UOB has launched a new overseas spending promotion for all three versions of the UOB PRVI Miles Card, which offers registered cardholders up to 5 mpd on in-person dining and shopping spend.

This includes restaurants, bars, fast food, department stores, factory outlets and electronics stores, and even some unexpected categories like pharmacies and wine stores.

This promotion is valid from now till 31 December 2024, and is very similar to the offer we saw back in May– but slightly improved as the bonus cap has been increased from 10,400 miles to 13,000 miles, which you’d max out with S$5,000 (non-regional) or S$6,500 (regional) of FCY spend.

| 💳 tl;dr: UOB PRVI Miles FCY Promo |

|

Earn up to 5 mpd on overseas dining & shopping

The UOB PRVI Miles overseas dining & shopping promotion runs from 8 November to 31 December 2024, and is valid for UOB PRVI Miles AMEX, Mastercard and Visa cardholders.

Registration is required, and can be done by sending the following SMS to 77862:

| 📱 SMS to 77862 |

| PMX<space>Last 4 alphanumeric digits of NRIC/Passport e.g. PMX 567A |

There is no cap on the number of cardholders who can register.

Once registered, cardholders who spend at least S$1,500 on eligible dining and shopping transactions (defined below) will earn 5 mpd as follows.

Regional FCY spend

| Regional FCY Spend 🇮🇩 Indonesia, 🇮🇩 Malaysia, 🇹🇭 Thailand, 🇻🇳 Vietnam |

|||

| Base | Bonus | Total | |

| Overseas Dining (in person) |

UNI$7.5 per S$5 (3 mpd) |

UNI$5 per S$5 (2 mpd) |

UNI$12.5 per S$5 (5 mpd) |

| Overseas Shopping (in person) |

UNI$7.5 per S$5 (3 mpd) |

UNI$5 per S$5 (2 mpd) |

UNI$12.5 per S$5 (5 mpd) |

Non-Regional FCY spend

| Non-Regional FCY Spend 🌏 Rest of the World |

|||

| Base | Bonus | Total | |

| Overseas Dining (in person) |

UNI$6 per S$5 (2.4 mpd) |

UNI$6.5 per S$5 (2.6 mpd) |

UNI$12.5 per S$5 (5 mpd) |

| Overseas Shopping (in person) |

UNI$6 per S$5 (2.4 mpd) |

UNI$6.5 per S$5 (2.6 mpd) |

UNI$12.5 per S$5 (5 mpd) |

There is no cap on the base miles (3 mpd for regional, 2.4 mpd for non-regional) you can earn.

The bonus component is capped at 13,000 miles for the entire promotion period, which works out to:

- S$6,500 of spending in regional FCY

- S$5,000 of eligible spending in non-regional FCY

For avoidance of doubt, the bonus cap is shared between regional and non-regional FCY, so if you spend in a mixture of the two, you’ll hit the cap somewhere between the S$5,000 to S$6,500 mark.

Supplementary cardholders are eligible to participate in this promotion, but their spending will count towards the minimum spend and cap of the principal cardholder.

Do note that bonuses are only for in-person transactions; if you spend online in FCY, you’ll earn the regular year-round 2.4/3 mpd rate.

Can I participate on multiple cards?

You will only be able to enjoy this promotion once across all card accounts, regardless of how many UOB PRVI Miles Cards you hold.

For example, if you hold both the UOB PRVI Miles AMEX and UOB PRVI Miles Visa, you will only be able to enjoy the offer on one card.

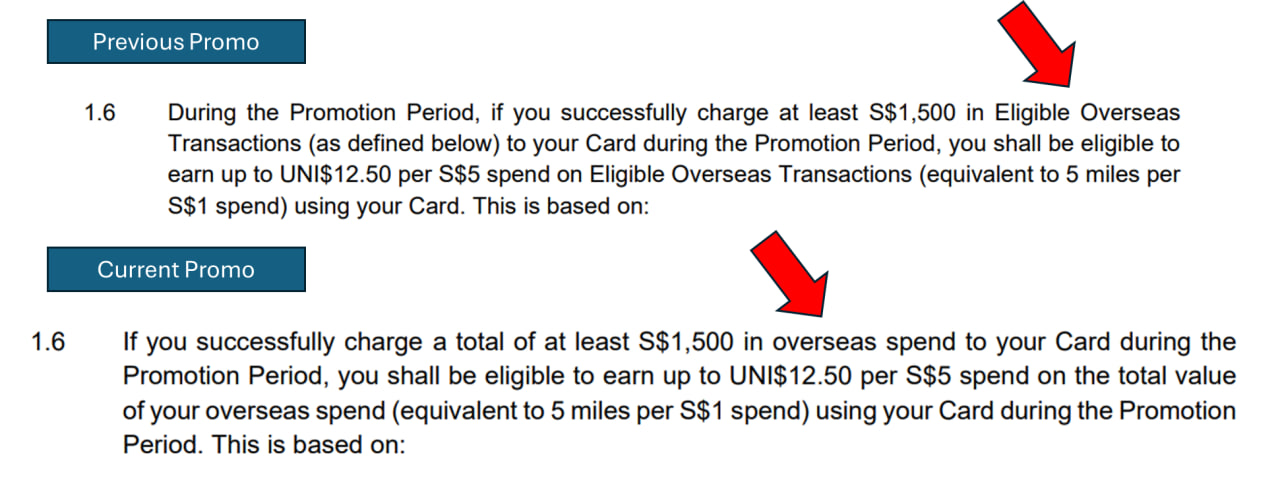

What counts as minimum spend?

| ⚠️ Update: UOB has clarified that despite the change in T&Cs wording, their intention is that only eligible overseas transactions will count towards the minimum S$1,500 spend. In other words, you must spend at least S$1,500 on overseas dining or shopping to trigger the bonus. |

A minimum spend of S$1,500 is required to trigger the bonus earn rate.

However, unlike past promotions where the minimum spend could only consist of eligible transactions (i.e. overseas dining and shopping), this time round UOB is using a wider definition by counting any overseas spend towards the S$1,500 threshold.

For example, if you spend at an overseas supermarket, which doesn’t fall under the definition of overseas dining or shopping, that transaction would still count towards the S$1,500.

What counts as eligible transactions?

Eligible overseas transactions are defined below.

Overseas dining

Overseas dining refers to in-person transactions made at merchants with the following MCCs.

| MCC | Description |

| 5441 | Candy, Nut and Confectionary Stores |

| 5451 | Diary Product Stores |

| 5462 | Bakeries |

| 5499 | Misc. Food Stores (Convenience Stores & Specialty Markets) |

| 5812 | Eating Places & Restaurants |

| 5813 | Drinking Places (Bars, Taverns, Nightclubs, Cocktail Lounges, Discotheques) |

| 5814 | Fast Food Restaurants |

| 5912 | Drug Stores and Pharmacies |

| 5921 | Package Stores- Beer, Wine and Liquor |

It’s a fairly generous definition of dining, even including places you might not have thought of like pharmacies and wine stores. If you’re planning on loading up on booze while overseas, this might be an excellent opportunity to make some hay.

However, do note that unlike the promotion we had back in May 2024, supermarkets are not included under dining this time round.

Overseas shopping

Overseas shopping refers to in-person transactions made at merchants with the following MCCs.

| MCC | Description |

| 5309 | Duty Free Stores |

| 5310 | Discount Store |

| 5311 | Department Stores |

| 5331 | Variety Stores |

| 5399 | Miscellaneous General Merchandise |

| 5611 | Men’s & Boys’ Clothing and Accessory Stores |

| 5621 | Women’s Ready-to-Wear Stores |

| 5631 | Women’s Accessory and Specialty Stores |

| 5641 | Children’s and Infants’ Wear Stores |

| 5651 | Family Clothing Stores |

| 5655 | Sports and Riding Apparel Stores |

| 5661 | Shoe Stores |

| 5681 | Furriers & Fur Shops |

| 5691 | Men’s and Women’s Clothing Stores |

| 5697 | Tailors, Seamstresses, Mending, Alterations |

| 5698 | Wig & Toupee Shops |

| 5699 | Miscellaneous Apparel and Accessory Stores |

| 5732 | Electronics Stores |

| 5733 | Music Stores — Musical Instruments, Pianos, and Sheet Music |

| 5735 | Record Stores |

| 5941 | Sporting Goods Stores |

| 5942 | Book Stores |

| 5943 | Stationery, Office and School Supply Stores |

| 5944 | Jewelry, Watch, Clock, and Silverware Stores |

| 5945 | Hobby, Toy and Game Stores |

| 5946 | Camera and Photographic Supply Stores |

| 5947 | Gift, Card, Novelty, and Souvenir Stores |

| 5948 | Luggage and Leather Goods Stores |

| 5949 | Sewing, Needlework, Fabric, and Piece Good Stores |

| 5950 | Glassware and Crystal Stores |

| 5970 | Artist Supply and Craft Stores |

| 5971 | Art Dealers and Galleries |

| 5977 | Cosmetic Stores |

| 5993 | Cigar Stores & Stands |

| 5994 | News Dealers & Newsstands |

| 5999 | Miscellaneous & Specialty Retail Stores |

Again, UOB is casting a very wide net, so whether it’s duty-free, clothes, shoes or electronics, you’ll be able to enjoy the bonus.

How do I know the MCC?

If you want to verify the MCC of a merchant before making a transaction, here’s three ways of looking it up.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

Given how easy it is to ascertain a merchant’s MCC these days, there’s no excuse for getting it wrong!

How to check Merchant Category Codes (MCCs) before making a purchase

When will I receive my miles?

Base UNI$ (equivalent to 2.4 mpd for non-regional spend and 3 mpd for regional spend) will be credited when the transaction posts.

Bonus UNI$ (equivalent to 2.6 mpd for non-regional spend and 2 mpd for regional spend) will be credited to your account within two months after the promotion period, i.e. by 28 February 2025.

Terms & Conditions

The full T&Cs for the UOB PRVI Miles Card promotion can be found here.

UOB PRVI Miles 46,000 miles welcome offer

|

|

| Apply (AMEX) | |

| Apply (MC) | |

| Apply (Visa) |

If you don’t already have a UOB PRVI Miles Card, here’s a quick reminder that UOB is currently running a 46,000 miles welcome offer for new-to-bank customers who spend at least S$2,000 per month for the first two months after approval, and pay the S$261.60 annual fee.

This offer is valid for customers who apply and receive approval between 1-30 November 2024, and there’s an opportunity to stack a further S$50 cash if you apply via SingSaver, though that’s capped at the first 1,000 applications. There is no cap on eligibility for the 46,000 miles welcome offer.

For the full details, refer to the article below.

UOB PRVI Miles Card offering 46,000 miles uncapped sign-up bonus and S$50 cash

Conclusion

|

| Card Review |

UOB PRVI Miles Cardholders will be able to enjoy 5 mpd on overseas dining and shopping till 31 December 2024, just in time for the year-end holiday travel period.

This would make it the highest-earning option for FCY spend, but because there’s a 3.25% FCY fee on all transactions, some might still prefer to pair the Amaze with the Citi Rewards Card instead for 4 mpd (with a lower FCY fee of 1.8-2%).

A S$1,500 minimum spend applies, but you have two months to hit it. Don’t forget the cap of S$5,000-S$6,500 as well, which applies to the entire promotional period, and the fact that you can only enjoy this bonus on one UOB PRVI Miles Card, no matter how many you hold.

So if we have spend on both prvi Amex and prvi Mastercard, how does it decide which card it will allocate the bonus miles to? Is it the higher of the two?

Hi, after you have busted the Prvi Miles cap for bonus miles, why don’t you use the DBS altitude FCY promo which will also give you 5 mpd? Pre-registration is also required and do read terms carefully before proceeding.

You absolutely can, assuming there are registration slots left

Does the rule of bonus on one UOB Prvi Miles card apply to supplementary card?

The DBS 5mpd is better – it is basically all overseas spend – rather than a list of MCC’s that you have to use with UOB, and you then find a lot of your spend isn’t in the right MCC, as knowing the MCC is a bit of guess work, so your overall result is not 5mpd in the end.

Is there anyway to register for these promotions when you are overseas? It seems SMS to the UOB number doesn’t work properly when roaming.

Crazy isn’t it. U hv to be overseas to use the card to avail of the promotion, but u have to be in Singapore to register! Surely registration should be on the app? Or given there is no registration cap, why require registration at all?

https://forms.uob.com.sg/eservices/contact/complaint.html#form

Please submit your feedback! I just got off the phone with customer service and tried live chat but they insisted they cannot register for me -_-

What’s the point of complaining? UOB does this by design. It is a feature not a bug.

First time I have been rejected for annual fee waiver. Did they get stricter recently?

does this apply to wechat transactions in China?

Have a similar question for alipay transactions in China.. read somewhere it counts as foreign currency transactions but coded online as it’s in app payment, can anyone confirm?

Must transactions be posted by 31 Dec to be counted towards the promo? Or just need to charge to the card by 31 Dec?

posted only