The past few years have seen foreign currency (FCY) transaction fees creeping ever upwards, with banks making it more expensive for customers to swipe their cards overseas.

Only three card issuers maintain an FCY fee in the sub-3% range; a figure that will drop to two from 1 November 2021 when Maybank throws in the towel.

Maybank hikes FCY fee to 3.25%

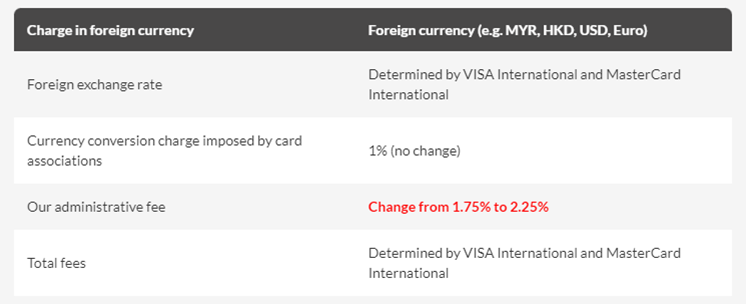

From 1 November 2021, the FCY fee on Maybank credit cards will increase from 2.75% to 3.25%. This is broken down into a 2.25% administrative fee collected by Maybank, and a 1% fee collected by Visa/Mastercard.

Here’s how these changes impact Maybank’s two best cards for FCY spending.

| Card | FCY MPD | Fee | CPM |

Maybank Horizon Maybank Horizon |

2.0 | 3.25% |

1.63 |

Maybank Visa Infinite Maybank Visa Infinite |

2.0 | 3.25% |

1.63 |

Prior to the changes, cardholders were paying about 1.38 cents per mile when they used their card overseas. From November onwards, that increases to 1.63 cents per mile- OK in and of itself, but nowhere near the cheapest.

How does Maybank’s FCY fee compare to the market?

As mentioned at the onset, Maybank was one of the last card issuers with a sub-3% FCY fee. The latest change puts it on par with Citibank, DBS, UOB and OCBC at 3.25%, and hands the crown of lowest FCY fees to HSBC at 2.8%. Who wants to bet how long that lasts for?

| 💳 FCY Fees by Issuer and Card Network | ||

| Issuer | Visa & Mastercard | AMEX |

| Standard Chartered | 3.5% | N/A |

| Citibank | 3.25% | 3.3% |

| DBS | 3.25% | 3% |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| Maybank | 3.25% (from 1 Nov) |

N/A |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

| American Express | N/A | 2.95% |

| HSBC | 2.8% | N/A |

In case you’re interested in the evolution:

- On 1 Apr 18, Maybank increased its FCY charge on Visa Diamante, Visa Infinite and World Mastercard from 2.5% to 2.75%

- On 4 Oct 18, Citibank increased its FCY charge from 2.8% to 3%

- On 1 Nov 18, HSBC increased its FCY charge from 2.5% to 2.8%

- On 1 Jan 19, CIMB removed the admin fee waiver for FCY transactions on the Visa Signature and Platinum Mastercard, effectively increasing the fee from 1% to 3%

- On 2 Jan 19, DBS increased its FCY charge from 2.8% to 3%

- On 15 Jan 19, BOC increased its FCY charge on Mastercard transactions from 2.5% to 3% (Visa fees increased from 2.5% to 3% on 1 Dec 18)

- On 15 Mar 19, OCBC increased its FCY charge from 2.8% to 3%

- On 4 Sep 19, UOB increased its FCY charge from 2.8% to 3.1%

- On 1 Nov 19, DBS increased its FCY charge from 3% to 3.25%

- On 3 Dec 19, OCBC increased its FCY charge from 3% to 3.25%

- On 15 Dec 19, Citibank increased its FCY charge from 3% to 3.25%

- On 1 Mar 20, AMEX increased its FCY charge from 2.5% to 2.95%

- On 9 Mar 20, UOB increased its FCY charge from 3.1% to 3.25%

Just use the Amaze Card

At the risk of sounding like an Instarem shill (which, for the record, hasn’t paid me a single cent; I can’t even use all those referral credits since I have no need to send money overseas), you should just default to Amaze whenever you have an FCY transaction.

Amaze offers zero FCY fees and lets you earn up to 4 mpd with your credit card, plus 1% cashback- what’s there not to like?

| 💳 tl;dr: Amaze card |

|

| Sign Up Here |

|

On my recent trip to Germany, I didn’t use a credit card at all, simply charging everything to Amaze (paired with Citi Rewards). The exchange rates were very close to mid-market, and I earned 4 mpd without any drama.

I’m quite certain this won’t last forever, but it’s fun while it lasts. The more banks hike FCY fees, the more they drive customers into the arms of alternatives like this.

Conclusion

Maybank cardholders will pay a 3.25% FCY fee from November onwards, though I really don’t see any reason to use Maybank cards for overseas transactions in the first place.

The only situation where this might make sense is making donations to overseas charities. Maybank has not added charitable donations to its rewards exclusion list, so picking up 2 mpd wouldn’t be the worst possible outcome.

Totally agree on the Amaze card switch, I’m not shilling but have since become a fan. 😁

However some merchants reject the card, with error messages like “Wrong issuing country”, any idea/guess why? I contacted InstaRem on this but still didn’t get an answer.

Hmm I haven’t encountered that issue before so I can’t say. But I just booked something on Asia miles and it asked me country of issuance. I put sg and the transaction went through fine.

Thanks for the quick reply! It’s great that you were given the option to enter your country of issuance, whereas I faced outright rejection 😅 Question is what did InstaRem code the Amaze’s issuing country as? If it is Singapore, why did Asiamiles query you? 🤔

Nice way to push customers away into the arms of alternative payment schemes. I was using Amex Cashback as it got another 1% on top of the 1.5% cashback to alleviate the cost of Forex charges. Now thanks to this website, I learnt about the Amaze card. Hope corporate learn more about alternative means of payment instead of paying these banks huge amount in Forex Fees that started with DBS Bank. So it now DBS is the last card I want to use for travel.

Transferwise has a business debit card, and I think Revolut and YouTrip have too.

ICBC Credit cards still the lowest at 2.5%.

https://v.icbc.com.cn/userfiles/Resources/ICBC/haiwai/Singapore/download/2019/20191209FeeSchedule.pdf

https://singapore.icbc.com.cn/ICBC/%e6%b5%b7%e5%a4%96%e5%88%86%e8%a1%8c/%e6%96%b0%e5%8a%a0%e5%9d%a1%e7%bd%91%e7%ab%99/en/CommercialBankBusiness/CreditCards/CreditCardProducts/ICBCGlobalTravelMasterCard/

Not sure if you have read the article on what Amaze is. Amaze offers 0% fees, and mid market rates. How can ICBC at 2.5% be lowest? 0% versus 2.5%, go figure.

And we haven’t even talked about the inflated exchange rate that banks and card networks uses. Mid market rates versus inflated bank and card networks’ rates, go figure again

alfred is probably talking about among credit cards, but anyway, ICBC’s are irrelevant to miles chasers!

Except for the 6 lounge passes 😎