Riddle me this: what’s all the rage over at UOB Plaza these days?

If you answered “sub-caps”, then pat yourself on the back, because you sir, are thinking like a UOB executive.

I mean, that’s the only conclusion I can draw, given how we’ve seen one UOB card after another take unified bonus caps and split them down the middle. It’s a solution worthy of Solomon.

But what’s behind this sudden love of “2-in-1” cards, what are the implications for cardholders, and should you navigate this new landscape? And — whisper it quietly — could some cardholders actually come off better from the changes?

Why is UOB adopting sub-caps?

Over the past few months, three of UOB’s most popular rewards cards have announced changes to their bonus caps.

| Card | Bonus Category #1 | Bonus Category #2 |

UOB Lady’s Solitaire UOB Lady’s SolitaireIn effect |

Choice of bonus category (S$750) |

Choice of bonus category (S$750) |

UOB Visa Signature UOB Visa SignatureIn effect |

Overseas spending (S$1,200) |

Petrol and contactless (S$1,200) |

UOB Preferred Platinum Visa UOB Preferred Platinum Visaw.e.f. 1 Oct 25 |

Selected online transactions (S$600) |

Mobile contactless (S$600) |

- The UOB Lady’s Solitaire’s monthly bonus cap was reduced from S$2,000 to S$1,500, and further split into two sub-caps of S$750 each

- The UOB Visa Signature’s monthly bonus cap was increased from S$2,000 to S$2,400, but further split into two sub-caps of S$1,200 each

- The UOB Preferred Platinum Visa’s monthly bonus cap will be increased from S$1,110 to S$1,200, but further split into two sub-caps of S$600 each.

While the numbers may vary, the end result is the same: cardholders no longer have the flexibility to allocate the bonus cap as they wish.

To put it another way, it is (or will be, in the case of the UOB Preferred Platinum Visa) no longer possible to max out the bonus cap by spending on a single bonus category. Instead, you must spend across both categories in order to fully utilise the card’s overall bonus cap.

For cards with a minimum spend, such as the UOB Visa Signature, this also decreases the “sweet spot” for spending. When the bonus cap was unified, the sweet spot to hit was S$1,000 to S$2,000. Now, it’s S$1,000 to S$1,200. Basically, there’s less margin for error.

Now, I don’t think it takes an MBA to see what’s going on here. By introducing these finicky sub-caps, UOB is anticipating that more breakage will happen, that more cardholders will either underspend and fail to achieve the “full potential” of their cards, or overspend and end up in 0.4 mpd territory.

Think about how little time the average person has to track their cards. Think about how little inclination the average person has to track their cards. Now add a further layer of complexity in the form of sub-caps, and that’s a sure-fire recipe to reduce the cost of rewards.

And even if you’re aware of the changes and know what you should be doing, it may not always be possible to do it.

Take the UOB Visa Signature for example. Previously, most people would use it as a single category card, focusing on either overseas spend or petrol and contactless each month (you could theoretically use it for both, but optimisation would require spending exactly S$1,000 on each category— no easy task).

Now, using the UOB Visa Signature as a single category card will only earn you 4,800 miles a month. To reap the benefit of the extra bonus cap, you must use both categories, and spend at least S$1,000 per month per category. But one bonus category is for overseas spend, and if you’re not travelling that month, how likely is it you’ll be able to spend at least S$1,000 in foreign currency? Sure, you could buy things online, but S$1,000 worth of it? And consistently, every month?

Therefore, for many UOB Visa Signature Cardholders, the maximum miles they can earn each month will effectively be reduced from 8,000 (S$2,000 @ 4 mpd) to 4,800 (S$1,200 @ 4 mpd).

How to handle 2-in-1 cards

One interesting consequence of these sub-caps is that they effectively create so-called “2-in-1” cards.

What I mean by this is that because bonus caps can no longer be shared between categories, the UOB Lady’s Solitaire, UOB Visa Signature, and UOB Preferred Platinum Visa could conceptually be thought of as two separate cards in one— each with its own bonus categories and bonus caps (and minimum spend, in the case of the UOB Visa Signature).

| Bonus | Cap | |

“Card #1” “Card #1” |

4 mpd on Bonus Category 1 | S$750 |

“Card #2” “Card #2” |

4 mpd on Bonus Category 2 | S$750 |

| Bonus | Min. Spend | Cap | |

“Card #1” “Card #1” |

4 mpd on overseas spending | S$1K | S$1.2K |

“Card #2” “Card #2” |

4 mpd on petrol and contactless spending | S$1K | S$1.2K |

| Bonus | Cap | |

“Card #1” “Card #1” |

4 mpd on selected online transactions | S$600 |

“Card #2” “Card #2” |

4 mpd on mobile contactless | S$600 |

But of course, they’re each one card as far as UOB is concerned, and that’s where things get messy.

If you intend to spend across both bonus categories, UOB isn’t going to keep a running tally of how much cap remains for each of them, nor will it categorise your spending. All your transactions will be lumped together, and the only way to figure out how much bonus cap remains for each category is to tally up items line by line — which transactions belong to Category 1, which transactions belong to Category 2?

Fortunately, there are two possible workarounds.

Workaround #1: Get a supplementary card

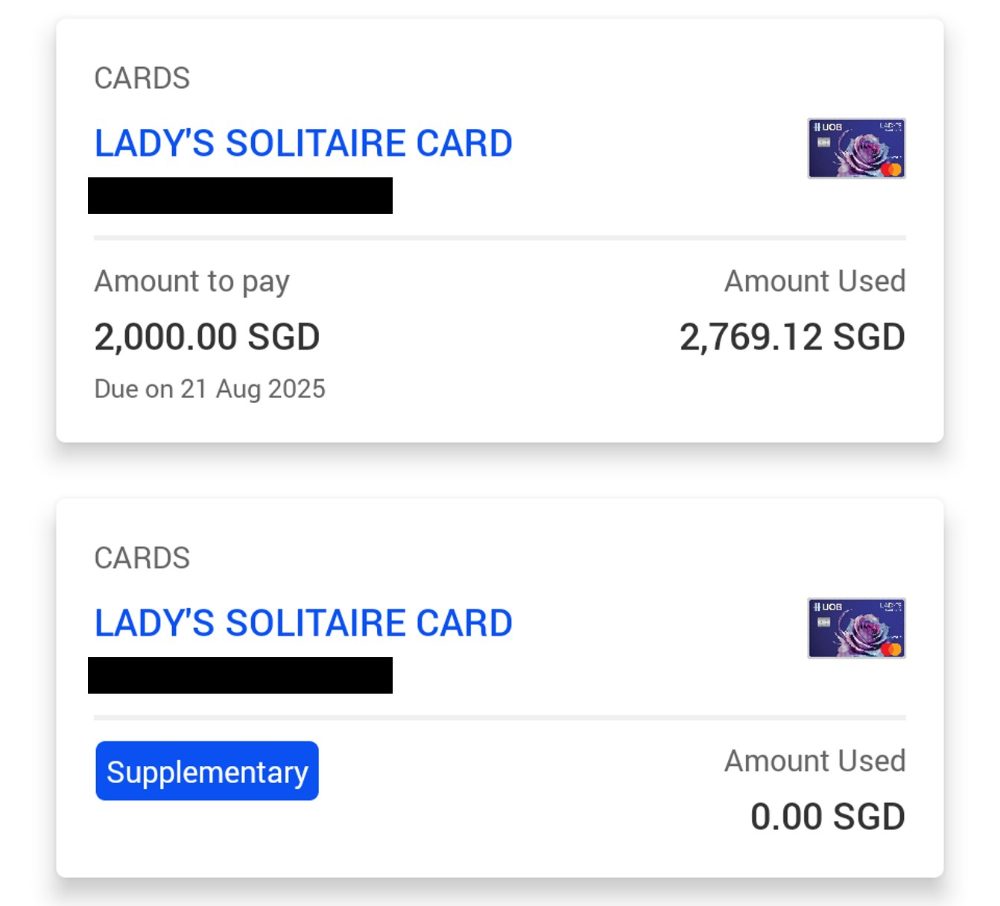

Getting a supplementary card has no impact on your bonus cap. Instead, what it does is make it much easier to track your spending. For example, you could put all the spending for Category 1 on the principal card, and all the spending for Category 2 on the supplementary card.

Since these cards are shown as separate accounts on internet banking, you can just look at the total spend on a card level. This is what I’ve done for my UOB Lady’s Solitaire Card.

The annual fee for the first supplementary card (first two for the UOB Lady’s Solitaire) is waived. Come to think of it, this could very well be the best-ever supplementary card campaign UOB has run!

| ❓Can you apply for a supplementary card for yourself? |

| To pre-empt a common question: no, a principal cardholder cannot also apply for a supplementary card. Find a family member or trusted friend to apply for. |

Workaround #2: Max out one bonus category at the start of every month

Another way to keep things simple is to commit to maxing out one bonus category at the start of every month. That way, you know that any incremental spending counts against the second bonus category’s cap.

For the UOB Preferred Platinum Visa and UOB Lady’s Solitaire, the easiest way of doing this would be to buy HeyMax vouchers for whichever merchants you normally use. These will code as MCC 5311, and qualify for bonus miles (you must select Fashion as your bonus category for the UOB Lady’s Solitaire).

|

|

| Sign up here |

|

|

|

Is this better than an outright nerf?

UOB has taken a lot of flak for these changes, but allow me to play devil’s advocate for a moment: is the introduction of sub-caps a preferable alternative to a hard nerf?

Yes, yes, I know. The UOB Lady’s Solitaire has been hard nerfed, because the overall bonus cap has been cut from S$2,000 to S$1,500.

In the case of the UOB Preferred Platinum Visa and UOB Visa Signature, however, it’s not so clear cut. The sub-caps are annoying, but if you can consistently max them out, then you could actually end up with more miles than before. Whether that’s actually realistic is another matter — see my earlier point about how challenging it will be to max out the UOB Visa Signature’s overseas spending bonus every month — but it is, at a minimum, theoretically possible.

So, hypothetically, if I had to choose between the UOB Preferred Platinum Visa cutting its earn rate to 3 mpd but keeping a unified S$1,110 cap, or keeping 4 mpd but introducing the S$600 sub-caps, I would probably pick the latter.

I keep thinking about the 2020 decision to exclude physical contactless spending from earning 4 mpd with the UOB Preferred Platinum Visa. At the time, many people criticised the move, calling it a dirty trick and a way of catching cardholders unawares. That said, different methods of payment have different interchange, and what if requiring mobile contactless was the only way to keep the bonuses flowing?

Granted, sub-caps are a different magnitude of difficulty altogether, but the idea is: if given a choice between additional hoop-jumping or a hard nerf, my general preference is for the hoops.

| ↕️ Still about trade-offs |

|

Of course we have to be careful about taking this argument too far, because there’s still a trade-off involved. If UOB were to say “you can earn an extra 10 miles a month if you yodel in your underwear while standing on your head in the middle of a snowstorm,” then yeah, I probably wouldn’t. Probably. |

Interestingly, if we line up all three cards and look at the overall change in the number of miles that can be earned each month, it’s almost a wash.

Don’t get me wrong. The vast majority of cardholders will probably earn fewer miles than before, but there will still be a spectrum, and the committed min-maxers will be less affected than the casual users.

In that sense, the new sub-caps will draw a brighter line between the two groups. It wasn’t rocket science to tap your UOB Preferred Platinum Visa everywhere, and stop when you got close to S$1,110. Now, you’ve got to remember to stop at S$600, and spend a further S$600 on selected online transactions like food delivery and shopping. People might do the first. Far fewer will do the second (many don’t even know that the UOB Preferred Platinum Visa can be used for online transactions!).

In her 2013 hit “Toil, Fair Lady” (I might be lightly paraphrasing), the learned Ms. Spears implores her listeners to put in a hard day’s labour, because there is no reward without rigour.

If thou desirest riches fair,

And wishest thy beauty to ensnare,

Thou must labour, toil, and strive,

Ere thy fortunes shall arrive.-Lady Spears

In the same way, you’ll now have to work harder to get the most out of your UOB cards, whether it’s applying for a supplementary card, buying vouchers, or keeping closer track of your spending.

Some will find the effort worthwhile. Many won’t. But everyone ultimately competes for the same award space, so the extra legwork might still pay off.

Conclusion

UOB’s recent introduction of sub-caps on three of its most popular cards is no doubt meant to reduce the ability of cardholders to fully utilise their bonus caps.

However, those who are willing to play along will be relatively less affected, and that might be the point. By layering in sub-caps and complexity, UOB is betting most cardholders won’t bother optimising, quietly trimming costs without slashing earn rates outright. The message is clear: if you want your miles, you’ll need to work harder for them, and UOB will happily pocket the savings from those who don’t.

Sub-caps aren’t as much a feature as they are a filter. The question is whether you’re willing to jump through the hoops.

life does not need to be so complex. Just move to DBS

agree. just cut UOB and move away

But dbs dont give 4mpd for contactless spend

True, only 10mpd and they don’t even care if it is contactless or not, and can get 2 versions, and for groceries, pharmacy and rides. 144k miles/yr and 5% (2.8mpd) cashback if overspend above the bonus line And 4mpd on another card for almost all online spend 48k miles/yr And the points pool for 192k miles/yr for $26.4K/yr spend, about 50K miles/yr less than all the 3 UOB cards above at 244.8K/yr for S61.2k spend assuming can min-max exactly. Anyway it’s half the effort to spend $26K rather than $61K. About 7.3 mpd vs 4 mpd with much simpler spending… Read more »

do you only shop at yuu merchants?

Nope, but for a family it’s easy to hit $1200 monthly spend on Cold Storage, Guardian, 7-Eleven, Giant and Charge+. CS is often cheaper than NTUC when there’s 18%/10mpd. When we shop at Sheng Siong and NTUC, we use one of our other cards. We also use other cards with Amazon and Shopee. WWMC, Revo, CRMC and 1.6mpd general spend cards. No need for UOB 4mpd since we rarely even use the CRMC (permanent AF waiver so it’s staying). We don’t pay AF except for our general spend cards(the benefits are worth a lot more $ to us). If you… Read more »

Ur tone sound familiar

U oso reply other post b4 rite

Oso say same thing abt credit card af n auto fee waiver

Rmb got sum1 said u pedantic lol I went n google the meaning

Ur comments quite annoying leh

Like u keep insisting everyone is wrong n u r rite like everybody else share the same spend pattern n lifestyle as u

Like tryna b low key superior 0_0‘’’

Interested to hear your thoughts and comparisons about this Aaron!

Same for me. I am not willing to jump through the hoops. I will use other banks’ cards instead.

I’ll cancel my UOB cards once bonus UNI$ are in. Thank goodness now there’s XL.

I’m in the majority who will lose out (more).

Previously I max out 1 or 2 months a year on some big category spend with a big chunk only earning 0.4mpd. Now, if I use UOB, the proportion of category or online spend falling into 0.4mpd will increase. Very upset. But what can be done.

It’s amazing banks doing this when they are reporting record profits and share price are record highs. Why doesn’t the Consumer Association or the MAS or government or opposition speaking up for the little people?

WTH. Are credit card miles a human right now? What a whiner.

so how to make big ticket (non online) contactless payments now?

Like if you go see a private medical doctor and get charged 3000 dollars for example?

gen spend lor no choice

In such situations when there are no better miles cards and no special gift redemptions, I will simply use the Amex True Cashback Card (which does not have an extensive exclusion list) to get 1.5% cashback, with no minimum spending requirement and no cashback cap. It does not have the cognitive load that makes using UOB cards tiring.

as I consolidate most of my miles in UOB, this sub cap change is frigging annoying. I am exploring to shift to other banks also.

Just hoping the other banks dont follow suit as the miles game is getting harder and harder as the years goes by.