The BOC Elite Miles World Mastercard is shaking up the miles game in Singapore, and in a good way.

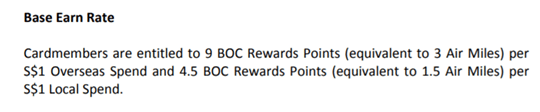

The card was announced barely a week ago, but given its outstanding earning rates (2/5 mpd on local/overseas spending until the end of the year, 1.5/3 mpd after, no minimum spend or cap), the impending end of the Citibank-Apple Pay 20X promotion and OCBC’s early termination of its 10X Titanium Rewards mobile payments promotion, the BOC Elite Miles World Mastercard is poised to become the new must-have card for miles chasers in Singapore.

Milelion readers had some questions about specific features of the card that weren’t made clear in the launch materials. Today I had a lunch meeting with the team responsible for the BOC Elite Miles card, and I’m pleased to tell you that most of the potential concerns are unfounded.

Here’s what I managed to confirm:

30,000 BOC points convert to 10,000 KrisFlyer miles

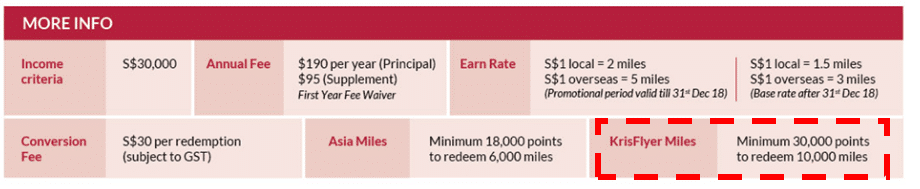

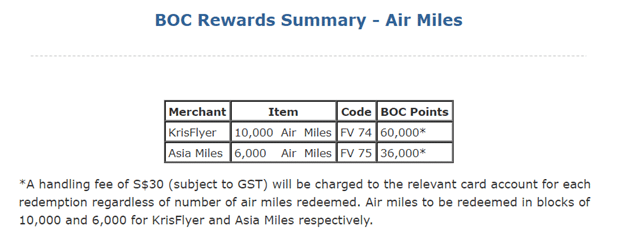

One point of confusion is that the publicity materials for the BOC Elite Miles World Mastercard state that it takes 30,000 BOC points to redeem 10,000 KrisFlyer miles…

…but the BOC webpage gives a ratio of 60,000 BOC points to 10,000 miles.

The reason for the discrepancy is that BOC has another points earning card: the Zaobao credit card. In addition to cashback, the Zaobao card earns 2X BOC rewards points for every S$1 spent overseas and 1X BOC rewards point for every S$1 spent locally. These points are converted to KrisFlyer miles at a 60,000:10,000 ratio.

The points from the BOC Elite Miles World Mastercard will convert at a 30,000:10,000 ratio. The Singapore team is working with the webmasters to get the page updated and add this clarification.

BOC Points do not pool across cards

I really don’t see this as an issue, given that the only other BOC card that earns points is the Zaobao card. But in any case, a natural consequence of the preferential conversion rate extended to the BOC Elite Miles World Mastercard (see above) is that you can’t combine points earned on this card with those from the Zaobao card.

Every cent earns you points

I thought the T&Cs already made this abundantly clear, but perhaps UOB’s rounding habits are putting paranoia into everyone. BOC does not round down transactions to the nearest $5 when awarding points.

Technically speaking, even cents count towards points accrual- for example, if you spend $10.53 on local spending, you earn 10.53*6=63.18 BOC points, or 21 miles. Your statement will show a rounded down figure of 63 BOC points, but the 0.18 additional is still captured on the BOC side. That’s pretty impressive.

Overseas spending is defined as any spending in FCY

There were some concerns about how BOC would define overseas spending- would it be as straightforward as any foreign currency denominated transaction, or would it require the transaction to be physically outside of Singapore? Would they bring in UOB-style payment processor location requirements?

The good news is they’re keeping it simple. So long as your spending is not in SGD, it counts as overseas and earns 5.0 mpd until 31 December 2018.

Spending on the BOC Elite Miles World Mastercard will count towards SmartSaver bonus interest

The BOC SmartSaver account allows you to earn up to 3.55% p.a interest when you credit your salary, make 3 bill payments and spend on BOC credit cards.

| Amount of Salary | Bonus Interest Rate (p.a.) |

|---|---|

| S$6,000 and above | 1.20% |

| S$2,000 – < S$6,000 | 0.80% |

| Monthly CC Spend | Bonus Interest Rate (p.a.) |

|---|---|

| S$1,500 and above | 1.60% |

| S$500 – < S$1,500 | 0.80% |

Spending on the BOC Elite Miles World Mastercard will count towards the monthly spending requirement for earning 0.8/1.6% bonus interest. This, intriguingly, would make the BOC SmartSaver the new best savings account for miles chasers.

Yes, you do earn 2.0 mpd on insurance payments and public transport (ABT)

There are some exclusion categories listed under the Elite Miles World Mastercard’s T&Cs which do not earn points.

Interest, annual fee, cash advance, fund transfer, balance transfer, finance charge, late charge, any purchase made through an Instalment Payment Plan or Purchase Instalment Plan, a Tax Payment Facility, IRAS processing fee, goods and services tax, loading of a prepaid account, card or merchant (including EZ-Link and TransitLink), an AXS payment, a bill payment via internet banking or any fee charged by the Bank or any other third party (if any) and such other transaction as may be determined by the Bank from time to time at its sole and absolute discretion.

You’ll note that insurance isn’t listed as an exclusion category, and that’s no accident. The BOC Elite Miles World Mastercard will earn points for insurance payments, wherever credit cards are accepted. In fact, the BOC team happily volunteered this information- they know that most banks exclude insurance from earning points, and they see that a a way of differentiating themselves.

What’s also cool is that you will earn points on public transportation rides paid through Paypass and ABT. Remember: this is different from loading your EZ-Link card with your credit card (which won’t earn any points with the BOC Elite Miles card). ABT means registering your Paypass-enabled Mastercard and using it to tap in and out of gantries.

The best card for this currently is the UOB PRVI Miles at 1.4 mpd (you could link your EZ-Reload account to your HSBC Revolution for 2 mpd but this is capped at $200 per month), so it’s good to have a better option available.

BOC has no plans to get on board with Apple, Samsung or Google Pay

BOC does not intend to get its cards on board with any of the big 3 mobile wallets, so if you’re hoping for the convenience of adding your BOC Elite Miles World Mastercard to your mobile phone, you’re going to be disappointed. China has always taken its own approach towards mobile payments anyway, so it wouldn’t surprise me to see BOC doing something similar .

You can view your points online, but you can’t redeem them online (yet)

It’s no secret that BOC’s IT setup in Singapore lags behind that of other major banks, and it follows that you can’t expect the same level of sophistication you’re used to elsewhere.

You’ll be able to see the total points earned on your BOC Elite Miles World Mastercard online. It’s on BOC’s IT roadmap to eventually add online points redemption, but until that happens (don’t expect it before the end of year), you’re going to have to call up customer service or fill out a form to get your points transferred to your frequent flyer account.

No transaction-level points breakdowns available online

As a follow on from the previous point, the relative simplicity of BOC’s internet banking interface means that Citibank style transaction-by-transaction level points breakdowns won’t be available.

In a sense, this isn’t so much an issue with the BOC Elite Miles World Mastercard because of its positioning as a general spending card- so long as it’s a qualifying transaction, you’ll earn the points. Contrast this with a category spending card, where the eternal question of “is the MCC what I think it is?” won’t get answered until the time the points are credited.

If you really want to, you can get a points level breakdown by calling up customer service.

BOC is looking for ways to reduce application processing time

Those of you who went down to the BOC roadshows will have been told by the card promoters to expect processing times of up to 1 month. In a market where banks boast about same day card delivery, 1 month seems like an eternity. The team is aware of this and is hoping to scale up their ability to deliver more cards, faster, but for now they’re erring on the “under promise and over deliver” side.

We should expect to see processing times come down over the next few months.

Conclusion

I applied for the card on the day it launched and am eagerly waiting for it to arrive. My plan is to put it into service after 4 August, and use the card liberally on my trips overseas (a 2.5% fee for 5 mpd is a no brainer in my book).

If you have other points you’d like clarified with the team, do leave a comment here and I’ll see what I can do.

And yes, I’ve already made our feelings on the free luggage clear.

Anyone knows if they have any ongoing roadshows?

Thanks Aaron, awesome FAQ!

Any sign up promotion for now? Or in the near future?

“We’ll see”

Should we wait for your affiliate commission link or just sign up straight with BOC?

If you need it urgently, sign up. If you can wait, wait. If nothing else, the sign up gift may be swapped out

Awesome, Aaron.. ????

Hey Aaron, thanks for confirming the insurance and transportation points. Are you able to also check if donations to charity/non profit organizations will also earn points? Thanks in advance!

Yes same qn!

Not to mention, cardup……

Yes, we’ve confirmed with the BOC team that CardUp spend does earn 2mpd til 31 Dec 2018, and 1.5mpd thereafter!

Hi cardup team, you haven’t sent out any promotion rate using your service for long time. however, ipaymy has good discount rate now. maybe u should match or offer lower rate to attract users.

What are your feelings on the free luggage?

It is paypass, not masterpass. Masterpass is a different product.

thanks, fixed

what is the validity of the points earned?

Free luggage does not apply to exiting BOC cardholders!

don’t worry, you can have mine.

???

I think the actual prop luggages used in the original 上海滩 with chow yun fat look even better. “vintage” luggage oh gosh.

Hello Aaron, Is this mean the insurance premium payment in FCY will give you 5mpd?

Yes

Hi Aaron, incredible write-up, as always, but can u help clarify if cashcard topping up comes under the same “no mile acrual” rule as EZ link cards, or will we still get the same miles for a cashcars top-up?

Thanx!

This would clearly be an exclusion category

Thanks for this article! I submitted my application at the Collyer Quay branch today. And urgently need the card for a long overseas trip in 2 weeks. Any advice on how to speed up the approval process?

reading the article is key to success

Best answer ever. LOL

Thanks Aaron! Correct me if i am wrong, i just checked that BOC Elite Miles World Mastercard will not earn points for GE life insurance payments, as it will be considered as bill payments via internet banking.

yes, that’s an exclusion. i dont know how the payment interface looks like for that though.

Thank, Aaron. I am not sure either but there will be many trying to pay their GE life insurance premium via BOC to earn points. I have tonnes of payments to make too but looks like Cardup will be the option now.

hi there. why would GE life insurance payments be considered bill payments via internet banking. i normally just give my card number to my insurance agent

Credit card payment is available for selected products only ie accident and health plans. Don’t think its applicable for life policies. Let us know if it’s possible.

Hi Aaron, any idea if the 2mpd will be applicable for paying school fees? I’m looking to take up my masters at SMU so that’s going to be a huge spending.

Aaron why are people treating you like you’re the CSO from BOC and asking you all sorts of questions which should have been rightly directed to BOC? And making this comment section as a FAQ for the card?

What are your thoughts about being treated this way and the site turning this way?

I personally feel your kindness is being taken for granted.

EXACTLY. I thought I was the only one who was thinking that way. There is a ton of flatware lovers prowling this site and thinking that Aaron owes them a living/an answer/a particular way of life/a chiobu/etc.

If I were the milelion, I’d have them all for lunch, dinner, and then some. But of course, the milelion is unlike any other lion. =D

Aaron should have a premium service where he charges $5 per answer.

That’s actually a very good suggestion. Will sieve out the freeloaders for sure.

I guess it was a sumptuous free lunch from BOC in exchange for another article (unfortunately skewed) just within a week!

Customers need to wait for 1 month for a card to be processed and there’s no issues with that?

BTW the free luggage looks oddly similar to the one my wife got from thomson medical. haha!

https://www.thomsonmedical.com/confinement-essentials/

I had the roast chicken. It was quite dry.

If you have an issue with the waiting time, don’t apply for it.

If you have an issue with the article, don’t read it.

If you have an issue, don’t use the keyboard.

Ty Aaron and team. You guys are the reason why I could bring my family to HKG on SQ Biz on A380 this May. Appreciate you big time digging up precious info and putting them in here.

Awesome tribute! ????

And you do deserve it, Aaron..?

Thanks for the clarity Aaron! Any idea about the validity of the BOC points earned?

Have you read his original article on this card?

I just did! Thanks Ben

missed the road show, where can i sign up now ?

found the forms on the FB ..

Doesn’t the PDF form have a Postage Paid side???

Hi Aaron, is the plaza premium lounge offer good for 4 x a year one off, or every year

Anyone received the card yet??

Signed up at the roadshow 2 weeks ago and have not received the card too.

Hi Belle,

Have you receive the card? I waited for 3 months and 1 week, have not received. wrote to BOC, their reply is many application and it takes longer than usual. Kindly advise whether did you receive the card

@ben and few others. I like milelion and am sure he is a great guy. He does not owe an answer to every question sure. But don’t kid yourself- he benefits from every visit and every comment. Those chiding the commentors for their questions, i invite you to count the number of ads as you scroll down the pages. You don’t have to shout down every dumb questions.

Seriously I agree with you!

[…] However, banks have started offering bigger incentives for customers to whip out their plastic when on the road. Most general spending miles cards offer an enhanced earn rate for overseas currency transactions, which can be as high as 5 miles per dollar in certain cases. […]

Great product, lousy bank. That’s my conclusion about this product. I tried online application – can’t find form. I called BOC, said will mail form, nothing has happened after more than a week. Action speaks louder than words. If this is how you court potential customers, wonder how you will treat existing customers. Waste of time.

I even got a PRC officer when I chose English as language option. Guy couldn’t speak English properly, and couldn’t understand me at all. What a joke. It looks like the quality of their customer service is similar to the quality of their free luggage. For a bank to be incapable of even putting up a product page for a card which has been launched for more than a month now is shocking. Imagine if one had real problems with the account and needed help. I suspect the waiting time for customer service to respond would be two months. I… Read more »

Hi there, read through the article but didn’t see anything related to expiry of the points. Is there an expiry for the miles collected/points collected with this card?

Edit: I think its stated that it expires within a year. That’s pretty fast! Might have to give this card a miss…

[…] BOC Elite Miles World Mastercard– 5.0 mpd, no cap […]

Processing time of 1 month appearing to be more of an over-promise than under at this stage!

Maybe if one slipped in a personal note from Comrade Xi in the application, you would see the card hand-delivered to you within an hour.

based on the comments in the telegram group i’m inclined to agree. shame- great product, but the speed of processing is doing them no favors at all.

Indeed a shame.. for having being able to come up with a great promo, but unable to process applications in a timely fashion so people are able to enjoy the benefits of the promo.. and in doing so, causing much frustration to those who did sign up.. And maybe funnier still, is that yesterday I saw a counter outside a Sheng Siong, manned by one or two people, peddling their Sheng Siong Card.. wanting to add more applications to a pile that they’re already having trouble clearing? I do wonder.. since their roadshow.. just how many people have gotten their… Read more »

What if they are delaying the application intending to deliver only in December so very few can enjoy the 5mpd offer….hmmm. It

never attribute to malice that which can be explained by incompetence.

Hear hear. Just look across the North Atlantic to find the finest example.

[…] spending card would earn you between 1.2-1.4 mpd (not to mention the 2.0 mpd of the just-launched BOC Elite Miles World Mastercard…). But then again, any general spending card doesn’t come with half the benefits The […]

If i were to link my BOC elite card to paypal and make an online purchase in USD, would I still get the 5 miles credited to me? The website only allows payment via paypal.

According to BOC, they have no exclusions or restrictions (for now/ until 31 Dec 2018).. they only look at whether the charge is in S$, local spend, or FX, Foreign Spend.. That’s what BOC agent on phone told me..

[…] spending now? That’s undoubtedly the BOC Elite Miles World Mastercard, which gives you 5 mpd on overseas spending until 31 December 2018, without cap, for a 2.5% foreign currency transaction […]

[…] BOC Elite Miles World Mastercard– 5.0 mpd, no cap […]

Gosh, I submitted my application on 3 Aug and I’ve yet to receive the card (more than 2 months!). Multiple calls to the service centre and the response was always the same – “no status”. Wondering if anyone else is facing the same problem?

Mine took a coupla days shy of 90 days.. my suggestion is to not even look out or long for it.. if it comes, it comes.. makes your life a whole lot less frustrating.. ?

Hi, I saw that the exclusion for miles calculation include AXS payment. But nowadays AXS payment is being used for many other services, such as insurance. So if I pay my insurance via the AXS app or machine, will I get my miles points?

Thanks for the write-up!

Here’s my experience with this card. Applied on 2 August, received the card on 22 October. For anybody applying the card, you should really expect the processing time of almost 3 months, or even more.

But I really want to point out the lack of convenience as compared to other banks. For example, applying for internet banking needs to be in person, and you must create two sets of logins to use internet banking for desktop and on mobile.

Otherwise using the card is like using any other cards.

[…] BOC Elite Miles World Mastercard– 5.0 mpd, no cap […]

[…] head and shoulders above what we can get in Singapore (well, BOC Elite Miles card […]

[…] upsized miles for foreign currency spending, your best bet until 31 December is still to go for the BOC Elite Miles World Mastercard, and pray that it reaches you before year […]

Aaron,

May I check if I pay my insurance premiums and Singtel bills … via SAM online or ASX online, would it be awarded with points?

My experience after 4 months of use:

1) Base points given have been accurate to the last digit, save for one oddity (see #2 below).

2) I made a FCY spend that was apparently processed in Singapore (Cebu Pacific ticket purchased online, priced in PHP), but I was given only 4.5 points. Not a big amount (<SGD50), so not going to waste my time calling them up about it.

3) Bonus points have yet to post for spend over 4+ months old. I'm already in my 5th billing cycle…..

Seen your post on HWZ, same here Oct spending bonus points still not posted yet.