While it’s “free” to use your credit card in Singapore (unless the merchant imposes a surcharge, which they really shouldn’t), swiping it overseas entails an explicit cost due to foreign currency (FCY) transaction fees imposed by banks.

And yet, many credit cards offer an upsized rate on FCY transactions. For example:

- UOB PRVI Miles Cardholders earn 1.4 mpd for all SGD spending, but 2.4 mpd for FCY spending

- DBS Altitude Cardholders earn 1.3 mpd for all SGD spending, but 2.2 mpd for FCY spending

So the question is whether it’s worth using your card overseas, and the answer depends on:

- How much you value a mile

- How much you’re paying for miles when you use your card overseas

(1) is a subjective measure, which I’ve addressed in this article (my personal value is about 1.5 cents). (2) is much more objective, and the focus of the discussion below.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide | ||

| ✈️ Air Tickets | 🌎 Amaze | 💗 Charity |

| 🍽️ Dining | 🏫 Education | 🥡 Food Delivery |

| 🏨 Hotels | ☂️ Insurance | 📱 Kris+ |

| ⚕️ Medical | 🏖️ Overseas | ⛽ Petrol |

| 🚍 Public Transport | 🛒 Supermarkets | 🚰 Utilities |

How much do banks charge for FCY transactions?

When you make a credit card transaction in a currency other than Singapore Dollars, what typically happens is the amount is first converted to USD, and then into SGD (based on rates provided by Mastercard or Visa).

| 💳 Example: DBS Bank |

| “Visa/Mastercard transactions in US Dollar shall be converted to Singapore Dollar on the date of conversion. Transactions in other foreign currencies will be converted to US Dollar before being converted to Singapore Dollar.” |

There’s some spread involved here (usually <0.5%), but the biggest expense is the FCY transaction fee charged by the bank.

| 💳 FCY Fees by Issuer and Card Network | ||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

You’d think that with competition from alternatives like YouTrip and Revolut, banks would be moderating their FCY transaction fees.

Fat chance- if anything, they’ve been edging upwards over the years. When I first started writing this blog in 2015, fees were in the range of 2.5-2.8%. Now, almost all the banks are at 3.25%, with StanChart at 3.5%.

Summary of FCY Fee Changes, 2018 to Present

- On 1 Apr 18, Maybank increased its FCY charge on Visa Diamante, Visa Infinite and World Mastercard from 2.5% to 2.75%

- On 4 Oct 18, Citibank increased its FCY charge from 2.8% to 3%

- On 1 Nov 18, HSBC increased its FCY charge from 2.5% to 2.8%

- On 1 Jan 19, CIMB removed the admin fee waiver for FCY transactions on the Visa Signature and Platinum Mastercard, effectively increasing the fee from 1% to 3%

- On 2 Jan 19, DBS increased its FCY charge from 2.8% to 3%

- On 15 Jan 19, BOC increased its FCY charge on Mastercard transactions from 2.5% to 3% (Visa fees increased from 2.5% to 3% on 1 Dec 18)

- On 15 Mar 19, OCBC increased its FCY charge from 2.8% to 3%

- On 4 Sep 19, UOB increased its FCY charge from 2.8% to 3.1%

- On 1 Nov 19, DBS increased its FCY charge from 3% to 3.25%

- On 3 Dec 19, OCBC increased its FCY charge from 3% to 3.25%

- On 15 Dec 19, Citibank increased its FCY charge from 3% to 3.25%

- On 1 Mar 20, AMEX increased its FCY charge from 2.5% to 2.95%

- On 9 Mar 20, UOB increased its FCY charge from 3.1% to 3.25%

- On 1 Nov 21, Maybank increased its FCY charge from 2.75% to 3.25%

- On 4 Jan 23, HSBC increased its FCY charge from 2.8% to 3.25%

- On 1 Oct 2023, AMEX increased its FCY charge from 2.95% to 3.25%

Don’t forget that the FCY transaction fees are charged on top of the implicit spread in the Mastercard or Visa exchange rate. For example:

- A US$100 transaction charged to a Mastercard would cost S$134.81, assuming no FCY transaction fees (spot rate: S$134.12)

- Once a 3.25% FCY transaction fee is factored in, the amount becomes S$139.19

| ❓ How much will my overseas transaction cost? |

| If you want to know how much a given FCY transaction will cost, you can use the Mastercard or Visa currency converter calculators. All you need to enter is the bank’s FCY fee, which you can find in the table above. |

| Mastercard Calculator |

| Visa Calculator |

What’s the cost per mile?

No one likes to pay more than they have to, but do the miles earned for overseas transactions justify the costs?

Generally speaking: yes, although some cards represent better options than others.

General Overseas Spending

The following cards offer bonuses on all foreign currency transactions, regardless of MCC (except those in the general exclusions list like charitable donations and cryptocurrency).

| Card | FCY Earn | FCY Fee* | CPM |

UOB Visa Signature UOB Visa Signature | 4 mpd1 | 3.25% | 0.81 |

Maybank Horizon Maybank Horizon | 2.8 mpd2 No cap | 3.25% | 1.16 |

SCB Visa Infinite SCB Visa Infinite | 3 mpd3 No cap | 3.5% | 1.17 |

SCB Rewards+ SCB Rewards+ | 2.9 mpd4 | 3.5% | 1.21 |

DBS Treasures Black Elite DBS Treasures Black Elite | 2.4 mpd No cap | 3% | 1.25 |

HSBC TravelOne HSBC TravelOne | 2.4 mpd No cap | 3.25% | 1.35 |

UOB PRVI Miles UOB PRVI Miles | 2.4 mpd No cap | 3.25% | 1.35 |

UOB VI Metal UOB VI Metal | 2.4 mpd No cap | 3.25% | 1.35 |

DBS Altitude AMEX DBS Altitude AMEX | 2.2 mpd No cap | 3% | 1.36 |

OCBC VOYAGE (Premier, PPC, BOS) OCBC VOYAGE (Premier, PPC, BOS) | 2.3 mpd No cap | 3.25% | 1.41 |

HSBC Visa Infinite HSBC Visa Infinite | 2.25 mpd5 No cap | 3.25% | 1.44 |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite | 2.24 mpd No cap | 3.25% | 1.45 |

DBS Vantage DBS Vantage | 2.2 mpd No cap | 3.25% | 1.48 |

DBS Altitude Visa DBS Altitude Visa | 2.2 mpd No cap | 3.25% | 1.48 |

OCBC VOYAGE OCBC VOYAGE | 2.2 mpd No cap | 3.25% | 1.48 |

OCBC 90°N Card OCBC 90°N Card | 2.1 mpd No cap | 3.25% | 1.55 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | 2 mpd6 No cap | 3.25% | 1.63 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | 2 mpd6 No cap | 3.25% | 1.63 |

Citi Premier Miles Citi Premier Miles | 2 mpd | 3.25% | 1.63 |

Citi Prestige Citi Prestige | 2 mpd No cap | 3.25% | 1.63 |

SCB Journey SCB Journey | 2 mpd No cap | 3.5% | 1.75 |

| *Fee refers to the FCY transaction fee imposed by banks, and does not include the spread charged by Mastercard or Visa, which can add an additional 0.3-0.5% depending on currency 1. Min. spend S$1,000 per statement month, cap at S$2,000 per statement month 2. Min. spend S$800 per calendar month, otherwise 1.2 mpd. Can be as high as 3.2 mpd for new customers, refer to this post for details 3. Min. spend S$2,000 per statement month, otherwise 1 mpd 4. Cap at S$2,222 per membership year 5. Min. spend S$50,000 in previous membership year, otherwise 2 mpd 6. Only in June and December, otherwise 1.1 mpd (Blue) or 1.2 mpd (Ascend) | |||

Special mention goes to the Maybank Horizon Visa Signature for its lack of exclusion categories, when it comes to FCY spend. If you charge donations, education, utilities or insurance premiums in FCY, you will earn an uncapped 2.8 mpd, provided the minimum monthly spend of S$800 is met. That could be a very lucrative haul for anyone with overseas tuition bills to pay.

Specific Overseas Spending

If you’re clocking FCY spend on particular categories, the cards below can also be options.

| Card | Earn Rate | Fee* | CPM |

UOB Lady’s Card UOB Lady’s Card | 6 mpd1 | 3.25% | 0.54 |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card | 6 mpd2 | 3.25% | 0.54 |

Citi Rewards Citi Rewards | 4 mpd3 | 3.25% | 0.81 |

DBS WWMC DBS WWMC | 4 mpd4 | 3.25% | 0.81 |

OCBC Rewards OCBC Rewards | 4 mpd5 | 3.25% | 0.81 |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa | 4 mpd6 | 3.25% | 0.81 |

HSBC Revolution HSBC Revolution | 4 mpd7 | 3.25% | 0.81 |

| *Fee refers to the FCY transaction fee imposed by banks, and does not include the spread charged by Mastercard or Visa, which can add an additional 0.3-0.5% depending on currency 1. Pick 1: Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport, Travel. Capped at S$1,000 per calendar month. Reduced to 4 mpd from 1 Apr 24 (T&Cs) 2. Pick 2: Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport, Travel. Capped at S$3,000 per calendar month. Reduced to 4 mpd and S$2,000 per calendar month from 1 Apr 24 (T&Cs) 3. Department store, apparel, or online transactions (excluding travel). Capped at S$1,000 per statement month (T&Cs) 4. Online transactions. Capped at S$1,500 per calendar month (T&Cs) 5. Department stores, apparel, electronics. Capped at S$1,110 per calendar month (T&Cs) 6. Apparel, electronics, dining, food delivery, entertainment. Also applies to overseas mobile payments. Capped at S$1,110 per calendar month (T&Cs) 7. Airlines, selected hotels, department stores, apparel, supermarkets, transport. Must be online or contactless payments. Capped at S$1,000 per calendar month (T&Cs) | |||

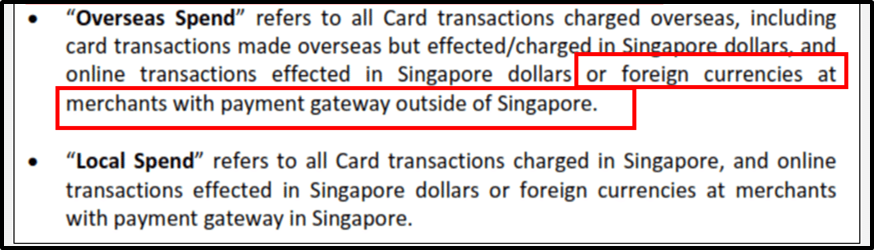

How do banks define overseas transactions?

For most banks, an “overseas transaction” is simply any transaction processed in a currency other than Singapore dollars.

But Bank of China and UOB add another condition: the payment gateway must be outside of Singapore. For example, if you were to book through the Hotels.com Singapore website and pay in Euros with your UOB PRVI Miles Card, you’d earn 1.4 mpd instead of 2.4 mpd because the payment is processed in Singapore.

How do you know where the payment gateway is located? You don’t. That’s the worst thing about such a rule: it puts the onus on the customer to find out information that’s not readily available.

If it’s any consolation, this is only an issue for online transactions. If you’re physically overseas when using your card, you don’t need to worry about where the payment gateway is located.

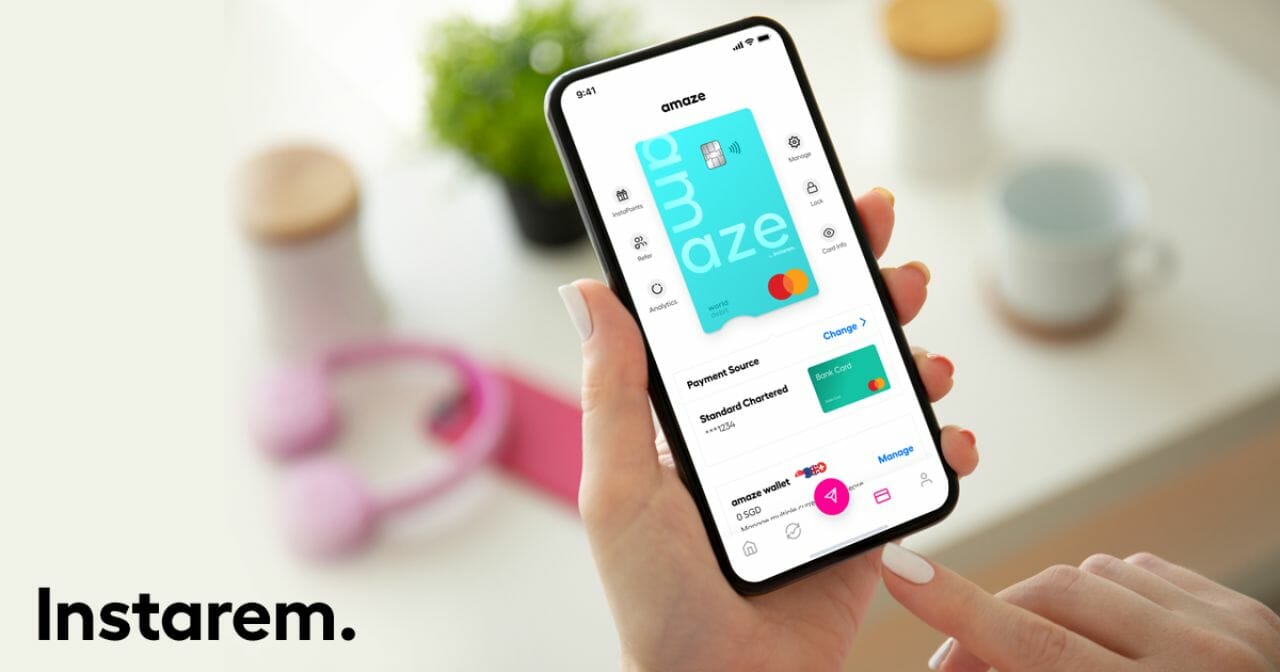

Amaze Card alternative

Amaze remains one of the best options to use for FCY transactions.

With Amaze, you’ll pay a 1.8-2% markup compared to Mastercard rates, which is partially offset by up to a 0.5% cash rebate via InstaPoints. You’ll continue to earn regular credit card rewards of up to 6 mpd, depending on MCC, which makes it a far superior option to any traditional credit card.

|

| Apply here |

| Use code 7HK2A2 for 225 bonus InstaPoints |

| 💳 tl;dr: Amaze Card |

|

The miles earned are limited only by the credit card linked to the Amaze, and the following pairings are recommended.

| 💳 Recommended Amaze Pairings | ||

| Card | Earn Rate | Cap |

UOB Lady’s Card UOB Lady’s CardApply | 6 mpd1 | S$1K per c. month |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply | 6 mpd2 | S$3K per c. month^ |

Citi Rewards Citi RewardsApply | 4 mpd3 | S$1K per s. month |

OCBC Rewards OCBC RewardsApply | 4 mpd4 | S$1.1K per c. month |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply | 3 mpd5 | None |

| 1. Pick 1: Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport, Travel. Reduced to 4 mpd from 1 Apr 24 (T&Cs) 2. Pick 2. Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport, Travel. Reduced to 4 mpd and S$2,000 per month from 1 Apr 24 (T&Cs) 3. All transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) (T&Cs) 4. Clothes, bags, shoes and shopping (T&Cs) 5. Dining, shopping, travel, transport. Must spend at least S$800 on SIA Group transactions in a membership year (T&Cs) | ||

A brief reminder of the ground rules for Amaze:

- Amaze transactions code as online

- Amaze transactions will be billed in SGD

- Amaze transactions retain the original MCC of the underlying transaction

- Amaze transaction descriptions are changed to AMAZE*merchant name

- Amaze can be paired with up to five Mastercard credit or debit cards

- DBS/POSB cards no longer award points for Amaze transactions

- Citi and UOB exclude certain Amaze transactions, but so long as you avoid transit-related transactions (i.e. bus/MRT/EZ-Link) you have nothing to be concerned about

Refer to this article for more details.

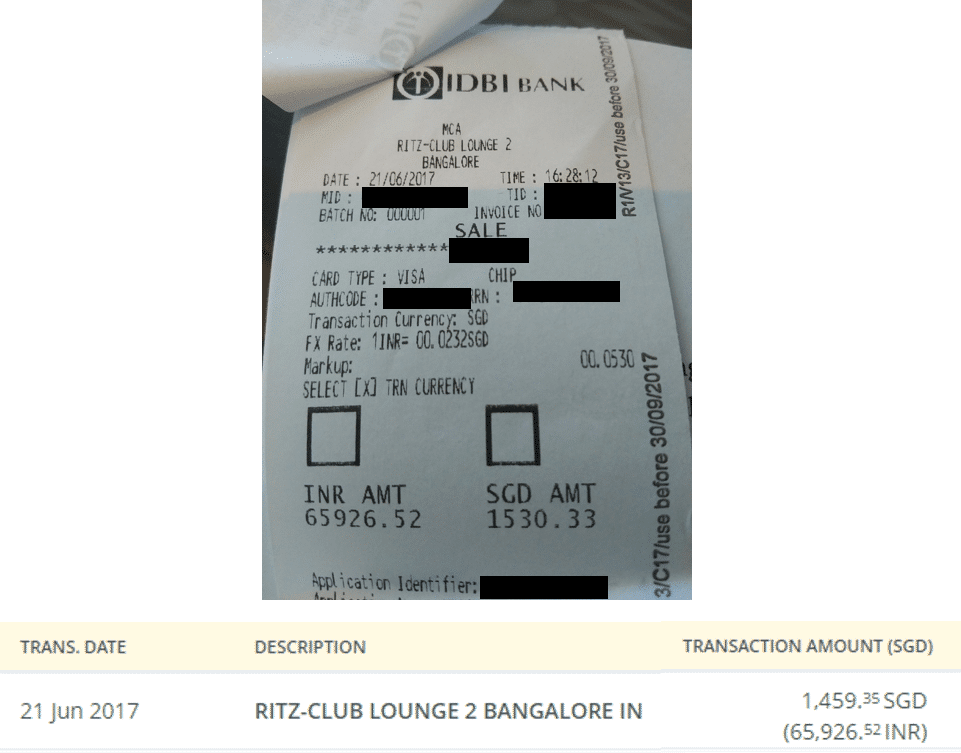

Beware of DCC!

Here’s my customary warning about the scam known as Dynamic Currency Conversion (DCC).

For the uninitiated, DCC is a “service” provided by merchants which converts the transaction into your card’s local currency, at a fee that’s much more than what your bank would charge. The merchant pockets part of the profit, so some unscrupulous places will instruct staff to select it by default, without the consent of the customer.

Be alert, and always, always emphasise that you want to be billed in the local currency. If you want to avoid the scourge of DCC altogether, use an American Express card, since AMEX does not support DCC.

Conclusion

Despite the FCY fees, I’d say it’s still worth using your credit card overseas if you’re able to earn an extra 4-6 mpd, especially if you can reduce those fees through Amaze.

Of course, if your only concern is minimising the total cost of the transaction, then a Revolut or YouTrip type solution would be better, since these offer superior exchange rates at the expense of earning rewards. Alternatively, you can consider the Trust Card, which has zero FCY fees on all transactions.

Does DBS WMC still give 4mpd when paired with Amaze? Some of the comments seem to suggest otherwise.

As of last month’s points crediting (transactions from Sep’21), I got my 4 mpd with DBS WWMC on 15th Oct for all my Amaze transactions, except the ones made on CardUp using my Amaze card.

Should HSBC revo be added to the list given it offers 4mpd albeit not on all categories and only 2.8% FCY fee? But most of what a general person would spend overseas would be on the categories that HSBC whitelists anyway e.g. airline, hotel, car rental, dining, travel agencies, supermarket, department stores, even uber (transport)?

revo is there, under specialised spending cards.

Thanks! Must have missed it. Think it’s the most attractive one for me given the low cpm

Thanks to your kind introduction of the Amaze card. It is now my default card for overseas expenditures.

How about pairing OCBC Titanium Rewards with Amaze? It does earn 4 mpd for shopping?

following. but my understanding from the other article seems to suggest so.

I’d also like to know if i charge foreign currency through amaze to ocbc 90n mc, is it considered foreign currency or sgd? because 90n gives 1.2mpd for local spend but 2.1mpd for forex, so it might actually be worth it to charge as forex despite the 3.25% fcy.

Does Amex Krisflyer card only earn 2MPD during the months of Jun and Dec?

correct

Hi Aaron, is the CPM for the American Express Platinum Charge Card also 0.98 cpm? Thanks!

What if a merchant charges DCC without giving me a choice (aka press yes and print for me to sign). what can I do?

Check before signing and ask them to reverse then charge in local currency.

What if they “refuse”?

Don’t sign. OR write DCC refused.

Dispute. No DCC gives only the SGD value for you to sign. It’s either FCY (in which case you can dispute) or FCY and SGD with boxes (in which case you tick the FCY box). Without a signature indicating your agreement, your bank will not honour thew charge. Had this several times with an StR…

https://milelion.com/2018/11/19/how-i-fought-and-won-a-dcc-dispute/

Hi Aaron, should Amaze cashback be reflected as 0.5% in the conclusion?

It’s 1% for overseas spend

I just came back from a 10-day trip and had been using Visa paywave (Apple Pay or the credit card directly). I was quite surprised that I wasn’t hit by DCC at all. All transactions were processed in the local currency without me even asking. Not sure if it was because DCC was not supported by contactless payments, or DCC was banned in that country?

Thanks for the review! I used the Amaze card with DBS WWMC for my entire UK trip! I won’t be applying for the CitiRewards card though, as I have too many cards. Pity that from 1 June, DBS WWMC will no longer be useful when tagged to the Amaze card for miles. I would be using ICBC Global travel mastercard instead (though this one no miles but has 3% cashback on overseas spend).

May I know why the Amex CPM is 0.98 for the krisflyer cards? it looks like it should be 2.95/2 = 1.475?

thanks for spotting that. have fixed it.

Sorry new to all this. For hsbc revolution, if I were to use pay wave overseas at a restaurant, will it be counted as 4mpd? Does this work by categories regardless if local or overseas? Sorry for the many questions. Thanks

Yes, overseas is fine

Hi Aaron, it’s probably time for an Amaze update. I find I’m getting charged ~2% spread for FCY transactions. Tested in TH, TW, MY in the last 2 months

Writing something on this, thanks!

its more than 2% – used Amaze in Japan this month and its 2.2% on FCY transactions. Saw the same for Euro transactions,

my transactions in USD and IDR have been at 1.8%. are you comparing to MC rates?

Which card should I use for big ticket (5-figure) overseas spending? I noticed that all the cards mentioned above have a 1-2k monthly limit, except maybe for OCBC Titanium Rewards with a S$13,335 limit for the first year.

good point. Im asking the same too especially 1 branded bag already cost 30K

Just calculate the theoretical average mpd on your big ticket purchase and measure it against using a general spending card with no cap?

I would use the UOB Krisflyer since they have no cap and use Amaze to qualify as an online transaction.

Hey guys, anyone has any tips to spend $800 on reasonable items on KrisShop to hit the SIA Group Spend? Thank you!

Having just made a big fuss with Amazon JP on the constant auto-DCC, I was surprised that my side by side purchases ended up cheaper on the Amazon DCC, though when taking the Amaze cashback into account, Amaze still beat out Amazon by a whisker. So so will continue to manually switch to local currency, but at least Amazon seems to offer a much more reasonable conversion now.

Amex converts to USD before converting to SGD. So on paper it is 2.95%, but you get hit with their FX spread twice, which usually leads to a worse outcome than any card with a 3.25-3.5% headline charge

Don’t all cards convert to USD before sgd?

UOB converts non-USD, non-AUD and non-SGD to USD before converting to SGD. So AUD and USD are the exception that gets converted to SGD directly. See https://www.uob.com.sg/personal/cards/credit-cards/terms-and-conditions.page

maybe I should rephrase, with other cards you pay the masterard/visa spread which is typically around 0.5% above mid-market. with amex you just get a really poor fx outcome, which is sad, since they control the entire chain. so lowest fee, but also poorest (typically) fx rate.

most of the times i have tracked, i have always received poorest SGD outcome with amex. so based on personal datapoints, i only use my amex when the final SGD figure is not my main concern

Does HSBC Evo give 4mpd for contactless overseas dining?

Citi Premiermiles is also running a 4mpd for till end June!

Hi Aaron, if I link the Lady Solitaire card to Amaze, which Solitaire bonus category should I pick for overseas spending using Amaze? Thank you for all the great tips so far!

Hi, May I check does HSBC TravelOne earn 1.2mpd for stacking with amaze too? Thank you

Stumbled here for the first time. Never really thought that one can benefit from credit card spending but learnt quite a bit here.

However, for a noob, I thought o just ask one question. I am going to make an overseas payment to Thailand which is equivalent of around $24k sgd and these visa fees payment

Which miles card would be best?

Any suggestions welcome.

Thanks in advance

Hard to monitor and I think I just stick to cards that charge the minimum forex fees. Almost everyone I met on private trips have switched to Youtrip, Revolut etc instead of paying the 3.25 per cent forex trip. The banks are not doing anything about it so I guessed they do not value the individual’s business.

for HSBC revolution, overseas dining is also 4mpd right?

Hi hi, does Amaze x Krisflyer UOB card earn miles if I were to use it for Uber or Lyft overseas? Is it considered a “Transit” transaction?

And I assume using it to tap on metro/subway would register as a “Transit” transaction..?