While we made it through the worst of COVID-19 with the KrisFlyer programme unscathed, there’s a certain inevitability to devaluations. It’s kind of like standing outside and declaring it’ll rain: sooner or later, you’ll be proven right.

On 5 July 2022, Singapore Airlines will hike the cost of award tickets by 8-16%, the first increase in 3.5 years. This will be followed by a stopover policy change on 1 August 2022, which caps complimentary stopovers at 30 days and removes the ability to add paid stopovers.

| ✈️ KrisFlyer 2022 Devaluation |

| 🔺 Award Price Increases |

|

| 👎 Changes to Stopover Policy |

|

| 📚 Further Reading |

| ⚠️Important Updates |

|

Singapore Airlines, via a spokesperson, has provided the following clarifications:

The article below has been updated. |

There’s a lot of analysis to be done, but I want to make one thing clear: this is not a run-for-the-exits devaluation. In the grand scheme of things, it’s more annoyance than anything else (even if Singapore Airlines’ reference to an average increase of 10% creates the perfect opportunity to use the term “decimation”).

If you’re able to book a few speculative awards, go ahead and do so. However, you should be doing this because you think there’s a decent chance you might be able to travel on those dates, not because of a sense of FOMO.

Here’s my thoughts on what’s happened.

A devaluation was inevitable

Singapore closed its borders in March 2020, and it wasn’t until September 2021 that they reopened under the VTL.

That’s an 18-month period (even more, if you consider that most people waited till December 2021 to start travelling), during which we saw some fantastic mileage accrual opportunities.

- KrisFlyer offered an uncapped 15% transfer bonus in November 2020 (and again in November 2021)

- 8 mpd offers by cards like the OCBC Titanium Rewards and Citi Rewards

- Uncapped 4 mpd offers by cards like the Citi PremierMiles and Citi Prestige

Sure, some people may have burned a portion of their stash on the ground, but it’s not the same kind of release valve that award flights normally offer.

In that sense, a devaluation was always going to be inevitable, and what accelerated the timeline was the pace at which air travel recovered. Few expected passenger volumes to bounce back as quickly as they did; even the IATA had to bring forward its forecast for return to pre-pandemic figures by a full year. Take a stroll through Changi now, and masks aside, you’d be hard-pressed to tell we’d just suffered a global pandemic.

When load factors are low, there’s no pressure to devalue. Those seats would have gone out empty anyway, so the opportunity cost of giving it up for redemptions is close to zero. But when people redeeming miles start competing for seats with people paying cash, then something’s got to give.

This devaluation is relatively mild

Let me make something clear: there’s no such thing as a painless devaluation. Whether we’re talking 1% or 100%, no one likes to see the goalposts shifted.

But in the cold light of day, this upcoming devaluation is on the mild side. It’s nothing like the March 2012 or March 2017 guttings, and given that Economy Class awards escaped the noose in January 2019, some award prices have gone more than five years without changing.

| ✈️ KrisFlyer Devaluations (based on Saver prices) |

|||

| Economy | Business | First | |

| February 2007* | +2% | +1% | +1% |

| March 2012 | -9-0% | 0-45% | 0-30% |

| March 2017 | +18-32% | +18-29% | +18-29% |

| January 2019 | 0% | +8-12% | +6-10% |

| July 2022 | +8-16% | +10-15% | +10-13% |

| *Feb 2007 prices based on simple averages, all figures provided in ranges |

|||

The upcoming devaluation sees a 8-16% increase in Saver award prices prices, but most Advantage awards have gone untouched (which may very well change how people see the trade-off between Saver and Advantage; see The “Advantage Premium” section below).

If you ask me, this isn’t a “burn everything now!!!” situation. I personally don’t have plans to cash out my entire stash before 5 July.

In fact, given that so much of my current stash was obtained through the recent 15% transfer bonus, I see the upcoming devaluation as putting things more or less back to square one. It’s the whole “give chicken wing take back whole chicken”, only in this case it’s more like “give chicken wing take back 75% of chicken wing” (11% increase/15% bonus). I’m still ahead, sort of.

The table above suggests that the average cadence of a devaluation is now once every 2-3 years, and if the current price hike has bought us some peace and quiet for the near future, well, it’s not the worst thing that could have happened.

Fuel surcharges didn’t return

Speaking of not the worst thing that could have happened, Singapore Airlines eliminated fuel surcharges on revenue and award tickets back in 2017, and with jet fuel now 100% more expensive, I’m very, very thankful fuel surcharges didn’t return with the latest devaluation.

I mean, it’s not that big a stretch of the imagination for Singapore Airlines to say something along the lines of “sorry, fuel’s too expensive, surcharges are coming back”. Emirates did it, and if oil basically grows on trees in the Middle East…

But the status quo remains. No fuel surcharges are payable on Singapore Airlines award redemptions, and the only cash you’ll pay is for airport taxes; currently S$52.30 for one-way flights out of Singapore:

- Singapore Airport Development Levy: S$10.80

- Singapore Aviation Levy: S$6.10

- Singapore Passenger Service and Security Fee: S$35.40

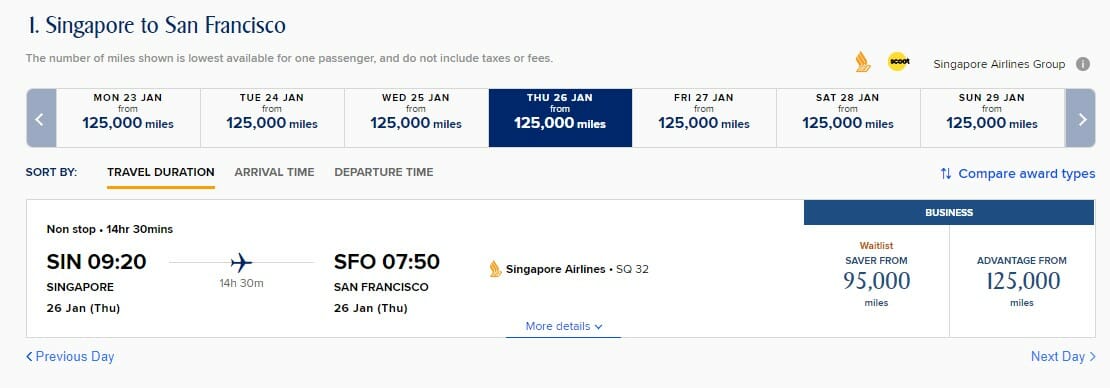

Spontaneous Escapes help take the sting out

|

| Spontaneous Escapes |

As you probably know by now, Singapore Airlines brought back Spontaneous Escapes in March 2022, with 30% off selected Economy, Premium Economy and Business Class awards.

Spontaneous Escapes will continue to be offered even after the devaluation, and for the sake of comparison, here’s how the post-5 July prices with 30% off compare to the pre-5 July prices.

| Spontaneous Escapes Discount (Compared to pre-5 July pricing) |

|||

| Economy | Premium Economy |

Business | |

| Zone 2 Malaysia, Indonesia, Brunei |

21% | – | 23% |

| Zone 3 Philippines, Thailand, Vietnam, Myanmar, Cambodia, Laos |

24% | – | 22% |

| Zone 4 South China, Hong Kong, Taiwan |

23% | 24% | 22% |

| Zone 5 Beijing, Shanghai |

25% | 25% | 23% |

| Zone 6 India, Sri Lanka, Maldives, Bangladesh |

24% | 25% | 23% |

| Zone 7 Japan & South Korea |

24% | 24% | 23% |

| Zone 8 Perth & Darwin |

25% | – | 22% |

| Zone 9 Australia (ex-Perth & Darwin) & NZ |

24% | 24% | 23% |

| Zone 10 Africa, Middle East, Turkey |

19% | 19% | 19% |

| Zone 11 Europe |

23% | 23% | 21% |

| Zone 12 USA (West Coast) & Canada |

23% | 23% | 21% |

| Zone 13 USA (East Coast & Houston) |

23% | 23% | 21% |

For example, a Spontaneous Escapes award from Singapore to Kuala Lumpur based on the post-5 July pricing would be 21% cheaper compared to the pre-5 July pricing. That’s obviously less than 30%, but helps soften the blow somewhat.

It’s a consolation for those who are able to travel on short notice (usually the following month) and don’t mind locking in their plans (Spontaneous Escapes cannot be changed or refunded).

The “Advantage Premium” is smaller

No one likes paying more than they have to, but if you can’t find Saver space and absolutely must travel on a particular date (and don’t want to buy a cash ticket), then Advantage awards are your best bet.

Since Saver awards are increasing in price while Advantage awards remain relatively stagnant, one interesting analysis is to look at the so-called “Advantage Premium”, or how much more you pay to redeem an Advantage award instead of Saver.

| Economy | Business | First | |

| Till 4 July | 95% | 61% | 82% |

| From 5 July | 80% | 47% | 66% |

| For example, up till 4 July, the average Business Advantage award costs 61% more than a Business Saver award. From 5 July, that figure drops to 47% |

|||

As expected, the Advantage Premium falls by 15% in Economy, 14% in Business, and 16% in First.

This can’t be an accident; I’m convinced it’s been done to nudge people towards booking Advantage awards. After all, you might be less inclined to choose an Advantage award if you see it costs 61% more than a Saver award, but if it’s available for immediate confirmation and the difference is 47%, well…

Stopovers still exist, but the stopover trick is dead

The KrisFlyer devaluation takes place on 5 July 2022, but the nerfing of the stopover trick takes place on 1 August 2022. This has led to a lot of confusion as to how existing tickets will be treated.

The way I see it, there are three periods to take note of.

Period 1: Before 5 July

- All award prices follow existing award chart

- Paid stopovers can be added to awards for US$100 each, and be up to one year

- All complimentary stopovers can be up to one year

Period 2: From 5 July to 31 July

- All award prices follow new award chart

- Paid stopovers can be added to awards for US$100 each, and be up to one year

- All complimentary stopovers can be up to one year

Period 3: From 1 August onwards

- All award prices follow new award chart

- Paid stopovers can no longer be added to any award

- All complimentary stopovers have a limit of 30 days

Period 1 is the status quo. You can book one-way Saver awards at existing prices, and add stopovers of up to one year for US$100.

Period 2 is post-devaluation. You can book one-way Saver awards at new (increased) prices, and add stopovers of up to one year for US$100

Period 3 is post-devaluation, post-stopover trick. You can book one-way Saver awards at new (increased) prices, but cannot add stopovers (because paid stopovers will cease to exist).

To be clear, you can still have a stopover/stopovers on an award from 1 August 2022- just that whatever the ticket comes with is what you get.

| Type | Award | Free Stopovers |

| One-way | Saver | 0 |

| One-way | Advantage | 1 |

| Round-trip | Saver | 1 |

| Round-trip | Advantage | 2 |

For example, if I book a one-way Advantage award, I’m entitled to one free stopover. Therefore, I could book an itinerary like BKK-SIN-LHR and add a stopover in Singapore, while saving on the miles required to book BKK-SIN and SIN-LHR separately.

But the value proposition is nerfed, because:

- You need to pay the more expensive Advantage prices

- The stopover is a maximum of 30 days, which means you need to be able to travel twice in quick succession

Therefore, the stopover trick, for all intents and purposes, is dead.

Get those bookings ticketed…

Any awards ticketed up till 4 July 2022 will follow existing prices, regardless of travel date. Singapore Airlines releases award space 355 days in advance, so as of 4 July 2022, the latest you’ll be able to book a ticket is 24 June 2023.

If you’re currently on the waitlist, you should do everything in your power to get it cleared by 4 July 2022. Unfortunately, that may not be a whole lot:

We are unable to expedite the confirmation of your waitlisted booking. Waitlists for redemption award bookings will be automatically confirmed at any time when seats become available and you will receive an email update on the waitlist redemption confirmation.

-Singapore Airlines

If your waitlist clears from 5 July 2022 onwards, you will pay the higher prices, period- it doesn’t matter when you added your name to the waitlist.

I suspect this is why the Singapore Airlines phone lines are jammed again, and PPS Connect hasn’t replied for 12 hours and counting.

…and don’t touch them!

| ⚠️Important Updates |

| Singapore Airlines, via a spokesperson, has clarified that date changes made to existing awards from 5 July 2022 will not attract the new prices, so long as the ticket was issued before 5 July 2022. |

Any changes made to an award ticket from 5 July 2022 onwards will attract the new pricing- whether it’s dates, flights, routes, whatever.

|

This is a change from how things worked during the last devaluation, where changes that did not involve a ticket reissuance (e.g. date changes) did not attract the increased pricing.

As I said at the start, if you’re in a position where you have a vague idea of your travel plans over the next 12 months, go ahead and book a few speculative awards. However, you should not be booking awards due to pure FOMO, because if your plans change, you’ll not only have to pay the new prices anyway, you may be looking at a US$75 redeposit fee per ticket.

Award availability may not improve the way some think it will

It’s hard to argue we’re not already in a soft devaluation situation of sorts, with long-haul Saver awards in First and Business Class increasingly difficult to find.

I did a few searches yesterday and the only destination I was regularly able to find instantly-confirmable First Saver space was Jakarta; fun if you want to explore The Private Room, but not that useful otherwise. Business Saver is likewise difficult to find for Australia, Europe and the USA, unless you’re able to book a year in advance- and even then it’s not a sure shot for 2 pax.

Some believe that a hard devaluation will help address these issues, and while that’s mathematically true to an extent, we need to keep in mind that the mild increases will only price people out at the margins. I don’t believe that Singapore Airlines will change the amount of award inventory it releases following this devaluation (for better or worse), so what we have is a slightly larger sponge to soak up the outstanding miles. It helps a bit, but not dramatically so.

In other words, don’t expect to be magically booking 2x Suites Savers to London in the peak of December, just because prices have gone up.

Conclusion

KrisFlyer’s upcoming devaluation, while relatively mild, is still going to force the hand of many members. I fully expect there to be a flurry of bookings made over the next few weeks, though hopefully common sense will prevail and people won’t be hogging seats they have no real expectation of flying.

This also has implications for how you should value a mile, the relative usefulness of KrisFlyer versus other frequent flyer programmes, and how to deal with existing award tickets with stopovers. I’ll be covering these in the days to come, but if you do have a question (that’s not covered in the FAQ), feel free to pop it below.

KrisFlyer devaluation: questions?

Plenty of advantage seats on non waitlist go un-redeemed.

Saver all waitlist only.

Was really expected. Maybe if some booked advantage this wont be an issue..

What a stupid comment. If I’m going to have to redeem advantage I might as well pay for a ticket and accrue miles, Elite Miles, and PPS value since the MPD valuation usually ends up costing more than a paid ticket.

That said, please go ahead and clear your miles in the advantage category. Certainly helps to have suckers like you burn up KF miles.

And people like you are the cause of this problem.

Why do you think advantage were not devalued? only saver

All want cheap, but when waitlist dont clear all kpkb.

Exactly!

Thanks Aaron. I have asked in your earlier post about my AMS-SIN-AKL booking which is for next May. I had originally intended to change the SIN-AKL leg in May 2023 to May 2024. Given that stopover of longer than 30 days are not be allowed after 1 Aug, would you advise that I call SIA to change it to a two-stop AMS-SIN redemption and forget about the stopover?

we dont know how stopovers on existing tickets will be treated yet.

Same situation here…

How has this devaluation affected your valuation of a mile, if you had a chance to think of this already?

simple mathematical calculation will be it drops 15% from 1.8 cents to 1.53 cent. 1.50 for ease of calculation and against future devaluation. While the last devaluation was 3.5 years ago, we had 2 years of no flying. So the devaluation time gap is only 1.5 years.

Oversimplistic. If redemptions are not available due to overcrowding, miles are worth 0 cents, not 1.8 cents. A drop in value by 10% against revenue vs a very difficult to quantify increase in availability.

Bang on 1.5 cents. I called it. At last my Mathematics Degree from Cambridge has paid dividend

Can we still buy $8/1000 miles with citibank? Is it via their CC website?

Read up on Citipayall promotion. Until end july iirc

It’s just inflation!

it was because of your earlier post on the stopover trick that resulted in SQ removing it totally… thanks for being helpful….zzzzzz

The stopover trick has been featured on the site since 2017. What you saw recently was an update of that post. Hope this clarifies!

Probably want to do some research before you start laying the blame on Aaron. This stopover thing have been there since forever in 2017.

Seriously….. u think SQ really dun know abt this stopover benefits till some bloggers sites (not only ML) tell them abt it? wait till one day all banks start to roll back 4mpd or more on spending… then who are you going to blame then? 😉

Aaron and other bloggers should for once care less about their clicks and readership & instead protect the sanctity of the miles program. We play the miles game precisely because it is full of sweet spots, quirks and loopholes. What good is it to go around publicising every single hack? Just so you can write another article on your blog? Oh please…

Good things must share 🙂

I have a new question that need clarify that I think no one have the answer now but maybe Aaron also can take it to SIA. If I have a ticketed FRA-SIN-CHC now, FRA-SIN in Dec2022, SIN-CHC in Apr2023, by right the SIN-CHC sector is already consider more than 30days validity after FRA-SIN sector. so if I made changes on SIN-CHC after 1 Aug 2022, will SIA : only allows me to carry forward the date of SIN-CHC 30 days within after first sector, or still allows me to choose a date 365 days after my first leg since it… Read more »

Hi Aaron,

Can you do a piece to compare Asia miles value vs KF miles value with this new devaluation? Since most SG banks can only transfer miles to one of these two. Thank you!

SQ was in a difficult position…cheaper for them to give you a 15% bonus miles and getting paid for the mile purchases.And now decided to take more than half away with a devaluation. Still cheaper for SQ to do it rather than going to the financial markets to raise funds. How SQ was able to remain in this position was also Thanks in no small part with the generous support given by the taxpayers’ dollars and that support was given over a longer period of time as compared to other industries. Spontaneous escapes are interesting but hard to fit into… Read more »

Exactly! They give you extra miles to get cash last year. They give you a 6 month holiday and now they devalue it. So its back to square one for us but extra money for them! We are at their mercy because KF miles is their currency and they can manipulate it anyway they want! I am ok with that but they stole billions from tax payers over the pandemic so at the very least give us 1-2 years holidays to use those miles. Its the same with Singapore rediscovers, cdc vouchers and the like. They give you peanuts, make… Read more »

Should call yourself Jaded Whining Bitch.

Tsk tsk. This is a family friendly website to have fun and not anti women website for a troll showing zero respect for his Mother, Sister, Wife and daughters.

Aaron – I am looking to book a 6 tickets for Christmas 2023. Should I be booking now and then changing the date in December to the dates I really want? (Assuming I ensure I follow the 355 day loading of availability). I need to book 2x YVR-DPS, 2x SEA-DPS and 2x ZHR-DPS. Thoughts?

aaron – big fan of ur site. thanks for all the posts. as someone who has called singapore home for the past six years, i am in love with my life here. but what i consistently find fascinating in singapore is this unflinching defense of everything sq does. this for an airline that only exists for the grace of investment made by a fund the taxpayers paid for. sure there were generous earning opportunities and sure miles are flowing – but it was sq that partnered with all the credit card companies to create those opportunities for the consumers in… Read more »

Accumulating Asia miles, and on company’s expense. So much negativity when you are all about redemption. Lol.

lol i am not accumulating asia miles on my biz trips (which is happening less thanks to zoom which actually is awesome). i can convert my personal credit card points to it and fly to europe at… 70k?

what else do u do with miles but redemption- eat it?

yeah good luck being positive about this devaluation

To each their own, in the same way you don’t have to like SQ just because other people do, others don’t have to be unimpressed with SQ just because you are.

I’ve tried a few airlines, not a lot, but am comfortable with SQ to the point that I’d rather take SQ economy over Thai Airways business for example. End of the day, do whatever makes you happy.

Elephant in the room: I simply don’t manage to redeem my miles anymore. Don’t find any flight, September or December, that I’m interested in, offering me a no waitlist reward option.

Exactly, hence the rise in redemption rates is a good thing. The rate increase will ease availability for redemptions.

If everything is unavailable, your miles are worth nothing. Better to pay 10% more for the redemptions than to have nothing available to redeem.

LOL. How do you know it is not SQ that is limiting award tickets at their end? Nowadays, the most I can see is only 1 business saver class seat available for redemption for each date.

Don’t try to spin a negative devaluation into something that will benefit consumers when SQ is not going to open up more award tickets even after devaluation.

Great point. I wonder if 10% will really make a difference though. But it might be safe to say that award flights are not really in the books anymore for 2022.

Easy for you to say, given your PPS status and priority saver availability. Plenty of us are frantically trying to get saver seats confirmed before the devaluation date.

If saver availability is a pain point for you, then the devaluation should come as good news to you. Devaluations address specifically this problem by freeing up more award space.

No it doesnt. A devaluation of any currency (miles or fiat) just results in panic buying and overall less availability for all. Which is exactly the situation we are seeing now.

Not exactly true too – all available saver tickets are already issued, then how will devaluation free up tickets?

Also, there are plenty of tickets available but SQ would rather they remain untaken with a chance someone comes along to buy them than to release to redemption. This is the way of life – just do a revenue ticket check and you would know what I mean. We can waitlist till forever and cannot get but pay cash and you can get it a day before flying.

Does any other airlines have similar stopover trick?

At last someone asks a smart question instead of complaining why stopovers are gone or miles are devalued. We should think maybe cathay might have something like this. stopover hk is easy and accessible to most of northern hemisphere. Asiamiles are easy to redeem. Maybe soon T4 is back up again for cathay

The comments from those complaining about SQ taking taxpayer monies and then devaluing miles are just hilarious. They expect that paying their taxes entitles them to a most-free premium class ticket.

These people, esp. Bitter Jaded Queen, must be the cheapest things in Singapore right now.

I feel some of the comments here have become too personal. While we are free to critique the comments, I feel that there are too many personal attacks, which are unwarranted liked calling people “Cheap” or “Bitches (what is the equivalent of the male bitch?)” when we are born to a Mother too and how do we like it when our Mother who care for us being called Bitches too just because of a difference in opinion? Or some people can also said we checked on Milelion.com because we are all looking for cheap deals too and does that make… Read more »