Here’s The MileLion’s review of the AMEX KrisFlyer Ascend Card, which launched in 2013 as a premium alternative to the entry-level KrisFlyer Gold Card (now known as the AMEX KrisFlyer Credit Card).

For many years, this was a solid, if unspectacular card. It had little miles-earning potential beyond the welcome offer, but a combination of the free Hilton hotel night, four complimentary lounge visits, assorted AMEX Offers and American Express’ general lack of exclusions made it worthwhile.

Unfortunately, that’s now changed, because in November 2024, American Express decided to “enhance” the AMEX KrisFlyer Ascend by:

- Bumping its annual fee to almost S$400

- Removing the four free lounge visits

- Axing bonuses for foreign currency spend, and the one-time bonus for telco bills

Needless to say, this isn’t how you win friends and influence people, and while there were some marginal enhancements (such as finally rewarding spend on Scoot after ignoring SQ’s LCC cousin for so long), the changes were overwhelmingly negative.

The upshot is that the AMEX KrisFlyer Ascend becomes little more than a “bonus and banish” card, something you get if there’s a good welcome offer, but abandon as soon as the first year’s up.

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

|

| 🦁 MileLion Verdict | |

| First Year | Recurring |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

☐ Take It ☐ Take It Or Leave It ☑ Leave It |

| What do these ratings mean? |

|

| Mediocre earn rates, convoluted benefits and a hefty annual fee mean the AMEX KrisFlyer Ascend isn’t worth holding beyond the first year- if at all | |

| 👍 The good | 👎 The bad |

|

|

Overview: AMEX KrisFlyer Ascend Card

Let’s start this review by looking at the key features of the AMEX KrisFlyer Ascend Card.

|

|||

| Apply Here | |||

| Income Req. | N/A* | Points Validity | 3 years |

| Annual Fee | S$397.85 |

Min. Transfer |

N/A |

| Miles with Annual Fee |

10,000^ |

Transfer Partners |

1 |

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 1.2 mpd |

Lounge Access? | No |

| Special Earn | 2 mpd on SIA, Scoot & KrisShop |

Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *AMEX no longer publishes an official income requirement for this card; the last documented requirement was S$50,000 p.a. | |||

| ^Offered in the form of a Miles Redemption Voucher, which comes with further complications of its own- more on that below | |||

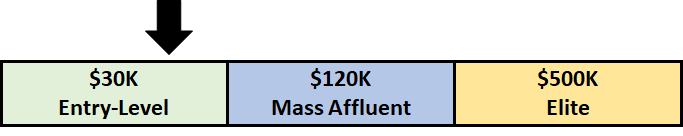

Singapore Airlines has a total of four Singapore Airlines AMEX cobrand cards.

The AMEX KrisFlyer Ascend is positioned as the more premium of the two cards available to the general public, the other being the AMEX KrisFlyer Credit Card (aka “KrisFlyer Blue”). The AMEX PPS and Solitaire PPS Credit Cards can only be held by PPS and Solitaire PPS members respectively.

| Card | Eligibility | Annual Fee |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

All | S$179.55 (FYF) |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

S$397.85 | |

AMEX PPS Credit Card AMEX PPS Credit Card |

PPS Club | S$561.35 (FYF) |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card |

Solitaire PPS Club* | S$561.35 (FYF) |

| *Only for principal members; supplementary members do not qualify |

||

How much must I earn to qualify for an AMEX KrisFlyer Ascend?

American Express no longer publishes minimum income requirements for any of its cards, saying instead that “card application is subjected to customers meeting the regulatory minimum income requirement and internal assessment”.

Prior to this, however, the AMEX KrisFlyer Ascend had an income requirement of S$50,000 per year. In all likelihood, this requirement is no longer strictly enforced, and you should be able to get approved with a minimum income of S$30,000.

How much is the AMEX KrisFlyer Ascend’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$397.85 | Free |

| Subsequent | S$397.85 | S$81.75 |

The AMEX KrisFlyer Ascend has an annual fee of S$397.85 for the principal cardholder, and S$81.75 for supplementary cardholders.

The principal cardholder annual fee represents a 16% increase from the pre-November 2024 figure of S$343.35. If your annual fee was billed on or after 1 November 2024, you’ll be subject to the higher charge (even if your card was approved in October 2024, which seems rather unfair to me!).

The first year’s annual fee is waived for the first two supplementary cards, but cannot be waived for principal cardholders.

That gives the Ascend the distinction of being the only Singapore Airlines cobrand card that does not come with a waiver of the first year’s annual fee. All other cobrand cards, be it the AMEX KrisFlyer Credit Card, AMEX PPS Credit Card, AMEX Solitaire PPS Credit Card or KrisFlyer UOB Credit Card, waive their fees for the first year.

Principal cardholders can request an annual fee waiver for the second and subsequent years, but it’s subject to approval. It never hurts to call up and ask, but unless you’ve been using it regularly over the past year (American Express does not define a minimum spend threshold for a fee waiver), or hold a premium card like the AMEX Platinum Charge or AMEX Centurion, you may not be successful.

In my experience, AMEX tends to offer principal cardholders a 50% waiver of the second and subsequent years’ annual fee upon request, on the condition you give up the complimentary hotel night voucher for the upcoming membership year.

What welcome offers are available?

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

||

| Apply Here | ||

| New Customers | Existing Customers | |

| First Spend | 5K | 5K |

| Spend S$1,000 in FCY (First 30 days) |

31.8K + S$50 cash | 21.8K + S$50 cash |

| Base Miles from S$1,000 in FCY (@ 1.2 mpd) |

1.2K | 1.2K |

| Total Spend | S$1K | S$1K |

| Total Miles | 38K + S$50 cash | 28K + S$50 cash |

New-to-AMEX cardholders who apply and receive approval for an AMEX KrisFlyer Ascend by 2 December 2024 and spend S$1,000 in FCY in the first 30 days will receive 36,800 bonus miles + S$50 cashback when they pay the annual fee and spend S$1,000 within 30 days of approval.

Existing AMEX cardholders who apply and receive approval for an AMEX KrisFlyer Ascend by 2 December 2024 and spend S$1,000 in FCY in the first 30 days will receive 26,800 bonus miles + S$50 cashback when they pay the annual fee and spend S$1,000 within 30 days of approval.

Cardholders will also earn a further 1,200 base miles (S$1,000 @ 1.2 mpd).

If the S$1,000 minimum spend is made in SGD instead of FCY, you will need to deduct 4,000 miles from the bonus component. Also, the calculations assume that this is your first-ever American Express Singapore Airlines cobrand card. If you have held one in the past at any time, you need to deduct 5,000 miles from the bonus component.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.2 mpd | 1.2 mpd |

2 mpd (SIA, Scoot, KrisShop, Grab) |

SGD/FCY Spend

AMEX KrisFlyer Ascend Cardmembers earn:

- 1.2 miles for every S$1 spent in Singapore Dollars

- 1.2 miles for every S$1 spent in foreign currency (FCY)

It used to be the case that the FCY earn rate was boosted to 2 mpd in June and December, but that feature has been discontinued effective 1 November 2024. I don’t think you should shed too many tears about that, since it was always an underwhelming, highly-restricted rate anyway.

No prizes for surmising that the earn rates are incredible mediocre. I’d have thought that cobrand cards would need to offer higher-than-average earn rates, because the cardholder is being asked to “pledge their loyalty”. Miles earned with the AMEX KrisFlyer Ascend can only be transferred to Singapore Airlines, after all, and if I could earn better rates through a non-cobrand card with a wider choice of partners, what appeal is there?

Here’s how this earn rate compares to other general spending cards.

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles UOB PRVI Miles |

1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude DBS Altitude |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | 2.2 mpd |

StanChart Journey StanChart Journey |

1.2 mpd | 2 mpd |

BOC Elite Miles BOC Elite Miles |

1 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.1 mpd |

When it comes to FCY transaction fees, American Express charges the same 3.25% as most of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Using your card overseas therefore means buying miles at 2.71 cents each, way too expensive to consider.

2mpd for Singapore Airlines, Scoot and KrisShop

AMEX KrisFlyer Ascend cardholders earn an uncapped 2 mpd on all transactions made at:

- Singapore Airlines website

- Singapore Airlines mobile app

- Singapore Airlines phone bookings

- KrisShop purchases onboard Singapore Airlines

- KrisShop purchases at krisshop.com

- Scoot website

- Scoot mobile app

Do note that the bonus for KrisShop transactions does not apply if you shop via the Kris+ app.

Tickets must originate from Singapore and be purchased in Singapore dollars. For avoidance of doubt, you’ll also earn 2 mpd if you redeem an award ticket and pay for the taxes and surcharges with the AMEX KrisFlyer Ascend. But considering how you could easily earn 3-4 mpd on these purchases by using other credit cards, there’s nothing to get excited about here.

2 mpd on Grab

AMEX KrisFlyer Ascend cardholders used to earn 3.2 mpd on Grab transactions, capped at the first S$200 spent per calendar month.

From 1 November 2024, this has been cut to 2 mpd, with the cap remaining the same.

No more bonuses on telcos

AMEX KrisFlyer Ascend cardholders used to receive a one-time bonus of 500 miles on their first recurring bill payment at Singtel, Starhub, M1, Circles.Life or MyRepublic.

This perk has been removed from 1 November 2024 onwards.

How are KrisFlyer miles calculated?

Here’s how KrisFlyer miles earned on the AMEX KrisFlyer Ascend are calculated:

| Local/FCY Spend | Multiply transaction by 1.2, then round to the nearest whole number |

Notice how the transaction is not rounded down to the nearest S$1; instead, it’s multiplied by 1.2 straight away. This means the minimum spend to earn points is S$0.42.

This beneficial rounding policy allows the AMEX KrisFlyer Ascend to compete favourably with ostensibly higher-earning cards like the UOB PRVI Miles (1.4 mpd), at least where smaller transactions are concerned:

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendEarn rate: 1.2 mpd |

UOB PRVI Miles UOB PRVI MilesEarn rate: 1.4 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 12 miles | 6 miles |

| S$15 | 18 miles | 20 miles |

| S$19.99 | 24 miles | 20 miles |

| S$25 | 30 miles | 34 miles |

| S$29.99 | 36 miles | 34 miles |

If you’re an Excel geek, here’s the formulas you need to calculate miles:

| Local/FCY Spend | =ROUND (X*1.2,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for KrisFlyer miles?

The AMEX KrisFlyer Ascend’s full exclusion list can be found below:

Exclusions

a) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date;

b) Cash Advance and other cash services;

c) Express Cash;

d) American Express Travellers Cheque purchases;

e) Charges for dishonoured cheques;

f) Finance charges – including Line of Credit charges and Credit Card interest charges;

g) Late Payment and collection charges;

h) Tax refunds from overseas purchases;

i) Balance Transfers;

j) Instalment plans;

k) Annual Card fees;

l) Amount billed for purchase of KrisFlyer miles to top-up your miles balance;

m) Bill payments and all transactions via SingPost (e.g. SAM kiosks, mobile app, online portal);

n) Payments to insurance companies (except payments made for insurance products purchased through American Express authorized channel);

o) Payments to Singapore Petroleum Company Limited (SPC) service stations;

p) Payments for the purpose of GrabPay top-ups;

q) Payments to utilities merchants (with effect from 12 February 2021);

r) Payments to public/restructured hospitals, polyclinics and other public/restructured healthcare institutions and facilities (with effect from 1 October 2022);

s) Transactions relating to education and other non-profit purposes (including charitable donations) (with effect from 1 October 2023);

t) Charges at merchants or establishments that are excluded by American Express at its

sole discretion and notified by American Express to you from time to time.

Historically speaking, the AMEX KrisFlyer Ascend was very liberal with awarding miles, and merchant acceptance was a bigger issue than exclusions. However, in recent times the exclusion list has been growing (though to be fair, it’s no different from what other banks do).

Key exclusions are charitable donations, education, GrabPay top-ups, insurance premiums, SPC transactions, utilities and public hospitals. For avoidance of doubt, private hospitals, CardUp and government organisations still earn miles, where AMEX is accepted.

However, American Express imposes certain restrictions on the types of payments that can be made via CardUp, which are explained below.

What do I need to know about KrisFlyer miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 3 years | N/A | None |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

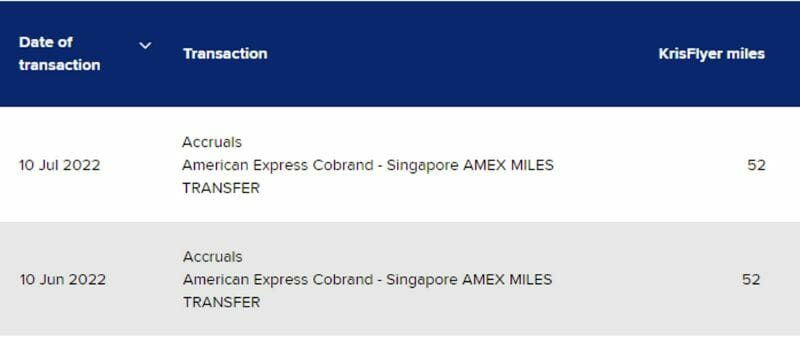

| N/A | 1 | Miles batched and credited once a month |

Expiry

KrisFlyer miles earned on the AMEX KrisFlyer Ascend will expire at the end of the month, three years after they were earned. For example, KrisFlyer miles credited to an account from 1-31 July 2024 will expire at the end of the day on 31 July 2027.

Cancelling an AMEX KrisFlyer Ascend has no impact on the miles already in your KrisFlyer account.

Pooling

All miles earned on the AMEX KrisFlyer Ascend will be credited directly to your KrisFlyer account, where they will pool with miles earned from all other sources (be it other credit cards, flights etc.).

Transfer partners & fees

At the risk of stating the obvious, the AMEX KrisFlyer Ascend is a cobrand card which does not give you a choice of where to credit your points. If you want to earn points that can be converted into a range of frequent flyer partners, pick a non-cobrand card instead.

All conversions to KrisFlyer are free of charge.

Transfer times

Miles earned on the AMEX KrisFlyer Ascend are batched and credited to your KrisFlyer account once a month.

You can typically expect to see them credited around the end of your statement period.

While direct crediting avoids conversion fees, it does mean the three year expiry countdown for KrisFlyer miles starts immediately.

Contrast this with non-cobrand cards where you pay conversion fees, but enjoy “two validities”, one on the bank side, and one on the airline side. For example, if I had a UOB PRVI Miles Card:

- My UNI$ are valid for two years

- Once I convert UNI$ to KrisFlyer miles, they’re valid for three years

- In total I get five years of validity

This means there’s slightly more time pressure to use your miles, though three years should be plenty for most people.

Other card perks

Lounge access (discontinued)

AMEX KrisFlyer Ascend Cardholders previously received 4x lounge vouchers, each of which grants access to one person at participating SATS and Plaza Premium Lounges worldwide.

From 1 November 2024, these vouchers will no longer be awarded. Existing vouchers can be used:

- at SATS Premier Lounges till 31 December 2024

- at Plaza Premium Lounges till 31 March 2025

Miles Redemption Vouchers

When the AMEX KrisFlyer Ascend got “enhanced”, one of the big selling points was a new feature called Miles Redemption Vouchers (MRVs), described as “new benefits specifically for KrisFlyer redemption flights”.

AMEX KrisFlyer Ascend Cardholders can earn a Foreign Spend MRV (18,000 miles) and a Renewal MRV (10,000 miles) by doing the following.

| Qualification | Value | |

| Foreign Spend MRV | Spend S$10,000 in FCY from 1 Nov 24 to 31 Oct 25 | 18,000 miles |

| Renewal MRV | Pay S$397.85 annual fee* | 10,000 miles |

| *Only available from second year onwards |

||

The Foreign Spend MRV is available to cardholders who spend at least S$10,000 in FCY between 1 November 2024 and 31 October 2025 (I assume this benefit will be subsequently extended for future years).

The Renewal MRV is available to cardholders who pay the S$397.85 annual fee. For avoidance of doubt, this MRV is not offered in the first membership year; as the name suggests, it’s for renewing your card.

The most important thing to highlight that MRVs are not credited to your KrisFlyer account as such. For example, it doesn’t mean that when you earn a Renewal MRV, your KrisFlyer miles balance increases by 10,000.

Instead, they’re used to offset the cost of a redemption booking or redemption upgrade. In other words, you must fly to use it; you can’t spend those miles on KrisShop, Kris+, Pelago or other on-the-ground options (not that these are worthy uses of miles, mind you).

Moreover, MRVs comes with some very nitpicky rules that limit their usefulness:

- MRVs can only be used for redemption bookings or redemption upgrades on Singapore Airlines operated flights

- MRVs work as rebates, not discounts. For example, if you have a Renewal MRV and want to book a ticket that costs 40,000 miles, you must have at least 40,000 miles in your account; 30,000 miles won’t cut it

- While you can earn both the Renewal MRV and Foreign Spend MRV, you can only use one MRV per booking

- MRVs will only be applied to the first eligible passenger in the booking or upgrade

Because of this, I strongly advise you against going out of your way to earn the MRVs. The opportunity cost incurred is just too high, and the MRVs are troublesome to use.

For a detailed rundown on how the MRVs work, refer to the article below.

How do the AMEX KrisFlyer Ascend Miles Redemption Vouchers work?

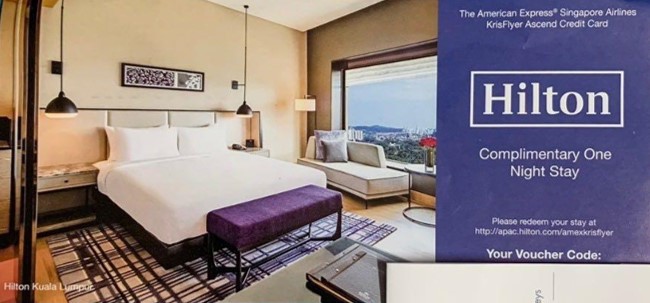

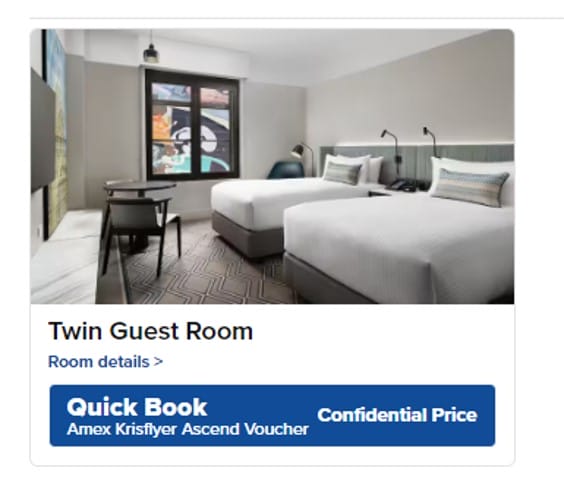

Free Hilton night certificate

|

| Booking Portal |

AMEX KrisFlyer Ascend Card members receive a free one-night stay at selected Hilton properties every year, which covers the room only without breakfast. This is a crucial benefit, because your ability to recover the annual fee depends on how strategically you use it.

There are currently 208 properties where this voucher is accepted, all within Asia Pacific (though more than half are in China).

Obviously, not all hotels represent equal value so you’ll want to choose wisely. As a general guideline, when it comes to brand positioning:

Waldorf > Conrad > Hilton > Doubletree > Hilton Garden Inn

You will not be eligible for Hilton Honors benefits and points on these stays, although some properties may choose to go above and beyond. When I used my voucher at the Conrad Bangkok a couple years back, I was accorded Hilton Gold benefits like free breakfast. This isn’t an entitlement, however, so YMMV.

All bookings must be made with a valid voucher code at least 14 days in advance of arrival via this webpage. Eligible rates will be displayed with a “Confidential Price” label.

Voucher stays follow the hotel’s flexible rate policy, which usually allows for free cancellations at least 24-48 hours before check-in. However, you may need to request a voucher reissuance if you want to cancel and rebook.

| ❓ Don’t have your voucher? |

| If you want to browse rates but don’t have your voucher number handy, you can do a search from the main Hilton page. Just enter the ZAMKF1 in the Group Code field. |

What’s interesting is that the T&Cs say you don’t need to present the physical voucher during check-in, though you will need to show the AMEX KrisFlyer Ascend Card. Based on past experience, however, some properties insist on collecting the voucher, and don’t care what card you use to pay!

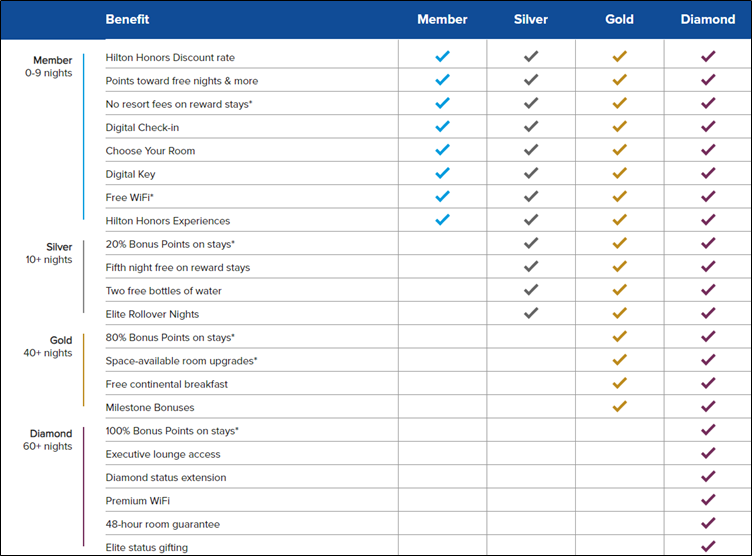

Hilton Silver status

|

| Register Here |

AMEX KrisFlyer Ascend Card members receive complimentary Hilton Silver status, which is valid until 31 March, two calendar years later. For example, if you register on 30 June 2024, your status will expire on 31 March 2026. The general formula to remember is that if you meet the requirements in Year X, your status expires on 31 March X+2.

Subsequently, you’ll need to requalify via the usual criteria. To stretch your validity, apply for the upgrade as early in the year as possible.

Hilton Silver status, in and of itself, isn’t fantastic. It’s just one rung above the entry-level, with no free breakfast, lounge access or room upgrade perks.

But why it matters is because Silver members get the 5th night free on all award redemptions. Hilton sells points several times a year, with prices as low as 0.5 US cents each. You could buy points and redeem them for Hilton’s top-tier properties, saving hundreds of dollars over retail value.

Take for example the Conrad Maldives, where rooms cost 120,000 points per night. If you bought those points at 0.5 US cents each, you’d pay just US$600, significantly less than the asking price. If you’re a Silver member and redeem five consecutive nights, you’d only need to pay 4 x 120,000=480,000 points, or an average of just 96,000 points (US$480) per night!

Fast track to KrisFlyer Elite Gold

AMEX KrisFlyer Ascend Cardholders can enjoy a fast-track to KrisFlyer Elite Gold when they spend at least S$15,000 on Singapore Airlines or Scoot ticket purchases within the first 12 months of card approval. If you miss that window, you won’t get another chance to try in the following membership year, barring a promotion.

Singapore Airlines or Scoot tickets must be:

- Purchased on the Singapore Airlines or Scoot website or mobile app

- Originating from Singapore

- Charged in Singapore Dollars

However, real world experience says that the “originating from Singapore” requirement is not strictly enforced. If you’re booking a ticket to Singapore and the website lets you pay in SGD (there’s usually a dropdown box appearing on the final screen, though not always), then such transactions would count. Keep in mind that this is an unofficial loophole that could be patched at any time, so do it at your own risk.

Eligible spending includes both commercial tickets as well as paying for taxes and surcharges on a KrisFlyer award ticket with your card (whether the award flight is on Singapore Airlines or one of its partners).

There is no requirement that the purchased tickets need to be flown by the cardholder. Think about the scenario of someone who often buys air tickets for his entire family. He can’t accrue the Elite miles on their tickets (only the person whose name is on the ticket can), but can nonetheless achieve KrisFlyer Elite Gold through his total card spending.

From time to time, American Express runs promotions that allow you to meet the minimum spend through transactions other than Singapore Airlines/Scoot flight bookings. The most recent offer, which ended on 31 May 2024, reduced the total spend to S$12,500, of which only S$2,500 had to be on Singapore Airlines flight bookings.

Fast Track T&Cs: AMEX KrisFlyer Ascend

|

|

American Express Singapore Airlines KrisFlyer Ascend Credit Card Members who charge S$15,000 or more on eligible Singapore Airlines ticket purchases* made directly online at singaporeair.com or the SingaporeAir mobile app to their Card within the first 12-months upon Card approval, will be upgraded to the KrisFlyer Elite Gold membership tier within 6 weeks from the time that you meet the spend criteria. Eligible ticket purchases* are for travel originating from Singapore only and must be purchased in Singapore Dollars. For Card Members who are already KrisFlyer Elite Silver members, you will be upgraded to the KrisFlyer Elite Gold membership tier. This benefit will not be applicable to Card Members who are existing PPS Club or KrisFlyer Elite Gold members. *excludes ticket purchases via Pay Small (from 10 Nov 2022 onwards, ticket purchases via Pay Small will be included). The Elite Gold status is valid for one (1) year from date of upgrade only. Requalification is based on standard requalification terms under the KrisFlyer programme. For information on the benefits of being an Elite Gold member and requalification into Elite Gold status, please visit: KrisFlyer and Singapore Airlines terms and conditions apply. Singapore Airlines reserves the right to vary these terms and conditions or terminate this benefit without prior notice at their own sole discretion. |

Status granted under this fast-track is only valid for 12 months, after which you will need to requalify by clocking the regular 50,000 Elite miles.

KrisFlyer Elite Gold confers additional benefits when flying on Singapore Airlines or Star Alliance carriers, such as:

- A 25% bonus on KrisFlyer miles

- Airport lounge access, including a guest

- Priority check-in

- Priority boarding

- Priority luggage handling and additional 20kg allowance

For more details on KrisFlyer Elite Gold benefits, refer to the post below.

Complimentary travel insurance

| Coverage | Amount |

| Accidental Death | S$1,000,000 |

| Medical Benefits | N/A |

| Travel Inconvenience |

|

| Policy Wording | |

AMEX KrisFlyer Ascend Cardholders who charge their airfares to the card will receive automatic travel insurance coverage, underwritten by Chubb. For avoidance of doubt, this applies both to cash tickets, as well as award tickets where the taxes and fees are paid for with the AMEX KrisFlyer Ascend.

Cardholders receive S$1,000,000 coverage for accidental death or permanent disability while traveling on a public conveyance. There’s also coverage for travel inconveniences like missed connections and bag delays.

However, there is no coverage for medical expenses, nor medical evacuation. This is something you can’t afford to miss, so a separate travel insurance policy is almost mandatory.

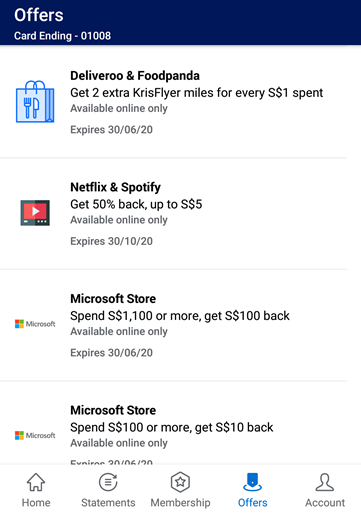

AMEX Offers

AMEX Offers are targeted deals pushed to your AMEX app, which can range from small savings like getting a few dollars back on contactless transactions, to much more substantial offers like S$75 off a S$300 Hilton transaction. They can also take the form of bonus miles promotions, like a bonus 2 mpd on Deliveroo and foodpanda.

This is a nice feature to have and can result in substantial savings, but it’s not a unique feature of the AMEX KrisFlyer Ascend, and you could enjoy the same benefits with any other AMEX card.

AMEX Pay

AMEX Pay is a QR-code based payment solution that allows you to pay with American Express cards at participating merchants.

The key use case here are hawker, wet market or other small businesses which normally don’t accept credit card payments. In these situations, having an American Express card allows you to earn some miles that you otherwise wouldn’t have been able to.

AMEX KrisFlyer Ascend cardholders will earn 1.2 mpd on AMEX Pay transactions. Of course, you don’t need an Ascend card to use AMEX Pay; you could just as well earn 1.1 mpd with an AMEX KrisFlyer Credit Card, for instance.

Terms and conditions

Summary review: AMEX KrisFlyer Ascend Card

|

|

| Apply Here |

|

| 🦁 MileLion Verdict | |

| First Year | Recurring |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

☐ Take It ☐ Take It Or Leave It ☑ Leave It |

While American Express may spin the changes to the AMEX KrisFlyer Ascend as enhancements, reality is anything but.

The Miles Redemption Vouchers are convoluted and earning them entails a significant opportunity cost, the earn rates are painfully mediocre, the lounge vouchers have been removed, and to add insult to injury, the annual fee has been hiked to almost S$400- that’s approaching the cost of some cards in the $120K segment!

The most you can say is that getting the card for one year might make sense if the welcome offer is good enough. For example, given the offer available at the time of writing:

- 36,800 bonus miles are worth S$552 (at a value of 1.5 cents per mile)

- The Hilton voucher could conservatively valued at S$250-300, though you can certainly get more depending on which property you choose and when you stay

Those two perks alone should cover the first year’s S$400 annual fee, but from the second year onwards, it’s hard to see any reason to keep the card.

All things considered, I still believe the KrisFlyer UOB Credit Card is the superior cobrand option, given its uncapped 3 mpd on dining, food delivery, online shopping & travel and transport (not to mention its waivable annual fee).

So that’s my review of the AMEX KrisFlyer Ascend. What do you think?

Hi Aaron, just a data point, I applied for a fee waiver and also received my lounge vouchers and hotel voucher too. Just FYI!

Thanks! Yes, have heard of those cases but they’re the exception not the rule.

I also got the fee waiver with vouchers sent

how much did you guys spend? I didn’t get anything

I got fee waiver with 8,000 miles but no vouchers 🙁

If they include donation to charities under exclusion, I might cancel the card. The good thing is no need for KF miles transfer fees.

For many years, every annual family holiday includes 1 lounge access with the 4 vouchers. But the fee is higher now. Not sure if I will call to cancel in few months time when renewal rolls round.

I’ve been a loyal member for many years now. But the benefits for existing card holders are measly. I’ve mentioned this to their customer service before, but seems like the benefits and attractions come at the beginning when you apply for the card. SO I’m thinking cancelling the card, and then re-apply a year later.

Hi Aaron, would you be reviewing the AMEX Platinum Reserve Card any time soon?

unlikely. you can read this: https://milelion.com/2019/09/26/neither-here-nor-there-the-future-of-the-amex-platinum-reserve/

For the first year free waiver, do i get the benefits too?

Hi Aaron, you state the list of exclusions has utilities. In the next paragraph, you say utility transactions can earn miles. Could you reconfirm which type of utilities can earn miles?

Thank you.

fixed. utilities do not earn miles

Hi Aaron, there is an option for “consent for direct marketing” when applying for the card. If I do not want to consent for marketing, do I get all the benefits and bonus miles as stated?

no need to opt in

Hi Aaron, can i use ascend to pay for cardup? Does it count towards the 3K spend?

Will amex give silver status to an existing standard Hilton member and if so, how do you get that applied to your account?

You will provide your Hilton account number at the time of registration

Question: Is the Hilton 1 night voucher only awarded upon paying the annual fee? Does that mean I cannot apply for the card today and use it for a Hilton stay a few months down the road?

annual fees are paid upfront

Thanks Aaron.

One more questiom, is there a way to check for blackout dates for this particular voucher or should I email the hotel?

hey Aaron, I think there’s a slight error in your mile table calculation compared to PRVI miles. In Amex TNCs it states miles are awarded in whole and are rounded up if the resulting calculation is 0.50 miles and down if 0.49 miles and below.

which means a $9.99 transaction would accrue 11.98≈12 miles, $19.99 would be 28.78≈29 miles, $29.99 would be 35.98≈36 miles and so on.

good spot! have fixed that, thanks.

2021 I got Platinum concierge to waive fee and no vouchers or even renewal letter received. That’s ok.

2022 I was too busy and paid the fee without checking the card statement details. 3 months later (yes, 3 mths later) got the envelop this week with useless lounge vouchers + 1 hilton voucher.

And…bummer: http://apac.hilton.com/amexkrisflyer validates my card and voucher number and Singapore only has 1 hotel for selection (even before inputing arrival date): Hilton Garden Inn.

Unbelievable…..

Aaron….pls spread the word

AMEX KrisFlyer Ascend cardholders earn 2.0 mpd on all transactions made with Singapore Airlines and KrisShop, without cap.

Not exactly, only for flights originating from Singapore and paid in SGD. It is in TnC.

For anyone else who, like me, was curious to see how you could see miles earned for individual transactions, I found the answer in another blog (https://trevallog.com/amex-krisflyer-review/):

“Later, I found that I can actually see the miles earned in each transaction via mobile app. To do that, I need to open my Amex SG mobile app, select AMEX KrisFlyer Card, tap the Membership tab at the bottom of the screen, then tap View Activity button. Here, I can see my recent transactions and the number of points earned on each transaction.“

Hey Aaron, wondering if you know would supplementary amex ascend card be able to use the vouchers that come with Ascend, i.e. the lounge access voucher and the free night stay voucher

YMMV but after holding this card (or other Amex cards) for over 15 years, this year (2023) it was no dice on a fee waiver. I canx the card because the fee is just not competitive for what Amex are offering. They were surprisingly nochalant about losing a long-time customer.

Sadly, I’ll do the same!

Same experience, I been holding this card for 14 years.

Basically a pump and dump card!

I have a DBS Amex card. Will I still be qualified for the sign up miles ?

Hello Aaron, I am a ‘New to American Express Card Members’ and looking to apply for this KrisFlyer Ascend card, can I clarify/confirm on the requirements for the offers as listed below? Do I have to spend S$2,000 or S$3,000 within the first 2 months, to get both Milelion Offer and Amex Welcome Offer? TnC (https://www.americanexpress.com/content/dam/amex/sg/campaigns/pdfs/affiliates-milelion-tncs-5septo16oct23-kfa.pdf) Eligible New to American Express Card Members will receive: 2a. Milelion Offer: • Samsonite RED TOIIS C Spinner 75/28 Exp in Black – 387 (worth S$420) (the ‘Gift’) with annual fee payment and additional S$1,000 spend within first 2 months of Card approval on… Read more »

full details here: https://milelion.com/2023/09/05/new-amex-krisflyer-ascend-welcome-offer-28100-bonus-miles-samsonite-luggage/

Hi Aaron, I signup for this card last year and cancelled it recently but have not yet utilized the hotel voucher. I’m planning for my trip and realized on the tnc it says I must present the “valid” Amex card during check-in. Do you happen to know for such case, will I get rejected when I check in at the hotel because my AMEX card is not valid anymore? I called AMEX, and obviously, they asked me to reinstate (and pay the annual fee), which is not really an option for me coz I don’t want to pay the annual… Read more »

I’m curious to know what happened in your case as I might encounter the same very soon

Hi Aaron, I have a question regarding the KrisFlyer Elite Gold Status Accelerator benefit.

For an SQ flight booked and paid and reflected in ‘Manage Booking’ on SQ site.

Will the purchase of ‘TOP UP THE FARE DIFFERENCE’ of that booking via AMEX KrisFlyer Ascend card be eligible for KrisFlyer Elite Gold Status Accelerator program?

*The flight is paid in SGD

**The top up upgrade is paid in SGD

***Travel originating from Singapore

Hi Aaron, do you know if the 4x lounge access can be shared with friends/family that do not have the cc?

Yes, as long as you are there to bring them in

Hi, may I ask if the new-to-card offer (spend 3000 in first month to get miles) can be stacked with the 2.0 mpd for the SIA flight? Basically will my SIA purchase qualify for the $3000 spending requirement?

If you hold both Amex Platinum Charge and the blue Amex Krisflyer, does it make sense to apply to convert the blue Krisflyer to Ascend? Will you be asked to pay the annual fee, and will you get the welcome bonus?

You’ll probably need to pay first year fee if you’re trying to hit a welcome offer (don’t recall any for existing cardholders though); but I’ve never had trouble getting my annual fee waived for subsequent years.

Very informative.

I see that you have given UOB Preferred Platinum a higher rating “Take it”. In summary could you tell me why? I have both UOB PP and Amex Ascend but a recent incident made me feel that Amex has poor service recovery so I am thinking of supporting UOB. My intention is to generate Krisflyer points. Appreciate your advice. Thanks

Just asked for a fee waiver and they would do it if I chose to forgo the lounge passes and hotel voucher. Will be looking at cards with better earn rate.

Very underwhelming card.

someone said we will not be able to use the voucher for hilton orchard next year? not sure how true.

I was just trying to book Jan 2025, and unable to do so. I just called and they said they can’t confirm with the list until early December. It certainly is a disappointment!