| ⚠️ Story Update: Good news! We’re now getting reports that Amaze x Citi Rewards transactions from 22 January onwards are successfully receiving the bonus 9X points. Transactions from late day 19 January to 21 January are still pending. Updated article here. |

While you won’t find this anywhere in the operating manual, one of the worst-kept secrets is that pairing Amaze with the Citi Rewards Card is an easy path to 4 mpd almost everywhere.

That’s because all Amaze transactions code as online, which triggers the Citi Rewards Card’s 4 mpd bonus (with exceptions for mobile wallet and travel-related transactions), capped at S$1,000 per statement month.

However, that may no longer be the case.

I need to emphasise that nothing is confirmed at this point, and I was debating whether it was too early to cover this story.

On the one hand, I’d hate to be the cause of unnecessary alarm if all this turns out to be much ado about nothing. But on the other, I certainly think it’s worth highlighting, in case you had plans to use the Amaze x Citi Rewards combination for a big ticket transaction in the coming days. If so, it might be a good idea to hold off or switch to another option until we get further clarity.

What’s happening with Amaze transactions on the Citi Rewards Card?

We’re still trying to piece together an exact timeline, but from what I’ve gathered in the MileChat, Amaze transactions charged to the Citi Rewards Card after a certain point on Friday 19 January 2024 only earned the base 1X points (0.4 mpd), and not the bonus 9X points (3.6 mpd).

This affects all kinds of transactions, regardless of the underlying MCC: Atome, dining, duty free, shopping, you name it. It even seems to affect MCCs that are on the Citi Rewards whitelist. For example, using Amaze + Citi Rewards at a clothes merchant does not trigger 10X, when using a naked Citi Rewards (i.e. no Amaze pairing) does.

| ⚠️ No expected impact for Citi PremierMiles or Citi Prestige Card |

|

For those who usually pair Amaze with the Citi PremierMiles or Citi Prestige Card, there’s no reason to believe you won’t continue to earn the usual 1.2 or 1.3 mpd respectively. If Citi’s intention was to blacklist Amaze entirely, then Citi Rewards Cardholders wouldn’t even be earning 1X points. The fact that it does means that base rewards are still possible- the real question is whether the 9X bonus points on the Citi Rewards Card still applies. |

Further complicating matters is the fact that Citi has now shut down its ThankYou Rewards Portal for Citi Rewards Cardholders, and with it the ability to check points breakdowns by day. Tracking is not impossible, of course, if you’ve built the right Excel spreadsheet. But if not, you’ll find it harder than ever to do your sums.

So far, we’ve been able to rule out a late posting of 9X. That’s because cardholders who used a naked Citi Rewards for transactions post 19 January 2024 have already seen their 9X credited.

This leaves us with three possible explanations:

- It’s a glitch specifically related to Amaze, which will be resolved in due course

- Amaze no longer converts offline transactions to online ones

- Amaze transactions are now blacklisted from the bonus 9X

(1) is the best case scenario, though it’s hard to see why there’d be a 9X glitch specifically affecting Amaze, and not other whitelisted transactions.

The bigger fear is that something has changed permanently, in which case we need to give (2) and (3) serious consideration.

Amaze no longer converts offline transactions into online ones

One reason why Citi Rewards Cardholders are earning only 1X points on Amaze could be that Amaze no longer converts offline transactions into online ones.

This can come about from a change in the way transactions are processed or tagged on the back-end, though for what it’s worth a check on the DBS digibot shows that Amaze transactions made in-store still code as online spend.

This may not be conclusive, because different banks may rely on different indicators to determine if a transaction counts as “online”. However, it’s certainly a relief if true, as it preserves another important use case for Amaze: pairing with the KrisFlyer UOB Credit Card.

KrisFlyer UOB Credit Cardholders earn an uncapped 3 mpd on online shopping (provided they spend at least S$800 on SIA Group transactions in a membership year), with an extensive range of MCCs covered. Pairing it with Amaze allows you to soak up big ticket transactions that would burst the bonus caps on other 4-6 mpd cards, such as shopping at luxury boutiques.

Amaze transactions are blacklisted from 9X points

Another possibility is that Citi has decided to blacklist Amaze transactions from earning the bonus 9X points on the Citi Rewards Card.

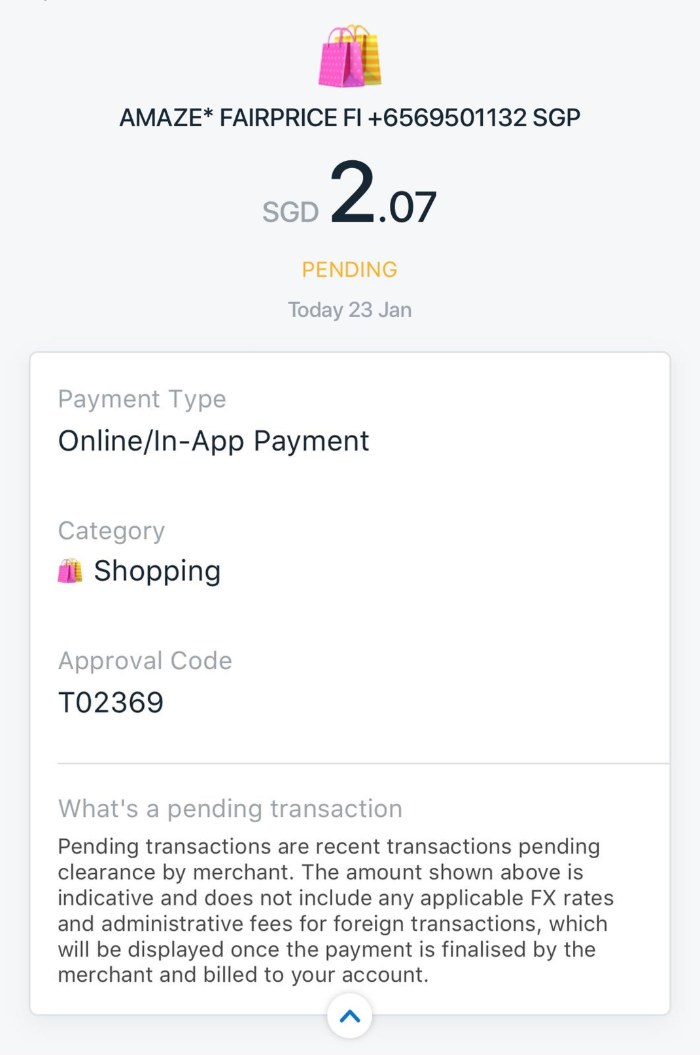

This blacklisting wouldn’t take the form of a specific MCC, since Amaze transactions simply follow the MCC of the underlying merchant. More likely it would be an exclusion of anything with AMAZE* in the transaction description. Citi previously excluded Amaze-tagged AXS, Bus/MRT, EZ-Link and transit transactions from earning rewards, so it wouldn’t be too hard for them to implement.

For what it’s worth, I don’t see anything new in the Citi Rewards T&Cs. Citi has announced that there will be some changes coming into effect from 1 April 2024 — which I’ve covered in a separate article — but these involve the addition of further MCCs to the travel-related blacklist and have nothing to do with Amaze per se.

So if Citi has indeed blacklisted Amaze from the Citi Rewards Card, my theory is that it’s been snuck in under the blanket “mobile wallet” exclusion. Amaze, you’ll recall, now has a wallet function of its own, and while wallet top-ups are a completely different kettle of fish from card-linked transactions, I wouldn’t be surprised if a bank tried to make the argument.

We know, from past experience, that Citi is not above a “shadow blacklist”, as seen from the exclusion of MCCs 4111 and 4789 from the Citi Reward’s 9X bonuses notwithstanding the fact that neither is explicitly stated in the T&Cs.

Conclusion

Mark this as developing, but Amaze transactions on the Citi Rewards Card have recently stopped receiving the bonus 9X points. I expect we’ll get additional data points in the days ahead, which we’ll need before we can conclusively say the combination is dead.

Truth be told, the Amaze x Citi Rewards pairing was never a way the bank intended the card to be used (which is probably why DBS nerfed it so early on). Even if it ends up surviving this brouhaha, we need to come to terms with the fact that it’s living on borrowed time.

Have you been getting your 9X bonus points for Citi Rewards transactions post 19 January?

Didnt get my bonus points also. Called up Citi and they told me they need to check

Oh dear following this closely. Am in Japan now using the amaze-citirewards

for most shopping. If they nerf it without any notification it will be very unethical of the bank? Hopefully this is not the case. Hopefully more infor will be available soon. Thank you for highlighting!

If this really is true, I have no more use for amaze. Will go back go using uob pov or HSBC revo.

All party comes to an end… good while it lasted.

I did have a couple of Atome transaction with Amaze.. ah well…

Why need to use Amaze for Atome. ? I use CR also can get the points

Called Citi yesterday and went through each Amaze-tagged transaction made from 19 January 2024 (1X only). CSO confirmed that these transactions were all coded as online and it could be due to the shutting of the Rewards Portal and backend migration (?). Citi will update me.

In any case, was advised to still consider these 1X transactions to be eligible for the 9X points and include them in the $1,000 statement limit. Fingers crossed.

CSO called back. Advised that transactions dated 19 January 2024 (posted on 22 January 2024) were undergoing “some system glitch” and they are resolving it. Affected customers should receive notifications when ready.

CSO is not aware of any nerfing of Amaze x Citi Rewards Card. Separately checked with my Citi RM who similarly advised that there has been no such announcement.

Thanks for the update. The qn I have is: if it’s a system glitch, why are non-Amaze transactions post 19 Jan still having their 9X posting as normal.

Because the glitch is something specifically related to the interface with Amaze. Most likely the API.

I had the same issues but starting to get 10X for transactions made on 22 Jan onwards. The original ones made between 19 to 22 Jan remained as 1X for now.

I think this could be a problem at amaze side. I’ve gotten 4x the usual instapoints with amaze card spend between 20-22Jan, i think this could be glitch at Instarem. The amount of Instapoints have now reverted to normal. I hope this means the bonus points with CRM-Amaze will also revert to normal.

Instarem sent out a notification about their promption for instapoints last week. The promption ended on the evening of 22nd Jan. So this aspect was not a glitch.

I see. Thanks for the info, I must have missed it.

Based on the post from Chong, above, it seems reasonably likely that when Amaze introduced their instapoints promotion that ran for about 3 days and gave 2 instapoints per dollar rather than 0.5 per dollar for transactions to linked cards, something occurred that stuffed up the 10X on the Citi Card. I say this because per Chong’s post everything seems OK from 22 Jan again, which is when the promotion ended. Coincidence – maybe. But I would bet it is related to an “unintended consequence” of the 3 day promotion from Instarem.

Thanks, Mark. I believe there was a cut-off on 22 Jan. My last transaction of the day (after 6pm) posted 10X but the earlier ones remained as 1X (for now).

That makes the cause even more likely to be what I mention above. As the promotion ended at a specfic time on the evening of 22nd per the Instarem promotion. And you seem to have cases where prior to the promotion ending there was an issue. As soon as 6pm passes and the promotion ends, all is OK. So I will now double up my bet, that it was caused by Instarem and their promotion. Actually in-line with the issue, I should make my bet 9X ! 🙂

Got the affected points today as adjusted points, everything checked out. Peace on earth again.