Back in July, the UOB Visa Signature announced some major changes to its rewards structure, which were a mixed bag by all accounts.

UOB Visa Signature Changes UOB Visa Signature Changes |

|

| 👍 The Good | 👎 The Bad |

|

|

| Changes apply to statement months ending on and after 1 September 2025 | |

The good news was that SimplyGo bus and MRT rides were reclassified as contactless spending, making them eligible to earn 4 mpd. Moreover, the overall bonus cap was increased from S$2,000 to S$2,400 per statement month, allowing cardholders to potentially earn an extra 19,200 miles per year.

The bad news was that the bonus cap was also split into two separate sub-caps: S$1,200 for overseas spend, and S$1,200 for contactless and petrol. This meant that cardholders could no longer allocate the bonus cap between the two categories as they saw fit.

Now, the annoying thing about cards which track minimum spends and bonus caps by statement month is that whenever changes are made, the implementation date will vary from person to person. In this case, the changes began rolling out in August, and by 1 September 2025, all cardholders will be on the new system.

So how should you be using the UOB Visa Signature — if at all — going forward?

What’s different about the UOB Visa Signature now?

Here’s what hasn’t changed.

The UOB Visa Signature still earns 10X UNI$ per S$5 (4 mpd) on overseas, petrol and contactless spending, divided into:

- A base reward of 1X UNI$ per S$5 (0.4 mpd)

- A bonus reward of 9X UNI$ per S$5 (3.6 mpd)

The bonus reward is subject to the following conditions:

- Category 1 (Overseas Spend): Spend at least S$1,000 in foreign currency (FCY) in a statement month

- Category 2 (Petrol and Contactless): Spend at least S$1,000 in SGD in a statement month

The table below addresses some commonly-asked questions, like which category overseas contactless spending counts towards.

| Transaction (currency) |

Category 1 (Overseas) |

Category 2 (Petrol and Contactless) |

| Online 🇸🇬 SGD |

❌ | ❌ |

| Online 🌎 FCY |

✅ | ❌ |

| In-app 🇸🇬 SGD |

❌ | ❌ |

| In-app 🌎 FCY |

✅ | ❌ |

| Contactless 🇸🇬 SGD |

❌ | ✅ |

| Contactless 🌎 FCY |

✅ | ❌ |

| Petrol 🇸🇬 SGD |

❌ | ✅ |

| Petrol 🌎 FCY |

✅ | ❌ |

In short, all you need to do is look at the currency. Anything that is in FCY belongs to Category 1. Anything that is in SGD belongs to Category 2.

All this is exactly the same as before. What has changed is the way the bonus cap is applied.

Old system

| 💳 UOB Visa Signature (Old System) |

||

| Category 1 (Overseas Spend) |

Category 2 (Petrol and Contactless) |

|

| Monthly Bonus Cap (UNI$) | 3,600 UNI$ |

|

| Monthly Bonus Cap (S$) | S$2,000 | |

| Min. Spend | S$1,000 in FCY | S$1,000 in SGD |

| Caps are based on statement month | ||

Previously, the bonus reward of 9X UNI$ per S$5 was capped at:

- Categories 1 & 2: 3,600 UNI$ per statement month (equivalent to S$2,000 of spending)

Cardholders were free to allocate this cap in any way they wished, and could even spend the entire cap on a single category.

The table below provides some illustrations.

| Category 1 (Overseas) |

Category 2 (Petrol & Contactless) |

Total Miles |

| S$1,500 | S$0 | 6,000 miles (S$1,500 @ 4 mpd) |

| S$0 | S$1,800 | 7,200 miles (S$1,800 @ 4 mpd) |

| S$2,000 | S$0 | 8,000 miles (S$2,000 @ 4 mpd) |

| S$1,000 | S$1,000 | 8,000 miles (S$1,000 @ 4 mpd + S$1,000 @ 4 mpd) |

New system

| 💳 UOB Visa Signature (New System) |

||

| Category 1 (Overseas Spend) |

Category 2 (Petrol and Contactless) |

|

| Monthly Cap (UNI$) | 2,160 UNI$ | 2,160 UNI$ |

| Monthly Cap (S$) | S$1,200 | S$1,200 |

| Min. Spend | S$1,000 in FCY | S$1,000 in SGD |

| Caps are based on statement month | ||

Now, the bonus reward of 9X UNI$ per S$5 is capped at:

- Category 1: 2,160 UNI$ per statement month (equivalent to S$1,200 of spending)

- Category 2: 2,160 UNI$ per statement month (equivalent to S$1,200 of spending)

While the overall cap is higher (4,320 UNI$ vs 3,600 UNI$), the category-level cap is lower. This means it’s no longer possible to spend the entire cap on a single category.

Let’s look at those scenarios again.

| Category 1 (Overseas) |

Category 2 (Petrol & Contactless) |

Total Miles |

| S$1,500 | S$0 | 4,920 miles (S$1,200 @ 4 mpd + S$300 @ 0.4 mpd) |

| S$0 | S$1,800 | 5,040 miles (S$1,200 @ 4 mpd + S$600 @ 0.4 mpd) |

| S$2,000 | S$0 | 5,120 miles (S$1,200 @ 4 mpd + S$800 @ 0.4 mpd) |

| S$1,000 | S$1,000 | 8,000 miles (S$1,000 @ 4 mpd + S$1,000 @ 4 mpd) |

In 3 out of 4 scenarios, you’re earning fewer miles than before, because each category’s bonus cap is now fixed at S$1,200.

How should you use the UOB Visa Signature now?

In theory, the UOB Visa Signature has been buffed because the monthly bonus cap is now S$2,400 instead of S$2,000. Therefore, if you were to fully max out each of the two bonus categories, you’d earn 9,600 miles a month, compared to 8,000 miles before.

In practice, however, you’re likely to be earning fewer miles. Why? Because of the introduction of strict sub-caps for each bonus category.

Previously, most people would use the UOB Visa Signature as a single category card, focusing on either overseas spend or petrol and contactless each month (you could theoretically use it for both, but optimisation would require spending exactly S$1,000 on each category— no easy task).

Now, using the UOB Visa Signature as a single category card will only earn you 4,800 miles a month. To reap the benefit of the extra bonus cap, you must use both categories, and spend at least S$1,000 per month per category.

It’s almost as if the UOB Visa Signature is now two cards in one.

| Bonus | Min. Spend | Cap | |

“Card #1” “Card #1” |

4 mpd on overseas spending | S$1K | S$1.2K |

“Card #2” “Card #2” |

4 mpd on petrol and contactless spending | S$1K | S$1.2K |

- Card #1: Offers 4 mpd on overseas spending, with a minimum spend of S$1,000 in FCY, and capped at S$1,200 per statement month

- Card #2: Offers 4 mpd on petrol and contactless spending, with a minimum spend of S$1,000 in SGD, and capped at S$1,200 per statement month

To put it another way:

- In the past, the sweet spot to hit was S$1,000 to S$2,000 of spending on either Category 1 or Category 2

- Now, the sweet spot to hit is S$1,000 to S$1,200 of spending on both Category 1 and 2

Granted, it’s not impossible to spend between S$1,000 to S$1,200 (I mean, the DBS yuu Card’s 10 mpd has a minimum spend and cap of S$600 per month!), but think about it: if you’re not travelling, how likely are you to spend S$1,000 in FCY? Sure, overseas spend can include both online and offline transactions, but even so, it’s not that easy to consistently spend S$1,000 online in FCY each month.

The way I see it, the UOB Visa Signature is now a more troublesome UOB Preferred Platinum Visa. You can use it wherever contactless spending is accepted, but you must spend at least S$1,000 per month, or else you’ll earn just 0.4 mpd!

|

|

|

| UOB Visa Signature | UOB Preferred Platinum Visa | |

| Earn Rate | 4 mpd on contactless spend | 4 mpd on mobile contactless spend |

| Min. Spend | S$1,000 per s. month | None |

| Cap | S$1,200 per s. month | S$1,110 per c. month |

| Contactless spend= tap physical card or phone | Mobile contactless spend= tap phone | ||

Don’t get me wrong. It’s good we still have another 4 mpd-almost-everywhere option. It’s just that you really need to commit to using the UOB Visa Signature once you start spending, because of the S$1,000 minimum spend.

As for overseas spend, the closest competitor would be the Maybank XL Rewards Card, which also earns 4 mpd on all FCY spend.

|

|

|

| UOB Visa Signature | Maybank XL Rewards | |

| Earn Rate | 4 mpd on overseas spend | 4 mpd on overseas spend |

| Min. Spend | S$1,000 per s. month | S$500 per c. month |

| Cap | S$1,200 per s. month | S$1,000 per c. month |

While the UOB Visa Signature has a bonus cap that’s 20% higher, there’s less margin for error when spending compared to the Maybank XL Rewards (i.e. S$1,000 to S$1,200 versus S$500 to S$1,000).

Also, when making online transactions, you need to ensure that the merchant’s payment gateway is located outside of Singapore— another UOB (and BOC) specific quirk.

All this to say I’m still going to be using the UOB Visa Signature, but only in months where I know my spending is going to be elevated.

Keeping track of spending across categories

If you really do plan to spend on both categories, it’s going to be a royal pain to track your spending. UOB does not keep a running tally of how much cap you have left for each bonus category, nor does it categorise your spending.

Therefore, the only way to calculate your minimum spend and remaining bonus cap for each category is to tally up items line by line — which transactions belong to Category 1, which transactions belong to Category 2?

But mercifully, there’s a workaround, as suggested by a MileLion community member: Get a supplementary card.

To be clear, this does not increase your bonus cap. What it does is make it much easier to track your spending. For example, you could put all the spending for Category 1 on the principal card, and all the spending for Category 2 on the supplementary card.

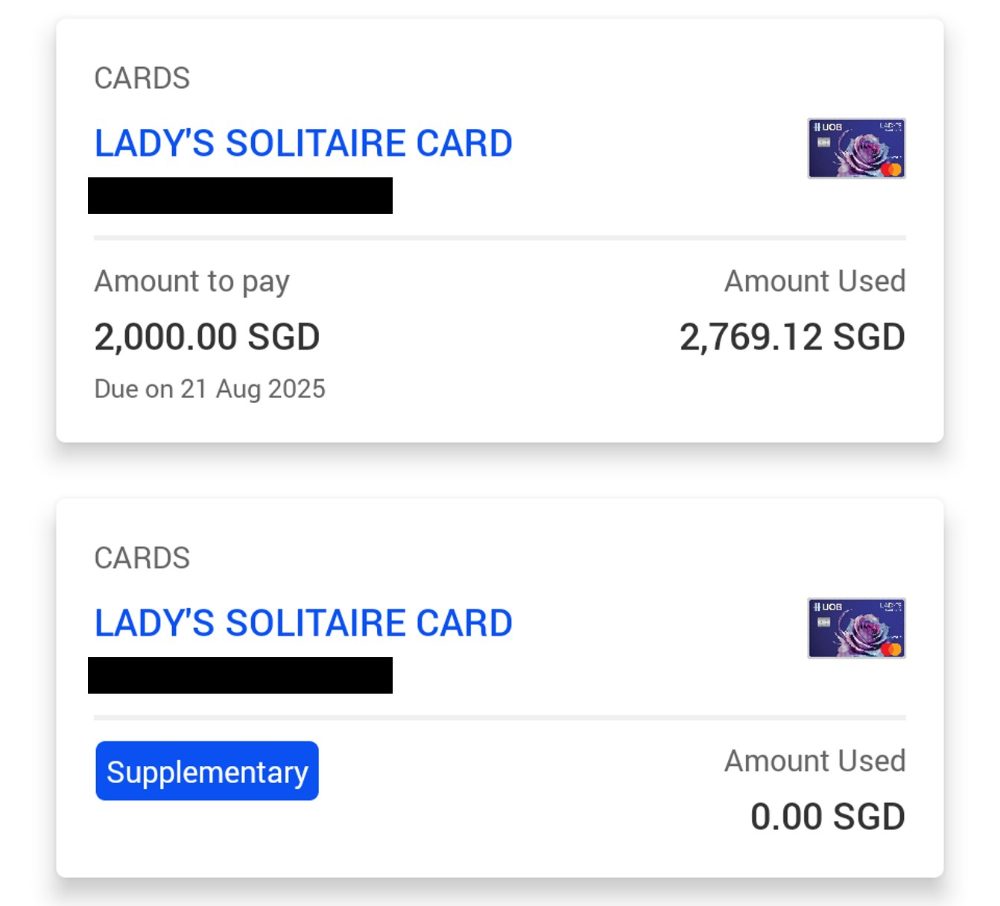

Since these cards are shown as separate accounts on internet banking, you can just look at the total spend on a card level. Incidentally, this is what I’ve done for my UOB Lady’s Solitaire Card, to better manage its now separated bonus caps (it’s no coincidence that UOB made a similar change to both cards at the same time!).

Conclusion

The UOB Visa Signature now comes with a higher monthly bonus cap, but it’s split into two separate sub-caps that can’t be combined. Those who continue using it as a single category card will earn fewer miles than before, and you’ll need to spend on both categories to benefit— not an easy feat given that one of them requires FCY spending.

The upshot is that this card, already not the simplest to use, is now even more complicated. And that’s probably a feature not a bug, insofar as it helps UOB better control its rewards costs.

How will you be using your UOB Visa Signature going forward?

Would switch to the ppv if it didn’t have $5 earning block sighs

One question, uob cards only award bonus dollar in blocks of $5 spending. Though simplygo awards 4miles per dollar but does the minimum $5 requirement still need to be met. I dont know what transport ride can cost more than $5 per trip using simplygo

common misconception. refer here: https://milelion.com/2025/05/17/whats-the-best-credit-card-to-use-for-simplygo-and-public-transport/

Tks for the clarifications

For the S$1,200 for contactless and petrol, do you happen to know if it can be combined from both primary and supplementary card? e.g $600 spend of primary and $600 spend on supplementary card. Tkss

This article could be half as long without losing anything.

u write loh

Actually these moves are quite smart, indirect nerfs without most customers cursing or swearing right off.

Finally some smart and non total a-hole product managers.

OR it’s just the usual scheme

1. create an overly unnecessarily complicated system

2. confused customers to the point they don’t understand if it’s a nerf or buff without milelion telling them

3. employ influencers to brainwash consumers into believing its a godsend

What about using Heymax to track spend by linking your Visa card? I would hope they come up with a category spend tracker!

tried the supplementary card method but UOB does not allow a mis-match between the name on the card vs the name of the apple id wallet.