| Looking for the 2020 edition of this post? It’s now ready…go here to find out how to earn miles on your 2020 income tax bill |

It’s the most wonderful time of the year once more- tax season, where we all render to Caesar in the name of nation (and miles) building.

Individuals with income tax obligations will need to file their taxes between 1 March and 18 April 2019. You’ll subsequently receive your tax bill (NOA) between the end of April and September 2019. IRAS sends NOAs in batches, so don’t feel left out if everyone else gets theirs before you do.

Although IRAS does not directly accept credit cards for income tax payments, there are several third-party options that enable you to do this. In this guide, we’ll compare the options available and the relative cost of buying miles through each.

How do I pay my tax bill with a credit card?

Bank payment facilities

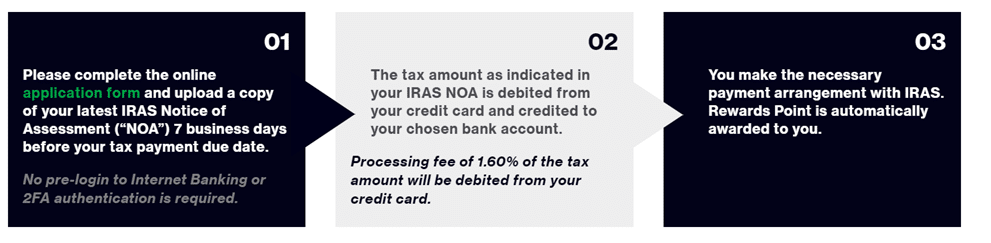

Certain banks allow cardholders to charge income tax bills to their credit cards, and earn points in exchange for a small processing fee.

The following banks currently offer tax payment facilities for selected cards:

*UOB technically doesn’t offer a tax payment facility, but there’s no reason why you can’t use PRVI Pay to achieve the same end

There are minor differences in the process for each bank, but the generalized flow is:

- You complete an application form and provide the bank with a copy of your NOA

- The bank approves your application and credits the tax due to your personal bank account, in cash. It also charges your credit card for the corresponding amount, plus a processing fee

- You use the cash to pay your tax bill directly to IRAS, then pay your credit card bill as per normal

- You earn credit card points from the amount charged to your credit card

A few points to note:

- The bank does not pay IRAS on your behalf- that’s still on you!

- The NOA you submit must be your own; you can’t make payment on behalf of other people

- The maximum amount you can request is capped by your tax bill, e.g. if your tax bill is $10K, you can’t ask the bank to charge you $20K

That said, there’s nothing stopping you from sending the same NOA to a few different banks to buy miles multiple times.

CardUp/PayAll

In addition to bank facilities, you can also opt to pay your taxes with a credit card through a payment platform like CardUp. CardUp is offering a special 1.99% fee for Milelion readers that’s valid until 31 May- simply use the promo code MILELIONTAX.

Citi PayAll now supports tax payments too at a rate of 1.5% (targeted) or 2% (public). Note that this option doesn’t exist yet for iOS users, but Android users who update to the latest version of the Citi app will see it.

How much does it cost?

Here’s a summary of how much you’ll be paying per mile with each of the different options. Remember that a “quick and dirty” valuation of a mile is about 2 cents.

[table id=20 /]

Conclusion

Back in the day there used to be some pretty fantastic ways of earning miles on your credit cards without any admin fee at all (hint: AXS, Masterpass, and a certain bags, shoes and clothes card). Unfortunately those loopholes have long been shut, and if you want to earn miles for nation building, you’re going to have to pay for the privilege.

While writing this article, an interesting thought came to mind: no bank will let you charge more than the tax due amount shown on your NOA. However, since the ultimate settlement is between you and IRAS, there’s nothing stopping you from applying for multiple tax payment facilities, assuming you qualify. That’s to say, I could apply for both the HSBC Visa Infinite and Standard Chartered Visa Infinite tax facility to enjoy their relatively low cost miles.

Any updates on Citi Payall and when they will be rolling it out for tax payment.

Yes, it’s now listed as one of the option to play in the citibank app.

Any idea if it is possible to set up payall for monthly instalment of income tax? Seems like citibank pays iras directly and not to your bank account so the 12 month giro arrangement with iras wouldnt work.

On your closing comment, if the precondition for the bank lending you the amount (because, a credit card charge is essentially a loan from the bank) is that the same amount be used to pay iras, wouldnt it be at least a breach of agreement, or worse, a criminal offence of cheating/breach of trust if you use the sum for other things?

Even if you accept the argument that it is a precondition of the loan that it be used to pay IRAS (which legally it is debatable as the principal terms are the credit card t&cs) breach of this agreement would be a Civil matter not a criminal offence.

It is highly unlikely any bank would wish to sue a customer for breach of contract in this way given no real loss has occurred and doing so would damage their reputation to a far greater extent.

Section 415 Penal Code: Whoever, by deceiving (i.e. that you will be using the money to pay your income tax) any person, whether or not such deception was the sole or main inducement, fraudulently or dishonestly induces the person so deceived to deliver any property to any person, or to consent that any person shall retain any property, or intentionally induces the person so deceived to do or omit to do anything which he would not do or omit to do if he were not so deceived (i.e. give miles/points for the amount used to pay tax), and which act or omission causes or is likely to cause damage or harm to any person in body, mind, reputation or property (i.e. bank loses the miles/credit), is said to “cheat”.

So heed the advice by “lawyer” that it is not a criminal offence at your own risk…

Wow. This clearly explains why one should never take advice from strangers, especially those who are Anonymous. But well, to each his own.

Which is worse – (1) be Anonymous, or (2) be anonymous and claiming to be a “Lawyer”, or (3) be anonymous and claiming to be “Lawyer” AND “Ben”?

hi – may i know if cardup with the AMEX Ascend card counts towards the current promotion (Spend $12k in 6 months for the additional 44,000 miles)?

Yes

Does the DBS Altitude card eligible for miles earning (1.2 mpd – 3X rewards) if paying Income Tax via CardUp?

Hsbc vi after the first year annual fee non waivable. If you include that your cost per mile will increase depending on how many miles you earn

If I get the SCB VI for paying tax, do I still need to spend 2k for that month to get the 1.4 earn rate? Assuming my tax is more than 2k?

if you can apply for the card base on salary, your tax confirm more than 2k…

So would the tax amt be considered as spending? Then no need spend extra 2k?

No, the tax spending counts toward 2k

I think you meant to say the tax spending does not count toward the 2k spend requirement.

Can anyone pls confirm it counts to 2K? I did try to check and note that Tax is not excluded from Qualifying Transactions. Hence should count

i always thought it counts towards 2k but if in doubt you should just call them up and ask directly

Hi Aaron, I called SC and the 2k spending on tax does NOT count towards the 2k minimum spending. Ie u would have to spend an additional 2k somewhere else to qualify for that reward lvl

This is different from my understanding. Did the cso sound sure, or just guessing?

Hi Aaron, thanks for this summary – it’s not often we can get anything back from paying our taxes.

Is the earn rate for OCBC Voyage, lower than the normal 1.2 miles for the tax payment facility?

Yes- it’s 1 mpd for tax

HSBC is definitely 1 mile not 1 reward point as stated on their site?

I read it as S$1=1 Reward point @ https://www.hsbc.com.sg/credit-cards/features/tax-payment-programme/. Based on this, HSBC cost/mile is much higher at 4 cents. Am I correct?

hsbc vi cardholders will earn miles for tax payments at their usual 1/2 or 1.25/2.25 level.

Ok. Guess can only enjoy this earn rate in 2nd yr of card membership as the 1.25/2.25 level does not kick in during 1st yr card membership

“Back in the day there used to be some pretty fantastic ways of earning miles on your credit cards without any admin fee at all (hint: AXS, Masterpass, and a certain bags, shoes and clothes card). Unfortunately those loopholes have long been shut”

Don’t quite fathom the cloak-and-dagger approach, especially if the loopholes have been long shut… 😁

Hi Aaron, not sure if this is a typo but the Cardup with BOC Elite Miles World Master card should be 1.73cpm instead of 1.69?

The admin fee earns miles too

Hi!

I only have 2 cards with DBS-Woman’s mastercard and DBS altitude, can you please advise which one is better to use? thanks!

Does anybody know if the amount is also cap by your credit limit (for SCB VI case)?

If yes, is it easy to request temporary credit limit increase for tax payment purpose?

Quick question. Any views on using ipaymy corporate account but pay personal income tax?

Update: ipay says it can be done but still wanted to check if anybody did it.

Hi Aaron, I read the T&C. For BOC, clause 11 said ” Reward points and cash rebates will not be awarded for transactions relating to successful TPP applications” – So no points award for BOC EM card? And for DBS, clause 6 said “DBS Points will not be awarded for fees or charges arising from the Income Tax Payment Plan. ” = So no points awarded for DBS Altitude card? Is this correct?

No points for Boc. that’s interesting for Dbs, didn’t see that. In any case the rate’s really bad

Hey Aaron – one thing to point out about CardUp – IRAS sorta complained that they have had issues reconciling monthly tax payments received via that platform (though I don’t see why they don’t have issues with GIRO payments which are also transmitted monthly… it’s the Civil Service after all *shrug*). So CardUp’s FAQ now says this:

“Only one tax payment per tax account will be allowed on CardUp within a one-year period, to prevent any reconciliation issues.” (https://carduphelp.zendesk.com/hc/en-us/articles/115007653747-How-do-CardUp-tax-payments-work-)

I like your articles – keep going, you’re on to something!

Thank you! Yes, it’s a bit annoying especially if you have referral credit that you can’t break up your payments.

Hi Aaron,

Silly as it sounds, is it correct ipaymy will continue to earn 1.5mpd on BOC World Elite Mastercard despite their revised T&C stating payments to IRAS are excluded from points?

Many Thanks

Has anyone confirmed if the tax amount contributes to the $2k requirement for scb card?

Can I check for those who have used iPayMy to pay taxes, how long does it take after the payment payout date for it to be reflected in IRAS website? Thanks!

missed my income tax due date thanks to IRAS (NOA yet to arrive despite actual issuance in May…) anyone know if SCB is strict with the 7 days before due date application for tax payment facility? literally applied for it just for the tax facility..

I applied for the scb visa card tax facility. They said that they only can do the entire lump sum and no monthly payments. Is that true? They are the worst bank ever to deal with!! Back and forth at least 6 times… Each time they say get back to me in 2-3 working days for every new question.

Yes, this is correct. They informed me as well lumpsum only. Also checked with CardUp – they will pay the full annual amount to IRAS & I have to pay cardUp upfront.

Thanks. Lump sum… Is no use cos we only get max of 3000 points per month right?

Has anyone used SCB VI card’s tax payment facility here?

I just did and received 2.5 reward points (or 1 mpd) instead of 3.5 reward points (1.4 mpd).

Not sure if it is because the tax amount does not count towards the $2,000 min spend because I did not use the card for anything else.

Anyone has a similar experience?

Let me answer my own question.

I checked the SCB VI card T&Cs again, and this time, under 6(j) they have explicitly excluded “tax payments charged to your eligible credit card” so looks like I’ll have to charge another $2K on the card to earn the additional 0.4 mpd.

Seems like the T&Cs were updated because this was not made clear when I last checked.