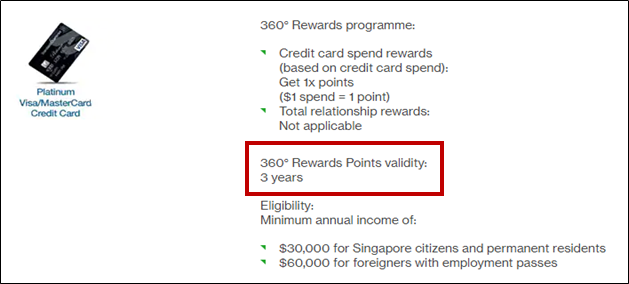

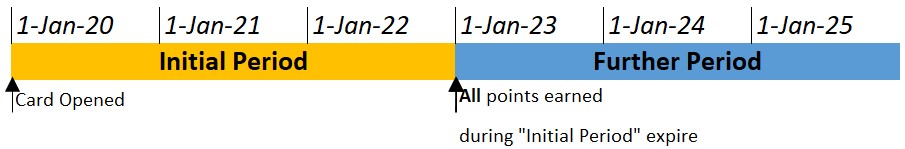

Most people think that Standard Chartered 360 Rewards points have an expiry of 3 years. After all, that’s how the bank itself portrays it:

Dig deeper into the T&Cs of the Standard Chartered Rewards program, however, and you’ll come across this term:

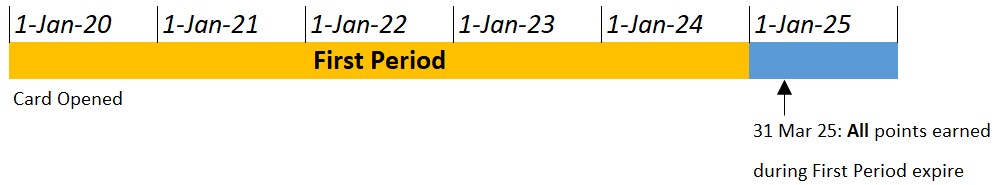

11.7 360° Rewards Points awarded are valid for 3 years from the date of opening of the credit card account to which the points are credited to (“Initial Period”). 360° Rewards Points awarded after the Initial Period will be valid for a further period of 3 years from the date the Initial Period ends (“Further Period”). Thereafter, subject to Clause 4.2.3 and Clause 7, any 360° Rewards Points that remain in the 360° Rewards Points balance after the Initial Period or Further Period will expire automatically. All 360° Rewards Points that have expired cannot be reinstated.

This suggests that your points aren’t valid for 3 years; they’re valid for a maximum of 3 years. In other words, when you open an SCB card account, a 3 year countdown timer starts. All the points you earn during that initial 3 year period will expire on the same date, regardless of when they were actually earned.

In an extreme example, whatever points you earn on 31 December 2022 expire the next day, on 1 Jan 2023!

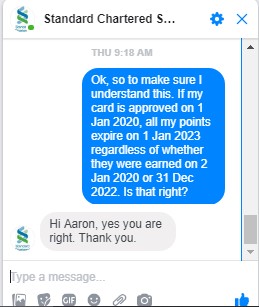

I felt so certain I had misunderstood this that I raised the matter with SCB customer service. They confirmed I’d read the clause correctly (I asked them to escalate the question for good measure)- your points are valid for a maximum of 3 years.

Why it probably won’t affect you

The good news is that this punitive policy won’t affect most miles chasers with SCB cards. If you’re playing the miles game with an SCB card, I’d wager that it’s the SCB Visa Infinite. Points earned on the SCB Visa Infinite card (either the Priority Banking version or the “regular” one) do not expire.

|

|

|

| Local Spending | 1.4 mpd* | 1 mpd |

| Overseas Spending | 3.0 mpd* | 1 mpd |

| *With min. S$2K spend per statement month, otherwise 1 mpd | ||

Instead, this policy affects anyone who holds a SCB Platinum Visa/Mastercard or an SCB Rewards+ card. But both these products are anyways so underwhelming that it’s unlikely a serious miles chaser would be regularly using them.

What can I do if my SCB points are going to expire?

We’re purely in the realm of the hypothetical here, because I’m sure well-informed Milelion readers wouldn’t be in this situation 😉

But for the sake of completeness, here’s what you can do if you’re an SCB cardholder with points that are going to expire.

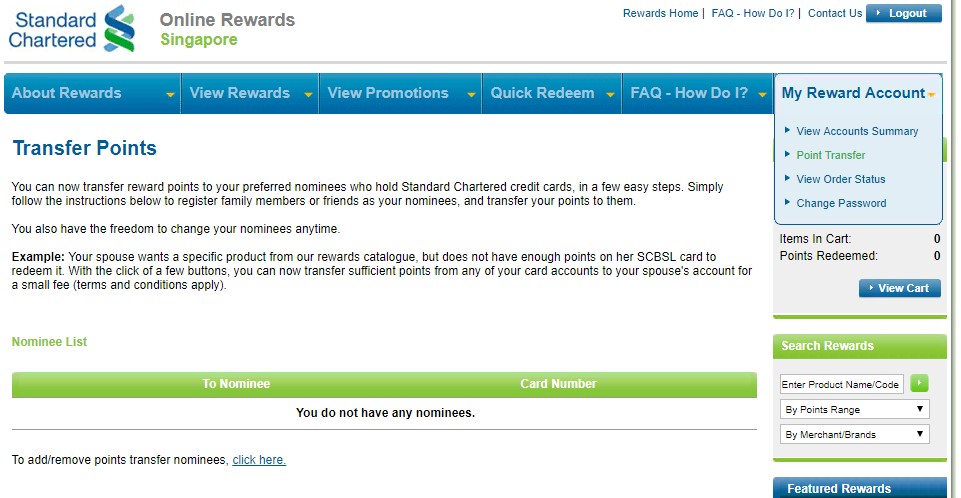

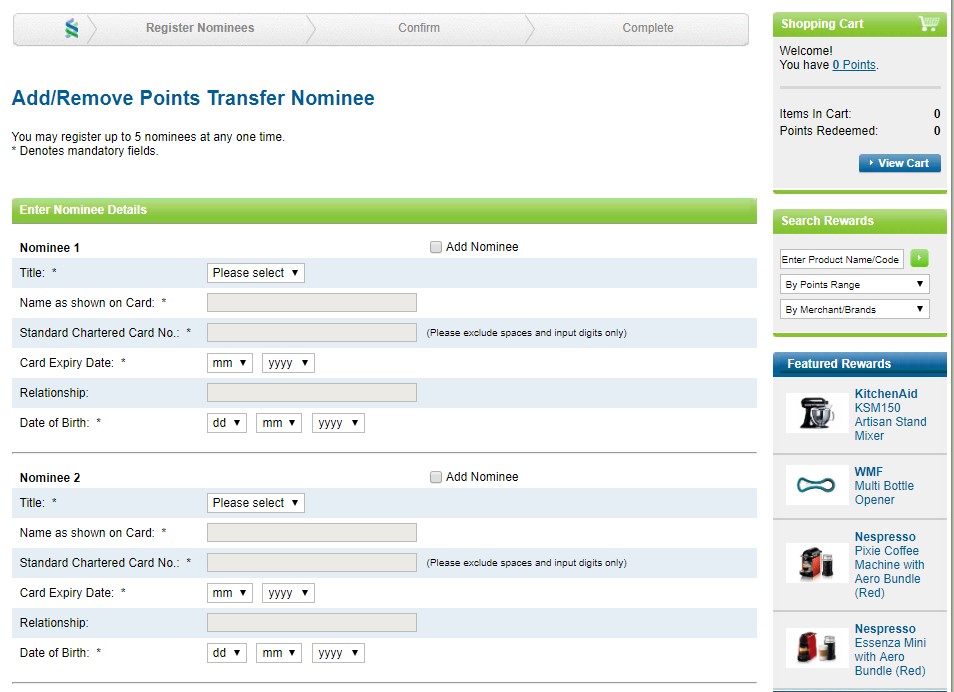

SCB is one of only two banks in Singapore (the other being OCBC) which lets you transfer credit card points to another customer. A fee of S$10 is charged for every 100,000 points transferred (no fee is applicable for SCB Visa Infinite cardholders). The transfer can be made online at the SCB Rewards portal- click on My Reward Account–> Points Transfer. You’ll be asked to add a points transfer nominee list, and can add up to five nominees.

The expiry of the transferred points follows the expiry of the nominated account.

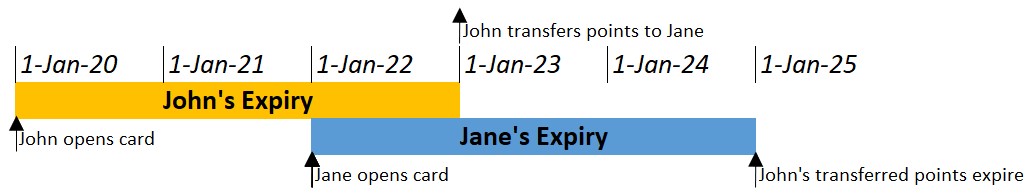

In other words, suppose John opens an SCB card on 1 Jan 2020, and Jane opens an SCB card on 1 Jan 2022. On 31 Dec 2022, John transfers some points to Jane. Those transferred points will be valid until 1 Jan 2025, because they now follow Jane’s expiry period.

Citibank has a similar policy

I was wondering why Standard Chartered would adopt such a customer-unfriendly policy when I remembered something: they aren’t the only bank who does this.

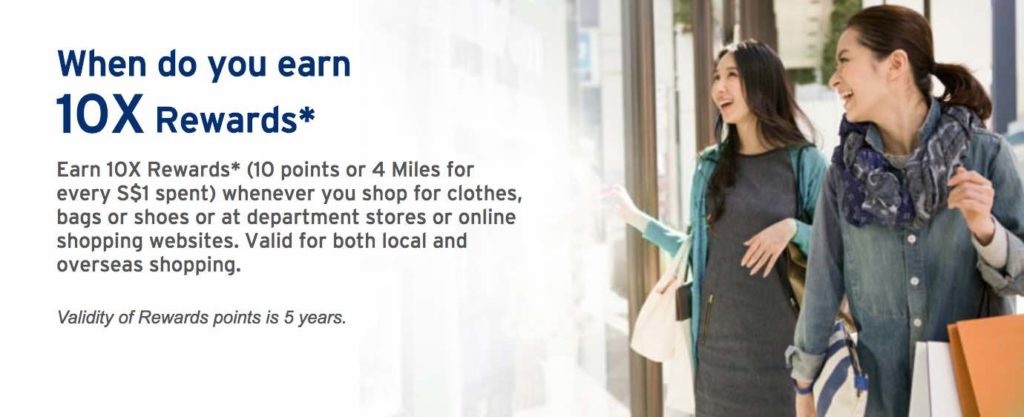

Back in May 2018, Louis wrote about Citi’s odd expiry policy. The common wisdom goes that Citi ThankYou points earned on the Citi Rewards Visa/Citi Rewards Mastercard are valid for 5 years. That’s pretty much what Citi says on its website anyway…

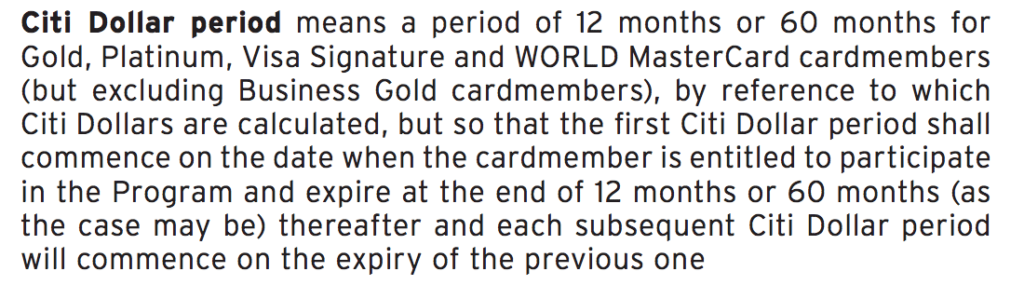

And yet, that’s not true either. In the Citi T&Cs you’ll find this clause:

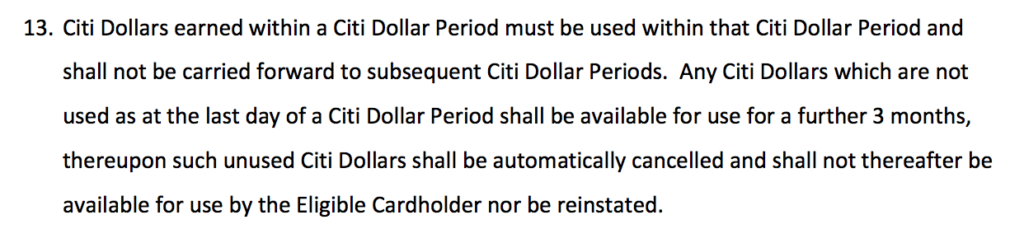

Which read in conjunction with this one in the 10X T&Cs…

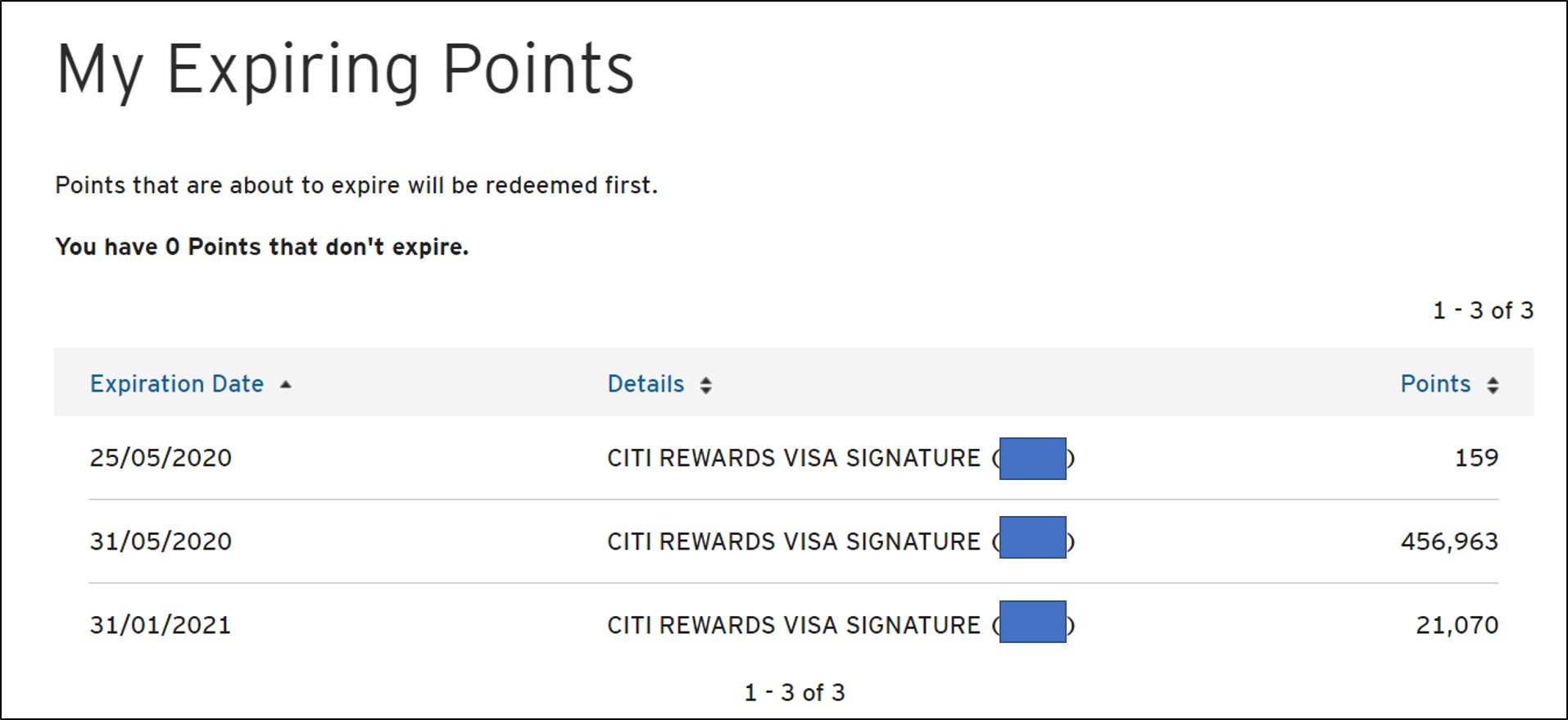

…suggests that Citi Rewards points expire every 5 years (with a 3-month grace period) starting from card approval, not when the points are earned!

I opened my Citi Rewards card in Feb 2015. Sure enough, when I go to check my points balance, I see that all my points expire on 31 May 2020, 5 years and 3 months after my card was opened.

(I can’t explain why I have 159 and 21,070 points that expire on 25 May 2020 and 31 Jan 2021 respectively, but apparently I’m not alone. Most people with Citi Rewards cards will see one big chunk of points expiring 5 years 3 months after card opening, with a few miscellaneous smaller amounts expiring on different dates)

You can argue that Citi’s policy is slightly better than SCB’s because at least there’s a three month grace period. This means that the shortest expiry of any Citi points is three months, versus one day for SCB.

Remember also that SCB and Citi do not pool points together, so each card has its own “points account”. That’s to say, your non-expiring SCB Visa Infinite/Citi Prestige points will not commingle with your expiring SCB Rewards+/Citi Rewards Visa points.

Conclusion

I have no idea whether this is a technical limitation of SCB’s points system or a deliberate policy, but in any case if you earn SCB 360 Rewards points on a card that isn’t a Visa Infinite, take note!

If you’re curious to know the expiry policy of various credit card points, whether they pool and how much you need to pay to transfer them, please refer to this guide.

Hi! Would you happen to know if transferred points on OCBC to a nominee also follows the nominee’s expiry date?

Those are valid for 1 year

Nicely done – you must have religiously maxed out the 10x categories every month!

Fucking stupid policy if you ask me. I got my reward points from a spend promotion. A notification saying my reward points arrived was received one day after it expired, which was one day after the points were credited. Who spends that much points in a day is beyond me.