At some point, everyone’s probably found themselves short of the miles required for a redemption (well, except this guy).

In that case, you might turn to some quick and instant ways of topping up a KrisFlyer account, such as transferring HSBC Rewards Points, shopping at a Kris+ merchant, or converting LinkPoints. But what if that’s still not enough to reach your goal?

While I generally advocate earning miles as a by-product of spending instead of buying them outright, there are situations where purchasing miles can actually make sense. In this post, we’ll look at how you can buy KrisFlyer miles for your next trip— legitimately.

How do I know if a source is legitimate?

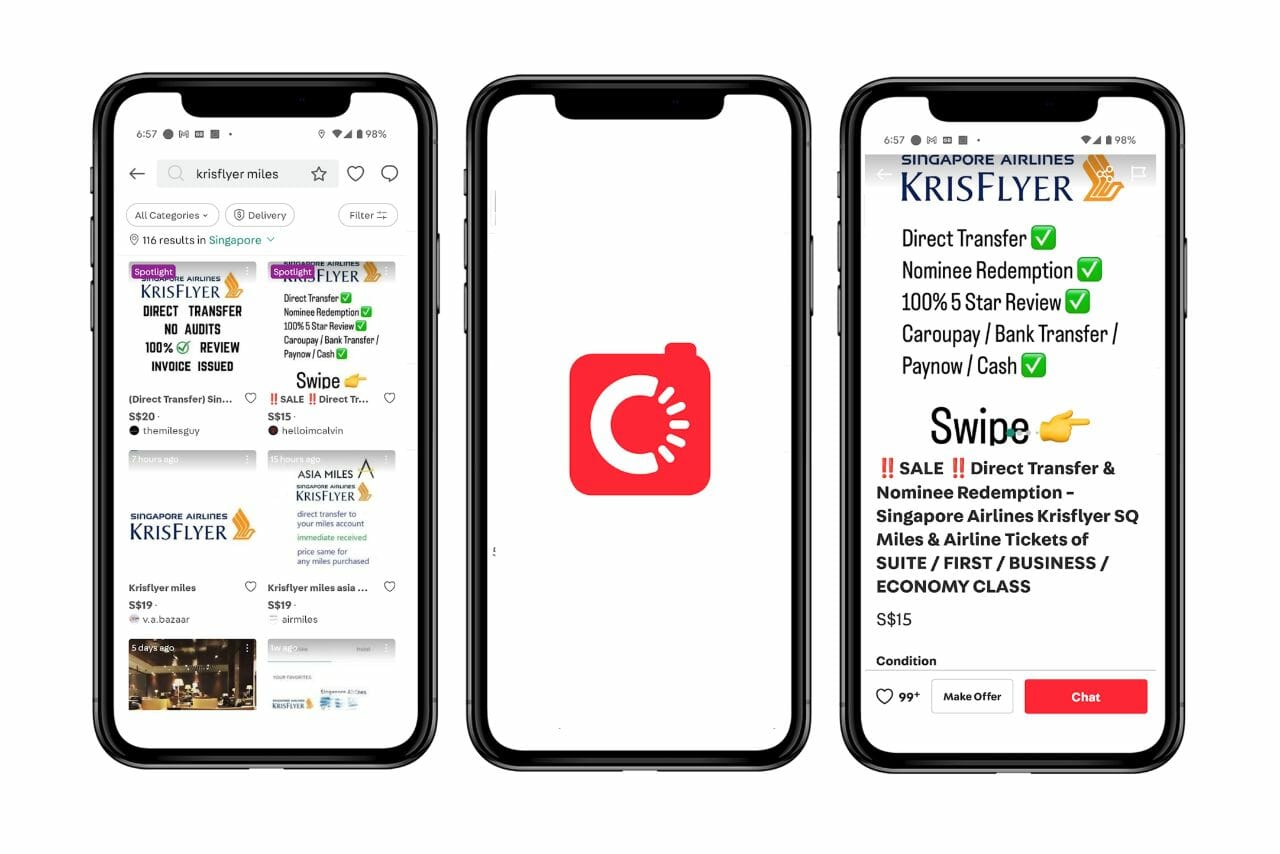

Yes, I said “legitimately”. It may shock you to know that there exist certain less-than-reputable sources which will sell you bootleg miles.

Buying miles from illegitimate sources is unwise, to put it mildly. Not only do you run the risk of getting scammed, even if the transaction goes off without a hitch, KrisFlyer can and does perform account audits. If you’re discovered, your account will be shut down, all your miles confiscated, and all your outstanding award tickets cancelled. Don’t risk it.

How do you know if a given source of miles is legitimate?

The simple answer is to check whether it’s featured on KrisFlyer’s partner list. At the time of writing, more than 200 banks, hotels, car rental companies, loyalty programmes and retail partners have the right to issue KrisFlyer miles. Anything that does not appear on this list is probably not above board. So, for example, you shouldn’t be buying KrisFlyer miles from a random dude on Carousell!

I should also clarify that even though we talk about “buying KrisFlyer miles”, most of these partners will not sell you KrisFlyer miles directly.

- In some cases, you’ll earn KrisFlyer miles as a by-product of your spending, such as signing up for a magazine subscription, or purchasing an electricity plan with PacificLight.

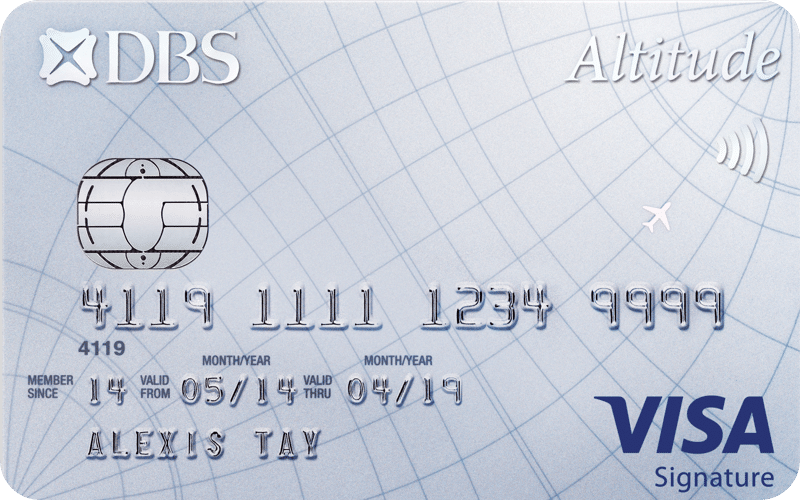

- Other times, the partner may sell you its own points currency, which can then be converted into KrisFlyer miles (for example, by paying the annual fee on my DBS Altitude Card I receive 5,000 DBS Points, which can be converted into 10,000 KrisFlyer miles).

And finally, even if a given source is legitimate, there can be illegitimate ways of going about things. For example, banks are a legitimate source of miles, but manufactured spending (where you artificially spend on cash-equivalent instruments for the sole purpose of generating credit card rewards) is going to land you in trouble eventually.

The methods I’m listing below may not be the most exciting, but they’ll all let you sleep soundly at night.

| ⚠️ Important Note |

| In this article I’m only talking about ways of buying miles, i.e. paying for them out of pocket. There are other ways to earn miles quickly such as spending on Kris+, but since that doesn’t involve an explicit cost I’m not mentioning them here. |

(1) Bill payment platforms

|

|

| Price | From 0.95 cents |

| Pros |

|

| Cons |

|

If you have bills to pay, then bill payment services consistently offer the cheapest way of buying miles in Singapore.

These platforms work in two main ways.

Platform makes payment on your behalf (CardUp, Citi PayAll, SC EasyBill)

Under the first model, the platform charges your credit card for the amount due, plus an administrative fee. It then performs a bank transfer to the recipient on your behalf (there is no need for the recipient to be registered with the platform).

Here’s an example of a S$5,000 rental payment made through CardUp with a UOB PRVI Miles Visa, using the ongoing 1.83% promotion for rental.

- CardUp charges my UOB PRVI Miles Visa for S$5,091.50 (S$5,000 + 1.83% fee)

- CardUp sends S$5,000 to my landlord

- I earn 7,128 miles from the transaction (S$5,091.50 @ 1.4 mpd, ignoring rounding)

- Cost per mile= S$91.50 fee/7,128 miles= 1.28 cents

Platform transfers you money, and you make payment (SC Tax Payment Facility, UOB Payment Facility)

Under the second model, the platform charges your credit card for the amount due, plus an administrative fee. It then transfers the amount due to your bank account, and you make the payment yourself.

Here’s an example of a S$10,000 income tax bill paid through the SC Tax Payment Facility with a StanChart Beyond Card (Priority Banking/Priority Private version):

- Standard Chartered charges my StanChart Beyond Card for S$10,190 (S$10,000 + 1.9% fee)

- Standard Chartered transfers S$10,000 to my designated bank account

- I use the S$10,000 to pay IRAS myself

- I earn 20,000 miles from the transaction (S$20,000 @ 1 mpd; unlike the CardUp example, you don’t earn miles on the admin fee)

- Cost per mile= S$190 fee/20,000 miles = 0.95 cents

When comparing platforms, don’t make the mistake of only looking at admin fees. That’s just half the picture; you also need the earn rates to calculate the all-important cost per mile.

For example, the UOB Payment Facility has an admin fee of 1.7-2.2%, but the earn rate is a flat 1 mpd. So even though Citi PayAll has a higher admin fee of 2.6%, it can come out cheaper in some cases because the earn rates on Citi cards range from 1.2-1.6 mpd.

The drawback is that you actually need a bill of some sort to pay (with the exception of the no-questions-asked UOB Payment Facility). For example, if you want to pay income tax with CardUp, you must submit your NOA. Documentation requirements vary by platform — Citi PayAll is noticeably lax about this — but you still need to be prepared to justify the payment if questioned. In other words, the payment needs some real economic substance behind it; you can’t just pay yourself!

That said, it’s very rare that someone doesn’t have bills to pay. Between insurance premiums, tuition fees, utilities bills, income or corporate taxes, renovations, membership fees, MCST or town council fees, there are plenty of avenues for using bill payment platforms.

Also, do note that you’re still capped by your credit limit. For example, if the credit limit on your card is S$15,000, you can’t pay a bill larger than S$15,000, unless you “prepay” a balance on your card account first.

(2) Credit card annual fees

|

|

| Price | From 1.42 cents |

| Pros |

|

| Cons |

|

Many general spending cards offer miles in exchange for paying the annual fee. This allows cardholders to buy miles on an annual basis.

| 💳 Miles awarded for annual fee payment |

|||

| Card | Annual Fee | Miles | CPM |

HSBC TravelOne HSBC TravelOneApply |

S$196.20 | 12K | 1.63¢ |

StanChart Visa Infinite StanChart Visa InfiniteApply |

S$599.50 | 35K 1st Year Only |

1.71¢ |

Citi PremierMiles Citi PremierMilesApply |

S$196.20 | 10K | 1.96¢ |

DBS Altitude AMEX DBS Altitude AMEXApply |

S$196.20 | 10K | 1.96¢ |

DBS Altitude Visa DBS Altitude VisaApply |

S$196.20 | 10K | 1.96¢ |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

S$196.20 | 10K | 1.96¢ |

OCBC 90°N MC OCBC 90°N MCApply |

S$196.20 | 10K | 1.96¢ |

OCBC 90°N Visa OCBC 90°N VisaApply |

S$196.20 | 10K | 1.96¢ |

StanChart Journey StanChart JourneyApply |

S$196.20 | 10K |

1.96¢ |

Citi Prestige Citi PrestigeApply |

S$651.82 | 32K | 2.04¢ |

DBS Vantage DBS VantageApply |

S$599.50 | 25K | 2.40¢ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

S$654 | 25K | 2.62¢ |

DCS Imperium DCS ImperiumApply |

S$1,294.92 | 40K | 3.24¢ |

DBS Insignia DBS InsigniaApply |

S$3,270 | 100K | 3.27¢ |

OCBC VOYAGE OCBC VOYAGEApply |

S$498 | 15K | 3.32¢ |

UOB Reserve UOB ReserveApply |

S$3,924 | 100K | 3.92¢ |

AMEX HighFlyer Card AMEX HighFlyer Card Apply |

S$400 | 6K | 6.67¢ |

While this can help to top-up your mileage account, you can only take advantage of it once a year, and only in the month your card is due for renewal. If you need the miles now, but your card is only due for renewal six months down the line, you can’t call up the bank and ask to pay early (what a model customer you are)!

Frequency and timing issues aside, you’ll also notice the prices here aren’t nearly as good as bill payment services. With some exceptions, the average price for mass-market cards like the Citi PremierMiles Card or DBS Altitude Card is 1.96 cents per mile. This is significantly higher than the prices offered through bill payment platforms.

For a full rundown of this topic, refer to the post below.

(3) Buying Marriott Bonvoy points

|

|

| Price | From 2.7 cents per mile (based on a 40% bonus) |

| Pros |

|

| Cons |

|

Marriott Bonvoy runs periodic points sales throughout the year, offering targeted bonuses that run as high as 40%.

Assuming a 40% discount, you’re paying 0.89 US cents per point. Marriott Bonvoy points can be transferred to KrisFlyer miles at a rate of 3 points = 1 mile, with a 5,000 miles bonus for every 60,000 points transferred (i.e. 60,000 points = 25,000 miles).

Do the math, and this works out to paying US$534 for 25,000 miles, or 2.70 SG cents per mile. That’s not cheap, and remember, it’s already a best-case scenario. If you need the points during a period where there’s no sale, or where your targeted bonus is smaller, then the price can go up significantly.

Moreover, given how easy it is to earn KrisFlyer miles in Singapore, if I were to convert Bonvoy points to miles, I’d much rather pick more “exotic” programmes with other sweet spots.

You could also buy and convert Hilton Honors or IHG One Rewards points to miles, but the conversion rates are so poor it is almost never worth it.

(4) Buying from Singapore Airlines

|

|

| Price | 5 cents per mile (US$40 per 1,000 miles) |

| Pros |

|

| Cons |

|

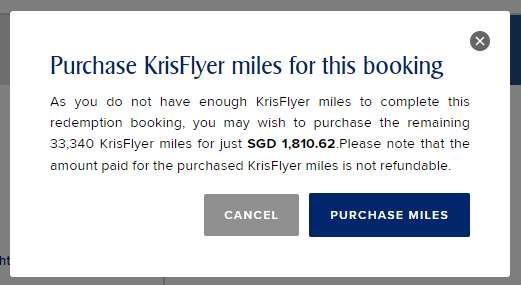

While other airlines like Alaska, British Airways and United run a roaring trade selling their miles at discounted prices throughout the year, Singapore Airlines has chosen not to go down that path. That said, you can buy miles from SIA, though the price is so exorbitant that this should only be seen as a last resort!

KrisFlyer members who have at least 50% of the miles required for an award ticket may purchase the remaining balance from SIA during the booking process. The offer will be made automatically if your itinerary is eligible, and miles are awarded instantly.

| ❓ What if I cancel my award? |

|

SIA’s physical miles top-up request form (thankfully, you don’t ever need to use this if you book your ticket online!) contains the following line: “In the event that miles from a completely unused award ticket are redeposited into a member’s account, any purchased miles will not be refunded.” This has led some to conclude that any purchased miles will simply vanish. Thankfully, this is untrue. SIA has confirmed that the cash paid for the miles will not be refunded, but the miles themselves will be refunded to the member’s account as per normal. |

What’s the catch? The price. Singapore Airlines charges a jaw-dropping US$40 per 1,000 miles, or approximately 5 cents per mile at the time of writing. Given the cheaper alternatives we’ve covered here, why would you even consider it?

Well, I can think of two reasons:

- Purchased miles are available for use instantly. If you were to buy miles via bill payment platforms or annual fees, there would be a time lag for the points to be credited to your account, then a further time lag for them to be converted to miles. In that period, the award seats you’ve been eyeing may have disappeared

- If you’re just shy of a small number of miles, then it might be acceptable to purchase miles to get yourself over the finish line. But keep in mind we’d be talking about very small amounts, perhaps no more than 5,000 or 6,000 miles (everyone will have a different threshold, of course)- and in that case, perhaps buying vouchers on Kris+ might be a better option

I mean, it’s a terribly expensive price to pay, but if you want the flight badly enough…

Other ways of getting miles?

Given the time lag involved with earning miles from bill payment services and credit card annual fees, the unpredictability of Bonvoy points sales, and the hefty price of buying miles directly from SIA, it’s probably better you don’t find yourself in this situation in the first place.

For those who need a quick way of topping up KrisFlyer miles on standby, I’d recommend planning your spending around the options mentioned in the post below.

Conclusion

If you find yourself short of the miles required for a redemption, the good news is that you can buy them through legitimate channels at competitive rates.

The best option by far would be to rely on bill payment services such as CardUp and Citi PayAll, although you can also pay your credit card’s annual fee (albeit at a much less competitive rate). And finally, there’s always the option of buying miles via Marriott Bonvoy or from Singapore Airlines during the booking process, but this is highly inadvisable unless you’re truly desperate.

Any other ways to legitimately buy miles?

(Cover Photo: Plane’s Portrait Aviation Media)

Kris+ ?

doesnt it make sense to sort out the various methods by cost? or time to credit?

Aiya, simple solution…buy airline tickets directly lor.

oh ok. then no point you read this blog then. no need points. just buy direct.

Another super low cost way: apply new credit card that offering miles and maximise the welcome offer

grey areas still the best way to buy miles.. just have to weigh risk and reward

there are still legitimate manufactured spending ways but nobody is going to share them as these will be shut down asap.