There’s been a flurry of good news surrounding Qatar Airways Privilege Club lately.

First, it reversed its 2018 devaluation, cutting the cost of awards by up to 49%. Second, it launched a sign-up promotion, giving as many as 7,500 free miles to new members. And third, I had a long overdue realisation that Qatar Privilege Club members don’t pay fuel surcharges on Qatar Airways when redeeming Qmiles (and haven’t since 2015, d’oh).

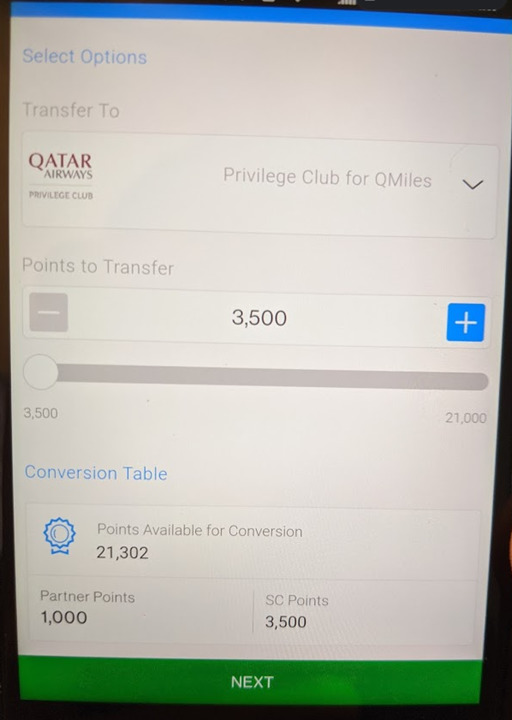

So naturally, here comes the other shoe: Standard Chartered has quietly hiked the points required for transfers to Qatar Privilege Club by 17%. This was done without notice, and I wouldn’t even have realised it if not for Oliver on the comments.

Standard Chartered devalues Qatar Privilege Club transfers

3,500 points |

⇒ | 1,000 miles |

If you navigate to the Standard Chartered rewards portal (remember: you’ll need to use the mobile app if you want to see non-SIA transfer partners; it won’t appear on desktop), you’ll notice that the cost of 1,000 Qatar Qmiles has increased from 3,000 SC points to 3,500 SC points.

There’s no way of knowing when this actually happened (since no announcement was made), but in a sense, it isn’t a huge loss insofar as it was always a bad idea to transfer Standard Chartered points to Qatar Privilege Club anyway.

Even at the old rate of 3,000 points: 1,000 miles, you’d be earning 17% fewer miles compared to transfers to Singapore Airlines, EVA Air or Air France/KLM. Barring a transfer bonus, there was really no reason to opt for Qatar, and that’s all the more so right now.

If you really want Qatar miles, you’d be better off transferring from Citibank, which thankfully has maintained its current transfer ratios.

| Citi Miles | ThankYou Points | |

| 1:1 | 5:2 | |

| For a full list of transfer partners by bank, refer to this post | ||

Where else can you transfer Standard chartered credit card points?

I’ve checked the rates for Standard Chartered’s other transfer partners, and fortunately Qatar is the only one whose rate was changed. All the rest remain as-is, as shown below.

| Airline Programs |

|||

| Loyalty Program | Conversion Ratio | Local Earn Rate | FCY Earn Rate |

| 2.5:1 | 1.2 | 2.0 | |

|

2.5:1 | 1.2 | 2.0 |

| 2.5:1 | 1.2 | 2.0 | |

| 2.5:1 | 1.2 | 2.0 | |

| 3:1 | 1.0 | 1.67 | |

3.5:1 |

0.86 |

1.43 |

|

| 3.5:1 | 0.86 | 1.43 | |

| 3.5:1 | 0.86 | 1.43 | |

|

3.5:1 | 0.86 | 1.43 |

| Hotel Programs | |||

|

5:1 | 0.6 | 1.0 |

| 2.5:1 | 1.2 | 2.0 | |

| The local/FCY earn rate refers to how many miles you’d accrue with the Standard Chartered X Card, given its rate of 3/5 SCB points per S$1 spend locally/overseas. |

As a reminder, KrisFlyer is currently offering a transfer bonus of 15% for all bank points conversions completed by 27 December 2020.

Conclusion

It’s now going to cost you more to earn Qatar Airways Qmiles via Standard Chartered credit cards, but if it’s any consolation, this was never a great idea in the first place.

We already need to worry about unannounced devaluations on the airline side; banks, please don’t get ideas.

This just cements the uselessness of SC’s retail banking products.