The Citi Prestige Card has long been a favourite among the S$120K cards, with cardholders able to recoup their annual fee (and then some) through the liberal use of perks like unlimited lounge access, complimentary airport limo rides, and the 4th Night Free (4NF) benefit.

But last month, Citi dropped a bombshell on customers by announcing an upcoming nerf, which will cap lounge visits at just 12 per year and increase the annual fee by 20% to S$651.82.

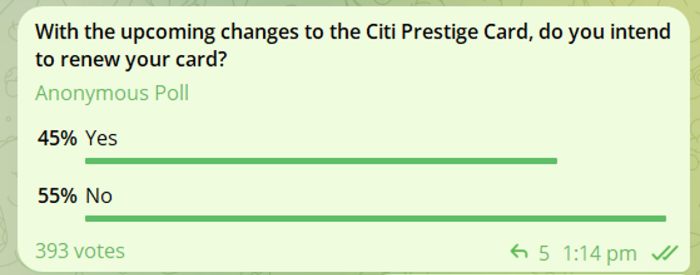

A quick straw poll in the Citi Prestige Telegram Group showed that members were split on whether they’d renew, highlighting just how conflicted people feel about the changes.

So if your renewal is coming up, is it still worth keeping the Citi Prestige Card, or is it time to make your exit?

Recap: Upcoming changes to Citi Prestige Card

For the benefit of those who missed it, the following changes are coming to the Citi Prestige Card from 1 July 2025:

- Priority Pass lounge visits will be cut from unlimited + 1 guest to 12 visits per calendar year

- The annual fee will be increased from S$545 to S$651.82

- The miles awarded for paying the annual fee will increase from 25,000 to 32,000

The cut to lounge visits will come into effect on 1 July 2025, regardless of when your membership year ends. In other words, every Citi Prestige Cardmember will have 12 lounge visits to use from 1 July to 31 December 2025.

However, the increase to the annual fee and the number of miles for paying it will only apply to renewals (or approvals) that take place on or after 1 July 2025. For example, if my membership year runs from March 2025 to February 2026, I will only pay the higher annual fee (and receive 32,000 miles) in March 2026.

How much are the Citi Prestige’s benefits worth?

In its eDM announcing the changes, Citi included a rather amusing benefits table, as if to say “hey, you’re still getting great value for your annual fee!” (someone’s clearly been taking lessons from the AMEX marketing playbook).

I don’t know about you, but I certainly don’t value a golf game at S$300, nor an airport limo transfer at S$120. And when an additional Priority Pass visit costs US$32 (~S$41), why would you value lounge access at S$50 a pop?

But that’s the thing isn’t it? Value is subjective, and it ultimately boils down to the individual. I personally don’t have any skin in the game, having cancelled my Citi Prestige Card back in 2019, but if I did, here’s how I’d think about the value of the benefits.

| ⚠️ Existing vs New Cardholders |

| Do note that I’m taking the perspective of an existing cardholder who is deciding whether or not to renew their card. If you’re a new cardholder, then the value of the welcome bonus (currently 50,000 miles at the time of writing) could very well make the first year’s fee worth it. |

32,000 miles each year

Citi Prestige Cardholders receive 80,000 ThankYou points for paying the S$651.82 annual fee each year.

This is the equivalent of 32,000 miles with 10 airline mileage programmes.

| Partner | Transfer Ratio (ThankYou Points : Miles) |

|

25,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 :10,000 |

|

25,000 : 10,000 |

|

25,000 : 10,000 |

|

25,000 : 10,000 |

|

25,000 : 10,000 |

|

25,000 : 10,000 |

|

25,000 : 10,000 |

| 25,000 : 10,000 |

We could conservatively value this at 1.5 cents per mile based on KrisFlyer, but if you know what you’re doing, you could easily get more than that by tapping sweet spots with EVA Air Infinity MileageLands or Qatar Privilege Club.

4th Night Free benefit

The 4NF benefit is notoriously difficult to value, because it boils down to the type of hotels you stay at, and the number of times you use the benefit. And since there’s no cap on usage, the sky’s the limit. This benefit could be worth nothing, or it could be worth so much it’d make Citi blush.

Of course, it’s no secret that the 4NF benefit gets harder to use each year, with more and more restrictions added (and some CSOs adopting rather creative interpretations of said restrictions).

Also, your actual savings will almost certainly be less than 25%, because:

- the free night doesn’t include taxes

- you can’t book member rates

- other OTAs might be offering the same room for less (plus you can stack cashback portals and/or promo codes)

And if the rumours are true—that Citi will eventually only accept 4NF bookings via the digital concierge —the benefit could lose even more value, since you’d no longer be able to request a human concierge to make bookings on the hotel’s official website to earn membership points and benefits.

All that said, I’m happy to go along with Citi’s assumption of two free nights per year at S$300 per night because frankly, I don’t have a better way to value it. I’ll let you argue over it in the comments.

12x airport lounge visits

Unlimited Priority Pass lounge visits with one guest was a fantastic benefit, but based on some of the stories I’ve read online, it’s perhaps not surprising it got nerfed. I don’t see the point of getting drawn into a debate as to what kind of behaviour crosses the line, suffice to say that this benefit has been used in ways that Citi probably didn’t originally intend.

If it’s any consolation, the 12 lounge visits can be shared with multiple people, so those who travel with family might find the new benefit suits them better— up to a point.

I’d value this benefit at S$33.50 per visit, based on the amount that Priority Pass members enjoy at Asian Street Kitchen, Tiger Den and Wolfgang Puck when flying from Changi Airport.

8x airport limo rides

This is another tricky benefit to value, because the rides aren’t “free” per se. Cardmembers must spend S$12,000 per quarter to unlock two rides, which could have been put on higher-earning cards instead.

However, you could reduce the opportunity cost by clocking minimum spend on transactions which are normally ineligible for rewards, such as donations, education, government services, insurance premiums, utilities and the like. While these transactions will not earn any points, they still count towards the minimum spend requirement (verified recently in real life).

Ignoring the opportunity cost, I’d say a S$30 valuation per ride would be reasonable, though it ultimately depends on where in Singapore you stay and how much a taxi would have cost you otherwise.

6x golf games

Citi Prestige Cardmembers enjoy six complimentary golf games per calendar year, split into:

- Three complimentary games in Singapore

- Three complimentary games in the region

While World Elite Mastercard customers already enjoy complimentary golf games, I’m guessing those are harder to book since the eligible pool of members is much bigger. In contrast, these slots are set aside specifically for Citi Prestige Cardmembers.

I don’t play golf, so this doesn’t mean much to me.

Haute Dining

Citi Prestige Cardmembers enjoy 1-for-1 pricing for the Haute Dining experiences that Citi organises several times a year.

While it’s a nice little perk, I wouldn’t put an explicit value on this because slots get snapped up almost as quickly as they’re released, and there’s a big element of luck involved. You’ll definitely save a few hundred dollars if you grab a slot, but it’s far from guaranteed.

World Elite benefits

As a World Elite Mastercard, both principal and supplementary Citi Prestige Cardmembers enjoy complimentary hotel and rental car elite status, an annual 3GB Flexiroam data package, complimentary travel insurance and other perks listed below.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

As valuable as these perks are, it should be noted that they’re available with any World Elite Mastercard.

| Card | Annual Fee | Qualification Req. |

Citi Prestige Card Citi Prestige Card |

S$545 | Min. income S$120K |

Citi Private Client Debit Card Citi Private Client Debit Card |

N/A | Min. AUM S$1.5M |

Citi ULTIMA Card Citi ULTIMA Card |

S$4,238 | Min. income S$500K |

DCS Imperium Card DCS Imperium Card |

S$1,294.92 | Unknown |

HSBC Premier Mastercard HSBC Premier Mastercard |

N/A* |

Min. AUM S$200K |

HSBC Prive Card HSBC Prive Card |

S$5,327.92 | Min. AUM US$2M |

OCBC PPC World Elite Debit Card OCBC PPC World Elite Debit Card |

N/A | Min. AUM S$1.5M |

OCBC Premier World Elite Debit Card OCBC Premier World Elite Debit Card |

N/A | Min. AUM S$350K |

StanChart Beyond Card StanChart Beyond Card |

S$1,635 | Min. income S$200K^ |

UOB Lady’s Solitaire Metal Card UOB Lady’s Solitaire Metal Card |

S$599 | Spend S$45K in 3-month period on UOB Lady’s Solitaire Card |

| *Waived if min. AUM is maintained, otherwise S$490.50 ^Priority Banking or Priority Private customers can qualify through AUM instead |

||

If you’re earning the S$120,000 per annum required to qualify for a Citi Prestige, it’s reasonable to assume that you’d be in a position to open a HSBC Premier account (min. AUM S$200,000), which would provide a fee-free HSBC Premier World Elite Mastercard.

Summing it up

| Benefit | Value |

| 32,000 renewal miles | S$480 |

| 4th Night Free | S$600 |

| 12x lounge visits | S$402 |

| 8x airport limo rides | S$240 |

| 6x complimentary golf games | – |

| Haute Dining | – |

| World Elite benefits | – |

| Total | S$1,722 |

Based on the value I’ve assigned each benefit, the total annual value of a Citi Prestige Card comes up to S$1,722, which seems like a tidy return on a S$651.82 annual fee.

Of course, you’ll definitely want to question some of the assumptions behind those figures. Will you really be able to use the 4NF benefit twice a year? Are you really able to spend the S$48,000 required to unlock the 8x airport limo rides? Do you normally travel in Business Class, such that the lounge visits don’t add meaningful value?

Instead of relying on Citi’s valuation (or mine, for that matter), every cardholder should be taking a long hard look at their historical usage patterns and deciding whether that warrants a S$651.82 expense.

That said, it seems to me that even post-nerf there’s a clear route to annual fee recovery, provided you make full use of the Citi Prestige’s benefits.

Conclusion

On 1 July 2025, the Citi Prestige Card will make significant cuts to its lounge benefit, while hiking its annual fee by 20%.

Asking customers to pay more for less is always going to be an unpopular move, but in the cold light of day, I think there’s still enough left in the tank for a conscientious cardmember to justify the fees.

At the same time though, the gap between the Citi Prestige and the rest of the $120K pack will have narrowed, so it wouldn’t be the worst idea to start exploring alternatives too.

Will you be keeping or cancelling your Citi Prestige Card?

Hahaha. All are very subjective.

i am still keeping the card to earn the mile and do not really calculate too much . It may not be the best but it serve me well .

The timing is, there isn’t any other decent alternatives from the beginning, that’s why citi prestige stood out

For now I am keeping as my renewal was in April ( before the new annual fees kick in from 1st July) so let’s see how it goes for the next year or 2 with the new annual fee cost.

I cancelled the card although my renewal was in May. The earning rate or benefits after nerf are ok, but not best. I’d rather cancel and wait for another welcome gift.

Cancelling and sticking to entry level 4mpd cards with Amex Platinum CC

Will the priority pass still be active throughout 2025 if I cancel my card now?

The 4th night free benefit is not worth anywhere near $600. It may be worth nothing at all. Consider that often Citi have a 20% off promotion for Agoda. There is one right now. So if I book 3 nights, I have already saved 60% of a night, so close to the 4th night free anyway, given the 4th night you still pay taxes. So paying 3 nights without the 20% discount and then getting a 4th night free is not much different.

The 20% agoda discount caps at 60sgd. Thats nowhere close what you can get with Citi Prestige

Maybe you book very expensive hotels then? If it caps at $60, that allows you to get 20% on hotels up to $300/night (of course, you book 1 night at a time to get $60/night). But I guess if you are paying $1000 a night and can get the 4th free this case is better than the 20%/$60.

Key is if citi prestige allow you go double stack vouchers and 4th night. Last time they did it for me but not sure of policy now since I cancelled the card. Comparison is to be made with other web portal that give voucher discounts Citi prestige 4th night is 25% off a 4d booking. Some other web portals will have upfront 10-15% vouchers, plus 4mpd cards bookings, and allow stacking on shopback, so it’s already equivalent discount without limiting yourself to t&c of prestige. I don’t see value of annual fee especially when I am getting PP from scb… Read more »

4th night is free is worth it for me as I am able to get family rooms ( rooms with a king size and bunk beds for teens ) but still classified as a room (not a suite, thank goodness!). Made a booking for a Hamburg hotel for 4 nights and saved SGD356. So there is still some value depending on one’s lifestyle ( in that sense).

Not forgetting other options as well. You could easily get OTA rates which are much lower then public rates that you need to pay for 4NF

And on you can use 4mpd cards or even Citixagoda 7mpd link

or even ShopBack/heymax links

add on the fact that not all hotel/accommodations are included in 4NF, you need to check which one is included with this offer

all in all, not worth as much as it sounds

Well it’s very disappointing to see one nice card getting a nerf. What’s more disappointing is to realise generally credits cards in Singapore provide terrible value, period. So banks are free to axe benefits one by one, card by card, bank by bank, yet we are forced to picked the “least worst” among the plethora of “bad”.

If you feel cards in Singapore provide terrible value, you should try having a card in Australia or New Zealand. THEN, you would realize that the cards here are (still) fabulous and the ability to earn miles and fly premium using Singapore cards is an order-of-magnitude easier than in other countries.

Cancel

Isn’t Citi PayAll the only way to earn miles while transferring money into a bank account, no questions asked?

I just value the card at its renewal mile award, now 32K miles at 1.5 cpm so $480 (although I always redeem at least J). The remaining $171.82 I’d suggest getting a 1-for-1 meal or maybe a 4NF stay. If I don’t get the $171 value I don’t sweat it, and the average cardholder in the >120K group probably shouldn’t either. The time spent thinking about it is probably worth more. The 1.42 mpd is also decent for local spend.

I value miles at 1.2 cent, so 32k miles = 384

so the net cost is just about 170 –> my take is to keep

Agree with some comments that the 4th night benefit is still a good reason to keep the card if the hotel rates are high. I had used it for booking 4N stays over certain peak travel period like CNY in Hong Kong at Shangri La and the rebate was very substantial in bringing the cost lower. My only peeve for years is how the benefit cannot be used at all suite and all villa resorts like in Maldives where the benefit will certainly lower overall hotel cost. My first Prestige was actually with Citi in Thailand years ago as I… Read more »

You know there are cards that have miles that don’t expire and don’t require annual fees right?

It’s worth noting that, for those who renew by 30 Jun 2025 at the “old” rate, you get effectively 24 lounge access for the membership year: 12 between 1 Jul to 31 Dec 2025 + 12 between 1 Jan to 31 Dec 2026 (and you can terminate by 30 Jun 2026 if you wish). So can defer this keep or terminate decision by one further year.

Note: almost all Maldives hotels are excluded from 4NF because they’re listed as “villas”.

If I sign up before 1st July 2025. Will I get the unlimited lounge access for the next 12 months? Or it will be revised once it crosses 1st July 2025?

latter

Annual Fee will be waived for CPC customers, just opt-in in the phone app. Offer since April 2025 till end of year. No AF mile award but all the other benefits remain.

thanks for sharing this- is there any link on the website referring to it?

Citi mobile app to opt in. Tap CPC benefits top left on app home page then tap on get more. Scroll to bottom. Or just tell your RM easiest way. Can’t remember if I got a notification. No email that I can find. No link that I know off on the website I didn’t bother looking at the website. Maybe you can check. The link in the app leads only downloads a pdf on my phone and doesn’t go to a webpage. Anyway I might take the miles instead since I don’t fly Y.