Here’s The MileLion’s review of the Citi Prestige Card, Citibank’s second most exclusive credit card after the invite-only Citi ULTIMA.

While the Prestige has been discontinued in the USA and the UK, it’s still going strong in Singapore. For years, it’s set the standard for the S$120K segment, offering unlimited lounge visits (with one guest), complimentary limo rides, and the 4th Night Free hotel benefit — perks which easily offset the annual fee.

But 2025 has not been kind to cardholders. Unlimited lounge access was slashed to just 12 visits, and Citi added insult to injury with a 20% hike in the annual fee. With the continued lacklustre PayAll promotions and middling earn rates, it’s little wonder that some customers are now reconsidering their loyalty.

Citi Prestige Citi Prestige |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| With the removal of unlimited lounge visits and an annual fee increase, Citi Prestige Cardholders will have to work even harder to recover their investment. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Citi Prestige Card

Let’s start this review by looking at the key features of the Citi Prestige Card.

|

|||

| Apply | |||

| Income Req. | S$120,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$651.82 |

Min. Transfer |

25,000 TY points (10,000 miles) |

| Miles with Annual Fee |

32,000 | Transfer Partners |

11 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 1.3 mpd | Points Pool? | No |

| FCY Earn | 2 mpd |

Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

The Citi Prestige comes in metal cardstock, but it’s actually one of the lightest metal cards on the market. In fact, it’s more of a hybrid, weighing in at 8 grams, just a hair over a standard plastic card’s 5 grams.

How much must I earn to qualify for a Citi Prestige?

The Citi Prestige has a S$120,000 p.a. income requirement, although it is also available to Citigold customers (min AUM: S$250K) who earn at least S$30,000 p.a.

If you don’t meet the income criteria, an alternative is to get the Citi Prestige as a secured credit card, with a deposit of at least S$10,000 (though you will need a total balance of at least S$15,000 to avoid paying fees). Visit a Citi branch to make enquiries.

How much is the Citi Prestige Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$651.82 | Free |

| Subsequent | S$651.82 | Free |

In July 2025, Citi Prestige increased its annual fee for principal cardholders by 20%, from S$545 to S$651.82.

The revised annual fee applies to renewals on or after 1 July 2025. Cardholders will not be required to top-up any difference for annual fees charged prior to 1 July 2025. All supplementary cards remain free for life.

To offset the higher fee, Citi also increased the miles awarded for paying the annual fee from 25,000 to 32,000. This actually lowers the cost per mile from 2.18¢ (S$545/25,000 miles) to 2.04¢ (S$651.82/32,000 miles). Despite this, the increase is still difficult to swallow, especially since it coincided with a significant reduction in lounge benefits (more on that below).

Annual fee waivers are generally not offered. However, Citigold Private Clients with a minimum AUM of S$1.5 million and accredited investor status can receive a waiver for the first year’s fee, though this comes at the expense of forfeiting the welcome offer (see below).

What sign-up bonus or gifts are available?

|

| Apply |

Customers who apply for a Citi Prestige Card by 16 January 2026 can enjoy a welcome bonus of up to 65,000 miles.

This is available to anyone who has not cancelled a principal Citi Prestige Card in the past 12 months. In other words, you are eligible even if you currently hold another principal Citi credit card.

Regular customers

New Citi Prestige Cardholders can earn up to 142,500 bonus ThankYou points (equivalent to 57,000 miles) by completing the following.

| ThankYou Points | Miles | |

| Pay S$651.82 annual fee | 80,000 | 32,000 |

| Spend S$2,000 during qualifying period | 62,500 |

25,000 |

| Total | 142,500 |

57,000 |

Citigold/Citigold Private Client

New Citi Prestige Cardholders who have Citigold or Citigold Private Client status can earn up to 162,500 bonus ThankYou points (equivalent to 65,000 miles) by completing the following.

| ThankYou Points | Miles | |

| Pay S$651.82 annual fee | 80,000 | 32,000 |

| Spend S$2,000 during qualifying period | 82,500 |

33,000 |

| Total | 162,500 |

65,000 |

Bonus points are awarded on top of the regular base earn rate. Assuming you spend the entire S$2,000 in local currency, you should add 2,600 miles to your total figure (S$2,000 @ 1.3 mpd).

More details on this offer can be found below.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.3 mpd | 2 mpd | N/A |

SGD/FCY Spend

Citi Prestige Cardholders earn:

- 1.3 mpd for spending in Singapore Dollars (3.25 ThankYou points per S$1)

- 2 mpd for spending in Foreign Currency (5 ThankYou points per S$1)

However, there is also a Relationship Bonus to factor in. This awards 5-30% more points depending on your tenure with Citibank, and whether you have Citigold status.

Contrary to popular belief, a 5% bonus does not mean you earn 1.3 * 1.05 = 1.365 mpd. Instead, the relationship bonus percentage is applied to your overall dollar spend amount to derive bonus points. For example, if you spend S$10,000 in a year with a 5% bonus, you get 5% * 10,000= 500 bonus points, or a paltry 200 miles. The bump in mpd is a mere 0.02!

| Non-Citigold (Local/FCY) |

Citigold (Local/FCY) |

| 0-5 years: 1.32/2.02 mpd | 0-5 years: 1.36/2.06 mpd |

| 6-10 years: 1.34/2.04 mpd | 6-10 years: 1.38/2.08 mpd |

| >10 years: 1.36/2.06 mpd | >10 years: 1.42/2.12 mpd |

Even with the Relationship Bonus, earn rates continue to be a weak point of the Citi Prestige Card, and it ranks towards the bottom of the $120K pack. Its only saving grace are the wider range of transfer partners, and more favourable rounding policy that awards points per S$1 of spend (unlike the S$5 blocks of some competitors).

| 💳 Earn Rates for S$120K Cards (sorted by sum of local and FCY earn rate) |

||

| Card | Local | FCY |

StanChart Visa Infinite StanChart Visa Infinite |

1.4 mpd# | 3 mpd# |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 3.2 mpd@ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd | 2.4 mpd |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 2.2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd | 2 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd | 0.69 mpd |

| #With minimum S$2K spend per statement month. Otherwise 1 mpd for both @With minimum S$4K spend per calendar month. Otherwise 2 mpd ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank |

||

All FCY transactions are subject to a 3.25% fee, which is par the course for the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With a 3.25% FCY fee, using your Citi Prestige Card overseas represents buying miles at 1.63 cents each.

You could pair this card with Amaze, but remember: Amaze converts all transactions into SGD, so you’ll only accrue miles at the local earn rate of 1.3 mpd. Still, that might be an acceptable trade-off. Given Amaze’s implicit FCY fee of 2%, the cost per mile is slightly lower at 1.54 cents each.

Transaction date or posting date?

The Citi Prestige Card tracks spending based on the posting date, not transaction date.

If you’re accumulating spend towards your welcome bonus, be careful about making transactions towards the end of the qualifying period– anything that posts beyond the deadline will not be included, even if the transaction was made during the qualifying period!

Which cards track spending by transaction date vs posting date?

When are ThankYou points credited?

ThankYou points are credited when your transaction posts, which generally takes 1-3 working days.

How are ThankYou points calculated?

Here’s how you can work out the ThankYou points earned on your Citi Prestige Card.

| Local Spend | Round down transaction to nearest S$1, then multiply by 3.25. Round to nearest whole number |

| FCY Spend |

Round down transaction to nearest S$1, then multiply by 5. Round to nearest whole number |

Unlike some cards which award points for every S$5 spent (such as the OCBC VOYAGE and UOB Visa Infinite Metal Card), the Citi Prestige awards points for every S$1 spent.

This means you lose fewer points through rounding, which can make a big difference on smaller transactions. For example, the Citi Prestige Card can outperform the ostensibly higher-earning UOB Visa Infinite Metal on certain transactions, as illustrated below.

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (ROUNDDOWN(X,0)*3.25,0) |

| FCY Spend |

=ROUND (ROUNDDOWN(X,0)*5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for ThankYou points?

A full list of ineligible transactions to earn ThankYou points can be found in the Citibank T&Cs, at point 2.

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Educational Institutions

- Government Services

- Hospitals

- Insurance

- Professional Services and Membership Organizations

- Quasi cash transactions

- Real Estate Agents and Managers

- Top-ups to prepaid accounts like YouTrip and GrabPay

- Utilities

For avoidance of doubt, the Citi Prestige Card will earn points for CardUp spending. However, you may be able to achieve a lower cost per mile through Citi PayAll, depending on what offers are running.

What do I need to know about ThankYou points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| No Expiry | No | S$27.25 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 25,000 TY Points (10,000 miles) |

11 | 24-48 hours (for KF) |

Expiry

ThankYou points earned on the Citi Prestige Card do not expire, so long as your card remains open.

Pooling

Citibank points do not pool across cards.

If you have 25,000 ThankYou points on the Citi Prestige Card and 30,000 ThankYou points on the Citi Rewards Mastercard, you will have to pay two separate conversion fees. This also means that you’ll need to transfer all your points out before cancelling the card, or else forfeit them.

Transfer Partners & Fee

Citibank has the widest variety of transfer partners in Singapore, with 11 airline and hotel programmes to choose from.

More importantly, all three airline alliances are represented: Star (KrisFlyer, EVA, THAI, Turkish), oneworld (British Airways, Cathay Pacific, Qantas, Qatar), and SkyTeam (Flying Blue). This means your points are intrinsically more valuable, since you’re hedged against any one particular programme carrying out a devaluation.

Points transfer at a 5:2 ratio, with a minimum transfer block of 10,000 miles. I really appreciate that Citi uses the same transfer ratio for all its programmes, unlike HSBC and OCBC.

| Frequent Flyer Programme | Conversion Ratio (Citi: Partner) |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

| 25,000: 10,000 | |

|

25,000: 10,000 |

| 25,000: 10,000 |

Transfers cost S$27.25 each, regardless of how many points are converted.

Transfer Times

Citibank tells customers that points transfers will take 14 business days, but in reality it’s usually 24-48 hours for KrisFlyer, or 2-4 working days for other programmes.

If you need your points credited instantly, you can move them via Kris+ at a rate of 10,000 ThankYou points = 3,400 KrisPay miles. KrisPay miles can then be instantly converted to KrisFlyer miles at a 1:1 ratio.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

There are pros and cons to this:

Pros

- Minimum conversion block is reduced to 10,000 ThankYou points, versus 25,000 ThankYou points if converting via Citibank’s rewards portal

- Transfers from Citi to Kris+ and Kris+ to KrisFlyer are instant

Cons

- Those 10,000 ThankYou points would normally be worth 4,000 KrisFlyer miles, so a 15% haircut is incurred

Should you choose to take this option, do note that it’s a two-step process. The first transfer is from Citi to Kris+, the second is from Kris+ to KrisFlyer. A big button will pop up after the first step, prompting you to make the second step.

If you do not convert these points within 21 days, or spend any of the transferred miles, the balance will be “stuck” in Kris+, where they expire after six months, and are worth a mere 0.67 cents apiece.

Other card perks

4th Night Free on hotel stays

One of the biggest draws of the Citi Prestige Card is the 4th Night Free benefit, which allows principal cardholders to stay four nights at a hotel for the cost of three.

- The principal cardholder must make a reservation in their own name for a stay of a minimum of four consecutive nights

- The reservation must be made through the Citi Prestige Concierge or Citi Prestige Digital Concierge

- The reservation must be fully prepaid at the time of booking

- The rate must be available on the hotel’s public website, or via Expedia

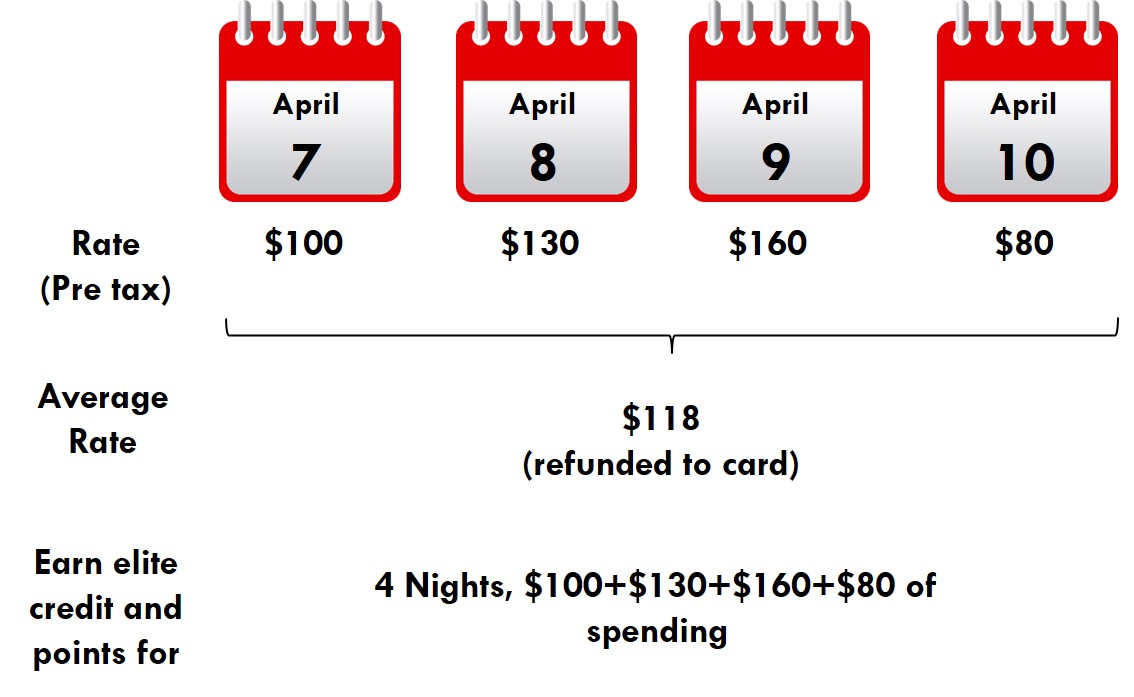

If the above criteria is satisfied, the average pre-tax rate of the first four nights will be refunded within two billing cycles (up to 90 days) from completion of full payment.

In the example above, the cardholder receives a refund of S$118 (the average of S$100, S$130, S$160 and S$80). Since the refund is on the Citi side, elite credit and hotel points (if applicable) are earned on the full amount of spending.

A maximum of one free night can be enjoyed per stay, and back to back stays will not be honoured. Back to back stays are defined as consecutive stays:

- In the same hotel, same city

- In a different hotel, in the same city

Consecutive stays are defined as any stay in which the check-in date is less than seven days from the previous check-out date.

The 4th Night Free benefit does not apply to:

- Full and half board room stays

- Single and multi-room suites

- Home & farm stays

- Serviced apartments

- Villas

- Packaged stay and member rates, such as air and hotel, hotel and car rental, hotel and meals bundled promotions

As you can see, Citi has slapped a whole lot of restrictions on this benefit, so much so that existing cardholders complain it’s dying the death of a thousand cuts. You can still save money, sure, but you might drive yourself a little crazy trying to do it.

Moreover, the 4th Night Free benefit won’t really save you 25%, because:

- OTAs may be offering lower rates, which allow you to stack promo codes, 4 mpd cards or even bonus miles from bank x OTA portals

- You can’t stack it with ShopBack cashback or HeyMax Max Miles

- You cannot book member rates, even if the membership is free to join

- The free night doesn’t include taxes

So can this benefit justify the annual fee? It all boils down to how you use it. There is no cap on the number of times you can use it each year, nor the maximum rebate you can receive. This benefit could be worth nothing at all, or it could single-handedly cover your annual fee.

Complimentary airport limo

Once upon a time, spending just S$1,500 per quarter in foreign currency would unlock four free airport limo rides on the Citi Prestige Card. But in April 2019, Citi hiked the spending to S$20,000 per quarter while reducing the rides to two. That was an outrageous change, and the bank’s attempts to spin it as an “enhancement” didn’t help.

In February 2020, Citi walked back the changes somewhat. The minimum spend was reduced to S$12,000 per quarter, where it’s remained ever since.

Quarters are defined as:

- Q1: 1 Jan to 31 Mar

- Q2: 1 Apr to 30 Jun

- Q3: 1 Jul to 30 Sep

- Q4: 1 Oct to 31 Dec

Citi defines qualifying spend as follows.

|

“Qualifying Spend” refers to any retail transactions (including internet purchases) which do not arise from: (i) any Equal Payment Plan (EPP) purchases |

This does not exclude transactions like charitable donations, government services, insurance premiums and utilities. Even though these transactions will not earn any points, they will still count towards the minimum spend for limo rides (corroborated by numerous data points in the Citi Prestige Chat)- so you might as well charge them here.

For the avoidance of doubt, Citi PayAll spending will count towards the S$12,000 qualifying spend, provided the service fee is paid.

Clarified: Qualifying spend for Citi card welcome offers & benefits

Rides must be booked in the same quarter they are earned, although the ride date can be outside the earning quarter. For example, on 3 May 2023 I charge S$12,000 in qualifying spend to my Citi Prestige Card. This earns me two complimentary limo rides, which I must book by 30 June 2023. The actual utilisation date can be beyond 30 June 2023.

Remember, limo rides are charged at the time of booking (not utilisation), so all that matters is the charge is reflected in the correct quarter.

Reimbursement for limo rides will take place in the following quarter. All bookings must be done via the Citi Prestige concierge at least 48 hours prior to pickup time.

Another point worth noting is that the airport limo service can be used for both airport pick-ups and drop-offs, unlike some competing cards like the HSBC Visa Infinite where rides are only valid for airport drop-offs.

12x lounge visits

Here’s where another big nerf has taken place.

Prior to 1 July 2025, Citi Prestige Cardholders enjoyed unlimited lounge visits via Priority Pass, together with one guest. However, because of some, shall we say, overenthusiastic usage, Citi decided to cut the number of visits to 12 per calendar year.

| 💳 Airport Lounge Benefits (Income Req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ Up to 5 supp. cards |

OCBC VOYAGE Card OCBC VOYAGE Card |

Dragon Pass Lounge only |

∞ | 2 |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

Dragon Pass | ∞ + 1 guest* | N/A |

Citi Prestige Card Citi Prestige Card |

Priority Pass | 12 Multi Guests |

N/A |

DBS Vantage Card DBS Vantage Card |

Priority Pass | 10 Multi Guests |

N/A |

StanChart Visa Infinite StanChart Visa Infinite |

Priority Pass | 6 1x Guest |

N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | 4 | N/A |

AMEX Platinum Reserve AMEX Platinum Reserve |

N/A | N/A | N/A |

| *Will be reduced to 12 visits per calendar year from 1 June 2026 |

|||

Lounge visits can be shared with any number of guests, so a family of four could visit the lounge three times, or a couple could visit the lounge six times.

Unlike American Express, Citi does not have any restrictions on so-called “non-lounge experiences” like restaurants and spas.

Haute Dining

Citi Prestige Cardmembers enjoy 1-for-1 pricing for the Haute Dining experiences that Citi organises several times a year.

While it’s a nice little perk, I wouldn’t put an explicit value on this because slots get snapped up almost as quickly as they’re released, and there’s a big element of luck involved. You’ll definitely save a few hundred dollars if you grab a slot, but it’s far from guaranteed.

Buy miles with Citi PayAll

|

| Citi PayAll |

Citi PayAll is a platform that allows Citibank cardholders to pay various types of bills and earn rewards points. 23 different categories of payment are currently supported:

| 💰 Citi PayAll: Supported Payments | |

| Category | Monthly Cap |

|

S$200,000 |

|

S$100,000 |

|

S$30,000 (each category) |

|

Outstanding balance with IRAS |

Here’s a simple example of how it works.

- Set up a S$10,000 insurance premium payment via Citi PayAll

- Citi PayAll will charge your Citi Prestige Card S$10,260 (S$10,000 + 2.6% admin fee)

- Citi Prestige Card will earn 13,000 miles (S$10,000 @ 1.3 mpd; no miles for admin fee)

- Cost per mile= 2 cents (S$260 admin fee / 13,000 miles)

The admin fee has to be paid, but historically speaking, Citi PayAll has run promotions that upsized the earn rate or threw in additional Grab vouchers, making it almost too good to be true- once upon a time we were buying miles at just 0.8 cents each!

Unfortunately, Citi has dialed back the generosity. In 2024, the admin fee for Citi PayAll was increased from 2.2% to 2.6%, which means that outside of a promotion, the cost is probably not worth considering. Moreover, this year’s income tax promotion was generally regarded as underwhelming, and we’ve not seen another offer in 2025.

Citi PayAll transactions will count towards the minimum spend for welcome offers and other promotions, provided the service fee is paid.

I’ve written a comprehensive guide to Citi PayAll, so be sure to check out the article below.

Complimentary golf games

|

| Golf Bookings |

Citi Prestige Cardholders enjoy six complimentary golf games per year, split into:

- Three complimentary games in Singapore

- Three complimentary games in the region

A maximum of one active golf booking per cardholder is permitted at any time, and you must complete the existing game before making another booking.

Games are valid at the following clubs.

Singapore

| Club | Benefit |

|

|

| ^There is a requirement of one minimum accompanying paying guest per cardholder for Sentosa Golf Club |

|

Region

| Club | Benefit |

|

|

| *Mission Hills Golf Club requires a minimum one-night stay for every tee time booking |

|

Sands Lifestyle Prestige Tier

From now till 30 April 2026, Citi Prestige Cardholders can enjoy a complimentary 3-month membership upgrade to the MBS Sands Lifestyle Prestige tier. They can renew their membership for a further 9-month period by spending at least S$1,500 within the initial 3-month period, failing which they will be downgraded to the entry-level Lifestyle tier.

To upgrade their status, Citi Prestige Cardholders must visit one of the following locations in person

- Lobby, Hotel Tower 1

Daily: 10am – 10.30pm - The Shoppes, B1 (above Sampan Rides)

Daily: 10am – 11pm - The Shoppes, B2 (near Digital Light Canvas)

Daily: 10am – 11pm

Sands Lifestyle Prestige members enjoy perks such as:

- Up to 20% instant Resort Dollars at over 250 outlets

- 10% savings on hotel room rate

- Preferential earning of up to 10% instant Resort Dollars at selected restaurants

- $4 Resort Dollar parking (with same-day spend)

- Complimentary tickets to Marina Bay Sands attractions (up to two tickets per day per attraction, capped at two per month)

- Digital Light Canvas

- Sampan rides

- SkyPark Observation Deck

- 1-for-1 ArtScience Museum exhibition tickets (up to four tickets per month)

The full list of perks can be found here, and the T&Cs here.

Complimentary travel insurance

Citi Prestige Cardholders used to enjoy two separate complimentary travel insurance policies: one provided by Citi, and the other by Mastercard.

While you can’t be reimbursed twice for the same expense (e.g. medical bills), if the coverage on one policy is insufficient, the second policy will step in to make you whole. Also, benefits like delayed luggage, flight delays or death claims can be paid out across both policies.

Unfortunately, Citi eliminated its own policy from 28 February 2025, leaving Mastercard (underwritten by AIG) as the only coverage.

| Accidental Death | US$500,000 |

| Medical Expenses | US$500,000 |

| Travel Inconvenience | Flight Delay: US$500 Baggage Delay: US$500 Lost Baggage: US$3,000 |

| Policy Wording | |

It’s not bad by any means, and covers the cardholder, spouse, children and even domestic helpers. However, there is no coverage for post-trip medical expenses in Singapore, so take note of that if it’s important to you.

World Elite Mastercard benefits

The Citi Prestige Card is part of the World Elite Mastercard tier, which means that cardholders enjoy the additional perks such as hotel and rental car elite status.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

|

Remember, Citi Prestige Cardholders enjoy all supplementary cards for free, so you can share these benefits with family members at no additional cost. They might not be able to enjoy Citi-offered perks like Priority Pass and the 4th Night Free benefit, but all the World Elite Mastercard benefits are still available.

Terms & Conditions

Summary Review: Citi Prestige Card

|

|||

| Apply |

It’s been a bruising year for the Citi Prestige Card, no two ways about it.

With the loss of unlimited lounge benefits and a 20% annual fee hike, cardholders will have to lean even more heavily on the 4th Night Free benefit, complimentary limo rides, golf benefits and Haute Dining to earn back their investment. Can it be done? For sure- as I’ve shown in my Keep or Cancel article, there is still a path to annual fee recovery.

But it’s certainly harder than ever before, and Citi has done little to enhance the card’s badly-lagging earn rates, or offer a more compelling Citi PayAll promotion. In fact, I’d wager that the HSBC Premier Mastercard could replace this in most people’s wallets, provided you’re willing to commit a S$200,000 AUM with HSBC.

So that’s my review of the Citi Prestige Card. What do you think?

Relationship bonus rates for Citigold are lower than non-Citigold?

i swapped them around. fixed!

Is the 4th night free applicable for stays in Singapore?

I don’t have personal experience, but reports in Citi Prestige Tele chat say yes

That’s new, will check it out thx Aaron

it does. i used before

Quite a sizeable chunk of points with KF, so any recommendations on transfer options for Citi? Or does it make sense to just renew and wait it out?

I can take the premium for $ per miles paid during renewal as storage maintenance fee for the points since they don’t expire. There’s the devaluation risk but I guess that’s a separate discussion since everyone is basically stuck in sg

yeah you could view it that way…although i still think it’s quite expensive storage.

How about the 3 free greenfees at SG golf clubs?

just read about this, seems to have been added on 20 august. no interest to me, but i’ll add something in the post for those who enjoy golf

These have been around for many years, it used to be three in SG plus three overseas. After the arrival of covid it actually got changed to six rounds in SG, as people could not travel overseas. Not sure whether it has reverted to 3+3 more recently. I’ve been able to secure two rounds this year at MBGC so far.

Thanks so much for the detailed review. I’ve been a member for one year now but this article was a nice recap for me. Due to the lost benefits under COVID situation I was thinking of canceling the membership but I somehow missed the renewal month so I’ll continue to be a member for another year. lol

One stupid question – is this card really metal? I thought the metal card feels heavier and colder but I don’t feel any difference from othe plastic cards…

thin metal glued to thin plastic. it comes apart with time. just like amex platinum card. plastic for paywave. metal cards like insignia and ultima don’t have plastic and are obviously heavier in the hand. some amusing articles actually compare card weights – older ritzcarlton card was the champ if I remember.

what met said- it’s a hybrid card. and one of the lightest metal cards on the market; there are some complaining about build quality.

Fantastic in-depth review! Just wondering, is the Singapore version of this card like the US where it is a metallic card?

yup! however the build quality isn’t great, and it’s only a few grams heavier than a pure plastic card

Hi Aaron, first time commenting here. I was actually looking at this after i saw the benefits you got from your GHA black membership that comes with a World Elite Mastercard (which this card is). With these World Elite Mastercard benefits (I only see 2 on the site, 1 of which is by invite only), do you think it will boost your rating or do you think it doesn’t move the needle much? (Specifically after your Capitol Kempinski Hotel glowing review :))

well i don’t think it’s possible to get GHA black anymore with world elite mastercard, which his why i didn’t mention it. the last successful data point posted was from january 2020, and the landing page is gone: https://www.discoveryloyalty.com/Discovery-Member-News/2018-09/You-re-Invited-To-Black-Status-with-DISCOVERY

if indeed gha black is still possible, then yes it does move the needle a bit. but as always it depends where you stay- some hotels like kempinski treat gha black well, others may not really care.

I attempted to cancel my card (near end Nov) as they would not waive the fees despite almost no opportunity to travel this year and potentially next year. The cancellation process is a nightmare – you have to wait for their retention team to call you, then they will repeat the same refusal to waive fees (ya I get the point) and then read an ultra long terms and conditions that you would indemnify them against any claims (like who will even bother??) and then take their own sweet time to remove the card (1-2 weeks) from your account. Make… Read more »

I’m wondering if there is any regulation or requirement in T&C on how to cancel a card. If not, just inform them and keep a record, then say bye-bye

Has Boingo benefit been removed?

Seems to be the case. Verified eligibility on mastercard website, and result is negative.

where can I find the link to the Prestige Concierge to book travels/hotels? Tried google without success.

Yes, where is this website? Have applied for the card and it’s taking ages to come. Wrote in to Citi for the URL and they asked me to call the ‘Aspire hotline’ on the back of the card. It’s like some heavily guarded trade secret lol smh

Yes, call the Aspire Hotline number (Prestige cardholders can call 63386911). It’s a long wait though.

The 4th night free restrictions are an absolute killer

The 4th night free MUST NOT ONLY be a prepaid, non cancellable/refundable rate

But ALSO be a non discounted rate. Meaning if you book a hotel with an advanced booking discount, that rate is not eligible for the benefit even if the rate is entirely public

And booking through the so-called Travel Concierge is basically you going to the websites, doing your own research, and THEN going back to the Concierge to get them to book it for you.

Absolutely gawd awful benefit. Ridiculous.

Same thing for car rental – I asked how do they do it…they said they’d take my requests and go to 1 of 2 websites…i’d thought concierge means they’d go find the best value option….

Yeah agree.

The difference in prices for member rates could reduce the savings by using the prestige to around 9%.

And the difficulty in calling the concierge…God makes me want to cancel the card

4NF can be refundable, there is no such restriction as long as it is fully prepaid.

That’s right – it just needs to be prepaid. Expedia has a paynow but refundable option – the concierge will typically use that option.

Thanks for the review ! Do agree the 4th night stay is a great way to recoup the AF but in all likelihood my travel profile means i will stay typically a few nights rather than an extended period of time. However, with the 48000 miles bonus offer, it seems quite enticing to get the card at just around approx. 1.1 cents/mile? Although in all likelihood may end up canceling the card just before renewal, with my current spends optimized around on 4 mile/dollar cards. Currently only holding a Citi PM card since 2008 (does that qualify as non-citigold relationship… Read more »

4th night free only available for prepaid rates or some nonsense like that – for W Singapore, I couldn’t get the concierge to book the rooms through the Marriott website because no prepaid rate was available at that time, so they had to use some OTA.

Even though I got the 4th night free, I couldn’t get the nights to count towards status :/

Was pretty much done with the card after that.

How do the current sign up promotions fare in comparison to that 1-2 year back?

I need some advice here. I’m thinking of using this Citi Prestige as my “charge everything” Mastercard. I can use the Citi PayAll to pay for insurance, etc. Strangely, AIA only accepts Mastercard. And I will be earning 1.3 mpd, better nothing at all. PremierMiles earns 1.2 mpd. So I thought this is a better deal.

I have a DBS Vantage that earns 1.5 mpd on Visa spends. Is this a good idea to maximise my mpd? Or should I go for other MasterCards?

Thanks in advance.

If you are looking to maximise mpd dumping all your expenditure on these cards should be the last thing you ever do.

I use the Prestige card as my ‘charge when I don’t have a 4 MPD card’.

Sometimes saving time is worth more than optimizing for miles (I realize some will attack me for this heresy).

Also, Citi Prestige miles convert to Turkish and other programs that often have much lower mileage requirements than Krisflyer.

So while you might earn fewer miles per dollar, the miles you get are worth more IMO.

Joke of the day.

Asked prestige concierge to book an intercontinental club room as was told because it comes with club lounge access hence it’s counted as a package stay.

Not going to renew the card for next year…

that is hilarious indeed. citi CSOs have never been known for competency, but this is special indeed.

Thanks for a great article and an amazing website overall! Does anyone know if the complimentary green fees extend to supplementary card holders?

Was wondering about the limo ride, if I hit the 12k spend in Dec but the payment is 30 Dec, do I get the 2 rides? It can’t be that they expect usage on 31 Dec if it can’t be carried over to next quarter or calendar year right?

Just realised the Kaligo special Earn ended lasg month. Should we expect renewal of that programme?

May I know when I pay the annual fee to renew for the 2nd year, do I get 25000 TY points? Or renewals don’t come with any points at all?

In my case, I received the 25,000 TY points during my renewal month in March 2024. To be fair, neither the Citi website nor this article mention anything about renewal miles / points, so perhaps this is only for legacy customers.

Hey Aaron!

i’m looking for Milelion’s Verdict

will be updating this review in the next few months…stay tuned!

Would appreciate if its before promo period ser

For the 4th night free benefit, how is it booked at chain hotels? Can I ask the concierge to book at the official website and quote my membership number for the booking? Because, sometimes, the website offers members’ price and public price which is higher than members’. If the concierge can accommodate us by booking prepaid member’s prices, then that is still worth the trouble I think.

Can book through hotel website and may be able to link membership (works for IHG but other chains may leave it as a note), but can only book the public non-member rate.

Thanks for sharing the experience. Were you holding the phone line until the booking is finished?

Based on 11Sep’23 updated article, may I confirm if Citi PayAll enables one to receive miles when used for Income Tax payment? Thanks. (my apologies if I had missed it somewhere….)

Yes, only reason I have kept this card. Not renewing next year, will get the Rewards card which still gives access to Citi Payall at a lower cost (for the card)

I keep this card to pay rent and school fees on payall- the nice side benefit is the limo rides. The advantage of the Citi ones is that can be used from Changi and also get a maxicab- saves $60+ each time. They also do random spend promotions (I received a $400 restaurant voucher last month)

the insurance coverage is $5mil or $500k?

Hi aaron,

To confirm, i can use citi payall to pay for donations via giving.sg and this donation will qualify as a valid spending for the welcome gift of max of 71k miles?

Thks

Manage to utilised the 4th night free thrice recently due to my travel plans. A few things to take note: 1) You can ask Citi to book the hotel at no discount rate and your stay will be eligible for hotel membership status 2) You can ask Citi to get cheapest rate (about 5% price difference to booking.com) but then your stay will not be eligible for hotel membership status 3) When calling Citi for 4th night stay, it is better to confirm the hotel booking while on the call. DO not ask them to follow up via email for… Read more »

Hello, grateful for any data points on whether the Marriott Bonvoy hotels will honor the membership status benefits (e.g Platinum benefits) when booking a hotel stay through Citi using the 4th Night free benefit?

Used the card for 12 months, here is the review. – redemption – best redemption offers will come from retailers, like Tangs, however, be prepared to receive pile of vouchers form Citi, which you have to tear up and sign, each voucher is 50$. If you do it for 1000$+ it takes some time. online redemption rates are extremely off. I had some sign up bonus to be charged, that was charged in time, no issues. usage of bonus points a bit of a hassle. – for lounge access, Citi usesi priority pass, which either gives you access to the… Read more »

Aaron, the renewal of Prestige needs to be discussed in the context of PayAll promos becoming much worse and the availability of good hotel promos in APAC. It’s not enough to say that paying the annual fee gets you miles at 2.16 cpm because without PayAll, you are not going to get a lot more miles on Prestige and will have to think when you will get enough miles to redeem. The renewal bonus is in miles, but the other main benefit is 4N1F cashback. After the first year bonus miles, Prestige is a very complicated lifestyle and cashback card.… Read more »

Just cancel after the first year

IMO, this is primarily a lifestyle card, with a secondary goal as a mile-chaser card. Other than the renewal bonus, the best features don’t involve miles. I got the card in 2016 for its 1-for-1 dining deals which were reduced post-COVID but have recently improved with better frequency and venues. One-for-one at Shinji or Iggy’s (I think both were offered in 2024) is enough to cover the annual fee, sometimes without even considering the renewal miles. From my experience (>10x) the prix fixe Citi menus and portions are nearly identical to the regular menu (I also dine there on other… Read more »

Citi Prestige Card is actually a plastic card, not metal. I just got mine recently. I even called CitiBank to ask, and they say Citi Prestige Card has always been a plastic card, only Ultima is metal.

It’a a bit metallic on the front with a plastic layer behind to allow paywave. It’s actually nicer material than the old Prestige card which was plain plastic and even followed a standard World Elite graphic design template. Need to be careful the 2 layers don’t separate but it’s better than the Amex Platinum Charge – mine has already separated into 2 leaves with only the area near the chip part still glued together. The older version of Ultima was all metal and had no paywave function. The newer cardstock for Ultima has the same front but is similar to… Read more »

I notice you had mentioned that for example, insurance, transactions aren’t eligible for ThankYou points. However, may I know if such transactions contribute towards the S$12K per quarter for 2 complimentary limo rides? Is there any way to check if eligibility has been met?

CardUp can be used for qualifying spend?

The Citi Prestige 4th night free perk is quickly becoming a scam. firstly they have nerft booking off expedia, they are only allowed to book through their inhouse portal, so as a consumer you will have to call in and compare their price to the prices you have researched had you book on your own. now here comes the scam. this is not the first time, but just going to share my recent experience. I intend to stay 4 nights in Chengdu, prizes at big names like Hyatt, St Regis, Jw Marriott were charging rooms at 230-250 per night this… Read more »

Did they give a breakdown of the 3000?

AF increase to 598 and PP limit to 12 starting 1st July, time to update the article…

+1 598 without gst, but it looks like we get more miles

just want to say this is no longer true:

it is also available to Citigold customers (min AUM: S$250K) who earn at least S$30,000 p.a.

For a card named “Prestige”, the customer service is nowhere near worthy. I was speaking to their phone officer and I could hear roosters crowing in the background throughout the call! I wonder which kampung in Philippines is their call centre based in.

There are chickens everywhere in Singapore now. Come to Tanjong Pagar, Outram, Cantonment Road and see the chickens in the CBD. They crow too. And they shit too. Part of some sort of misplaced effort from town councils is what I believe.

But you’re right, I think Citi Prestige card support is usually outsourced. Usually Malaysia I think which is better than anywhere else since their accent is similar. Higher tier card has local support and RM.

The 4th night benefit is based on standard rates. If you are getting a discounted rate with 20%, say, thrown in on a Citibank Agoda promotion for example, the 4th night is of no benefit. I loose count of the number of times I have tried to see if the 4th night benefit was worth it, only to find it is not. This card is going to be cancelled next year at renewal – I only kept it 1 more year because my renewal was a few weeks before the ridiculous increase in the annual fee.

This is so true. Because of the difficulty to access the 4th night free rates (refer to article for exclusions) – it is in most instance, even cheaper to go direct to the hotel (not even OTA) and look for promo rates!

Unfortunate nerfs.That 4th N benefit was really good at a certain point of time – two holidays in a year and it covered the cost of the card.Have cancelled the card.Cancellation was also a pain in the rear as Citi kept asking for reasons and delaying the cancellation for no reason at all.Had to walk-in to their Jurong office ( when it existed ) and bang table! That itself makes sure that I will never apply for a Citi card again.

The math still works for me.

Assuming I value SQ miles at 1.7 center / mile, the 32,000 miles received for paying the annual fee give me a value of worth SGD 544. That leaves 108 SGD of the annual fee to be offset (652 – 544).

I get 12 Priority Pass visits, meaning I essentially will pay 9 SGD per lounge visit (108 SGD / 12 PP visits).