earn rates are concerned, an uncapped 2 mpd on SGD spending beats any other competitor, but you’d have to spend a lot in order to generate sufficient miles to put a dent in the annual fee. And keep in mind, the Maybank cards are still better for FCY spending, when you factor in their lower FCY transaction fee, and waivable annual fees.

So again, I find it hard to recommend the Beyond Card to this segment, unless you’re a big spender who doesn’t have any problem hitting the minimum spend for the welcome offer, and spends enough in SGD to make that 2 mpd count.

If you’re a Priority Private customer

If you’re a StanChart PP customer, the Beyond Card offers you:

- 100,000 miles welcome offer

- An uncapped 2/4 mpd earn rate, with 8 mpd for dining

- Birthday meal

- Business Class upgrades

- Unlimited Priority Pass visits for principal cardholder, and up to four supplementary cardholders, plus 6x guests

- Generic World Elite Mastercard benefits

- 10x airport limo rides

- Accor Plus Explorer Plus membership

The incremental benefits over the PB version are improved earn rates, and the Accor Plus Explorer Plus membership.

What about the limo rides? Remember: Standard Chartered already gives you 8x airport limo rides by virtue of being a PP customer. So the Beyond Card basically gives you the same two airport limo rides as a PB customer.

The earn rates for PP customers are head and shoulders above the competition, so if you’re the sort who spends big, especially overseas, then go ahead and get this card. You’ll be minting miles with those uncapped 4/8 mpd rates- though remember you’ll need to keep your AUM above S$1.5M every month!

Just for fun, here’s a math question: How much would you have to spend on overseas dining for the Beyond to be worth it? Well, ignoring all the other card benefits, the figure I have is S$13,625, based on 8 mpd and 1.5 cents per mile (S$13,625 x 8 mpd x 0.015).

But that’s not quite right, because we should only be looking at the incremental earnings that you get from the Beyond Card. Given the next best alternative is an uncapped 3.2 mpd, then we’re talking a 4.8 mpd incremental, and at 1.5 cents per mile you need to spend at least S$22,708 (yes, I know there’s further math to be done regarding StanChart’s 3.5% FCY fee, but I’m going to ignore that).

I’m sure there are folks out there who can easily do several times that, and if you’re one of them then yes, get a Beyond Card, because everything else is just icing on the cake.

Conclusion

The StanChart Beyond Card offers an impressive-sounding list of benefits, but I can’t help but feel that other cards offer equivalent or close to equivalent benefits at a much lower fee.

And once the first year is up and the requirement to buy investment products or make deposits kicks in (for the Priority Banking and Priority Private segment), you have to further weigh whether StanChart is offering compelling enough returns to warrant renewing.

The only group I could recommend this card to are Priority Private whales, who think nothing of spending high five or even six digit figures on their card each month. If that describes you, then the miles you’d generate would easily cover the annual fee, and then some.

So that’s my overall read on the Beyond: it rewards spending more than membership. What I mean by that is that merely holding the card will get you marginal returns at best, relative to the annual fee. If you really want to get your money’s worth, you’ll have to spend, spend, spend, because that’s how you milk the uncapped earn rates of up to 8 mpd.

That’s certainly by design, not accident, and something to carefully consider before pulling the trigger.

Would you take a StanChart Beyond Card?

Would paying taxes with this card through Cardup count towards the $20,000 spending requirement?

Yup, that’s what I wanna know too.

If so then paying taxes is probably the main use of this card

any update on this? does cardup count towards 20000 spending requirement?

First, fantastic article!

Also are there mgmt fees for keeping the $1.5m AUM there?

i dont actually know how Priority Private works. i suppose if you put all your $1.5m in a savings or fixed deposit, there wouldn’t be fees.

I was under the impression that the SCB share custodian accounts do not charge a holding fee even for foreign shares? Anyone knows for sure?

The other thing is the cost of brokerage and share transfers in/out of SCB

Lastly, given that the brokerage business for shares/ETF are relatively low-margin compared to mutual funds and insurance products, it might be that SCB will require purchase of those products instead?

SCB PP Foreign Share custodian cost is very low, same like Citi Private Client, UOB Bank and UOB Kay Hian SG as I had experienced with. There is no cost involved for incoming shares transfer with any banks or brokers mentioned above. For outgoing transfer is also neglectable. Lastly, No need to buy any products if you don’t want, or doesn’t match your investment style or if you don’t think it will make you richer. But sure, it is their job to try to sell you bank products as much and as often as they can. It’s their job and… Read more »

Nope, PPC is just like priority banking. If you don’t trade, invest or buy insurance products, your RM will never call you at all. But you do get a free birthday cake each year!

No, PPC is not like Priority banking. RM is far more respond and quite efficient especially when you are located abroad. Everything can be process within 1-2 days. It gave mr RM very high regards.

Why does my RM need to call? No, Please let us rest in peace. Just continue each other’s jobs and just respond just when we need help. That’s all to it.

And No, Arron. PP don’t spend 5 or six figures a month. That is not a way we achieved PP to begin with.

Pathetic card. Dead on arrival.

Didn’t read the article. I know the answer for sure is no.

StanChart just has a knack for creating “junk cards”

I would take exception to how you present the 10 limo rides for PP, when 8 of them are not related to this card but rather from the Priority VI and PP status. I know you mentioned it but it’s only one time in the text, but the 10 rides is mentioned multiple times. it should be listed as 2, because that’s what the $1600 gets you.

That’s a rather weird thing to take exception to, when I’m the one highlighting it. You should be taking issue with stanchart.

When writing articles like this, it’s important to match things between the webbsite and the article. If I put 2x rides for pp, I will have a whole other set of people asking me whether it’s a typo. So the best thing is to put 10x and explain why that’s inflated.

And I actually mention the caveat three times, if we’re keeping score.

Looking at the write up that Aaron has diligently prepared for our benefit and understanding, it looks liked other cards already have more compelling offers at lower cost. Pay a 4 digit fee or 3.5% forex fee do not exactly make sense if you are value based. All credit cards issuer I am sure have done their sums on the bottom line on cost and benefits. Credit card issuers are now less generous in their offerings as compared to the past. Is the mile game still worth it?

In response to one of the queries, I achieved priority private status by transferring into SCB some shares. The is no charge whether for local or foreign-listed shares. Sometimes I also buy unit trusts on FSMOne (no sales charge but has holding fees) and then transfer to SCB which has no holding fees whether for shares or other investments. If you have investments that you intend to hold long term this is a good option. SCB’s free limousine rides are good because they fetch you from Changi airport to home (costs more with surcharge), not just home to airport like… Read more »

Thanks for the excellent information. It’s makes more sense to achieve the status if we can use shares. And thanks for confirming that there are no custodian holding fees (I suppose that would include NASDAQ-listed shares like Mag7?) One thing you didn’t mention was if there is any charge for transferring out shares? But great information for anyone looking to pick up this card since the only useful case would be for PP, at least for the first year. If SCB requires purchase of high-margin investment products and insurance for subsequent years then it’s probably time to get out (hence… Read more »

PB here. No fees for transfer in but yes there are fees for transferring shares out, presumed would be the same for PP (to lock u in)

SC should hire you.