Last month, I wrote about how ALL Accor+ Explorer was offering a 2,000 ALL points welcome gift for members who signed up by 30 November 2025.

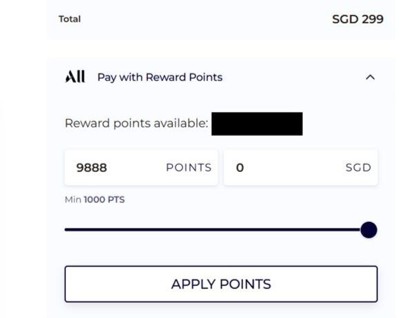

In the article, I also mentioned that members had the option of paying their membership fee with 9,888 ALL points, instead of S$299. However, there have been numerous reports that members are now seeing a charge of 14,000 ALL points, and it does appear that a stealthy devaluation has taken place…

Accor devalues points for ALL Accor+ Explorer purchases

When I first published my article on 16 November 2025, ALL members were able to redeem 9,888 ALL points to cover the ALL Accor+ Explorer membership fee, in lieu of S$299.

S$299 is roughly equivalent to €199, so 9,888 ALL points matches Accor’s standard redemption rate of 2,000 ALL points = €40. This is the same rate offered for offsetting hotel stays, dining, spa treatments and other incidentals.

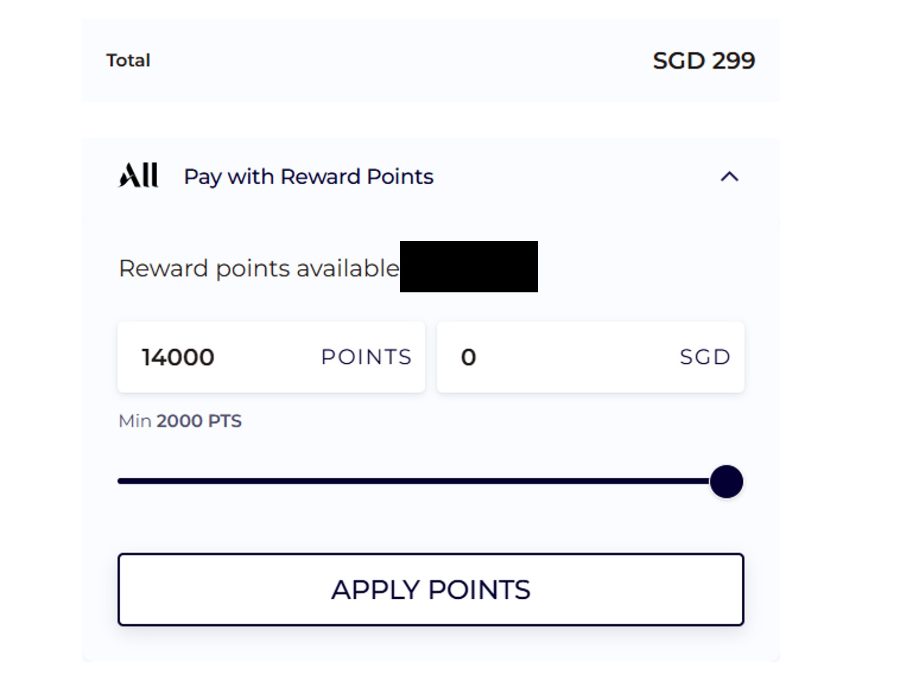

However, Ben in the comments flagged that he was being charged 14,000 ALL points, as of 19 November 2025. I didn’t see this comment initially, but it’s since been highlighted by others in the MileChat.

I can now see that when I attempt to purchase a membership, I’m also being charged 14,000 ALL points.

The new cost would suggest a rate of 2,000 ALL points = €28, or a ~30% devaluation. I’ve reached out to Accor to ask about the change in rate, and will update this post when I get a response.

As a reminder, you can only use ALL points to pay for new memberships, or the renewal of a membership that expired more than 30 days ago.

What card should you use to pay for ALL Accor+ Explorer?

Given the devaluation to ALL point value, I would recommend buying an ALL Accor+ Explorer membership with cash instead.

ALL Accor+ Explorer memberships code as MCC 8699 Membership Organizations (Not Elsewhere Classified). This is not specifically whitelisted by any 4 mpd card, so your best bet is to use a card that offers bonuses for online spending in general.

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Cap of S$1K per s. month |

Unfortunately, the DBS Woman’s World Card excluded MCC 8699 on 1 December 2025.

What does an ALL Accor+ Explorer membership offer?

ALL Accor+ Explorer members enjoy the following privileges:

- 2 Stay Plus free nights across Asia Pacific (buy 1 night, get 1 night free)

- Up to 50% off member exclusive room rates with Red Hot Room offers

- 15% off Accor hotel stays worldwide

- 30% off dining across Asia Pacific for up to 10 pax

- 15% off drinks across Asia Pacific

- 30 status nights each year

The big draw here are the Stay Plus free night certificates, each of which needs to be redeemed in conjunction with a single paid night (the more expensive of the two nights will be free). These supposedly have better availability than the legacy Stay Plus certificates, though it is not last-room availability.

ALL Accor+ Explorer Stay Plus: Has availability really improved?

The 30 status nights is sufficient for Gold status, though you need to moderate your expectations because most of its benefits — including room upgrades, early check-in and late check-out — are subject to availability.

| Status | Status Nights | Status Points |

Silver Silver |

10 | 2,000 (€800 spend) |

Gold Gold |

30 | 7,000 (€2,800 spend) |

Platinum Platinum |

60 | 14,000 (€5,600 spend) |

Diamond Diamond |

N/A | 26,000 (€10,400 spend) |

Given all the changes that have happened during the transition from Accor Plus to ALL Accor+ Explorer, I would strongly encourage you to read the article below to get up to speed.

Which credit cards offer an ALL Accor+ Explorer membership?

There are currently three credit cards in Singapore which offer a complimentary ALL Accor+ Explorer membership.

| Card | Min. Income | Annual Fee |

StanChart Beyond Card StanChart Beyond Card(Priority Private) Apply |

S$200,000 | S$1,635 |

AMEX HighFlyer Card AMEX HighFlyer CardApply |

S$30,000 | S$400 |

DBS Vantage Card DBS Vantage CardApply |

S$120,000 | S$599.50 |

While the StanChart Beyond Card’s annual fee cannot be waived, fee waivers are possible for the AMEX HighFlyer and DBS Vantage Cards.

- AMEX HighFlyer Card annual fee can be waived subject to an internal review that looks at your spending and tenure with American Express

- DBS Vantage Card annual fee can be waived with a minimum spend of S$60,000 in a membership year (though this will not be possible after 1 August 2026)

However, unlike the DBS Vantage Card, if your annual fee is waived for the AMEX HighFlyer Card, your ALL Accor+ Explorer membership will not be renewed.

Conclusion

If you plan to use ALL points to cover the cost of an ALL Accor+ Explorer membership, you should know that Accor has devalued the rate by almost 30%, compared to its standard redemption rate of 2,000 points = €40.

I certainly hope this doesn’t point towards a broader devaluation of ALL points in general, and for what it’s worth, I’m still able to offset hotel rooms at the standard redemption rate.

The worst part about this is that it was devaluation by stealth. So it begs the question should we use our Accor balances for hotel bookings now? Or risk finding at some point in the future you are suddenly getting 30% less there as well……….