Here’s The MileLion’s review of the UOB Visa Signature, one of UOB’s oldest credit cards— veterans might remember that it launched back in 2006 with a striking purple design!

Although UOB no longer actively promotes it, this remains one of the most versatile cards on the market, earning 4 mpd on nearly all local and overseas spend. The minimum spend requirement can be a little tricky to understand at first, but it’s fairly straightforward once you get the hang of it.

Recent changes, however, have altered the card’s value proposition. On the plus side, SimplyGo has been reclassified as contactless spending, making it eligible to earn 4 mpd. Moreover, the monthly bonus cap has also been increased from S$2,000 to S$2,400, allowing cardholders to earn an extra 1,600 miles per month.

But there’s a catch. The monthly bonus cap is now split into two sub-caps of S$1,200: one for contactless and petrol, and one for overseas spending. And unless you’re travelling abroad every month, it’s highly unlikely you’ll be able to utilise the latter category, effectively reducing the card’s realistic earning potential.

In short, the UOB Visa Signature is still a good card to have— just not as great as before.

UOB Visa Signature UOB Visa Signature |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? | |

| 4 mpd on almost all local or overseas spending is a welcome feature, but the UOB Visa Signature’s sub-caps and minimum spend can easily trip you up. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: UOB Visa Signature

Let’s start this review by looking at the key features of the UOB Visa Signature.

|

|||

| Apply | |||

| Income Req. |

S$30,000 p.a. |

Points Validity |

2 years |

| Annual Fee |

S$218 (First Year Free) |

Min. Transfer |

5,000 UNI$ (10,000 miles) |

| Miles with AF | N/A | Transfer Partners | 4 |

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 4 mpd | Points Pool? | Yes |

| FCY Earn | 4 mpd | Lounge Access? | No |

| Special Earn | 4 mpd on petrol | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

How much must I earn to qualify for a UOB Visa Signature?

The UOB Visa Signature used to have a minimum income requirement of S$50,000, which was unusual given that most cards defaulted to either S$30,000 or S$120,000. But any income requirement above S$30,000 is essentially arbitrary, and there were plenty of reports of approvals within the S$30,000 to S$50,000 range.

In any case, UOB has now reduced the official income requirement to S$30,000, the MAS-mandated minimum.

If you do not meet the minimum annual income, you can place a S$10,000 fixed deposit with UOB to get a secured version of the card. Visit a branch for more details.

How much is the UOB Visa Signature’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free, S$109 for 2nd onwards |

| Subsequent | S$218 | Free, S$109 for 2nd onwards |

The UOB Visa Signature has an annual fee of S$218, which is waived for the first year. The fee for the first supplementary card is waived in perpetuity, while the second card onwards is charged at S$109 per year.

Waivers are fairly easy to get in my experience, but be warned that UOB’s default behaviour is to automatically deduct your UNI$ to cover the annual fee.

How do UOB’s automatic UNI$ deductions for annual fees work?

When the time comes for renewal, you will be charged either:

- 6,500 UNI$ for a full waiver

- 3,250 UNI$ + S$109 for a half waiver

- If you have at least 6,500 UNI$ in your account, you will be charged (i)

- If you have less than 6,500 UNI$ but more than 3,250 UNI$, you will be charged (ii)

- If you have less than 3,250 UNI$, you will be charged the S$218 annual fee in cash

It’s up to you to monitor your statement and request a waiver when this happens. Look at the expiry date on your credit card; the month corresponds to the month your annual fee will be charged.

For what it’s worth, if UOB subsequently grants you a fee waiver, the reinstated UNI$ will have a fresh 2-year validity.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 4 mpd | 4 mpd |

4 mpd on petrol |

Regular SGD/FCY Spending

The UOB Visa Signature normally earns 1X UNI$ per S$5 spent (0.4 mpd), whether in SGD or foreign currency (FCY). However, these rates can be increased significantly, as we’ll see in the next section.

All FCY transactions on the UOB Visa Signature Card incur a 3.25% FCY transaction fee. This is par the course for the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Overseas, Petrol and Contactless Spend

The UOB Visa Signature earns 10X UNI$ per S$5 (4 mpd) on overseas, petrol and contactless spending, divided into:

- A base reward of 1X UNI$ per S$5 (0.4 mpd)

- A bonus reward of 9X UNI$ per S$5 (3.6 mpd)

The bonus reward is subject to the following conditions:

- Category 1 (Overseas Spend): Spend at least S$1,000 in FCY in a statement month

- Category 2 (Petrol and Contactless): Spend at least S$1,000 in SGD in a statement month

Category 1 and 2 can be mutually exclusive. You can choose to fulfil just (1), just (2) or (1) + (2).

While the minimum spend requirement can be annoying to track, the UOB Visa Signature Card’s blacklist policy makes it very versatile. It doesn’t matter what particular merchant you’re spending at (general exclusions aside, of course). So long as you meet the minimum spend, you’ll earn 4 mpd.

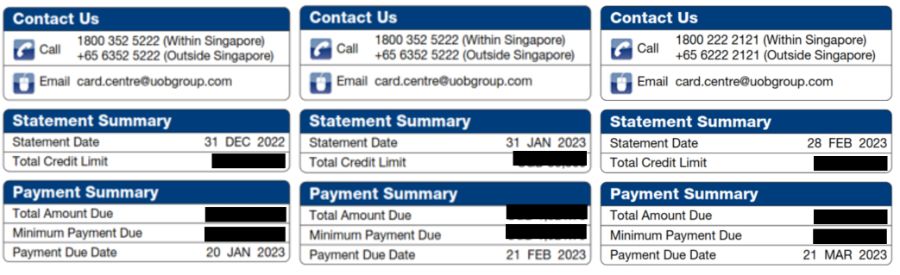

| ⚠️ Statement Month vs Calendar Month |

|

Minimum spend and caps for the UOB Visa Signature are tracked by statement month, not calendar month. To find out what your statement month is, login to internet banking and download your e-statement. The statement date is the last day of your statement month. For example, if my statement date is 12 May 2025, then my minimum spend and bonus cap run from the 13th of each month to the 12th of the following month.

You may be able to request a change of statement period to match the calendar month. I did that a long time ago, and now all of my statements are generated at the end of each calendar month. |

Until recently, Category 1 and 2 shared a unified bonus cap. Cardholders were free to allocate this cap in any way they wished, and could even spend the entire cap on a single category.

| 💳 UOB Visa Signature (Old System) |

||

| Category 1 (Overseas Spend) |

Category 2 (Petrol and Contactless) |

|

| Monthly Bonus Cap (UNI$) | 3,600 UNI$ |

|

| Monthly Bonus Cap (S$) | S$2,000 | |

| Min. Spend | S$1,000 in FCY | S$1,000 in SGD |

| Caps are based on statement month | ||

However, for statement months ending from 1 September 2025 onwards, the bonus cap has been split into two separate sub-categories: one for Category 1, and another for Category 2.

| 💳 UOB Visa Signature (New System) |

||

| Category 1 (Overseas Spend) |

Category 2 (Petrol and Contactless) |

|

| Monthly Cap (UNI$) | 2,160 UNI$ | 2,160 UNI$ |

| Monthly Cap (S$) | S$1,200 | S$1,200 |

| Min. Spend | S$1,000 in FCY | S$1,000 in SGD |

| Caps are based on statement month | ||

While the overall cap is higher (4,320 UNI$ vs 3,600 UNI$), the category-level cap is lower. Therefore, if you use the UOB Visa Signature as a single category card, you’ll now earn fewer miles than before.

How is overseas spend defined?

For most banks, overseas spend simply refers to any online or in-person transaction charged in a currency other than SGD.

UOB, however, defines overseas spend differently. Not only must the transaction not be in SGD, it must also be processed through a payment gateway outside of Singapore. The first condition is straightforward, but the second is more nebulous— how is a customer supposed to know where the merchant’s payment gateway is?

Fortunately, there’s a way of checking before you make a transaction, which I’ve written about in the article below.

The payment gateway issue will only affect online transactions. Using your card overseas in-person guarantees you 4 mpd, so long as you don’t fall victim to the DCC scam (i.e. always opt to pay in FCY and not in SGD).

| ❓ Must my overseas spending be made via contactless? |

| No. Contactless, chip or even magnetic stripe transactions will all be eligible for the overseas spending bonus. |

How is petrol and contactless defined?

Petrol spend refers to any transactions made at petrol stations (MCC 5541/5542).

Shell and SPC are officially excluded in the T&Cs, but in practice, Shell earns UNI$ nonetheless. I can’t say for sure whether this is a feature or a bug, or whether it’ll still be accurate by the time you read this post, so do it at your own risk (I feel better about Shell than SPC).

Contactless spend refers to any transactions made via the following contactless methods:

| Payment Method | Eligible? |

| ✅ | |

|

❌ |

| ✅ | |

| ✅ | |

Tapping Physical Card Tapping Physical Card |

✅ |

Contactless spend does not include online or in-app transactions.

I realise this can be confusing at first, so the general rule to remember is that if you hear a “beep” sound when you pay, it’s a contactless payment. If you don’t hear a beep (e.g. an online or in-app transaction), it’s not a contactless payment.

What if I spend across categories?

Where people usually get confused is when they make both local and overseas petrol and contactless transactions. How does that affect the calculation of minimum spend and bonus eligibility?

The table below addresses some commonly-asked scenarios.

| Transaction (currency) |

Category 1 (Overseas) |

Category 2 (Petrol and Contactless) |

| Online 🇸🇬 SGD |

❌ |

❌ |

| Online 🌎 FCY |

✅ |

❌ |

| In-app 🇸🇬 SGD |

❌ | ❌ |

| In-app 🌎 FCY |

✅ | ❌ |

| Contactless 🇸🇬 SGD |

❌ | ✅ |

| Contactless 🌎 FCY |

✅ | ❌ |

| Petrol 🇸🇬 SGD |

❌ | ✅ |

| Petrol 🌎 FCY |

✅ | ❌ |

| ❌ Does not count towards min. spend or bonus | ✅ Counts towards min. spend and bonus | ||

| ❓What about excluded transactions? |

| For the avoidance of doubt, any transactions that are ineligible to earn UNI$, such as education, donations, government services or insurance, will also not count towards the minimum spend |

To keep it simple, remember this:

- Category 1 (Overseas Spend): Any transaction in FCY will count towards the S$1,000 minimum spend

- Category 2 (Petrol & Contactless): Any transaction in SGD on petrol & contactless will count towards the S$1,000 minimum spend

Here are a few scenarios to illustrate how it works.

| Category 1 Overseas Spend (FCY) |

Category 2 Petrol & Contactless (SGD) |

Outcome |

| S$600 | S$500 |

Total: 440 miles (S$600 @ 0.4 mpd + S$500 @ 0.4 mpd) 4 mpd rate is not triggered because the S$1,000 minimum spend has not been met on either Category 1 or 2. |

| S$1,000 | S$1,000 |

Total: 8,000 miles (S$1,000 @ 4 mpd + S$1,000 @ 4 mpd) 4 mpd rate is triggered for both Category 1 and 2. |

| S$2,000 | S$1,000 |

Total: 9,120 miles (S$1,200 @ 4 mpd + S$800 @ 0.4 mpd + S$1,000 @ 4 mpd) 4 mpd rate is triggered for both Category 1 and 2. However, the cap for Category 1 is also breached. |

| S$900 (all contactless) |

S$100 (all contactless) |

Total: 400 miles (S$900 @ 0.4 mpd + S$100 @ 0.4 mpd) 4 mpd rate is not triggered because the S$1,000 minimum spend has not been met on either Category 1 or 2. |

| S$1,200 (all contactless) |

S$100 (all contactless) |

Total: 4,840 miles (S$1,200 @ 4 mpd + S$100 @ 0.4 mpd) 4 mpd rate is triggered for Category 1 4 mpd rate is not triggered for Category 2 as S$1,000 minimum SGD spend has not been met |

Note in particular the last two scenarios, which show how overseas and local contactless spend do not mix. Overseas is overseas, local is local. Even if you unlock the overseas 4 mpd earn rate through FCY contactless spending alone, it has no bearing on whether you earn 4 mpd on local contactless spend. That requires a minimum spend of S$1,000 in SGD, period.

Say it with me: “Contactless overseas transactions do not double count towards “overseas” and “petrol and contactless”; it will only count towards “overseas”.”

Transaction date or posting date?

The minimum spend and bonus cap on the UOB Visa Signature is tracked based on posting date, not transaction date.

For example, if your statement month ends on the 15th, and you make a transaction on 14 June that posts on 16 June, it will count towards the following statement month’s minimum spend and bonus cap.

Therefore, you should exercise caution when spending towards the end of the statement month, in case transactions “leak” into the following period.

Which cards track spending by transaction date vs posting date?

When are UNI$ credited?

Base UNI$ are credited when the transaction posts. Bonus UNI$ will be credited in the following statement period.

| Base Points (1X) | Credited when transaction posts |

| Bonus Points (9X) |

Credited in the following statement period |

How are UNI$ calculated?

Here’s how you can work out the UNI$ earned on your UOB Visa Signature:

| Base Points (1X) | Round down transaction to the nearest S$5, divide by 5, then multiply by 1 |

| Bonus Points (9X) |

Sum all eligible transactions (including cents), round down total to the nearest S$5, divide by 5, then multiply by 9 |

While you normally need to watch out for S$5 earning blocks with UOB cards, it’s less of an issue with the UOB Visa Signature than the UOB Preferred Platinum Visa. That’s because all unrounded transactions on the UOB Visa Signature are summed up during the calculation of the 9X bonus.

Here’s a simple example. Suppose you have three transactions for the whole month, S$99.99, S$199.99 and S$700.02.

- With the UOB Preferred Platinum Visa, each transaction is rounded down to the nearest S$5, so you’ll earn 3,960 miles (S$95*4 + S$195 *4 + S$700*4)

- With the UOB Visa Signature, each transaction is rounded down to the nearest S$5 for the purpose of 1X points (0.4 mpd), but all transactions are summed up for the purpose of 9X points (3.6 mpd). Therefore, you’ll earn 3,996 miles (S$95 * 0.4 + S$195 * 0.4 + S$700 * 0.4 + (S$99.99+ S$199.99+ S$700.02) *3.6)

If you’re an Excel geek, here’s the formulas you need to calculate your points:

| Base Points (1X) | =ROUNDDOWN (X/5,0)*1 |

| Bonus Points (9X) |

=ROUNDDOWN (Y/5,0)*9 |

| Where X= amount spent, Y= sum of all eligible transactions |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for UNI$?

A full list of transactions that do not earn UNI$ can be found in the T&Cs at Point 1(iii).

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Education

- Government Services

- Insurance

- Prepaid account top-ups (e.g. GrabPay, YouTrip)

- Real Estate Agents & Managers

- Utilities

UNI$ will be awarded for CardUp, but not ipaymy. However, the UOB Visa Signature will only earn 0.4 mpd on such transactions, so you’re much better off using the UOB PRVI Miles or another general spending card instead.

What do I need to know about UNI$?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 2 years | Yes | S$25 per conversion |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 UNI$ (10,000 miles) |

3 | 48 hours (KrisFlyer) |

Expiry

UNI$ expire 2 years from the last day of each periodic quarter in which the UNI$ was earned.

For example, if any UNI$ earned in January 2024 will expire on 31 March 2026. This means that the validity could technically be up to 2 years & 3 months in some cases, but it’s probably better to think of it as 2 years to avoid confusion.

Pooling

UNI$ pool across cards. If you have 10,000 UNI$ on the UOB Lady’s Card, and 5,000 UNI$ on the UOB Visa Signature, you can redeem 15,000 UNI$ in a single transaction and pay a single conversion fee.

It also means that you don’t need to transfer your UNI$ out before cancelling the UOB Visa Signature, assuming it’s not your last UNI$-earning card.

Transfer Partners & Fees

UNI$ can be transferred to KrisFlyer or Asia Miles with a minimum transfer block of 5,000 UNI$ (let’s ignore AirAsia, because converting points there is like throwing them away):

| Frequent Flyer Programme | Conversion Ratio (UNI$: Partner) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 2,500: 4,500 |

Transfers cost S$25 per programme, regardless of how many points are transferred.

UOB also has an auto-conversion option for KrisFlyer, which costs S$50 per year. UNI$ will be automatically converted on the last day of the calendar month, in blocks of UNI$2,500 (half the regular conversion block).

|

| FAQs |

| T&Cs |

| Read Point 53-55 |

However, you’ll need to keep a minimum balance of UNI$15,000 (30,000 miles) in your account at all times. This is a hefty working capital balance! Make what you will of UOB’s reason for this policy…

|

Why must a minimum balance of UNI$15,000 be kept KrisFlyer auto conversion programme? This is to give card members the flexibility to convert the UNI$ to other items from UOB Rewards Catalogue. Card members can still choose to convert this UNI$15,000 to KrisFlyer miles by the one time miles redemption process through UOB Rewards Catalogue, subjected to S$25 conversion fee and must be in blocks of 10,000 miles. |

Cardmembers who wish to make ad-hoc conversions can still do so, subject to the payment of the usual S$25 fee per conversion, in standard blocks of 5,000 UNI$ (10,000 miles).

Here are the pros and cons of the automatic transfer scheme:

| Pros | Cons |

|

|

At the risk of stating the obvious, opting for the KrisFlyer auto conversion programme locks you into the scheme. You can still make ad-hoc conversions to Asia Miles if you want, but it’s likely you’ll need to terminate participation in the auto conversion programme in order to acquire a critical mass of points.

Transfer Times

UOB transfers to KrisFlyer are typically completed within 48 hours.

If you need your points credited instantly, you can do so via Kris+. 1,000 UNI$ can be transferred to 1,700 KrisPay miles, which can then be transferred to KrisFlyer miles at a 1:1 ratio with no fees.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 500 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

However, those 1,000 UNI$ would normally have earned you 2,000 KrisFlyer miles, so you take a 15% haircut. Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan UNI$ balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer UNI$ to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than 21 days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 100 miles = S$1.

Summary Review: UOB Visa Signature

|

|

| Apply | |

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

The UOB Visa Signature is a versatile solution that allows you to earn 4 mpd both in Singapore and overseas, and if you max out the S$2,400 bonus cap every month, you’d have 115,200 miles after a year. That’s enough for a one-way Suites or First Class ticket from Singapore to Australia!

But will you though? Back when the UOB Visa Signature had a unified bonus cap, it was common to use it as a single category card, focusing on either overseas spend or petrol and contactless each month (you could theoretically use it for both, but optimisation would require spending exactly S$1,000 on each category— no easy task).

Now, using the UOB Visa Signature as a single category card will only earn you 4,800 miles a month. To reap the benefit of the extra bonus cap, you must use both categories, and spend at least S$1,000 per month per category.

That’s easier said than done. If you’re not travelling, how likely are you to spend S$1,000 in FCY? Yes, online transactions qualify too, but even then, reaching S$1,000 in FCY through online spend alone isn’t easy. Therefore, it’s a safe bet that most UOB Visa Signature Cardholders will be earning fewer miles than before.

Even so, it’s still a card I’m willing to keep, especially since I regularly max out the bonus cap on the UOB Preferred Platinum Visa and Maybank XL Rewards Card— the two closest replacements for the UOB Visa Signature.

And since UOB pools points, the UOB Visa Signature could easily slot into a card portfolio also featuring the UOB Preferred Platinum Visa, UOB Lady’s Card and UOB PRVI Miles Card.

So that’s my review of the UOB Visa Signature. What do you think?

Do those UNI$-ineligible transactions count towards the $1,000 monthly requirement?

unfortunately no.

at least for the excluded categories. Not sure about SMART$/UOB$

Thanks. That’s unfortunate…

this card is the bomb, everywhere has paywave now. i use it for dining, groceries, literally everything physical. 1k should be easily reached

Will be great if some kind Excel geek can do up a macro which feeds in the card transaction CSV downloaded from Internet banking and automatically calculates the base and bonus points and tally them for reconciliation against the monthly statement. Extra bonus if it tallies the merchant name with MCC code and known UOB merchants to exclude UNI$ calculation.

Just suggesting, don’t troll me 😅

You know what, I might actually be willing to pay for such an app / tool!

(Paging all geeks)

I will pay too!

@Aaron, business opportunity for you **hint hint** 😉

Is there a 4x UOB card for general online spending? It seems the Preferred Platinum Visa used to be that card but it’s restricted by MCCs now. I had the DBS womans card before but I prefer UOB for the points pooling. I have the citi rewards (combined with Amaze) but travel-related MCCs are excluded from 4x. Any suggestions? Should I just get the womans card again?

So if I’m a UOB cardholder starting from scratch, the first 15,000 UNI$ that I have accumulated cannot be transferred to Krisflyer? Anything above that, I can only transfer the excess?

Only if you choose the auto conversion option. Makes more sense to pay for and transfer when needed.

So the ideal 4 card 4 mpd strategy is UOB Visa Signature for the first $2000 paywave spend, UOB PPV for the next $1110; DBSWWMC for the first $2000 online spend; and either UOB PRVI or DBS Altitude for everything else (depending on whether you want to accumulate UOB or DBS points)? Sure you can get HSBC Revo and Citi Rewards, but that’s spreading yourself too thin, no?

Are local and foreign spends counted separately and counted as combined spend ? i.e spend $500 FCY + $500 local will trigger the bonus points min spend ?

Separate

How about if the Fcy is also a contactless method. Would that pool to the contactless spend? Say i hit 1k with paywave but spent 200FCY (but through paywave terminal), would the 1200 be awarded 4mpd?

So if I am understanding this correctly a Minimum spend of $1800 FCY And $500 local spend will therefore only trigger the 4mpd on fcy but not the local.

Will this however apply for the entire 1800 FCY or will it be based chronologically combined with the local spend ?

My understanding is that 1800 will trigger 4miles and local will trigger only 0.4×200

If I am not wrong, it means there is no incentive to use the card locally as soon as you crossed 1k in FCY, which can be a bit annoying to keep track of. Best strategy would be to keep off the card from using it if you are sure there is some big ticket spend on FCY planned .

What if I spend $1,000 in local currency and say $200 in foreign currency? Will the 4mpd at least apply for the $1,000 local currency spend?

Just had a chat with UOB live chat assistance, statement date cycle for example, if it’s indicated 8th of the month. It starts counting on 8th ends on 7th.

Not sure if UOB has changed policy but I requested customer service to double confirm with manager. Would be different from what’s indicated in this article about the statement cutoff and counting.

thanks, have checked and indeed the statement date marks the beginning of the next period.

Hi Aaron. If statement date is 12th of the month (i.e 12 Feb and 12 Mar), possible to share if the posted transactions should be from (i) 12 Feb to 11 Mar or (ii) 13 Feb to 12 Mar?

Does online spend Eg. Lazada, Shopee etc qualify for the 4mpd too? Thank you!

I have the same qns!

If it’s not FCY, no.

Bonus is for contactless or FCY, not online.

Does 4 mpd trigger for $1k local spending and $0 FCY?

What a complicated card and what a mess UOB makes out of its promotions and card mileage earning. Why do I even both with this bank!!!

What if I only have 1 txn of FCY amounting to $2000? I don’t have any local spend but I would have triggered the 4mpd for the FCY spend?

Yes. You will get 400 uni$ immediately and then 3600 uni$ a couple of days after your statement date.

Thanks!

What happens if i have a $1500 local spend and $500 on foreign spend? As i hit the $1k minimum local spend do i at least get 4 miles for the $1500?

Same question as you @DTjoa – did you ever get the answer?

Yes for local spend. No for the foreign spend.

Any idea if this $1000 minimum spend is necessary for every month to get 4mpd or just for that particular statement month?

can i use uob vs for air bnb?

Sounds like you will as it transacts in FCY. Did you get an answer?

I don’t think you need to hit $1K per statement month for local contactless transactions to enjoy 10 UNI$ per $5 spent. This $1K minimum only applies to FCY transactions. Sounds like they’ve changed the terms from before?

From T&Cs: Contactless Transactions You will earn UNI$10 per S$5 spend on Contactless Transactions (excluding at UOB$ merchants) successfully carried out on and charged to the Card.

What happens if i have a $1500 local spend and $0 on foreign spend? As i hit the $1k minimum local spend do i at least get 4 miles for the $1500?

Yes

Possibly dumb question, does in-app purchases via Apple Pay count as contactless for UOB VS?

No. Contactless is when you tap the card or nfc on phone onto a terminal and it beep beeps.

If I make a contactless transaction in FCY while overseas, does this count to both FCY and contactless minimum spends?

Is there a way to see when are the UNI$ credited? like a summary of uni$ earned per transaction via UOB.

https://milelion.com/2021/10/13/uob-tmrw-get-transaction-level-credit-card-rewards-points-breakdowns/

Hi Aaron, in the above, you say: Petrol and contactless refers to any spend at petrol stations (MCC 5541/5542, excluding Shell and SPC).

Do you mean that contactless payments at Shell and SPC do not earn 4mpd?

updated with a note: shell transactions apparently earn UNI$ despite the official T&Cs (https://t.me/milelionroars/3949)

Amaze transactions are excluded from earning uni$. FYI

Hi all, I just got my stmt. Shell txns earns base but not bonus UNI$. So looks like they’ve caught up and closed the gap.

Clarification – above is for UOB VS, have not tried Lady’s nor PPV.

just a follow-up: so if I spend at Shell, though it does not earn 4mpd, does it count towards the 1k min spend?

Hi, if i make an in-app payment using apple pay, eg making a payment in the fairprice app using apply pay, does that qualify as contactless payment for bonus?

this question is already addressed in the article.

not really an excel geek but i find this formula much easier to use

base = FLOOR(X,5)*1

bonus = FLOOR(X,5)*9

where 5 refer to $5 blocks

hence for other cards (eg Citibank) at $1 blocks

base = FLOOR(X,1)*1

bonus = FLOOR(X,1)*9

i have never tried the FLOOR function before. time to explore it!

Does charging physical card overseas in FCY qualify for the bonus mpd please?

Same question I have.

Same question!

Hi Aaron, if I make an offline payment through ApplePay on the Kris+ app, I should still get 4MPD provided I hit the min 1k spend for contactless right?

I think you are referring to this:

https://milelion.com/2021/08/03/kris-to-award-miles-for-in-app-payments-only-will-end-offline-earning/

EXTREMELY strange. I pay-waved my visa signature card over a POS terminal by waving it a few cm away from the device, SGD$1600 mcc-coded at 5411 (checked with the UOB bank), but they told me it’s online instead. I cant seem to understand how could a contactless payment change into an online transaction.

Big implications-nullifying the bonus UNI$…

Hi Aaron, is it possible to get the 4mpd when I accumulate the minimum $1k spending from a Supplementary card and Principal card?

same question!

Hi, wanted to ask if I will still earn 4mpd on FCY spending if I exceed the 2k mark. Say I spend 20k on FCY spend, does that equate to 80k miles earned? I’m trying to find the card with best miles for FCY spending. Many thanks

No, you will get 4mpd for 1st 2k spend and 0.4mpd for the rest. I suggest using uob Kf as 3mod uncapped as long as within MCCs and hit 800 SIA group spend.

Are transactions based on post date? Means if I spend on 31st March, it gets posted on 1st April so does it fall under April?

Yes, it is based on posted dates.

Is there minimum $1,000 expenditure per statement month based on 200 blocks x $5 or summed up amount of $1,000 at the end of the statement month? Thanks!

Hi, if i spend $1000 + $4.99 + $4.99 + $0.02, will I get bonus miles for the $4.99 & $0.02?

As explained in the article, the bonus will be calculated based on total SUM for the mth, in this case $1010

For the “payment gateway outside of Singapore” clause, how can I check on the gateway? For example, if I buy an air ticket on the Cathay Pacific SG website, is this gateway outside of Singapore, because it is a HK-based airline?

hi,

if i have a company corporate UOB card but do not have a personal one,

am i still consider as a “New to Bank Customer”??

Thanks in advance.

If I get a supplementary card, the min $1k spending to trigger 4MPD is it combined with the main plan or is it each $1k minimum?

Is there recent data on how much the Visa spread adds to the 3.25% FCY? For developing countries, it can be as much as 5.0-5.5% right? Still worth 4 mpd but much less value.

Hi, I’ve notice that there is an update to the spending requirements. Are they adding specific spending categories to earn the 4mpd? Did the requirements change from a minimum $1000 local spending to earn the 4mpd to having to spend both $1000 local spend and S$1000 overseas to hit the 4mpd

[with minimum overseas spend of S$1,000 and local spend of S$1,000 respectively per statement period, capped at UNI$4,000]

“

Found an interesting fact: I double checked my August bill and surprisingly see I earned Bonus UNI$ for my SGD contactless spending, even though I didn’t spend all my SGD in contacless payment.

Important point is: my bill is around $1,700, included online trnxs of around $1,100 (by mistake – I know no bonus UNI$ earned). My actual SGD contactless spending is around $600+.

So I believe (and hope not by UOB’s calculation bug) the minimum $1,000 spending criteria actually is not limited to “petrol and contactless” trnxs.

Called UOB and they said in-app Apple pay transactions are considered for the 10x UOB$. Anyone experienced in-app Apple pay transactions awarded the bonus points? Thanks!

I need to know this as well, especially when I use Kris+, would it be considered as the min $1k spend & will it get the 9X UNI$ bonus.

Hi Aaron, looking at the T&Cs, SimplyGo transactions reward 1 UNI$ for every 5 dollars calculated at end of calendar month. This also counts towards the $1000 contactless local spend! For your update please, thank you!

it’s not a question of whether it counts towards local spend. it’s a question of why you would want to earn 0.4 mpd on simplygo when there are other cards out there which will reward you with up to 4 mpd.

Hi can I ask if I pay online using Apple Pay – will that count as contactless?

No beep = not contactless

Does it still get points from Shell Petrol ???

I have the UOB preferred VISA. Can easily bust the S$1000 spending easily. Should I get this too? What are the pros and cons comparing these 2 cards?

Must FCY payment be contactless? Eg I’m overseas.

No necessarily. Can be online spend in FCY (through overseas payment gateway).

Nerf to the card effective 1Jul 2025.

There is no longer a shared cap of UNI$4,000 (S$2,000) per statement month.

Instead a cap of UNI$2400 (S$1200) for each category.

Time for an update. Card has been somewhat nerfed and now FCY and contactless/petrol no longer share a $2k cap. Each category capped at $1.2k instead. Simplygo transactions now count towards contactless/petrol category.

https://milelion.com/2025/07/01/uob-visa-signature-adds-4-mpd-for-simplygo-and-increases-bonus-cap-but-its-not-all-good/

the changes have not come into effect yet.

If I use Kris+ using Visa Signature via ApplePay to pay at Esso, does it still count as Petrol transaction for higher earn rate, or have to be contactless payment at the station?

Counts as petrol transaction and gets 4mpd (on top of the Kris+ miles). Kris+ preserves the MCC.

Just for discussion, although it may not make sense – if I pay via contactless Apple Pay at an overseas hotel and opt to pay in SGD, does that fall under “overseas” or “contactless”?

Does SimplyGo transactions count towards meeting the minimum spend for contactless? Say, I spend $900 local contactless and $150 SimplyGo, does that enable you to get across the line and earn 4mpd for $1050?

Yes

can use on SG Agoda booking for oversea hotel? not sure how to check if charges will be FCY.

Is the Shell petrol exclusion limited to Shell Singapore or does it apply to all Shell station fuel purchases worldwide?

I get that it’s excluded in SG probably because of partner discounts, but we don’t get the same discounts for petrol overseas.

i dont even think shell SG is excluded. it earns just fine with uob ppv, stands to reason uob vs will be ok too

Hi Aaron, thanks for the reply, but unfortunately it is. See clause 1(iv)(c) under terms and conditions, all transactions or payments made to Shell and SPC stations are excluded. But it wasn’t specific if this is limited to SG purchases or if this also applies to FCY.